[ad_1]

Right here Lie The Hopes And Goals Of These That Purchased PayPal At $300 Justin Sullivan/Getty Photographs Information

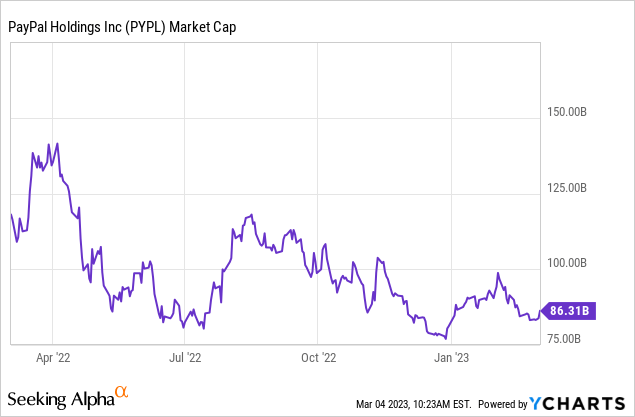

Whereas we had been bullish on PayPal Holdings, Inc. (NASDAQ:PYPL) for a number of selection months final yr, we had a impartial stance in our most up-to-date piece again in November.

Searching for Alpha

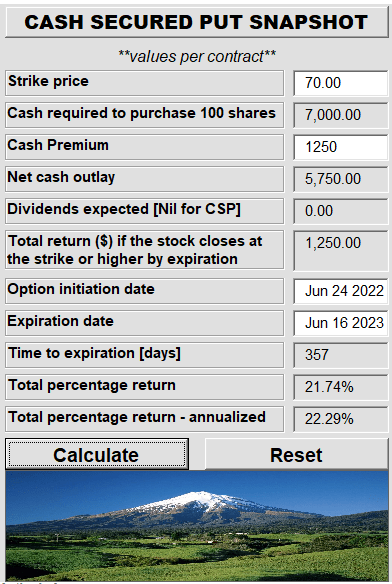

We thought a bounce was imminent after we wrote our bullish piece for the reason that valuation had compressed sufficiently. Whereas we weren’t all the best way there but, choices provided profitable earnings for a defensive entry worth.

PayPal: Valuation Hits All-Time Low

With the value appreciation within the months following that piece, the above commerce may have been closed with seize of virtually 100% of the premiums with out ready out the entire time period as we had advised in our following article. We have been again within the impartial camp as soon as we reviewed the Q3 leads to mild of the prevailing macro surroundings. The income run charge was nearly maintaining with the nominal GDP and transaction volumes have been trending downward. Alternatively, whereas the transaction and working margins have been down yr over yr, they held up higher than our expectations. With development firmly previously tense, we arrived on the truthful worth for this inventory utilizing free money movement adjusted for inventory primarily based compensation. The quantity was 17X and concluded with:

PYPL is pretty valued at present and unlikely to maneuver a lot larger. Draw back dangers stem from margin compression and a doable recession. At 5% danger free charges, one may argue that PYPL ought to be valued at a 13-15X free money movement a number of, particularly since there may be development on the quick horizon. We charge the inventory at impartial/maintain. We might now think about choice entries solely at $60 or decrease and would shut out our earlier advised money secured places for $70 strike.

Supply: PayPal: How To Worth It Now That Progress Is Gone

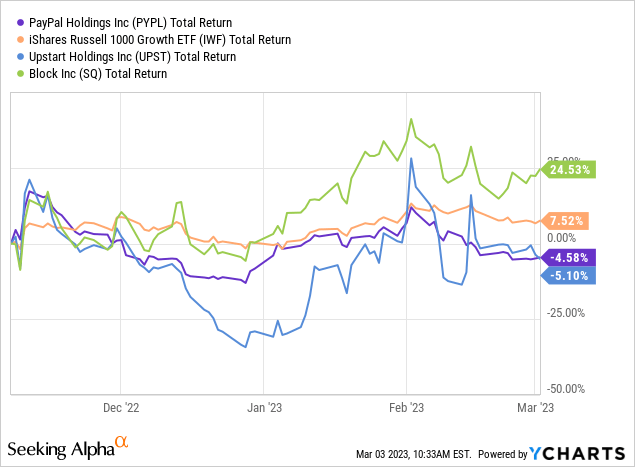

The inventory worth has been kind of flat since then, performing according to one other fintech fan favourite Upstart Holdings, Inc. (UPST).

We check out the This fall outcomes subsequent.

This fall-2022

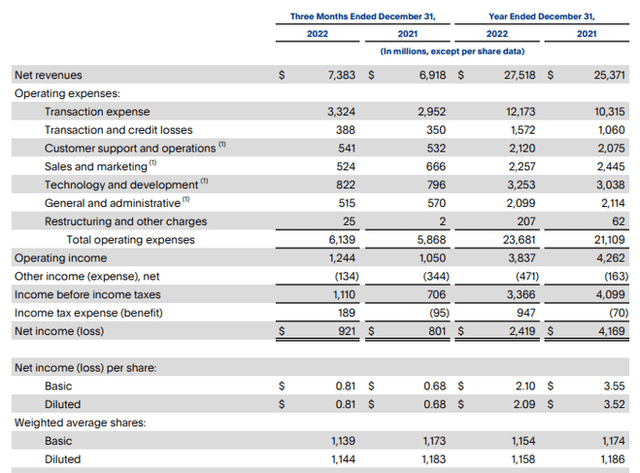

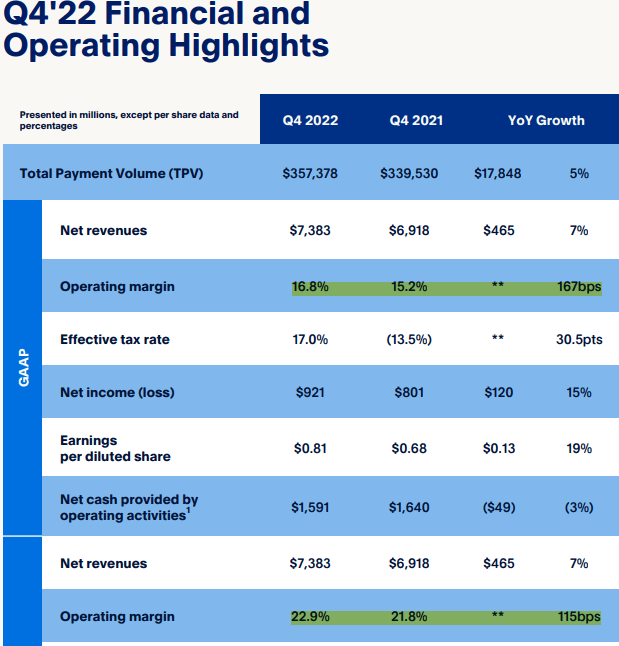

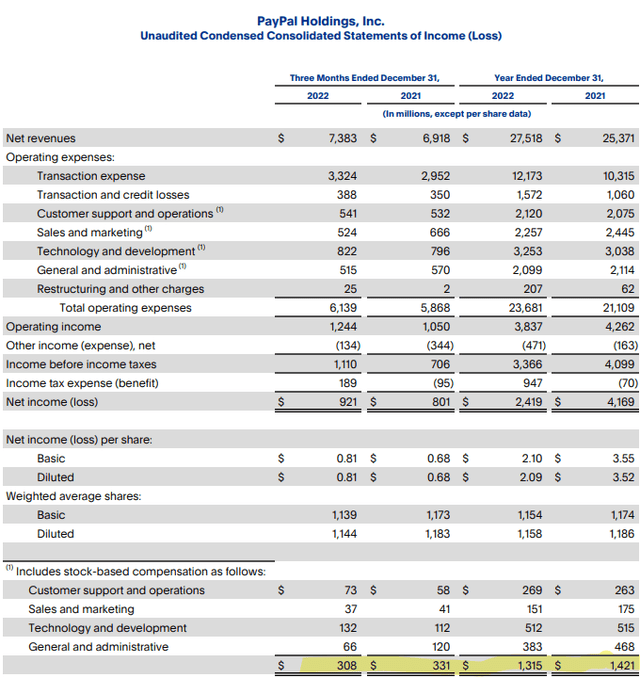

This fall-2022 was a superb quarter and PYPL delivered a stable beat in earnings although income got here in a shade beneath estimates. This was positively stronger than our outlook as we anticipated margins to remain weak.

PYPL This fall-2022 Presentation

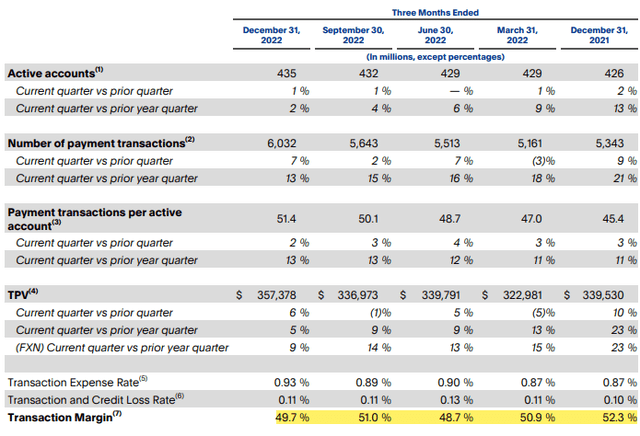

Lively accounts grew as soon as extra, regardless of intense competitors and funds transactions have been up 7%. Within the slide under, you’ll be able to see the transaction margin which, whereas decrease than the 52.3% we noticed final yr, continues to be comparatively wholesome.

This fall-2022 Earnings Launch

That very same transaction margin led to an working margin that expanded versus the 15.2% seen on the finish of final yr.

PYPL This fall-2022 Presentation

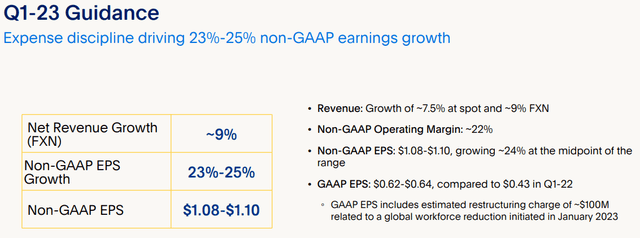

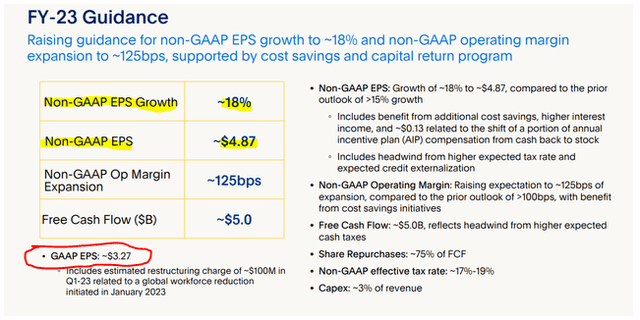

PayPal raised the ante for the bears by offering their greatest steering in a minimum of the final 4 quarters. Q1-2023 will present a 23-25% earnings development, a quantity that was approach forward of analysts’ estimates.

PYPL This fall-2022 Presentation

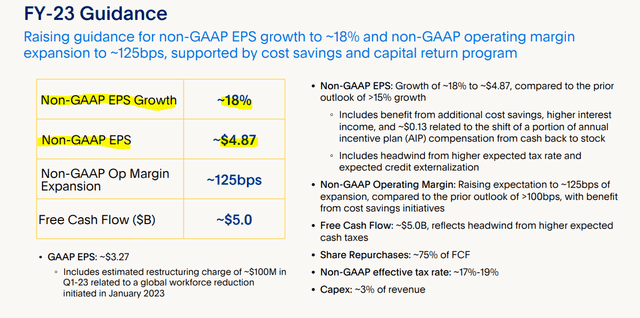

For the total yr, earnings per share are anticipated to come back in at $4.87.

PYPL This fall-2022 Presentation

Our Take

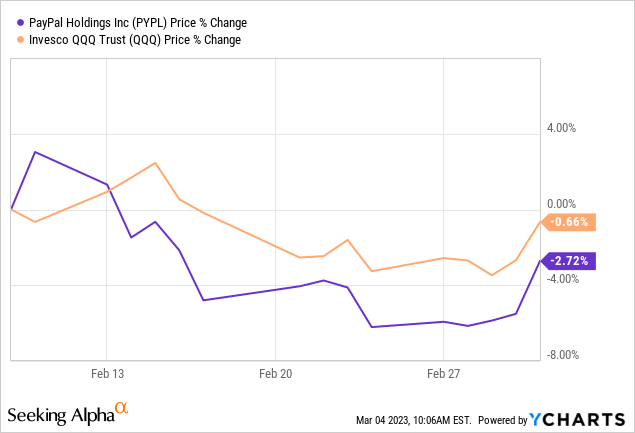

The market didn’t get too impressed with these outcomes and the early positive aspects have been squandered within the days forward.

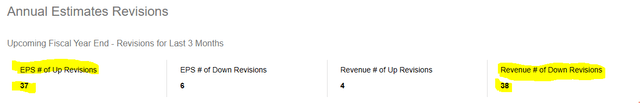

Bulls is perhaps annoyed right here and questioning precisely what the corporate must do to catch a break. There are three totally different elements to this reply. The primary is that revenues are all the time the story for development shares. You’ll be able to dance on the earnings beat, but when revenues are available in beneath, there can be stress. So the truth that 38 analysts introduced down their income numbers, whereas 37 revised their earnings estimates larger, has so much to do with this.

Searching for Alpha-PYPL

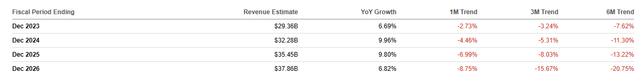

On the income facet, estimates have been falling for fairly a while as PayPal is maturing as a development play. Estimates for 2026 are down virtually 30% within the final 6 months.

Searching for Alpha

That is mainly what occurs when analysts take a present development trajectory and extrapolate it into infinity. When the cycle normalizes, there are these unrealistic expectations which must be grounded.

The second half is that analysts nonetheless suppose that margins will proceed increasing, as evidenced by EPS development being stronger than income development.

PYPL This fall-2022 Presentation

Whereas which will play out for 2023, we expect past that, they could once more have to chop estimates. We predict markets already know this and are discounting a really sluggish rising firm sooner or later.

Valuation

The ultimate piece is the valuation story. At 15X earnings, PYPL inventory would possibly seem like a development investor’s dream. Actually when traders have been paying 17X gross sales in 2021, the percentages have been firmly stacked towards them. The issue in fact is that these are non-GAAP earnings and exclude $1.31 billion of inventory primarily based compensation.

PYPL This fall-2022 Presentation

This works with PYPL issuing inventory to staff and the repurchasing that as a approach of deploying free money movement. We and most analysts which have invested exterior of the bubble years of 2020 and 2021, consider that the GAAP quantity is definitely fairly applicable.

PYPL This fall-2022 Presentation

An alternate is to compute the adjusted free money movement yield by taking the corporate offered free money movement and subtracting the inventory primarily based compensation out. The rationale is that the preliminary portion of the inventory buyback is simply getting used as an offset to maintain share counts static, you actually shouldn’t be giving the corporate credit score for that. So adjusted free money movement works to round $3.7 billion. On the present market capitalization, you have got a 4.3% adjusted free money movement yield.

We hate to interrupt it to you, however that’s not a lot in an period of 5.5% danger free Federal Funds charge.

Verdict

The excellent news is that PYPL does have a good valuation. 4.3% adjusted free money movement yield or 23 occasions GAAP earnings are literally very good valuations relative to what insanity transpired over the markets within the final 2 years. The unhealthy information is that it isn’t remotely low sufficient if you happen to perceive the historical past of bubbles. Bubbles finish with excessive undervaluation and we aren’t there but. Cisco Techniques, Inc. (CSCO), Microsoft Corp. (MSFT) and Intel Corp. (INTC) are all good examples that discovered a real backside in March 2009 as their PE ratios markedly compressed from Dotcom days.

Sure, that was in the course of the international monetary disaster, however you’ll be able to see that journey was 85% full even earlier than the collapse we noticed within the latter half of 2008. We’ll add right here that the rates of interest have been slashed to the bone and the shares nonetheless turned that low-cost. On the minimal you must count on an analogous consequence when rates of interest are so excessive and climbing.

Whereas PYPL is likely one of the few development shares with respectable valuations, we do not suppose the journey is over. If you happen to embrace that forecast, the easiest way to play it’s to promote money secured places at $60 or decrease strikes, after the inventory takes tough tumble. We charge this a maintain at current. Marrying our pondering on PYPL with our outlook available on the market, makes us consider {that a} long term shopping for alternative will current itself in late 2023.

Please be aware that this isn’t monetary recommendation. It might look like it, sound prefer it, however surprisingly, it isn’t. Buyers are anticipated to do their very own due diligence and seek the advice of with knowledgeable who is aware of their targets and constraints.

[ad_2]

Source link