[ad_1]

wakr10/iStock through Getty Photos

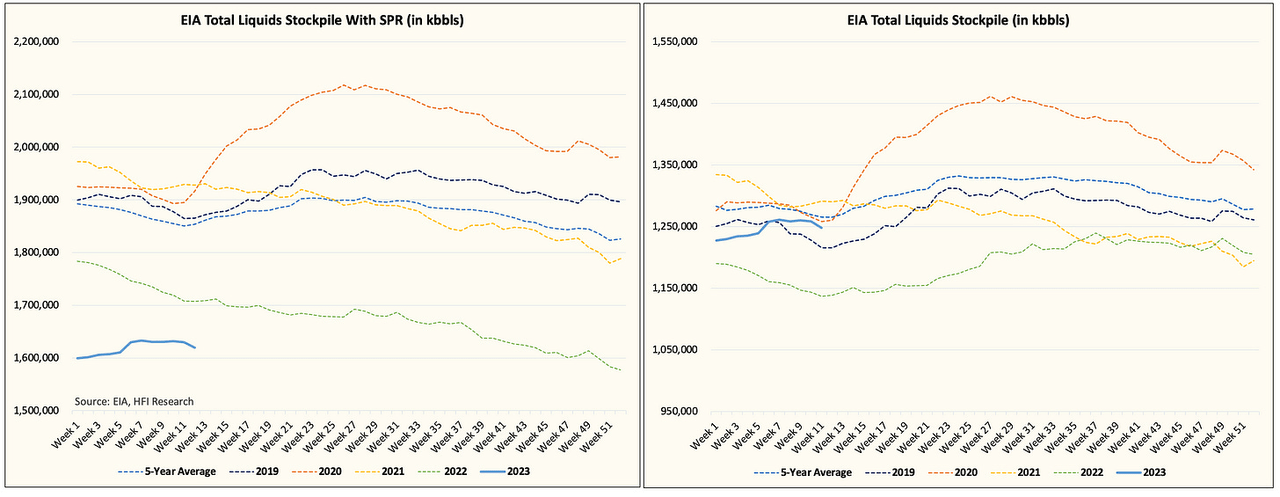

As we method the top of Q1, world oil inventories are lastly beginning to flip the nook. EIA’s oil storage report in the present day was probably the most supportive report for the 12 months, with whole liquids declining by 10.4 million bbls.

EIA, HFIR

Extra importantly for us, there have been just a few hidden bullish variables on this report that weren’t obvious to the bare eye.

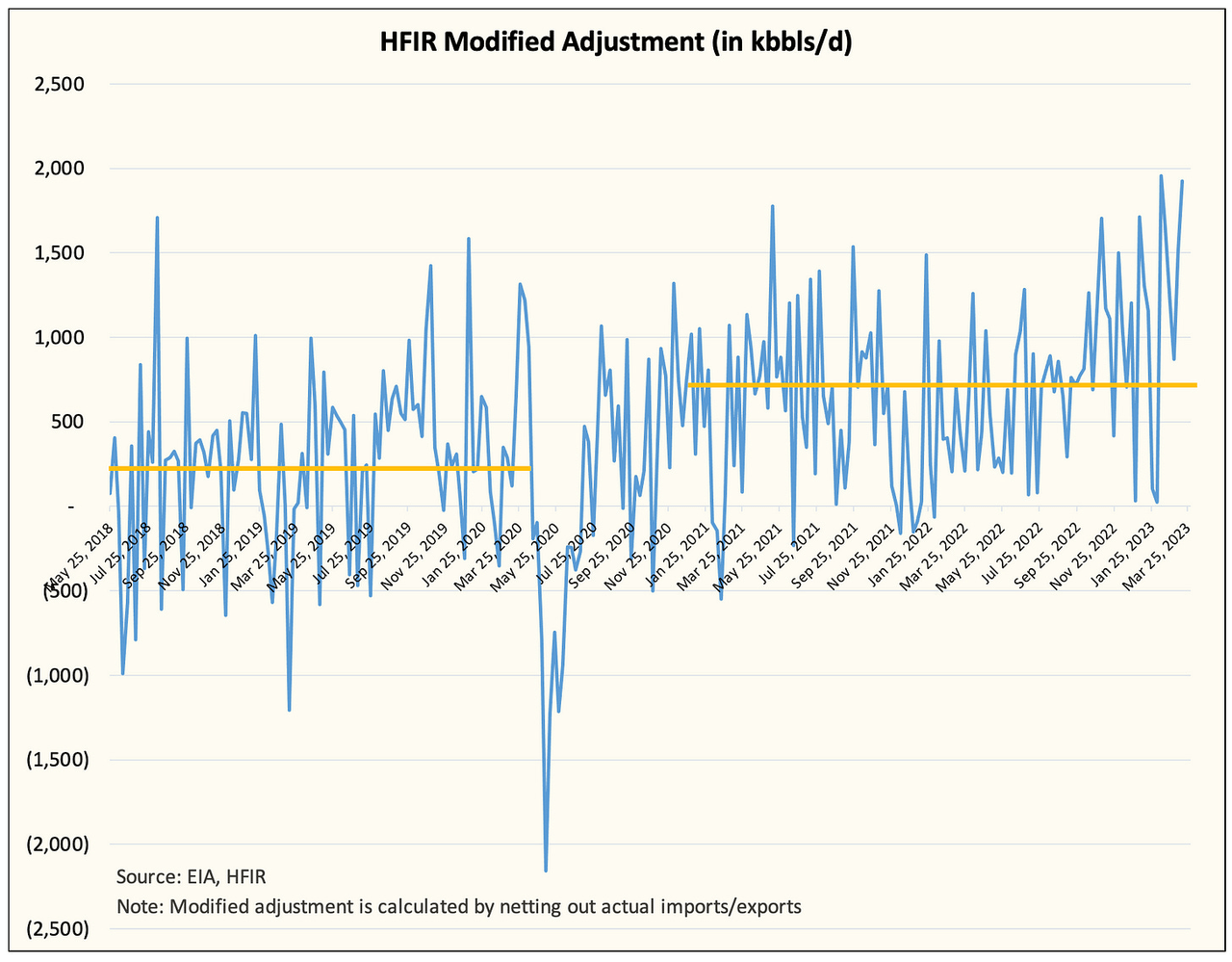

First, regardless of the massive draw of 10.4 million bbls, industrial crude storage really confirmed a construct of ~1.1 million bbls. This got here on account of the 2nd highest modified adjustment studying in our dataset. The biggest got here only a month in the past, within the week ending Feb 10.

EIA, HFIR

Massive jumps in modified changes are normally adopted by an analogous drop. The common normalized adjustment since 2021 is round ~750k b/d, so we should always see this determine pattern again decrease within the weeks/months forward.

For these of you asking what this suggests, elevated modified adjustment is a short lived phenomenon. Assuming the info normalizes, we should always see crude attracts return if exports stay elevated.

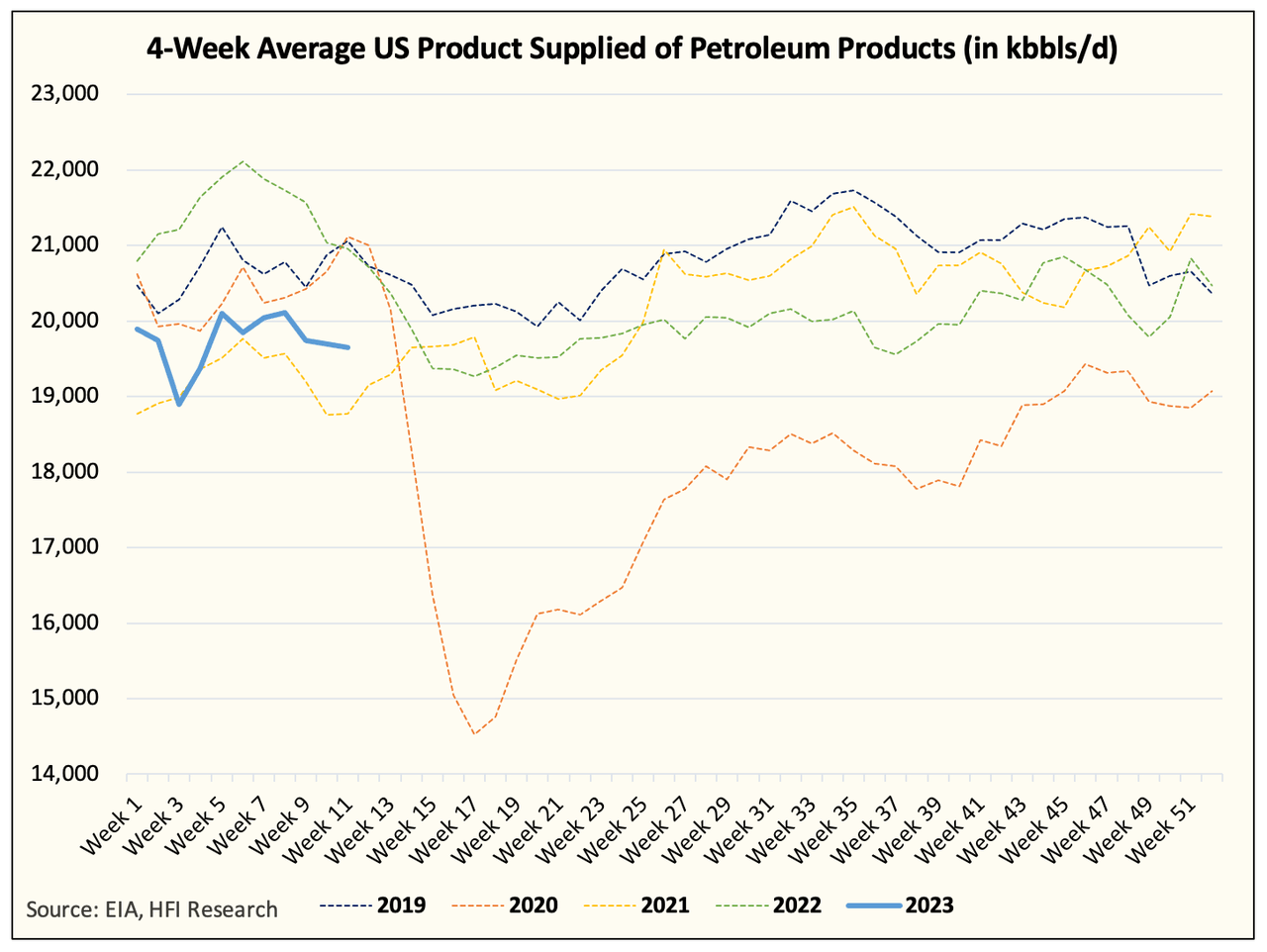

Second, US oil demand appears much better than meets the attention.

EIA, HFIR

Here’s a chart of whole implied oil demand. At first look, you might discover how 2023 is coming in properly under 2019. However what you might not understand is that the underperformance in demand is usually associated to heating.

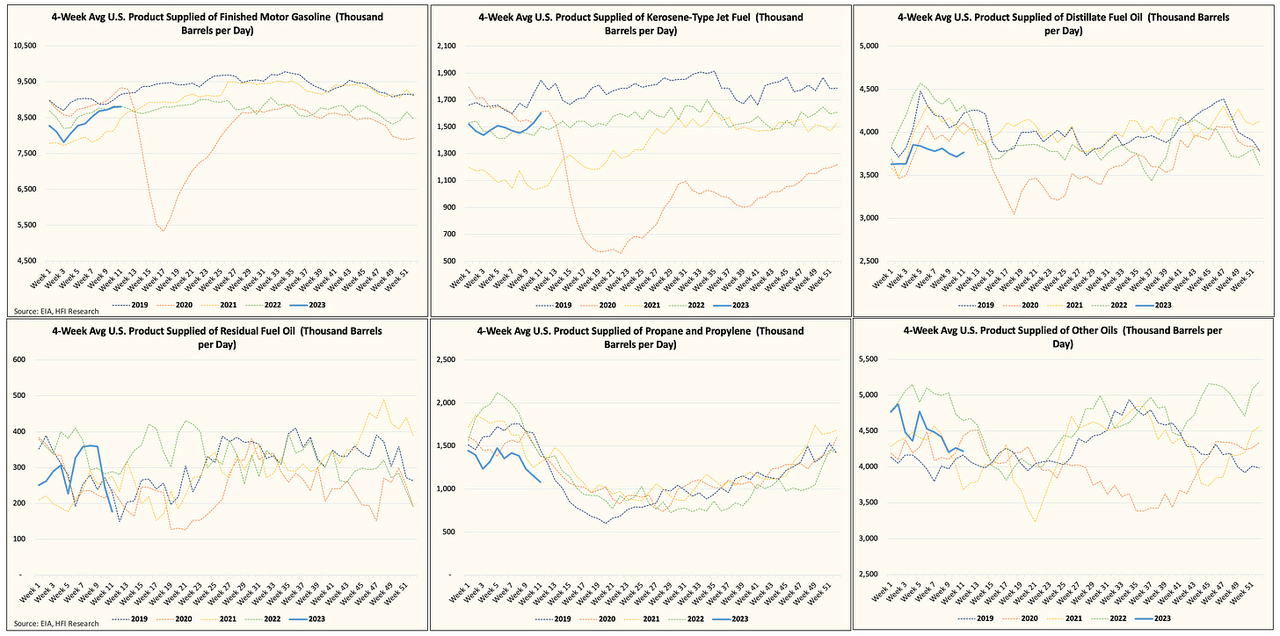

EIA, HFIR

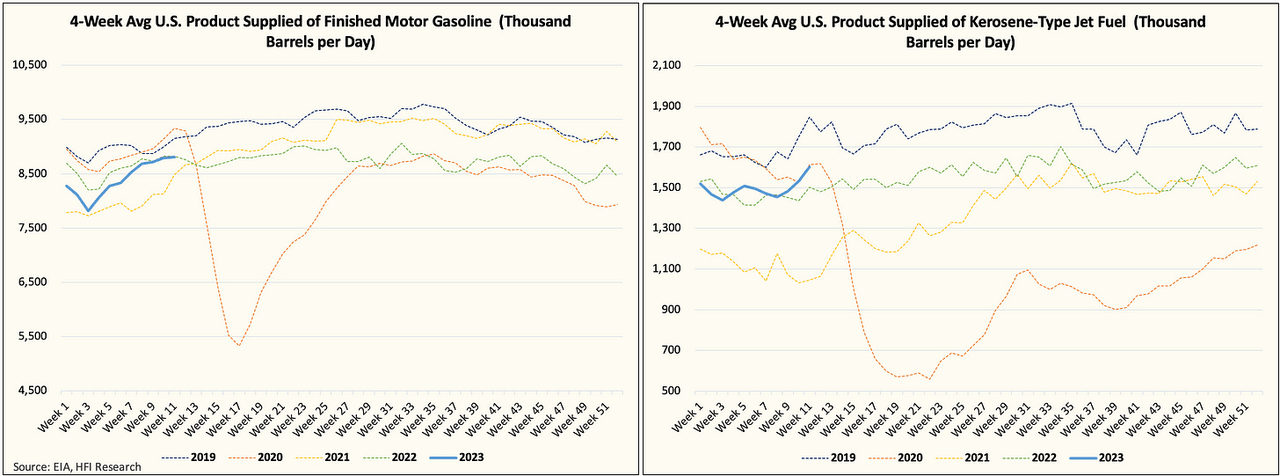

This winter has been one of many warmest on report. So this makes this determine decrease than it actually seems. For us, the important thing to figuring out the general well being of oil demand is by being attentive to gasoline, jet gas, and distillate. Specifically, gasoline and jet gas demand are on tempo to eclipse 2022.

EIA, HFIR

Given the oil worth decline since June of final 12 months, oil demand has taken fairly a very long time to get better. We first pointed this out again in mid-June final 12 months, however with the info turning the nook, we may see this translate into larger product attracts and higher balances going ahead.

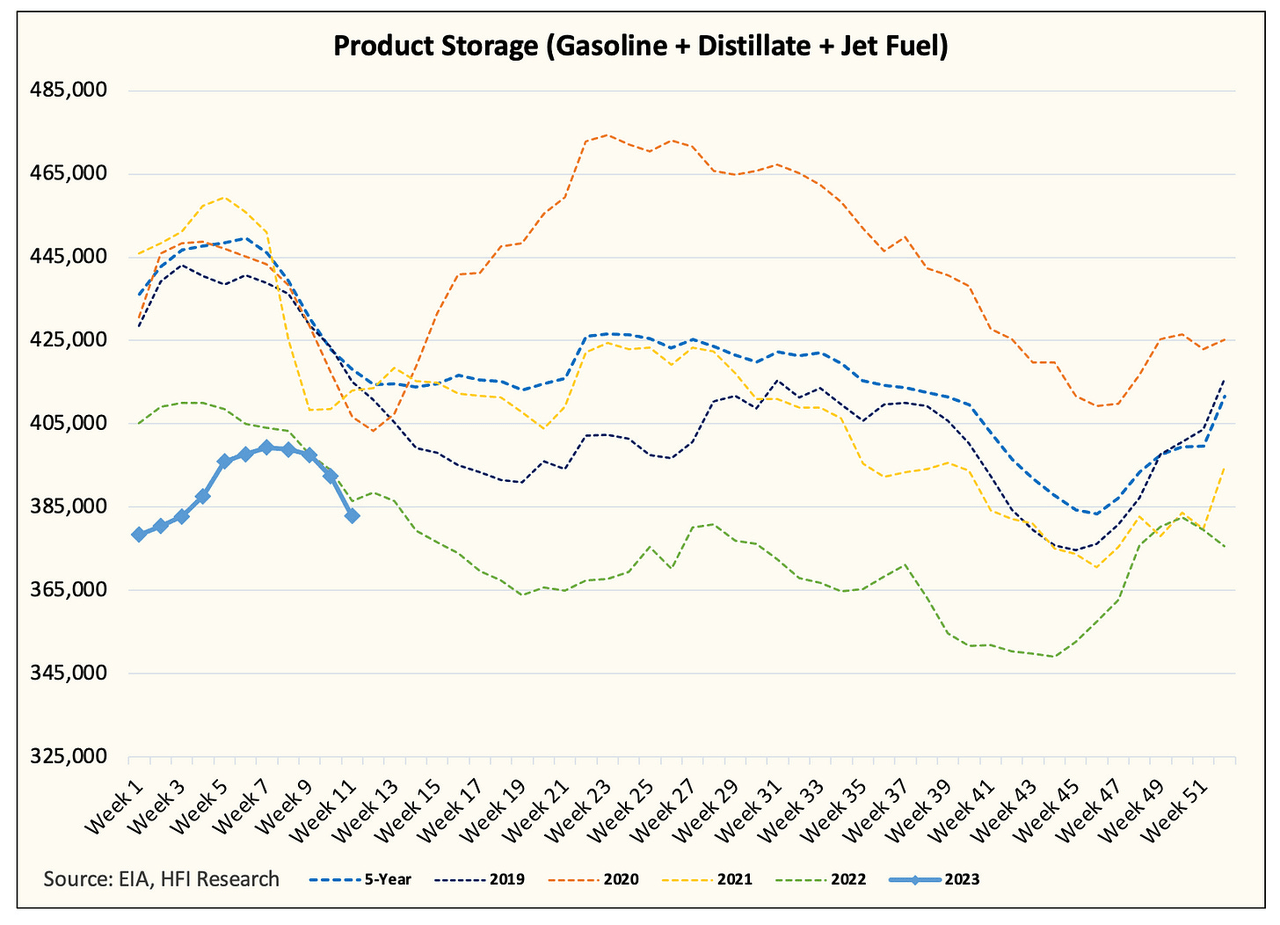

With these two hidden bullish factors apart, it’s price noting that product storage is lastly following seasonality.

EIA, HFIR

Primarily based on mobility knowledge, gasoline demand is probably going going to shock to the upside going ahead. The three-2-1 crack unfold continues to maneuver larger, which is telling me that storage attracts ought to proceed.

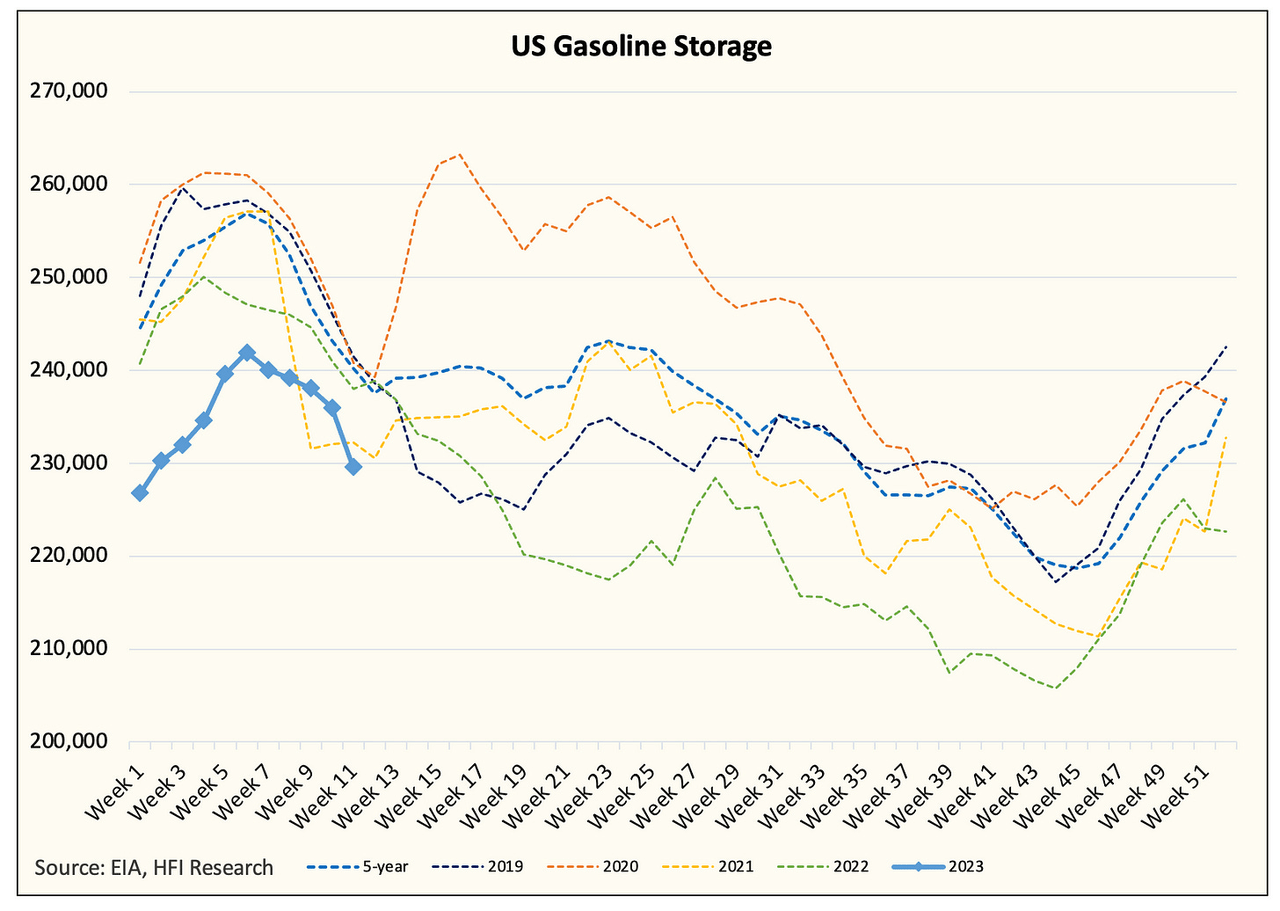

EIA, HFIR

Gasoline storage is presently on the lowest degree for this time of the 12 months lately. Going ahead, gasoline might be an enormous driver for general product storage, so it is going to be essential for oil bulls to look at this determine pattern decrease.

What do we have to see going ahead?

With oil inventories lastly turning the nook, we see general Q2 balances shifting right into a small deficit. Judging by the market worth motion in numerous crude grades, the deficit is anticipated to be small (~0.5 million b/d).

The important thing for oil bulls might be to look at not solely the entire liquids draw however the velocity of change within the implied demand figures. Whereas whole demand continues to be lackluster, gasoline demand ought to meaningfully decide up, which ought to speed up whole demand larger. If that’s the case, we should always first see this manifest into larger 3-2-1 crack spreads after which into gasoline stock attracts.

For now, oil bulls can take a sigh of aid. The underlying knowledge will not be as dangerous as the value motion suggests, however we will not take our eyes off the wheel. Q2 balances will nonetheless want to point out stock attracts, and one bullish report doesn’t make a pattern.

Editor’s Observe: This text covers a number of microcap shares. Please concentrate on the dangers related to these shares.

[ad_2]

Source link