[ad_1]

Kameleon007

Funding thesis

Ingersoll Rand Inc. (NYSE:IR) is predicted to profit from the carryover pricing impression of will increase from the final yr and extra value hikes this yr. The corporate must also see continued order progress resulting from sustainability and the onshoring development. The corporate’s inorganic progress prospects additionally look good and, earlier this yr, it accomplished two acquisitions of Paragon Tank Truck and SPX Move and signed 11 letters of intent (LOI) with potential goal firms.

On the margin entrance, the corporate is predicted to profit from moderating inflation, coupled with value hikes made final yr and anticipated ones this yr. Furthermore, the corporate ought to profit from synergy and cost-cutting associated to Seepex integration. In the long term, the corporate is prone to profit from a mixture shift to higher-margin aftermarket providers, resulting from its prospects’ elevated use of IIOT-enabled (Industrial Web of Issues) merchandise.

The inventory is buying and selling at a reduction versus its historic common and different industrial compounders, making it a purchase.

Income Evaluation and Outlook

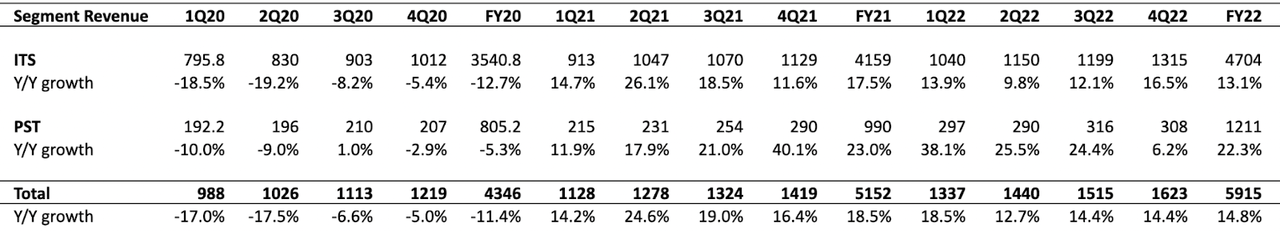

Final yr, the corporate skilled sturdy topline progress of 14.8% Y/Y, and its revenues reached ~$5.9 billion. This progress was primarily pushed by pricing, quantity, and acquisitions, partially offset by foreign exchange and provide chain-related headwinds. Through the yr, the corporate witnessed 7.9% Y/Y quantity progress, because of strong demand from the core industrial finish market, which was complemented by ~8% Y/Y value will increase. Moreover, the corporate made vital portfolio adjustments by divesting its particular automobile expertise enterprise and high-pressure resolution enterprise whereas making a number of tuck-in acquisitions, leading to a 4.4% Y/Y tailwind for income from inorganic progress in FY2022. Nevertheless, forex-related headwinds impacted the topline by -5.6% Y/Y.

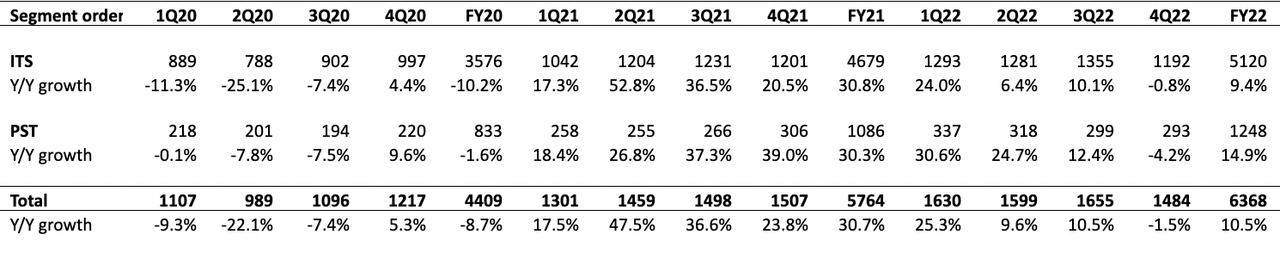

Throughout 2022 the corporate booked orders price $6.36 billion (up 10.5% Y/Y). The rise was primarily pushed by 11.4% Y/Y natural progress resulting from a robust core industrial finish market which was complemented by 4.4% Y/Y progress from acquisitions. Nevertheless, forex-related headwinds impacted the orders by -5.3% Y/Y.

Ingersoll Rand income progress (Firm information, GS Analytics Analysis)

The corporate continued to expertise robust income progress in 4Q22, reporting $1.6 billion in income, up 19% Y/Y on an natural foundation. Nevertheless, new orders declined 1% Y/Y to $1.48 billion, although on an natural foundation, orders had been up 2%. The surprising decline so as progress was because of the slippage of a giant order to 1Q23 within the Industrial Applied sciences and Providers (ITS) America Enterprise. The PST section order was additionally impacted by robust Y/Y comparisons ensuing from a big hydrogen order consumption in 4Q21. Regardless of this, the corporate ended the yr with a $2 billion backlog, nearly 1.5x the conventional backlog ranges. The elevated backlog ranges had been resulting from provide chain points and labor shortages.

Ingersoll Rand’s new order progress (Firm Knowledge, GS Analytics Analysis)

Wanting forward, IR is predicted to profit from excessive backlog ranges, value will increase, and continued order progress, which ought to improve income within the coming quarters.

As beforehand talked about, the backlog stage was 1.5x the historic ranges resulting from provide chain constraints and labor shortages. Nevertheless, the scenario is enhancing with the availability chain constraints easing, which ought to facilitate the next backlog-to-sales conversion price and assist income progress in FY2023.

The corporate has a coverage of accelerating pricing by 1-2% yearly, which it has been profitable in implementing because of the mission-critical nature of its merchandise. In 2022, the corporate raised costs a number of occasions past the same old improve resulting from elevated inflation strain, mountaineering pricing by ~8% in the course of the yr. These elevated costs, particularly in the course of the again half of the yr, ought to have carryover impacts in FY23. This, coupled with the same old value hikes, signifies that FY23 might be one other robust yr for pricing for the corporate.

Along with pricing-related tailwinds, the corporate is predicted to develop its new orders at an honest tempo which ought to assist FY23 revenues. Whereas orders had been down in 4Q22, they turned optimistic once more in January. The demand within the firm’s finish market continues to be robust with the rising alternatives in sustainability and onshoring benefiting the corporate.

As extra firms and organizations goal being extra sustainable, they’re revamping their capability with merchandise which can be extra power environment friendly and helps preserve assets like water. Nearly 30% of the corporate’s income is from water-efficient merchandise, and 100% is from energy-efficient merchandise. instance of IR’s sustainable providing is the corporate’s Runtech enterprise, a Turbo Blower expertise for the pulp and paper trade that reduces water utilization by 90% and power utilization by 50%. Furthermore, lots of IR’s prospects are onshoring their manufacturing amenities which helps IR’s order progress.

Moreover natural progress, IR can also be centered on rising its income inorganically. In 2022, IR acquired 12 firms with a cumulative funding of ~$800 million, including ~$300 million to the corporate’s topline. In 2023, this inorganic progress momentum is predicted to proceed. Thus far in FY23, the corporate has signed 11 letters of intent and accomplished two acquisitions of SPX Move and Paragon Tank Truck price $525 million and $40 million, respectively. The 2 accomplished offers already had a mixed income of $205 million in 2022, and given extra potential acquisitions this yr, I anticipate a robust contribution from inorganic progress this yr as nicely. In the long term, the corporate goals to ship 400bps to 500bps of Y/Y topline progress from M&A until 2025, which appears affordable given the corporate’s robust stability sheet place. As of the final quarter’s finish, the corporate had a web debt to EBITDA of 0.8x, which is under its goal of 2x web debt to EBITDA, giving it good headroom by way of inorganic progress within the coming years.

Margin Outlook

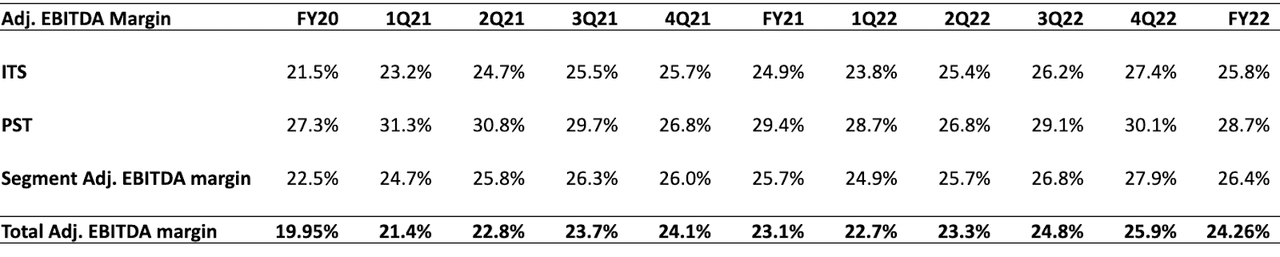

In 2022, the corporate skilled a 70 foundation factors Y/Y segment-adjusted EBITDA margin enchancment to 26.4%, primarily pushed by robust ~8.2% Y/Y value will increase. On a section foundation, the ITS section’s adjusted EBITDA margin improved by 90 foundation factors, whereas the PST section’s adjusted EBITDA margin declined 70 foundation factors Y/Y.

Throughout 4Q22, the IST section achieved a 170 bps adjusted EBITDA margin enchancment to 27.4%, with an incremental margin of 38%. In the meantime, the PST section’s adjusted EBITDA margin improved 330 bps Y/Y to 30.1%, benefiting from value value enchancment and synergy advantages from the Seepex acquisition.

Adjusted EBITDA margin (Firm information, GS Analytics Analysis)

Wanting forward, I anticipate the corporate’s margins to profit from the carryover value improve applied final yr and the synergy advantages from the Seepex acquisition. In FY2022, the corporate raised its product costs by ~8% on common to offset rising enter prices and preserve a optimistic price-cost equation. Wanting ahead, uncooked materials costs are anticipated to stabilize or lower within the coming quarters, however the firm is predicted to retain its earlier value improve, leading to a margin tailwind.

Moreover, the PST section, specifically, is predicted to proceed benefiting from the synergy advantages associated Seepex acquisition made in 3Q21. Earlier than the acquisition, the general section had an adjusted EBITDA margin of round 30%, which decreased to the mid-20s because of the inclusion of mid-teens EBITDA Seepex enterprise. Over the past 5 quarters, the corporate built-in the Seepex enterprise and realized synergy advantages. By 4Q22, the Seepex enterprise had a mid-20s EBITDA margin, which is predicted to strategy the general segment-level margin of round 30% over the approaching quarters. The latest SPX Move acquisition with EBITDA margins within the mid-20s can also be anticipated to attain related synergy advantages and assist IR’s total margins.

Other than near-term margin tailwinds, the corporate goals to extend higher-margin aftermarket income in the long run. The corporate plans to leverage the Industrial Web of Issues (IIOT) to extend its aftermarket income by providing prospects service contracts, half subscriptions, and system optimization providers. In 2021, the corporate derived 10% of its income from IIOT-enabled merchandise, which elevated to 19% in 2022. The elevated adoption of IIOT-enabled merchandise ought to end in greater aftermarket income within the coming years. The corporate goals to extend its aftermarket providers income from the mid-30s to the mid-40s.

Through the investor day in 2021, the corporate set its long-term adjusted EBITDA margin goal within the excessive 20s. The goal is predicted to be achieved via increasing IIOT merchandise, footprint optimization, M&A synergies, direct materials and provide chain optimization, and implementation of lean manufacturing and automation. In 2021, the corporate had an adjusted EBITDA margin of 23.1%, which the administration supposed to extend by roughly 100 bps yearly till 2025. The corporate delivered a 120bps enchancment in 2022 and is predicted to have one other 80-90 bps enchancment this yr. I consider the corporate is on observe to attain its goal and attain its purpose by 2025.

Valuation

The inventory is presently buying and selling at a ahead P/E of 20.79x primarily based on the FY23 consensus EPS estimate of $2.55 which is a reduction to its 5-year common ahead P/E of 37.58x. I consider the corporate can publish mid-single-digit natural progress in the long run which coupled with bolt-on acquisitions and margin enchancment prospects can assist it ship excessive single-digit income progress and low double-digit EPS progress within the medium to long run. If we take a look at different high-quality industrial compounders like Danaher (DHR) following an identical bolt-on acquisition and margin enchancment technique, they’re buying and selling at a P/E within the mid-20s vary. Ingersoll’s P/E may re-rate and attain an identical vary because it continues to execute nicely. This, coupled with good EPS progress prospects, makes the inventory a purchase.

[ad_2]

Source link