[ad_1]

imaginima

[Please note that all currency references are to U.S. dollars except if indicated otherwise.]

Descartes Methods Group (NASDAQ:DSGX) (TSX:DSG:CA) offers software program and companies to the logistics and provide chain business. The corporate was based in 1981, is headquartered in Waterloo, Canada, and is listed on the Nasdaq and Toronto Inventory exchanges.

Descartes has carried out properly over the previous decade by constructing and increasing a platform of software program options for the worldwide provide chain business. An skilled administration workforce ought to be capable to proceed executing the growth-by-acquisition technique in a big and fragmented business. Nonetheless, the expansion technique comes with dangers whereas the valuation leaves no room for error.

Connecting the availability chain operators

Descartes operates the biggest impartial transport community on this planet and offers software program that organizes operations of and facilitates connections between the assorted events concerned within the world provide chain and logistics community. These events embody carriers (ocean, air, truck, rail), shippers (retailers, producers, distributors), intermediaries (customized brokers, freight brokers, forwarders), and authorities companies (customs, regulators).

The options supplied by the corporate embody business-to-business connectivity, transportation administration, e-commerce cargo and achievement, world commerce intelligence, dealer and forwarder enterprise methods, and customs and regulatory compliance. The methods supplied by Descartes serve 25,000 prospects within the logistics chains and allow the monitoring of 575 million shipments yearly.

Distinguished prospects embody American Airways, Hapag-Lloyd, FedEx, Kuehne+Nagel, The Dwelling Depot, Toyota, Coca-Cola, and Fresenius. The indicated buyer retention charge is round 95%.

Descartes operates globally with shoppers primarily based in 160 international locations. Income within the 2023 monetary 12 months (ended 31 January) was $486 million, with a internet revenue of $102 million. Revenues are largely derived from subscription charges for using the software program and merchandise (“software-as-a-service” mannequin). Different revenues come from consulting, implementation, and coaching actions associated to the services.

Clients paying in U.S. {dollars} supplied the majority of the revenues in 2023 (69%), adopted by the Euro (11%), Canadian greenback (7%), and British Pound (7%) with the stability in different currencies.

The corporate faces competitors from varied entities together with builders of provide chain community options (for instance Manhattan Associates), enterprise useful resource planning software program distributors (SAP and Oracle), messaging networks (OpenText GXS), cargo reserving portals (Unisys Company), customized compliance and forwarder back-office options (WiseTech), commerce intelligence platforms (S&P World), and eCommerce transport and achievement suppliers (Stamps.com).

Speedy and worthwhile development…fuelled by acquisitions

Descartes has grown quickly over the previous decade, largely by means of acquisitions. Acquisitions are usually smaller in dimension (common of $40 million per transaction) and are targeted on complementary applied sciences that may be supplied to present prospects.

Since 2015, the corporate has accomplished 28 acquisitions for a complete outlay of about $1.1 billion. Acquisitions are largely financed with money available, utilizing an present credit score facility, or the occasional difficulty of shares.

As a proportion of annual revenues, the acquisitions averaged 41% over the previous decade. Nonetheless, this has slowed down to twenty% over the previous three fiscal years after a bumper interval in 2019.

Latest acquisitions embody XPS which helps e-commerce shippers hook up with e-commerce platforms; GroundCloud offers remaining mile logistics automation and video telematics for driving occasion verification; NetCHB offers customs submitting options within the U.S.; whereas Foxtrot presents machine-learning cell route planning options.

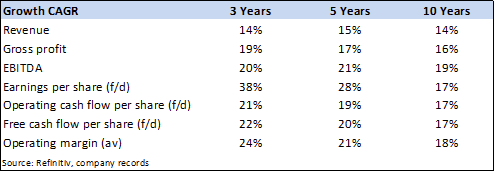

Whereas the tempo of acquisitions slowed considerably in recent times, the tempo of revenue development has accelerated (see desk). Importantly from an investor perspective, the per share internet revenue and money movement development additionally accelerated and grew at a sooner charge than revenues – this means that administration succeeded in extracting worth and synergies from the acquisitions. Enhancing revenue margins carry the identical message.

Refinitiv

Descartes is actively exploring additional acquisitions and may entry a revolving credit score facility of $500 million for additional acquisitions. As well as, in 2022 the corporate filed a base shelf prospectus which permits for the difficulty of a vast variety of frequent shares, most popular shares, or debt securities.

The problem for firms that develop primarily by acquisitions is firstly to seek out the rights targets after which to extract synergies that may be accretive to the bottom-line income. The second problem is that the acquisitions have to grow to be bigger because the enterprise grows which will increase the chance that a big mistake will probably be made.

Descartes – evaluating properly with the business leaders

Descartes is a worthwhile entity with enticing revenue margins though the return on capital is low. However the low return on capital is considerably defined by the various acquisitions that contributed to a big intangible asset base on the stability sheet which, in flip, depresses the return on capital.

In comparison with a peer group Descartes compares properly on the EBITDA margin, however the return on invested capital is under par. Income development and earnings per share development have been increased than the peer common however corresponding to Constellation Software program over the previous 5 years.

Lastly, Descartes, Manhattan, and Constellation carried out very properly by way of inventory worth efficiency with annual positive factors in extra of 20% over the previous 5 years. These returns align with the excessive ranges of revenue development and profitability.

A fortress stability sheet supported by ample money movement

The corporate had shareholders’ fairness of $1.1 billion by the top of January 2023, zero debt, and money of $276 million. Acquisitions made within the early a part of 2023 would have consumed among the money however the stability sheet stays wholesome.

As well as, the corporate generates important money movement, and given the asset-light enterprise mannequin, incurs restricted capital expenditures. This leaves ample free money movement that can be utilized for debt discount, acquisitions, share buybacks, or dividend funds.

Over the previous 5 years, the corporate generated $657 million in free money movement whereas acquisitions amounted to $614 million, taking on the majority of the obtainable money movement. The corporate doesn’t pay a dividend and has not been an energetic purchaser of its personal shares out there though it at present has regulatory approval to purchase as much as 7.4 million shares.

An skilled C-team

Edward J. Ryan is the Chief Government Officer, a place he has held since 2013. He joined Descartes in 2000 when his earlier employer E-Transport Integrated was acquired by Descartes. Earlier than he was appointed CEO, he was the company’s Chief Industrial Officer with oversight of gross sales, advertising, and buyer success.

The Chief Working Officer is J. Scott Pagan; he joined in Might 2000 and was appointed to his present function in 2013. The Chief Monetary Officer is Allan Brett who was appointed in 2014 and the Government VP of Data Providers, Raimond Diederik joined in 1998. One other key govt is Ed Gardner who’s chargeable for the event and execution of the acquisition technique – he joined in 2003.

Executives earn a base wage, advantages, short-term incentives, and long-term incentives. Brief-term incentives are primarily based on the achievement of annual income, EBITDA, and money movement targets. Lengthy-term incentives are primarily based on the share worth efficiency of Descartes relative to a peer group over a 3-year interval. Within the 2022 fiscal 12 months, the CEO earned $5.9 million with the motivation awards making up 91% of his complete reward.

The members of the board and senior executives collectively maintain lower than 2% of the whole issued shares. Main institutional shareholders are T. Rowe Value with 14.0% of the frequent shares and Jarislowsky Fraser holding 5.5%.

Sound current outcomes

The corporate not too long ago reported strong outcomes for the fourth quarter and 12 months ending 31 January 2023. For the complete 12 months, revenues elevated by 14% to $486 million and with increasing revenue margins, internet revenue was up by 18%. Absolutely diluted earnings per share was additionally up by 18%. Money movement from operations elevated by 9% and free money movement by an analogous margin.

Consensus estimates point out a income development of 14% for the 2024 fiscal 12 months and earnings per share development of 24%.

Nothing low cost right here

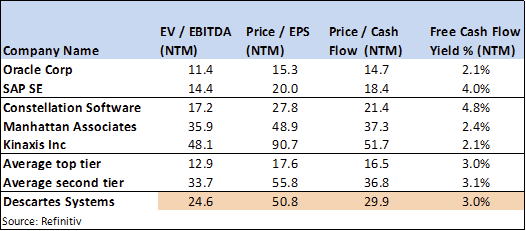

Given the inventory’s present worth and consensus estimates for the following 12 months, the corporate is valued on an EV/EBITDA ratio of 24.5 occasions and a price-to-cash movement ratio of 29.9 occasions.

Refinitiv

The operations of the chosen friends overlap to some extent with the verticals by which Descartes operates. Nonetheless, the friends signify a combined bag of slow-growing giant firms and fast-growing smaller firms. In comparison with the typical of the top-tier, slow-growth peer group, Descartes appears to be like overvalued. When in comparison with the smaller, fast-growing friends, comparable to Constellation Software program or Manhattan Associates, the valuation appears to be like extra cheap, though nonetheless costly.

Backside line … good enterprise however too costly

There may be a lot to love about Descartes – administration has developed the enterprise by means of complementary, small, low-risk acquisitions in area of interest markets, and within the course of created a worthwhile entity with robust money flows. However the valuation is simply too wealthy for our style.

By Deon Vernooy, CFA, for TSI Wealth Community

[ad_2]

Source link