[ad_1]

Following the fallout over the previous two weeks within the U.S. banking business, the Federal Reserve raised the federal funds price by 25 foundation factors (bps) on Wednesday, citing the necessity for the inflation price to return to 2% over the long term.

Fed Raises Charge Regardless of Calamity within the U.S. Banking Sector

It’s been a tough two weeks for the U.S. economic system after the autumn of Silvergate Financial institution, Silicon Valley Financial institution, and Signature Financial institution. After these financial institution failures passed off, the Federal Reserve introduced the creation of the Financial institution Time period Funding Program (BTFP) and introduced that uninsured depositors of Signature Financial institution and Silicon Valley could be made complete. After the turmoil within the banking business, some consultants suspected the Fed wouldn’t increase the benchmark price this month.

On Wednesday at 2 p.m. Japanese Customary Time, the Federal Open Market Committee (FOMC) revealed that it could increase the speed by 25bps. “The committee seeks to attain most employment and inflation on the price of two p.c over the longer run,” the FOMC mentioned. “In assist of those targets, the committee determined to lift the goal vary for the federal funds price to 4-3/4 to five p.c. The committee will carefully monitor incoming info and assess the implications for financial coverage.”

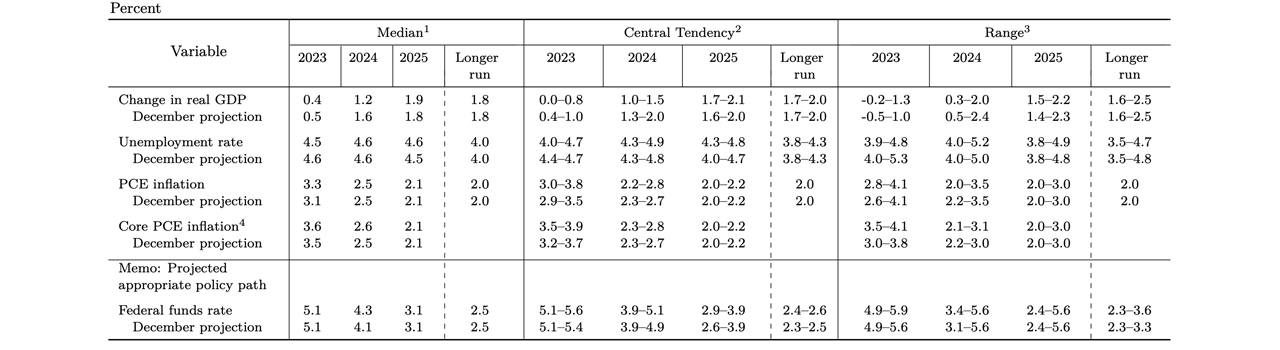

As well as, the Fed revealed the central financial institution’s “Abstract of Financial Projections,” which suggests the inflation price can attain 2.1% by 2025 and a pair of% over the longer run. By 2025, the FOMC projections see the federal funds price lowered down to three.1%. Following the FOMC’s assertion and projections report, fairness markets jumped greater on the information, with three out of 4 of the U.S. benchmark indices within the inexperienced.

Crypto belongings dropped after the small enhance from the Fed, with bitcoin (BTC) nearing the $29K vary at $28,700 at 2:15 p.m. Japanese Customary Time on Wednesday. However by 2:45 p.m., BTC had shortly dropped right down to the $27,876 per unit vary. At current, BTC’s USD worth is hovering simply above the $28K zone.

Whereas cryptos had a combined response to the Fed information, valuable metals held robust. Each gold and silver jumped on the Fed hike, rising 1.6% to 2.5% greater in opposition to the dollar. General, the FOMC assertion famous that latest indicators have proven “modest development in spending and manufacturing.”

Additional, the Fed says that whereas “job features have picked up in latest months and are operating at a sturdy tempo, [and] the unemployment price has remained low, inflation stays elevated.”

After the FOMC press assertion, Fed chair Jerome Powell insisted the U.S. banking system “is sound and resilient with robust capital and liquidity.” Powell added, “we predict our financial coverage device works, and we predict … our price hikes had been nicely telegraphed to the markets, and lots of banks have managed to deal with them.”

What do you assume the Fed’s choice to lift rates of interest means for the U.S. economic system? Share your ideas about this topic within the feedback part beneath.

Picture Credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This text is for informational functions solely. It isn’t a direct supply or solicitation of a suggestion to purchase or promote, or a advice or endorsement of any merchandise, companies, or corporations. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the writer is accountable, immediately or not directly, for any harm or loss brought on or alleged to be brought on by or in reference to using or reliance on any content material, items or companies talked about on this article.

[ad_2]

Source link