[ad_1]

Printed on March twenty second, 2023 by Aristofanis Papadatos

Paramount Sources (PRMRF) has two interesting funding traits:

#1: It’s providing an above common dividend yield of 4.6%, which is sort of triple the 1.6% dividend yield of the S&P 500.#2: It pays dividends month-to-month as a substitute of quarterly.

You may obtain our full Excel spreadsheet of all month-to-month dividend shares (together with metrics that matter like dividend yield and payout ratio) by clicking on the hyperlink under:

The mixture of an above common dividend yield and a month-to-month dividend render Paramount Sources interesting to particular person buyers.

However there’s extra to the corporate than simply these components. Maintain studying this text to be taught extra about Paramount Sources.

Enterprise Overview

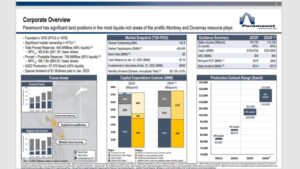

Paramount Sources explores for and produces oil and pure fuel from typical and unconventional fields in Canada. The corporate holds pursuits within the Karr and Wapiti Montney properties, which cowl an space of 185,000 web acres positioned south of the town of Grande Prairie, Alberta. The corporate was based in 1976 and is predicated in Calgary, Canada.

Paramount Sources has a mean manufacturing charge of about 97,400 barrels per day and complete proved reserves of 445 million barrels of oil equal, with oil and fuel at a 49/51 ratio.

Supply: Investor Presentation

It’s also necessary to notice that the corporate has 47% possession by insiders. It is a remarkably excessive p.c of possession, which leads to the alignment of pursuits between insiders and the opposite particular person shareholders.

As an oil and fuel producer, Paramount Sources is extremely cyclical because of the dramatic swings of the costs of oil and fuel. The corporate has reported losses in 6 of the final 10 years and resumed its dividend funds solely in the summertime of 2021, after 22 years with no dividend cost.

However, Paramount Sources has some benefits when in comparison with the well-known oil and fuel producers. Most oil and fuel producers have been struggling to replenish their reserves because of the pure decline of their producing wells. Quite the opposite, Paramount Sources posted an exceptionally excessive reserve alternative ratio of 190% in 2022. In consequence, the corporate expects its manufacturing in 2024 to be roughly 30% greater than its manufacturing in 2022. That is undoubtedly a powerful manufacturing progress charge, which can’t be discovered among the many well-known oil majors, similar to Exxon Mobil (XOM), Chevron (CVX), Shell (SHEL) and BP (BP).

The reserve alternative ratio is paramount within the oil and fuel trade. And not using a strong reserve alternative ratio, a producer can not develop its earnings in a sustainable method in the long term.

Identical to virtually all of the oil and fuel producers, Paramount Sources incurred losses in 2020 because of the collapse of the costs of oil and fuel brought on by the pandemic. Nonetheless, because of the large distribution of vaccines worldwide, world demand for oil and fuel recovered in 2021 and thus the corporate returned to profitability in that yr.

Even higher for Paramount Sources, the battle in Ukraine triggered a rally of the costs of oil and fuel to 13-year highs final yr. In consequence, the corporate almost tripled its earnings per share, from $1.32 in 2021 to $3.42 in 2022. Paramount Sources reinstated its dividend in mid-2021, after having suspended it for the previous 22 years.

Development Prospects

Paramount Sources posted one of many highest reserve alternative ratios within the oil and fuel trade in 2022. Even higher, the corporate has ample room for manufacturing progress because of the acceleration of its growth efforts in its producing areas.

Supply: Investor Presentation

Paramount Sources has a confirmed document of figuring out key useful resource areas, with a low decline charge and greater than 15 years of manufacturing.

However, as an oil and fuel producer, Paramount Sources is extremely delicate to the cycles of the costs of oil and fuel. That is clearly mirrored within the efficiency document of the corporate, which has posted materials losses in 6 of the final 10 years.

Because of the rally of the costs of oil and fuel to 13-year highs final yr, Paramount Sources posted earnings per share of $3.42 in 2022. Nonetheless, the costs of oil and fuel have plunged greater than 50% off their highs in 2022. In consequence, the corporate is prone to publish a lot decrease earnings per share this yr.

Given the extremely cyclical nature of the oil and fuel trade and the excessive comparability base fashioned by the abnormally excessive earnings per share final yr, we anticipate the earnings per share of Paramount Sources to say no by about 20.0% per yr on common over the subsequent 5 years, from $3.42 in 2022 to $1.12 in 2027.

Dividend & Valuation Evaluation

Paramount Sources is presently providing an above common dividend yield of 4.6%, which is sort of triple the 1.6% yield of the S&P 500. The inventory is thus an attention-grabbing candidate for income-oriented buyers however the latter ought to be conscious that the dividend is much from secure because of the dramatic cycles of the costs of oil and fuel.

Paramount Sources has a payout ratio of solely 29% however its earnings are prone to lower considerably within the upcoming years. In consequence, the payout ratio will improve. On the brilliant aspect, the corporate has a powerful stability sheet, with web debt of solely $540 million. As this quantity is barely 17% of the market capitalization of the inventory, it’s actually manageable and can assist the corporate endure the subsequent downturn of the vitality sector with none liquidity points.

Nonetheless, it’s important to notice that Paramount Sources reinstated its dividend solely in mid-2021, after 22 years with no dividend cost. The corporate failed to supply a dividend within the previous years, because it incurred materials losses in most of these years. Due to this fact, it’s evident that the dividend of the corporate is much from secure.

In reference to the valuation, Paramount Sources is presently buying and selling for under 6.3 instances its earnings per share within the final 12 months. Given the excessive cyclicality of the corporate, we assume a good price-to-earnings ratio of 10.0 for the inventory. Due to this fact, the present earnings a number of is far decrease than our assumed truthful price-to-earnings ratio. If the inventory trades at its truthful valuation degree in 5 years, it is going to get pleasure from a 9.5% annualized achieve in its returns. Nonetheless, this achieve might be offset by our anticipated -20% common annual decline of earnings per share over the subsequent 5 years.

Taking into consideration the -20% annual decline of earnings per share, the 4.6% present dividend yield and a 9.5% annualized enlargement of valuation degree, Paramount Sources may provide a -10.3% common annual complete return over the subsequent 5 years. The destructive anticipated return alerts that the inventory is extremely dangerous from a long-term perspective, as we’ve got simply handed the height of the cycle of the oil and fuel trade. Due to this fact, buyers ought to look forward to a a lot decrease entry level.

Ultimate Ideas

Paramount Sources is prospering proper now because of the above common costs of oil and fuel. The inventory is providing an above common dividend yield of 4.6%, with a payout ratio of solely 29%. In consequence, it’s prone to entice some income-oriented buyers.

Nonetheless, the corporate has proved extremely susceptible to the cycles of the costs of oil and fuel. As these costs appear to have entered a downcycle, the inventory is extremely dangerous proper now. Due to this fact, buyers ought to look forward to a way more enticing entry level.

Furthermore, Paramount Sources is characterised by under common buying and selling quantity. Which means it could be onerous to determine or promote a big place on this inventory.

If you’re concerned with discovering extra high-quality dividend progress shares appropriate for long-term funding, the next Positive Dividend databases might be helpful:

The most important home inventory market indices are one other strong useful resource for locating funding concepts. Positive Dividend compiles the next inventory market databases and updates them month-to-month:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].

[ad_2]

Source link