[ad_1]

Plummeting bond yields, steep drops in oil and inventory costs, and a pointy soar in volatility are all signaling that traders worry a recession is now on the close to horizon.

Shares had been down Wednesday, as worries about Credit score Suisse spooked markets already involved about U.S. regional banks following the shutdown of Silicon Valley Financial institution and Signature Financial institution.

“What you are actually seeing is a big tightening of economic circumstances. What the markets are saying is that this will increase dangers of a recession and rightfully so,” stated Jim Caron, head of macro technique for world mounted earnings at Morgan Stanley Funding Administration. “Equities are down. Bond yields are down. I believe one other query is: it seems to be like we’re pricing in three charge cuts, does that occur? You possibly can’t rule it out.”

Bond yields got here off their lows and shares recovered some floor in afternoon buying and selling, following stories that Swiss authorities had been discussing choices to stabilize Credit score Suisse.

Wall Road has been debating whether or not the financial system is heading right into a recession for months, and plenty of economists anticipated it to happen within the second half of this 12 months.

However the speedy strikes in markets after the regional financial institution failures within the U.S. has some strategists now anticipating a contraction within the financial system to return sooner. Economists are additionally ratcheting down their development forecasts on the belief there can be a pullback in financial institution lending.

“A really tough estimate is that slower mortgage development by mid-size banks may subtract a half to a full percentage-point off the extent of GDP over the subsequent 12 months or two,” wrote JPMorgan economists Wednesday. “We imagine that is broadly in step with our view that tighter financial coverage will push the US into recession later this 12 months.”

Financial institution shares once more helped lead the inventory market’s decline after a one-day snap again Tuesday. First Republic, as an example was down 21% and PacWest was down practically 13%. However power was the worst performing sector, down 5.4% as oil costs plunged greater than 5%. West Texas Intermediate futures settled at $67.61 per barrel, the bottom degree since December 2021.

On the similar time, the Cboe Volatility Index, generally known as the VIX, rocketed to a excessive of 29.91 Wednesday earlier than closing at 26.10, up 10%.

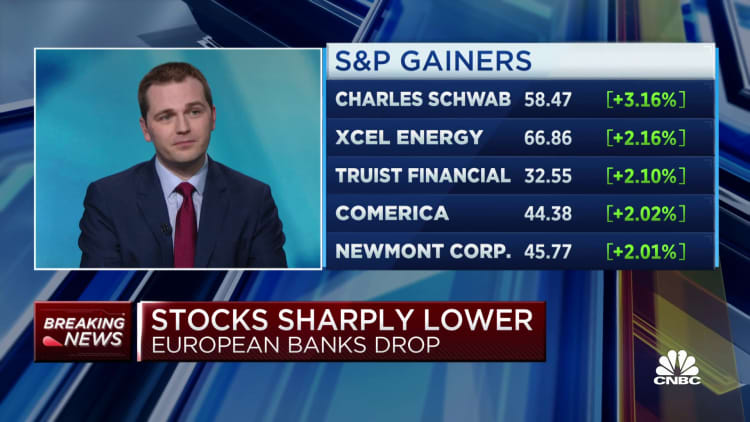

The S&P 500 closed down 0.7% at 3,891 after falling to a low of three,838.

stx

“Bear market bottoms are normally retested to make sure that the low is actually in. The rising threat of recession is now being exacerbated by the elevated probability that banks will restrict their lending,” famous Sam Stovall, chief market strategist at CFRA. “In consequence, the excellent query is whether or not the October 12 low will maintain. If it does not, we see 3,200 on the S&P 500 being one other probably goal, based mostly on historic precedent and technical concerns.”

Treasury bonds, normally a extra staid market, additionally traded dramatically. The 2-year Treasury yield was at 3.93% in afternoon buying and selling, after it took a wild swing decrease to three.72%, properly off its 4.22% shut Tuesday. The two-year most carefully displays traders’ views of the place Fed coverage goes.

2 y

“I believe persons are rightfully on edge. I assume after I take a look at the entire thing collectively, there is a element of the rally within the [Treasury] market that’s flight-to-quality. There’s additionally a element of this that claims we will tighten credit score,” stated Caron. “We will see tighter lending requirements, whether or not it is within the U.S. for small- and mid-sized banks. Even the bigger banks are going to tighten lending requirements extra.”

The Federal Reserve has been making an attempt to decelerate the financial system and the robust labor market as a way to struggle inflation. The patron worth index rose 6% in February, a nonetheless sizzling quantity.

However the spiral of stories on banks has made traders extra nervous {that a} credit score contraction will pull the financial system down, and additional Fed rate of interest hikes would solely hasten that.

For that motive, fed funds futures had been additionally buying and selling wildly Wednesday, although the market was nonetheless pricing a couple of 50% probability for 1 / 4 level hike from the Fed subsequent Wednesday. The market was additionally pricing in a number of charge cuts for this 12 months.

“Long run, I believe markets are doing the proper of factor pricing out the Fed, however I do not know if they will reduce 100 foundation factors both,” stated John Briggs, world head of economics and markets technique at NatWest Markets. Briggs stated he doesn’t anticipate a charge hike subsequent week. A foundation level equals 0.01 of a proportion level.

“Credit score is the oil of the machine, even when the near-term shock was alleviated, and we weren’t nervous about monetary establishments extra broadly, threat aversion goes to set in and take away credit score from the financial system,” he stated.

Briggs stated the response from a financial institution lending slowdown might be deflationary or at the least a disinflationary shock. “Most small companies are banked by neighborhood regional banks, and after this, even when your financial institution is okay, are you going to be kind of prone to provide credit score to that new dry cleaner?” he stated. “You are going to be much less probably.”

CFRA strategists stated the Fed’s subsequent transfer is just not clear. “The current downticks within the CPI and PPI readings, in addition to the retrenchment of final month’s retail gross sales, added confidence that the Fed will soften its inflexible tightening stance. However nothing is evident or sure,” wrote Stovall. “The March 22 FOMC assertion and press convention is only a week away, however it would most likely really feel like an eternity. Ready for tomorrow’s ECB assertion and response to the rising financial institution disaster in Europe additionally provides to uncertainty and volatility.”

The European Central Financial institution meets Thursday, and it had been anticipated to lift its benchmark charge by a half %, however strategists say that appears much less probably.

JPMorgan economists nonetheless anticipate a quarter-point charge hike from the Fed subsequent Wednesday and one other in Could.

“We search for a quarter-point hike. A pause now would ship the fallacious sign in regards to the seriousness of the Fed’s inflation resolve,” the JPMorgan economists wrote. “Relatedly, it will additionally ship the fallacious sign about ‘monetary dominance,’ which is the concept the central financial institution is hesitant to tighten, or fast to ease, due to issues about monetary stability.”

Moody’s Analytics chief economist Mark Zandi, nonetheless, stated he expects the Fed to carry off on a charge hike subsequent week, and the central financial institution may sign the mountain climbing cycle is finished for now.

He has not been anticipating a recession, and he thinks there may nonetheless be a mushy touchdown.

“I do not suppose folks ought to underestimate the impression of these decrease charges. Mortgages will go decrease and that needs to be a raise to the housing market,” he stated. Zandi stated he doesn’t anticipate the Fed to show round and reduce charges, nonetheless, since its struggle with inflation is just not over.

“I am a bit confused by the markets saying there is a 50/50 probability of a charge hike subsequent week, after which they will take out the speed hikes. We’ve got to see how this performs out over the subsequent few days,” he stated.

Zandi expects first-quarter development of 1% to 2%. “However the subsequent couple of quarters might be zero to 1%, and we could even get a destructive quarter, relying on timing,” he stated.

Goldman Sachs economists Wednesday additionally lowered their 2023 financial development forecast, decreasing it by 0.3 proportion factors to 1.2%. In addition they pointed to the pullback in lending from small- and medium-sized banks and turmoil within the broader monetary system.

Correction: This story was corrected to precisely mirror Jim Caron’s remarks that markets are pricing in three charge cuts.

[ad_2]

Source link