[ad_1]

The monetary market includes totally different market cycles relying on the broad market atmosphere.

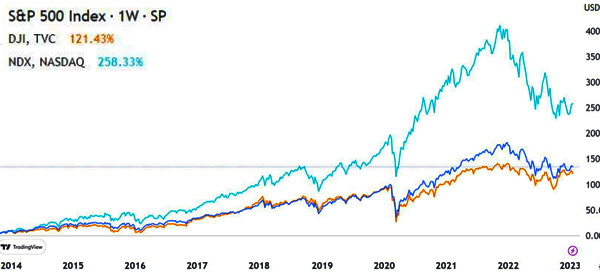

In some durations, as we noticed after the World Monetary Disaster of 2008/9, the world went by way of a serious bull run that noticed shares surge to a document excessive. The identical state of affairs occurred after the Covid-19 pandemic in 2020.

This text will clarify what a bull market is and the way it works (and, in fact, one of the best methods for making the most of it).

What’s a bull market?

A bull market is a interval when shares and different monetary property are doing properly. In most durations, the market occurs when the property rise by 20% from their lowest interval in a session.

For instance, within the chart beneath, we see that the S&P 500 index rose by about 20% from its lowest stage in October to its highest level in February.

Because of this it entered a bull market throughout this era. The time period bull market comes from the idea of a charging bull throughout bull fights.

In all, an actual bull market is stronger than that. In most durations, the bull market occurs when shares are in an total robust upward pattern in a sure length.

Associated » The way to Perceive Inventory Market Cycles

A bull market can final a couple of weeks or perhaps a few years. An excellent instance of a bull market is what occurred after the World Monetary Disaster of 2008. It lasted for over a decade.

Bull vs Bear market

A bull market is a interval when monetary property are doing properly. However, a bear market is a interval when monetary property should not doing properly.

In technical phrases, a bear market is outlined as a interval when monetary property have dropped by 20% and extra. An excellent instance of that is within the Carvana inventory beneath.

As you possibly can see, the shares plunged by greater than 20% from their highest level in August 2021 to its lowest level in September. Not like the S&P 500 above, the inventory then continued plunging because the state of affairs worsened.

One other idea just like a bear market is named a correction. Correction is outlined as a interval when a inventory declines by 10% from its highest level. In most durations, a correction can simply flip right into a bear market if sell-off strain occurs.

Causes of a bull market

There are numerous causes of a bull market:

Federal Reserve

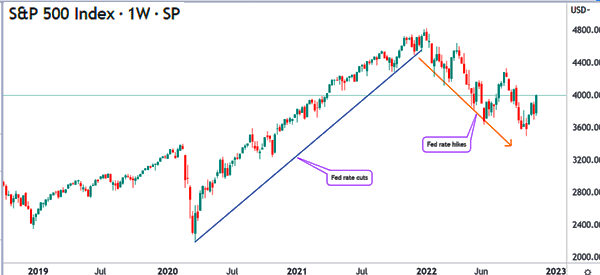

First, it’s attributable to the actions of the Federal Reserve. In most durations, buyers are inclined to rotate into shares and different property when the Fed decides to keep up a dovish financial coverage assertion.

This occurs as different monetary property like bonds expertise low returns. Among the high examples of the latest bull runs have been attributable to an especially dovish Federal Reserve.

Thematic causes

Second, bull markets occur due to the prevailing themes available in the market. This occurs when there are main themes that entice buyers to sure property.

For instance, prior to now few years, we’ve got seen a number of market themes like in expertise, electrical autos, cloud computing, and synthetic intelligence amongst others.

Geopolitics

At instances, geopolitics can have an effect available on the market. For instance, the inventory market can rise sharply when geopolitical tensions between two nations ease.

An excellent instance of that is what occurred when the Trump administration reached a cope with China. Earlier than that, tensions had been rising as Trump sought to extend tariffs on Chinese language items.

Earnings

A inventory might enter a bull market when there are optimistic earnings. It’s common for a inventory to rise sharply when an organization publishes robust earnings and ups its ahead estimate. The other can be true since it could actually enter a bear market when it publishes weak earnings.

There are different explanation why a bull market might occur, together with administration change, finish of a serious investigation, and the launch of a brand new product.

The way to know we’re in a bull market

A standard query amongst market contributors is on how you can know whether or not we’re in a bull market. There isn’t a absolute method of figuring out when this market occurs.

In most durations, a bull market occurs after a serious downturn within the monetary market. For instance, it occurs after the dot com bubble burst in early 2000s. It additionally occurred after the World Monetary Disaster of 2008 and after the Covid-19 pandemic of 2020.

You possibly can inform whether or not the market is in a bull or bear market in numerous methods. Probably the most fundamental is to take a look at whether or not shares or commodities are frequently rising or falling in a sure interval. In technical durations, you must take a look at durations of upper highs and better lows within the monetary market.

There are different traits of a bull market. For instance, the market is characterised by greater liquidity as buyers proceed shopping for property. Additional, it’s often characterised by irrational exuberance, the place shares of all qualities rise. Additionally, bull markets occur when there are elevated valuation metrics.

When does a bull market begin and the way lengthy does it take?

In most durations, a bull market begins in a interval when shares should not doing properly. It occurs after a serious dip, which is attributable to a big market occasion.

As talked about above, among the most typical bull markets occur after a serious occasion. Among the most essential occasions prior to now few years have been the dot com bubble, the worldwide monetary disaster, and the Covid-19 pandemic.

As proven above, the bull market that occurred after the Covid-19 pandemic began in March 2020 and resulted in January 2022. At instances, a bull market can final for a shorter interval, as we noticed within the first chart, the 2023 bull run was a bit brief.

Bull market buying and selling methods

In most durations, market contributors can profit by simply shopping for and holding monetary property throughout a bull market. You are able to do that by shopping for an index just like the Dow Jones and S&P 500 and benefiting as their costs rise.

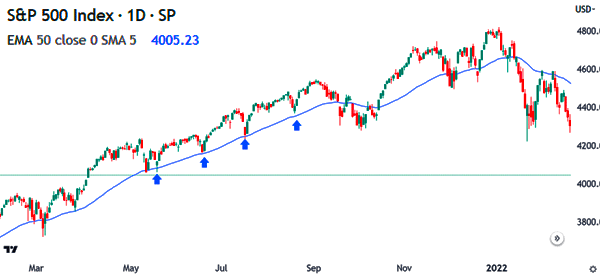

The opposite buying and selling technique is the place you purchase the dip through the bull market. It is a state of affairs the place you purchase shares any time they drop through the bear market. When it occurs, it often results in income since property are inclined to bounce again from their lowest factors.

One of the simplest ways of shopping for the dip throughout a bear market is to make use of a transferring common. On this case, you merely purchase a inventory when it retests the transferring common. Different pattern indicators that you need to use on this case are Bollinger Bands and Ichimoku kinko Hyo. An excellent instance of that is proven within the chart beneath.

As a substitute of utilizing technical indicators, you need to use trendlines that contact key lows. In most durations, these trendlines are often seen pretty much as good ranges of assist and shopping for alternatives.

Abstract

A bull market is a crucial interval available in the market. In most durations, it has extra alternatives than in a bear market. On this article, we’ve got checked out what a bull market is, the way it works, and among the high methods to make use of when buying and selling in such a interval.

Exterior helpful sources

Historical past of bull and bear market [PDF] – Uidaho

[ad_2]

Source link