[ad_1]

Elementary evaluation is likely one of the most necessary approaches in learning the market and making choices. It’s usually broader than different types of evaluation, which incorporates technical and nostalgic evaluation.

On this article, we’ll have a look at what elementary evaluation is and how you can do it properly.

What is key evaluation?

Elementary evaluation is outlined as a way of analysing monetary property like shares, commodities, foreign exchange, bonds, and cryptocurrencies to find out whether or not a monetary asset is a purchase or a promote.

It appears to be like on the intrinsic problems with an organization that have an effect on their valuation. It additionally appears to be like at the newest information and knowledge and the way they affect these monetary property.

The objective of elementary evaluation is to seek out out whether or not an asset is undervalued or overvalued. It additionally seeks to determine the important thing information that can transfer the property.

A very good instance of that is when the Federal Reserve delivers its rate of interest choice. When this occurs, it normally impacts the worth of most property like crypto and shares.

Who advantages most?

Elementary evaluation is a helpful course of utilized by all forms of merchants. Nevertheless, it’s normally extra helpful for swing and long-term merchants. In most occasions, scalpers not often use it as a result of they’re normally not focused on the primary numbers.

However, odd day merchants use elementary evaluation when planning their buying and selling methods.

For instance, day merchants who depend on volatility have a tendency to make use of elementary knowledge to foretell when actions might be greater. That’s as a result of, the market is normally extra risky when key numbers are launched.

Elementary vs technical evaluation

Elementary and technical evaluation are totally different from each other. Whereas elementary evaluation refers back to the research of financial and monetary knowledge, technical evaluation is the usage of technical instruments that can assist you decide entry and exit ranges.

Normally, technical evaluation is utilized by day merchants and scalpers whereas elementary evaluation is usually utilized by long-term and swing merchants.

That is merely the method of utilizing technical indicators like shifting averages, relative power index (RSI), and the superior oscillator to find out entry and exit factors.

The Federal Reserve and elementary evaluation

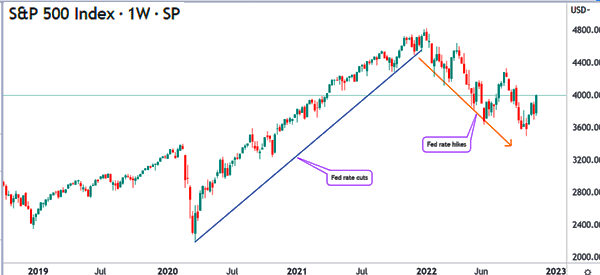

In our expertise, we consider that the Federal Reserve is crucial a part of elementary evaluation. A very good instance of that is proven within the chart under.

The chart exhibits that the S&P 500 index surged between March 2020 and early 2022. This pattern coincided with a interval when the Federal Reserve slashed rates of interest and carried out its greatest quantitative easing (QE) coverage.

The index then began dropping in 2022 because the Fed delivered quite a few large rate of interest hikes.

The Fed is so necessary in that it impacts all monetary property world wide. This occurs due to the particular function of the US as the most important financial system on the earth and the US greenback because the world’s reserve forex.

Subsequently, broadly, any elementary evaluation wants to start with the Federal Reserve. As such, you must have a look at the important thing components that transfer the Federal Reserve. Let’s examine a number of the prime financial numbers to look at that transfer this establishment.

Inflation knowledge

Inflation is a vital a part of the financial system. It merely refers back to the upward transfer of costs of things. In actual fact, inflation is likely one of the dual-purpose of the Federal Reserve. It was shaped in a bid to make sure that inflation stays steady.

Normally, the Fed hikes rates of interest when it believes that inflation is getting out of hand. It then slashes charge hikes when it hopes that inflation has been maintained. Subsequently, merchants have a look at three necessary inflation numbers, together with:

Shopper worth index (CPI) – This determine appears to be like on the broad change of costs of things. It’s revealed on a month-to-month foundation.Producer worth index (PPI) – This quantity appears to be like on the change in costs of things that producers pay for. It tends to have an effect on the price of gadgets that individuals purchase.Private Consumption Expenditure Index (PCE) – That is the Fed’s favourite inflation software, and it measures shopper spending.

Associated » 10+ Economics Knowledge You Ought to Search for

Employment

The opposite dual-role of the Federal Reserve is to make sure that the financial system has a low unemployment quantity. Within the US, the federal government publishes key employment numbers each month. In most durations, these numbers come each first Friday of the month.

Subsequently, merchants have a look at these numbers to find out whether or not the Fed will hike or slash rates of interest. When inflation stays stubbornly excessive and the unemployment charge low, it will increase the chance that the Fed will hike rates of interest.

There are different financial numbers that traders and merchants watch in elementary evaluation, included:

PMIs – These numbers are revealed each month to point out the efficiency of key sectors of the financial system. They embrace companies and manufacturing knowledge.Retail gross sales – These numbers present the amount of retail gross sales that individuals purchased within the US each month.Shopper confidence – These numbers are necessary as a result of shopper spending is the most important a part of the American financial system.Manufacturing – The info exhibits issues like industrial and manufacturing manufacturing that present the amount of manufacturing.

This elementary evaluation may help you establish wether to purchase or promote monetary property, together with shares, currencies, and indices.

Different Financial Knowledge

Non-farm payrolls knowledge present the variety of folks totally different sectors of the financial system are including or decreasing. Buyers and merchants use this knowledge to know whether or not to spend money on the nation or keep away.

One other instance of financial knowledge are Firm’s earnings or the crude oil inventories. These inventories present crude oil traders the tendencies which are occurring within the oil market and how you can make investments, going ahead.

As a dealer, it’s due to this fact essential to grasp the various kinds of financial and firm knowledge, when they’re launched, their relevance, and how you can commerce when they’re launched.

Elementary evaluation in shares

It is usually attainable to do elementary evaluation in shares. This consists of a number of key components that transfer shares. Among the prime elementary issues to take a look at when buying and selling and investing in shares are:

Earnings – That is the place you have a look at an organization’s earnings and decide whether or not to take a position or commerce it. You should utilize the financial calendar to know firms which are about to publish their monetary outcomes.Valuation – It is best to have a look at shares valuation. That is the place you employ varied valuation metrics to know whether or not a inventory is overvalued or undervalued. You should utilize a number of comparability and DCF valuation metrics.Firm information – One other elementary factor to think about is the most recent company-specific information. These information embrace administration change, merger and acquisition, and an investigation.

Along with all this, you need to use key instruments offered by most brokers to conduct inventory evaluation in shares. A few of these options are Stage 2 and Time & Gross sales.

Stage 2 supplies the precise bid and ask costs of shares. Time & gross sales considers the precise time and quantity of shares. You should utilize this knowledge to find out whether or not to purchase and or quick a inventory.

Elementary evaluation in cryptocurrencies

It is usually attainable to do elementary evaluation within the crypto trade. This could begin with a broader view of the market, which begins with the macro view. The macro view ought to contain issues such because the Federal Reserve and different components.

Beneath that, you too can do an on-chain evaluation, the place you have a look at key tendencies within the particular crypto. There are a number of on-chain metrics that you would be able to have a look at when analysing cryptocurrencies.

Among the prime metrics to think about are the variety of customers, alternate inflows and outflows, in-the-money and out-of-money, transactions quantity, alternate reserve, and community worth to transaction.

Associated » Analyze Fundamentals in Foreign exchange

Combining technical and elementary evaluation

A key rule that many day merchants use is that they mix elementary and technical evaluation. That is the place they use the 2 collectively in a deal to foretell the subsequent worth motion. Technical evaluation is the place a dealer appears to be like at charts and determines the subsequent worth motion.

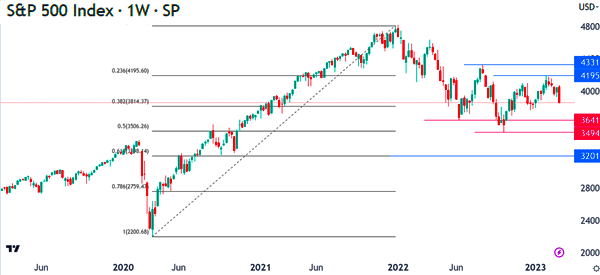

A very good instance of that is proven under. On this chart, we will use elementary evaluation to give attention to issues like earnings and the Federal Reserve.

In case you consider that the Fed will proceed climbing charges, then you need to use technical evaluation to seek out the important thing ranges to look at, together with $3,641 and $3,494. For this commerce, the stop-loss might be at $4,195 and $4,331.

Create a plan

To grasp the artwork and science of elementary evaluation, it’s essential to have a plan! This plan will assist you know the way to commerce when the info is launched.

Some merchants like to be on the sidelines when the info is launched. They do that for the easy motive that they can’t predict precisely the info that might be launched.

However, there are merchants who like buying and selling when the info is being launched. They do that due to the volatility that’s normally occurs after the discharge of the info.

The very best factor so that you can do is to create a plan and understand how you can be buying and selling on this.

We have now adopted a quite simple approach of buying and selling when the financial or earnings knowledge is launched. We at all times keep out of the market two hours earlier than the info is launched. Then, we enter sure property half-hour after the info has been launched.

At the moment, we will confidently predict the route the asset will go.

The important thing to success in elementary evaluation is expertise. On this, the extra time you’re taking to review and analyze the market conduct after the info is launched the higher it’s for you.

Financial and Earnings Calendar

The earnings and financial calendars are two influential gadgets that traders and merchants use. So that you can achieve success in this kind of evaluation, it’s essential to first know the time when totally different knowledge is launched.

The 2 calendars may help you realize when to count on the info to be launched. As a dealer, We advocate that you simply go to the financial calendar on the finish of the week. This can assist you plan your buying and selling for the next week.

Associated » Smart Merchants Ought to Consider in Evaluation, not Forecasting

Finest sources of elementary knowledge

As a day dealer who makes use of elementary evaluation, you’ll need to have a superb entry to elementary knowledge. Happily, there are numerous sources of this data, together with:

Investing.com – Investing is a widely known web site that gives all forms of elementary knowledge resembling financial, monetary, IPO, and inventory cut up calendars.SeekingAlpha (SA) – SA is a significant writer of monetary content material from 1000’s of authors from world wide. It additionally supplies different necessary instruments like instantaneous information and calendars.Bloomberg, CNBC, WSJ, and FT – These are the most important distributors of monetary data. As a dealer, you must make a degree of checking them out day by day.Barchart.com – Barchart is a wonderful web site that gives you with entry to high quality evaluation instruments.

One other good answer is to look at TraderTv Reside on Youtube!

Last ideas

Elementary evaluation is likely one of the three forms of evaluation in monetary buying and selling. The others are technical evaluation and nostalgic evaluation. Having a superb understanding of the technique will assist you develop into a greater day and swing dealer.

To grasp this evaluation you want three issues:

Know when the related knowledge will come outLearn how you can interpret the dataHow to commerce utilizing the info quickly after and earlier than it’s launched

Additionally, do not forget that the way in which you commerce is not going to at all times work. It is best to learn to undertake to that too.

And also you? Do you like elementary or technical evaluation? Do you could have different methodologies to suggest? Tell us within the feedback!

Exterior Helpful Hyperlinks

[ad_2]

Source link