[ad_1]

Day buying and selling is commonly a dangerous endeavor. In reality, most day merchants make extra losses than income available in the market (to be a profitable dealer it ought to be the alternative, win greater than you lose).

Those that succeed are individuals who mix their buying and selling abilities with danger administration ideas. One of the vital fashionable danger administration approaches is named a stop-loss order.

On this article, we we’re going to analyze in depth what a stop-loss order is and how you can use it correctly available in the market.

Outline a cease loss order

A cease loss order is outlined as an order (a pending order to be particular) that seeks to restrict the quantity of losses {that a} dealer makes in a commerce.

The objective is to make sure that the dealer is protected in case their authentic thesis doesn’t go as deliberate. Additionally, it seeks to restrict losses when there may be an abrupt information occasion that pushes the asset greater or decrease.

An excellent instance of that is within the chart beneath. As proven, the First Republic Financial institution inventory was buying and selling in a decent vary for some time because it was thought-about to be a protected financial institution. Nonetheless, in March 2023, the inventory plunged from over $100 to about $20.

On this case, individuals who had invested within the firm made spectacular losses. As such, if that they had positioned a stop-loss on the necessary assist at $107.36 (November 9 low), their losses would have been minimized.

How a stop-loss order works

To know how a stop-loss works, it’s essential to know the way brokers execute order available in the market. While you execute a commerce, you might be merely telling the dealer to purchase or brief an asset. Up to now, this course of used to work by calling a dealer to execute the order.

Equally, whenever you wish to exit a commerce, you merely inform the dealer to promote the order. Due to know-how, this course of often takes microseconds to occur.

Subsequently, whenever you place a stop-loss order, you might be merely telling the dealer to exit a commerce when it reaches a sure level. You might be telling the dealer to shut the commerce when it reaches the pre-determined stage.

Associated » DMA vs Retail Buying and selling

Kinds of a stop-loss order

There are three essential forms of a stop-loss order. First, there’s a primary fastened stop-loss order. That is the commonest sort.

It’s an order that’s positioned above or beneath a commerce relying on the commerce sort. In case of a bullish commerce, the stop-loss order is positioned beneath the value. However, in case of a bearish commerce, this order is positioned above the value.

Any such a stop-loss has a significant problem. For instance, assume {that a} monetary asset was buying and selling at $20 and also you positioned a purchase commerce with and a stop-loss at $18.

On this case, if the commerce jumps to $22 after which rapidly nosedives to $18, it implies that your preliminary features is not going to be captured. As an alternative, your commerce will finish at a loss.

Trailing cease

The second sort of a stop-loss order goals to take away this danger. The trailing stop-loss strikes with the commerce primarily based on the factors that you’ve indicated.

For instance, within the above instance, if the inventory jumped to $22, the stop-loss would even have moved up with it.

Cease restrict order

Lastly, there may be an order often called a cease restrict order. This can be a instrument that specifies the best and lowest value of an asset that they’re prepared to just accept.

It combines the ideas of pending orders often called cease and restrict. On this case, you may set a cease order that buys or sells an asset at a selected value after which inserting a restrict value.

Why is a cease loss so necessary?

There are a number of essential explanation why a stop-loss is so necessary within the monetary market. A few of these causes are:

Nobody is all the time correct – The truth concerning the market is that nobody is all the time correct when buying and selling shares and different property. Subsequently, having a stop-loss will enable you to decrease losses when your thesis isn’t correct.Restrict shocks – The opposite cause is {that a} stop-loss will enable you to stop main shocks available in the market comparable to when there’s a main occasion.It may well enable you to in danger/reward evaluation – A stop-loss will help you in danger and reward evaluation. This is a vital side within the monetary market.Hole safety – A spot is a scenario the place a inventory opens sharply greater or beneath the present value. As such, having a stop-loss will enable you to keep away from dropping cash when the hole goes in opposition to you.Feelings – A stop-loss order helps to take out feelings out of the decision-making course of by robotically closing a commerce when the predetermined stage is reached.

Advantages

The good thing about utilizing this kind of order sort is that you just don’t want to remain in entrance of your laptop ready for the sign to occur. Based mostly in your evaluation, the Ppro8 (or your buying and selling software program) will provoke the commerce itself.

Generally, the Cease trades are sometimes extra worthwhile than market order trades.

One other sort of cease order is an order to robotically finish an unprofitable commerce as soon as a sure stage is reached.

When you have got a commerce open, you may keep and watch it and when the loss reaches a sure level, you may finish it. Alternatively, you may set a cease loss order which can cease the commerce robotically even if you find yourself not there. This can be a good danger administration instrument.

Methods for putting a stop-loss

There are a number of key methods for setting a stop-loss when day buying and selling. A number of the hottest methods are:

%-based cease loss

This can be a scenario the place you resolve the extent to make use of primarily based on the share of your buying and selling. For instance, you may resolve that the utmost loss you’ll make in a commerce is 2%.

On this case, you probably have a $50,000 account, it implies that it’s best to place the stop-loss the place your most loss is $1,000. This is likely one of the hottest approaches to contemplate when utilizing a stop-loss available in the market.

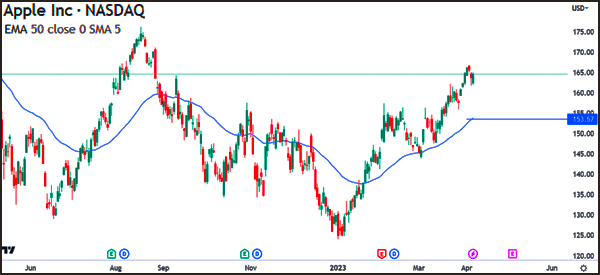

Transferring common primarily based stop-loss

This can be a scenario the place you resolve to cease a commerce primarily based on the transferring common. The thought is {that a} inventory or some other asset will usually stay above a sure transferring common for the development to proceed.

If it strikes beneath the transferring common, then will probably be an indication of a reversal. Within the instance beneath, one woud place the stop-loss on the 50-day transferring common stage.

Associated » 3 Useful Methods for Transferring Averages

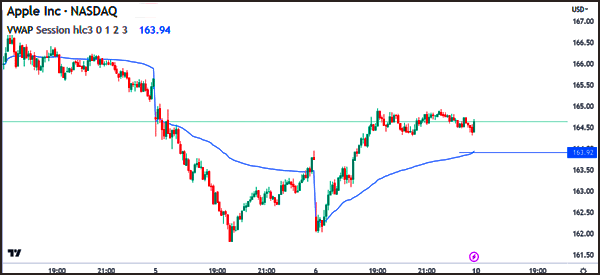

VWAP stop-loss

For many day merchants, the VWAP is the perfect indicators to make use of. The Quantity-Weighted Common Worth appears to be like on the common value of an asset in a sure interval.

An excellent instance of that is within the chart beneath. As seen, a dealer might place the stop-loss on the VWAP stage of $163.92.

Fibonacci Retracement stop-loss

The Fibonacci Retracement is a instrument that makes use of the fibonacci sequence to establish key ranges in a inventory. These ranges are often 23.6%, 38.2%, 50%, 61.8, and 78.6% retracement factors.

The Fibonacci instrument is drawn by connecting the higher and decrease sides of the asset. In case of a bullish commerce, you may place a stop-loss on the 23.6% retracement stage.

Volatility primarily based stop-loss

This can be a scenario the place you employ one of many fashionable volatility indicators to position a stop-loss. Probably the greatest ones is named the Bollinger Bands.

It’s calculated by first calculating the transferring common after which discovering the usual deviations. On this case, you may place a stop-loss on the decrease aspect of the band.

Greatest practices for setting a stop-loss

Most merchants know the advantages of getting a stop-loss. Nonetheless, most of them both ignore them or set them in a foul means. Listed here are sme of the perfect practices to set a stop-loss when buying and selling.

First, all the time do a multi-timeframe evaluation to establish the perfect locations to find a stop-loss. That is an evaluation the place you take a look at the assorted timeframes when making the choice.

You may begin by figuring out the degrees within the 30-minute chart adopted by a 15-minute, after which a 5-minute chart (this 3-step evaluation is named ‘rule of three’).

Second, all the time persist with the stop-loss. This can be a scenario the place merchants shift the stop-loss to forestall it from being triggered. Generally, one can regulate the stop-loss order an excessive amount of after which lose more cash than they anticipated.

Third, consider the efficiency of the stop-loss orders primarily based in your efficiency. It’s all the time necessary so that you can rigorously consider whether or not your stop-loss technique is working. When the circumstances are modified, it’s important to optimize and set them once more.

FAQs

When must you use a stop-loss?

You need to all the time use a stop-loss when buying and selling. On this, make sure that all of your trades are protected with a stop-loss to forestall an enormous and sudden loss.

Which sort of stop-loss must you use?

Generally, we suggest that you just use a trailing stop-loss order that strikes with a commerce. It’s higher than a hard and fast cease loss.

Can stop-loss orders fail?

Generally, stop-loss orders work nicely. Nonetheless, in instances of loads of volatility, the commerce may be stopped at a decrease stage due to slippage.

Closing ideas

A stop-loss order is a wonderful order that permits you to cease a commerce if it strikes to a sure stage. Its profit is that it prevents additional losses and can be an necessary strategy to handle danger. The one downside is when it’s executed after which the monetary asset reverses.

Exterior helpful Sources

[ad_2]

Source link