[ad_1]

Aslan Alphan

Overview

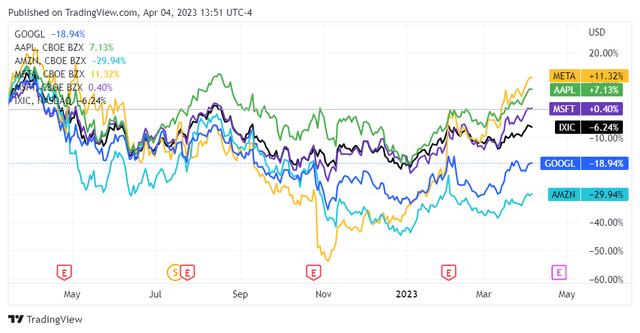

The Federal Reserve enacted the primary of its ongoing price will increase on March 16, 2022, starting a elementary shift in each enterprise and market situations that’s nonetheless ongoing. A market-wide repricing instantly started, with the notoriously rate-sensitive expertise sector instantly taking a hit. All through 2022 the Huge 5 expertise companies skilled vital volatility, initially clambering their manner again to a tough parity (albeit with loads of unfold between the 5) after which depreciating once more all through 2022.

In search of Alpha

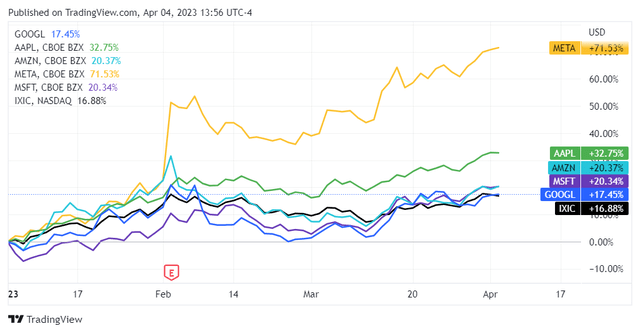

2023 has seen a resurgence within the Huge 5, with all of them outperforming the NASDAQ Composite (IXIC) year-to-date.

In search of Alpha

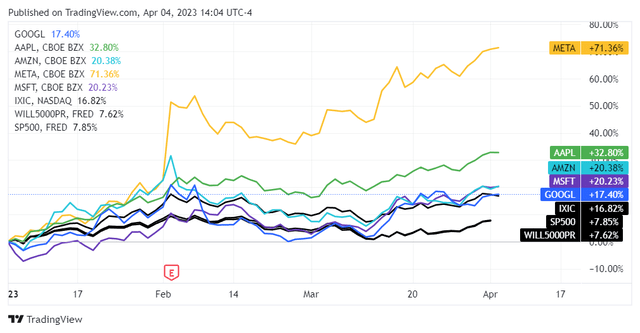

Certainly, it’s the heavy weighting of the big tech shares within the NASDAQ Composite that’s truly driving the efficiency of NASDAQ itself. This may be seen by the numerous relative outperformance of the NASDAQ Composite Index vis-à-vis the S&P500 and the Wilshire 5000 Whole Market Index.

In search of Alpha

This value conduct is wise from a elementary valuation perspective. These firms are all extremely cash-flow generative, which is one thing that’s usually not the case throughout the tech sector – notably so amongst smaller entities. Money circulate is now way more vital throughout the present market context than it was earlier than because of the actions of the Fed and the repricing of cash in of itself. This text will element the logic underlying this ongoing shift after which evaluation the relative money circulate valuations throughout the Huge 5 expertise companies.

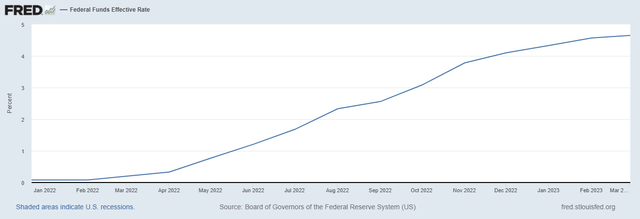

Charges, Danger, and Discounting

What growing charges actually imply is an growing system-wide price of capital. This mechanism is very complicated in observe, however basically the Federal Funds Fee units the risk-free price of return for cash within the financial system. This price is listed by 3 month Treasury payments, the worth of which mirror the Fed Funds Fee. As of this text, the Fed Funds price is 4.65% and the 3-month Treasury Invoice return price is 4.85%. Treasury Invoice yields enhance and reduce linearly with modifications in Federal Funds price, normally buying and selling at some small premium as we see right here.

Taking this 3-month Treasury Invoice rate of interest we now have the risk-free price of return. That is precisely what it seems like: it’s the return you will get on capital with out taking any danger. It is because Treasury Payments, and particularly short-dated ones, are thought-about a risk-free asset. Whereas a US authorities default would result in a lack of yield on these securities, that is usually not thought-about an precise chance and we won’t concern ourselves with that right here.

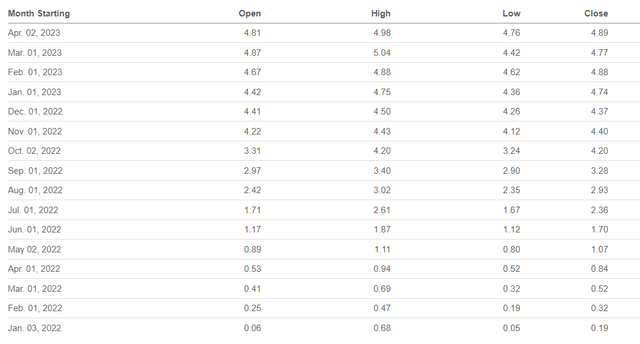

Earlier than the Fed started its present tightening cycle, the Fed Funds price was .08% and the three month Treasury Invoice return price was buying and selling between .06% and 0.19% in January 2022. This fluctuation in January 2022 was as a consequence of the truth that the Fed was truly ticking charges up slowly in January and February earlier than tightening way more aggressively in March.

St Louis Federal Reserve

In search of Alpha US3M

Over the previous 5 quarters, these shifting numbers have essentially altered the connection between money and time. It is because we use the risk-free price of return as the overall low cost price for money flows: they’re the identical quantity. Since there’s at all times a price of return we are able to get with out taking danger, we low cost any ‘danger money circulate’ (funding) by this quantity. The next low cost price implies that cash within the current finally ends up being value extra relative to cash sooner or later.

For instance, let’s low cost a single $100 on the finish of 1 yr by two completely different low cost charges: .125% (common for January T-Invoice return) and 4.87% (present 3 month T-Invoice return). Discounting $100 by every of those charges will take the longer term worth of $100 and yield the current worth.

At .125%, $100 in 1 yr is value $99.88 at the moment. At 4.87%, $100 in 1 yr is value $95.36 at the moment.

As you may see that may be a vital distinction. This all is smart since we’re evaluating the chance price for cash that we’re placing into an asset through the use of the danger free price because the low cost price. Alternative price is increased at the next low cost price as a result of there’s extra alternative for cash to take a seat round incomes extra money underneath increased risk-free price situations.

What this all means is that money has turn out to be that rather more vital. These results are literally quantitatively much more vital for longer durations because of the mechanics of compound curiosity. The longer-dated a money circulate is, the much less it is value at the moment, all else being equal.

The underside line for all of that is that this market now has a way more vital concentrate on current money circulate and has been regularly repricing itself as such. Progress shares, which maintain the promise of money flows later, are value a lot much less due to the time that we’re discounting these – to not point out the uncertainty as as to if they are going to even happen. Uncertainty and future money flows are, and can proceed to be, punished by this present market. That is all fairly smart from a valuation perspective as it’s a well-understood impact of upper charges altering the time worth of cash.

This offers the underlying logic for why the Huge 5 tech shares at the moment are so handedly outperforming their friends throughout each the expertise sector and the market at massive. Certainly, I believe this attitude might be crucial to remember for any safety that an investor could need to pursue for the time being. If there aren’t money flows, the worth is more likely to be down. If there received’t be money flows quickly, then the worth of the safety will keep down. As they are saying on Wall Road: don’t battle the Fed.

Now that we’ve coated the rationale for these value shifts we are able to take a fast have a look at the relative money valuations of the Huge 5 expertise shares.

Huge 5 Money Valuations

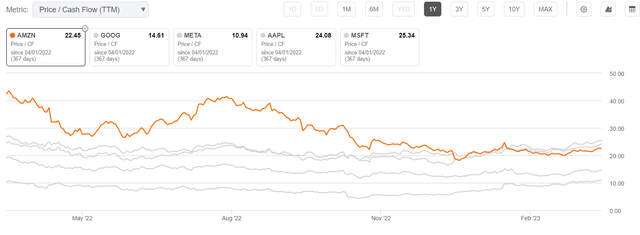

Trying on the evolution of (working) money multiples over the previous yr, we see that there’s truly a major unfold between the Huge 5.

In search of Alpha

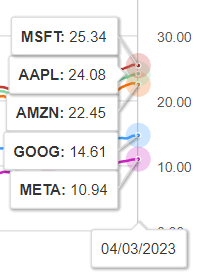

As of the top of yesterday’s buying and selling day (4/3/2023), the numbers have been as follows:

Microsoft (NASDAQ:MSFT) : 25.34x TTM working money circulate a number of Apple (NASDAQ:AAPL): 24.08x TTM working money circulate a number of Amazon (NASDAQ:AMZN): 22.45x TTM working money circulate a number of Alphabet/Google (NASDAQ:GOOG): 14.61x TTM working money circulate a number of Meta/Fb (NASDAQ:META): 10.94x TTM working money circulate a number of

In search of Alpha

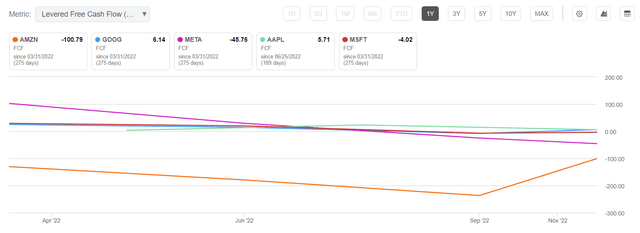

These disparities are considerably extra stark than I personally anticipated. Off the bat I do know that every of those firms has strong companies that – headwinds apart – will not be going to fall off a cliff. Which means that Google and Meta are considerably discounted relative to their efficiency proper now. The market thinks these firms are going to endure. I wouldn’t be so fast to consider that; I believe the trigger is extra probably because of the ongoing media cycle, during which Microsoft has been a darling, and these two on the opposite facet of the fence at current. Google is ‘behind on AI’ and Meta is ‘fighting the metaverse’. We will shortly examine how affordable that is by trying on the (levered, i.e. post-interest funds) free money circulate that every of those has generated on a trailing twelve months foundation:

In search of Alpha

Please notice that we don’t but have knowledge for all of those for Q1 of this yr. As such we should have a look at the newest quantity that we now have for all 5 – finish of yr 2022. Right here, the disparity between the working money multiples turns into vital.

In search of Alpha

Apple’s valuation in mild of this seems smart.

Google’s, nonetheless, doesn’t. Google outperformed Apple – and everybody else – on free money circulate for 2022. But it’s buying and selling at a comparatively a lot decrease a number of, under that of Amazon, Apple, and Microsoft. This makes me assume it’s a sufferer of the AI hype cycle and is a purchase. As I discussed in a earlier article, the hype round Bing and AI don’t represent a reputable menace to Google’s goliath search enterprise.

Additionally it is smart for Meta to be buying and selling on the backside of the pack in mild of those figures.

Microsoft and Amazon are additionally extremely overvalued primarily based on these metrics.

Conclusion

The caveat right here is the continuing price reductions and layoffs we now have seen throughout all 5 of those. It will yield vital modifications in working and free money circulate for every of those in Q1 and can warrant additional evaluation. This example, nonetheless, isn’t going to show round quickly in a single quarter – and I believe these relative valuations converse for themselves. Though I’m a bit extra unsure across the different issues that we are able to infer from this, I do have one conclusion that I’ll state with conviction: purchase Google at these costs.

[ad_2]

Source link