[ad_1]

Revealed on March thirty first, 2023 by Nikolaos Sismanis

Investing in actual property funding trusts, or REITs, could be a fruitful possibility for traders in search of high-income yields. This is because of their obligation to distribute the vast majority of their income to shareholders within the type of dividends. Many income-focused traders, notably retirees, discover REITs interesting however often concentrate on the U.S.-based ones.

It could be smart to discover alternatives past the U.S. market, as there are dependable dividend-paying REITs in different international locations. Canada, specifically, options a number of REITs that boast many years of constant shareholder worth creation. One such is Canadian Condominium Properties Actual Property Funding Belief (CDPYF).

Canadian Condominium Properties REIT stands out amongst different REITs, because it affords month-to-month dividend funds, whereas most REITs present dividends on a quarterly foundation.

Whereas there are just a few different REITs that additionally supply month-to-month dividends, this can be a distinguishing function that units Canadian Condominium Properties REIT other than the pack. That is very true on this case, as the corporate has paid a month-to-month dividend persistently since 1998 and has by no means lower it regardless of the hardships which have arisen since.

There are at the moment simply 86 month-to-month dividend shares.

You’ll be able to obtain our full Excel spreadsheet of all month-to-month dividend shares (together with metrics that matter, like dividend yield and payout ratio) by clicking on the hyperlink beneath:

Canadian Condominium Properties REIT affords a dividend yield of greater than 3% at present costs, which is notably larger than the broad market’s dividend yield, as that stands at about 1.6% proper now.

The above-average dividend yield and the truth that Canadian Condominium Properties makes month-to-month dividend funds make the REIT worthy of analysis for earnings traders. This text will focus on the funding prospects of Canadian Condominium Properties (in brief, CAPREIT) intimately.

Enterprise Overview

CAPREIT is Canada’s largest actual property funding belief. The corporate owns roughly 59,689 suites, together with townhomes and manufactured housing websites, in Canada. Additional, the corporate, immediately and not directly, owns a 66% fairness stake in European Residential Actual Property Funding Belief, one other publicly-traded Canadian REIT. By means of this funding, the corporate additionally owns roughly 6,900 suites within the Netherlands.

In whole, CAPREIT manages roughly 66,586 of its owned suites in Canada and the Netherlands and, moreover, roughly 3,800 suites in Eire.

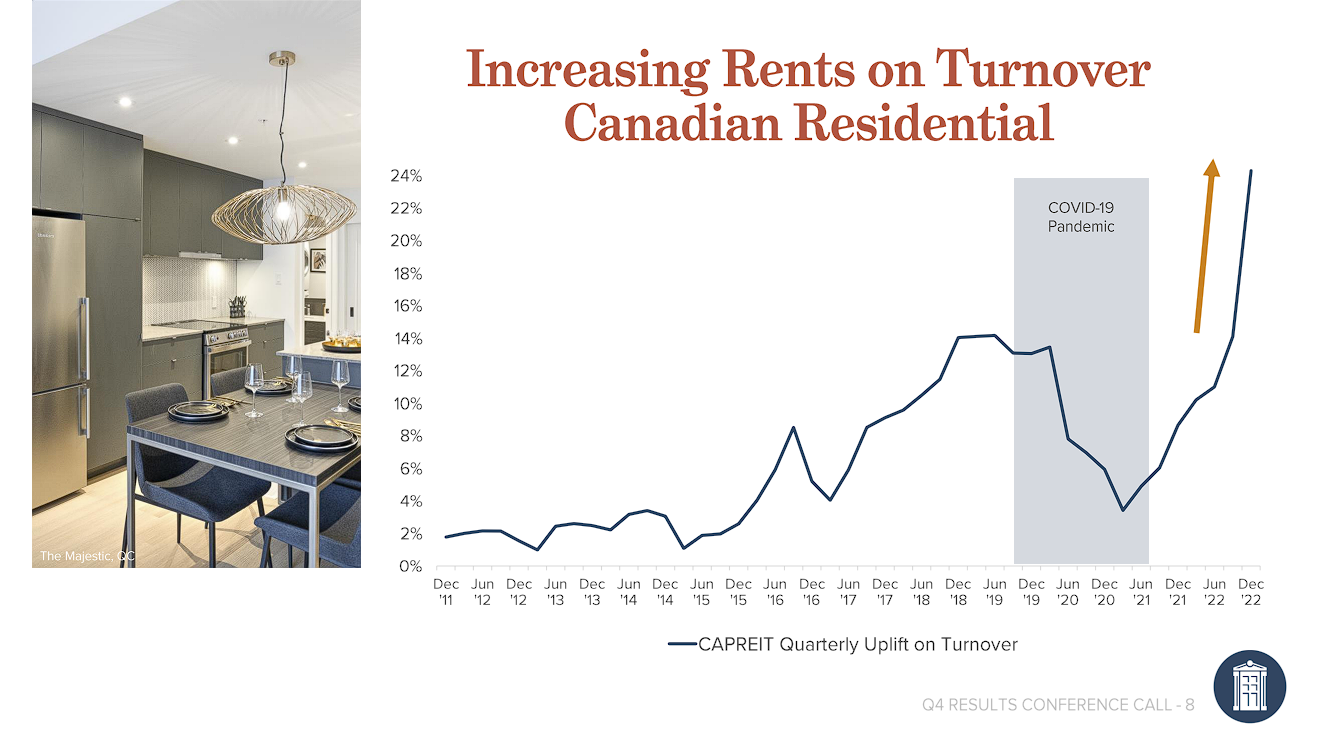

In 2022, CAPREIT celebrated its twenty fifth anniversary, including one other yr of record-breaking outcomes to its books. Particularly, capitalizing on the rapidly-growing demand for residential properties in Canada, CAPREIT managed to attain a record-breaking fourth-quarter and annual lease uplift on turnover of 25% and 15%, respectively.

Supply: Investor Presentation

The corporate was additionally in a position to additional broaden its already spectacular occupancy ranges from 98.1% to 98.3% throughout the yr, which together with larger common rents, drove revenues 7.1% larger to C$1.0 billion. Whereas larger bills offset a lot of this enhance, Normalized Funds from Operations (NFFO) per share nonetheless grew by about 1% to C$2.328.

The corporate at the moment prioritizes its core targets as follows:

To supply shareholders with long-term, secure, and predictable month-to-month dividends,

To develop NFFO, sustainable dividends, and NAV (web asset worth) by lively property administration, accretive acquisitions, and tendencies, and,

To deploy inner CAPEX in an effort to maximize earnings in its current properties.

Development Prospects

Shifting ahead, we count on CAPREIT to drive progress by accretive acquisitions and natural lease progress, because it has accomplished previously. In 2022, for example, the corporate acquired a complete of 1,181 suites and manufactured dwelling group websites in Canada for $517 million.

Administration believes that buying newly constructed properties ought to be a positive technique lately, as such properties ought to scale back its future capital funding wants and, subsequently, the corporate’s publicity to inflationary pressures.

Like all REITs, CAPREIT faucets into each debt and fairness markets to finance its future progress. As rates of interest proceed to rise, one legitimate concern traders might have is the potential challenges to the corporate’s growth efforts attributable to financing changing into notably costlier currently. Regardless of this, CAPREIT has established a formidable credit score profile over time, which permits it to entry financing at extremely aggressive charges.

Whereas the corporate’s common rate of interest has barely elevated from 2.47% to 2.61%, it stays remarkably low. Moreover, with a weighted common time period of maturity of 5.4 years, the corporate received’t must refinance its debt to larger charges anytime quickly.

Even a big mortgage refinancing of C$879.3 million in 2022 had a weighted common time period of maturity of 8.0 years and a weighted common rate of interest of simply 3.36%, showcasing CAPREIT’s functionality to barter extremely favorable phrases even throughout turbulent market situations.

Concurrently, CAPREIT’s whole debt to gross ebook worth stands at a cushty 39.4%, which means that the corporate can comfortably undertake additional borrowing with out over-burdening its steadiness sheet. Due to this fact, we keep our confidence within the firm’s means to develop and generate worth for its shareholders.

Dividend Evaluation

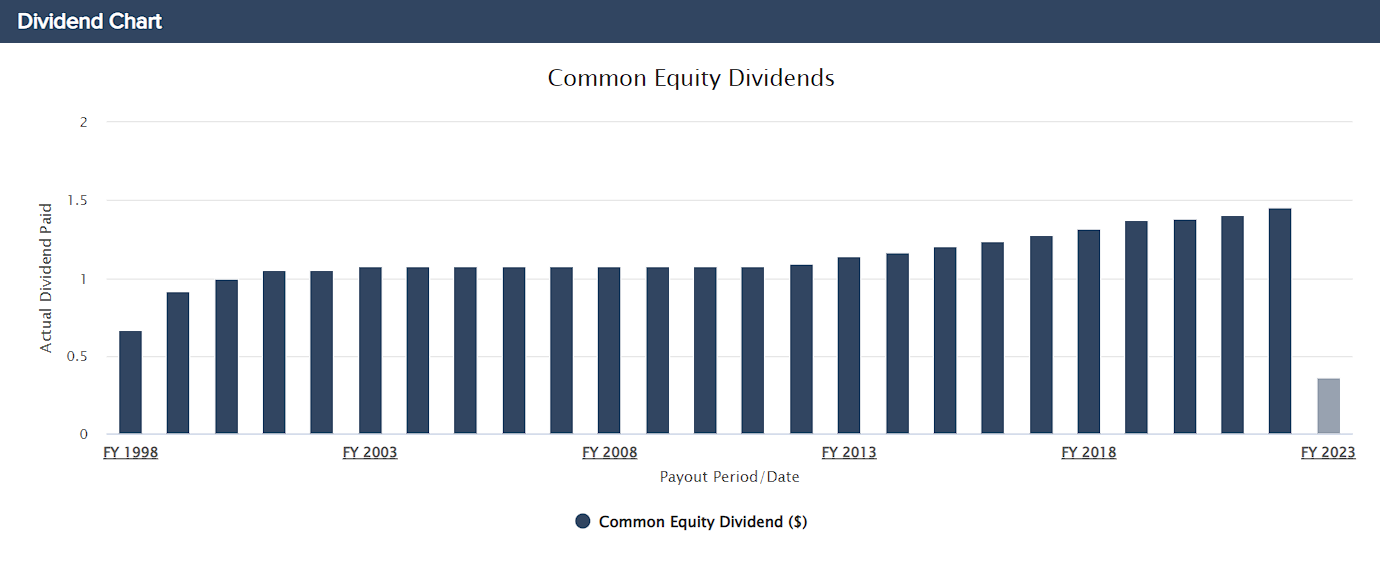

CAPREIT boasts a formidable monitor report of paying month-to-month dividends for 25 consecutive years. Most significantly, the corporate by no means needed to lower its dividend, even throughout difficult instances just like the Nice Monetary Disaster and the COVID-19 pandemic, when most REITs struggled considerably.

Apart from the years between 2004 and 2011, when the dividend remained secure at C$1.08 yearly, CAPREIT has persistently elevated its dividend each different yr throughout its 25-year historical past.

Supply: Investor Relations

Though the present annual fee of C$1.45 yields simply over 3%, which is beneath common for the sector and considerably underwhelming given in the present day’s rates of interest, we stay extremely assured in CAPREIT’s dividend security. Not solely has the corporate confirmed its resilience in harsh financial situations, however with a cushty NFFO payout ratio of 62.1%, there may be ample room for future hikes and no issues about potential cuts.

Last Ideas

CAPREIT is certainly one of Canada’s most respected REITs, with a confirmed monitor report of rising its financials and dividends. In 2022, the corporate achieved record-breaking figures, and though the present macroeconomic local weather could not align with its progress technique, we predict that CAPREIT will fare higher than its friends within the face of rising rates of interest.

Total, whereas CAPREIT’s yield is just not sizeable, the inventory is more likely to preserve serving income-oriented traders who search a predictable payout fairly satisfactorily. In spite of everything, long-term, secure, and predictable month-to-month money dividends is the corporate’s primary goal.

If you’re all in favour of discovering extra high-quality dividend progress shares appropriate for long-term funding, the next Certain Dividend databases might be helpful:

The most important home inventory market indices are one other stable useful resource for locating funding concepts. Certain Dividend compiles the next inventory market databases and updates them month-to-month:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].

[ad_2]

Source link