[ad_1]

courtneyk

Co-produced with Treading Softly

How are you going to have a “wealthy retirement?” To be wealthy means to have an ample provide of money, capital, or a excessive internet value. One of the simplest ways to generate such an overage is to have a excessive money circulate into your brokerage accounts.

Being rich means having a big sufficient asset base that the revenue it produces exceeds your bills. This lets you take the surplus revenue and reinvest it into extra income-producing property. As your wealth grows, so does your revenue. Nothing fairly makes cash, as cash does.

I’ve written quite a few instances about how being rich will routinely default you into being wealthy as a byproduct, however being wealthy doesn’t imply you’re rich. A couple of particular person with a $1 million+ revenue managed to blow all of it.

For a wealthy retirement, you both wanted to have stockpiled these extra {dollars} throughout all of your working years, or it’s essential to discover a means to generate a excessive stage of revenue now – hopefully with out working!

My private funding philosophy – The Revenue Methodology – makes use of instant revenue investing as a method to generate a excessive stage of revenue in the present day to fulfill your bills head-on. Most significantly, you may present a excessive sufficient revenue that you’ve an extra to reinvest and develop your asset base additional.

At present, I need to have a look at two nice alternatives to get pleasure from a wealthy retirement by the revenue they supply.

Let’s dive in.

Choose #1: GHI – Yield 8.8%

Greystone Housing Impression Traders, LP (GHI) had an unimaginable 2022, ending the yr with CAD (Money Out there for Distribution) of $2.37/unit. This led GHI to pay out supplemental distributions for a complete distribution of $2.109/unit for the yr. That may be a realized yield that’s effectively into the double-digits on the costs GHI traded at all year long.

Do not get used to it. Going ahead, we should always count on payouts to be a lot nearer to the “common” distribution, which is ready at $0.37/quarter. $1.48/yr is a extra correct reflection of the distribution that traders can count on to be recurring.

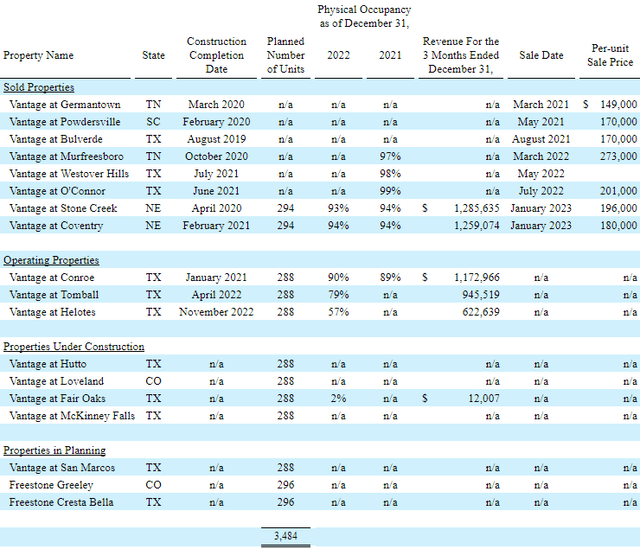

We will thank GHI’s “Vantage” three way partnership for the surplus distributions in 2022. They realized $39.7 million in capital positive aspects promoting properties in 2022, and GHI handed alongside a considerable portion of these positive aspects to traders.

The Vantage JV follows a technique of creating flats, renting the items, and promoting them when occupancy stabilizes. It usually takes about three years for this course of to occur. In consequence, the proceeds from these gross sales are lumpy, however are additionally extraordinarily profitable. Traders are pleased to pay a premium for a property that’s already leased up and all of the exhausting work has been finished. GHI performs the position of offering capital, with a most well-liked funding that recovers a set quantity, after which the companions cut up the positive aspects after the popular funding is paid off.

Final yr, situations have been exceptionally favorable to be promoting flats. Hire was rising and rates of interest have been nonetheless low within the first half of the yr when most of those gross sales occurred. At present, rents are slowing down and rates of interest are excessive. Nevertheless, regardless of that, the JV did handle to appreciate gross sales of two properties, paying GHI a $244k most well-liked return, plus $15.2 million in capital positive aspects (about $0.67/unit).

This technique has been very profitable for GHI, and it’s increasing it. There are three extra properties the place development is accomplished and leasing is underway (Conroe was introduced listed on the market on March sixth), 4 extra which can be below development, and three which can be within the planning levels. Supply

GHI 2022 10-Ok

This may be sure that GHI has a gentle pipeline of properties that could possibly be offered. The issue is, that you could’t management when a purchaser needs to purchase. The final two gross sales offered at $196,000 and $180,000/unit. That is decrease than the costs that the JV was capable of obtain final yr however nonetheless larger than seen in 2021.

With rates of interest larger and numerous uncertainty concerning the economic system, any further gross sales closed this yr needs to be thought of a cherry on high. The excellent news is that the gross sales already closed present numerous cushion for the distribution payout, and it’d even present sufficient for a small complement/particular at year-end.

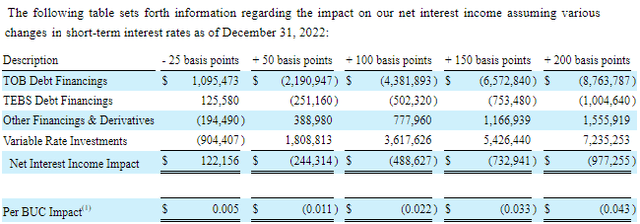

GHI’s different core enterprise is investing in “mortgage income bonds”, these are bonds issued to builders who’re constructing low-income housing. The decline in bond costs has impacted the MRB market, identical to it has each different sort of debt. This has been a headwind to ebook worth, and rising rates of interest are a slight headwind to earnings. GHI has hedged itself very effectively, however one other 100 bps in charge hikes would cut back earnings by roughly $0.022/unit for the yr.

GHI 2022 10-Ok

The excellent news is that if rates of interest began coming down, GHI would profit from this portion of the enterprise. Increased yields scale back the worth of held loans, nevertheless it additionally makes it cheaper to purchase new loans. GHI’s most up-to-date MRBs have coupons of round 6.5%.

GHI is a superb selection for an funding that might profit from declining rates of interest, however has proven nice resilience in holding as much as rising charges. We will thank the Vantage JV technique for that. The mix of two methods which can be utterly totally different, creates an organization that’s able to producing an awesome return in any setting. We will not rely on $2+ in distributions for 2023, however we may be very assured that the $1.48 in common distributions is sustainable.

Choose #2: GLP-B Most popular – Yield 9.3%

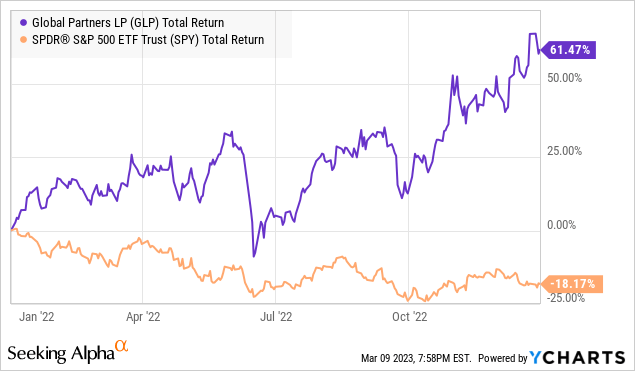

International Companions LP (GLP) is a big gasoline distribution grasp restricted partnership that has strongly rewarded its traders by all of 2022.

GLP strongly trounced the general market resulting from increasing gasoline margins. GLP, by its wholesale and retail gasoline distribution and comfort retailer community, loved robust returns as gasoline demand picked up, and gasoline costs climbed swiftly by 2022.

GLP advantages from shopping for gasoline at wholesale costs, and when costs rise as they transfer it to their gasoline stations, they profit from the upper worth. Moreover, the comfort retailer sector is basically fractured with many small mom-and-pop operations, so when costs rise after which fall once more, these small places are unable to afford to drop costs. This enables GLP to match their costs whereas benefiting from transferring extra quantity than their opponents.

This all added as much as a banner yr for GLP and different gasoline distributors. GLP coated their widespread distributions by 2.6x after factoring in the popular dividends over the course of 2022. This contains their giant particular distribution.

Nevertheless, at the moment, GLP’s widespread shares are more likely to see a retracement of their climb larger. GLP’s widespread yield is at present simply over 7%. So why will we count on GLP’s widespread shares to fall in worth? The important thing metric to look at is gasoline margins – the costs GLP gleans from the worth they pay for gasoline and the worth they cost.

GLP’s administration is forecasting, and forewarning of a drop on this margin in 2023 as gasoline demand and gasoline costs normalize:

So I believe we’re — our expectations and who is aware of what is going on to occur ahead. Our expectations, as we sit right here in the present day, our margins ought to — and we’ve got seen this, margins ought to return again in the direction of one thing extra regular because the curve has flattened, as volatility has quieted down and as the price of carrying stock has decreased.

We have seen a corresponding downshift in margins in the direction of extra of a historic norm, though nonetheless at elevated ranges. And with out figuring out what is going on to occur subsequent, I believe as you look out the curve, it is cheap to imagine that these are the market situations that we will be coping with for the steadiness of ’23. Now clearly, if there’s some kind of occasion or demand is stronger than anticipated, which I really feel just like the bias is that it’s going to underperform, not overperform. However any occasion, I might say inventories are nonetheless on the tighter facet. So any occasion might ship that in a special path. However as we — based mostly on our visibility proper now, we’re beginning to see issues development extra in the direction of historic norms than what we noticed in 2022. – GLP Incomes Name Transcript

This drop in margin, tied together with larger bills resulting from inflation, will put a squeeze on GLP’s general distribution protection. We don’t count on GLP must reduce its widespread distribution – they elected to do a big particular vs. an enormous common hike, which was clever in our analysis. Nevertheless, because the market sees GLP’s earnings underperforming year-over-year, we count on promoting strain to speed up.

So if we’re uninterested within the widespread shares because of the poor year-over-year comparisons to return, the place do we discover engaging yields from GLP?

Their most well-liked securities supply engaging risk-adjusted returns. International Companions, 9.50% Sequence B Fastened Price Cumulative Redeemable Perpetual Most popular Models (GLP.PB) at present commerce over PAR however supply a excessive mounted yield at 9.3%. We discover these extra engaging than GLP’s different most well-liked providing at the moment, which trades at a wider premium and has a floating interest-rate part. GLP can name International Companions, 9.75% Sequence A Fastened-to-Float Cumulative Redeemable Perpetual Most popular Models (GLP.PA) in August and is already contemplating tapping the bond market to repay a current acquisition. Tacking on the wanted funds to name GLP-A could be simply finished as effectively.

GLP-B can’t be referred to as till 2026, offering a wholesome yield-to-call of 9%. GLP’s capability to pay their most well-liked dividends is just not in query with their robust widespread dividend protection. So we discover GLP-B to be exceptionally engaging at the moment.

The world wants gasoline and diesel to get from level A to level B. Do you’ve gotten an EV? GLP is routinely including EV charging stations to their places as effectively. The world is stopping to go to their places, and GLP offers me with a wholesome revenue.

Conclusion

GHI and GLP-B supply excessive ranges of revenue which you’ll depend on and revel in. This regular circulate of high-yield revenue will proceed in good instances and dangerous, which all of us need after we know life throws curveballs frequently.

For a few of us, a “wealthy retirement” is not money-centric in any respect, however cash is usually the oil that lubricates the gears in life. It is exhausting to have enjoyable or get pleasure from life when monetary woes are piling up or looming throughout us. I need you to have the most effective retirement attainable, and these two picks will help you obtain that!

That is the fantastic thing about revenue investing.

[ad_2]

Source link