[ad_1]

Michael Kovac

Movado Group, Inc. (NYSE:MOV) first caught my consideration again in August 2021, however as a contrarian, I discovered it tough to justify its lofty valuation on the time. Only recently, its inventory value dipped beneath $30, reigniting my curiosity – a sentiment which may be placing it mildly. Contemplating its fruitful partnership mannequin, the vast enchantment of MOV’s model portfolio throughout numerous areas, and the attainable decline of its foremost competitor, there is no denying that MOV presents a considerable funding alternative.

What Does Movado Do?

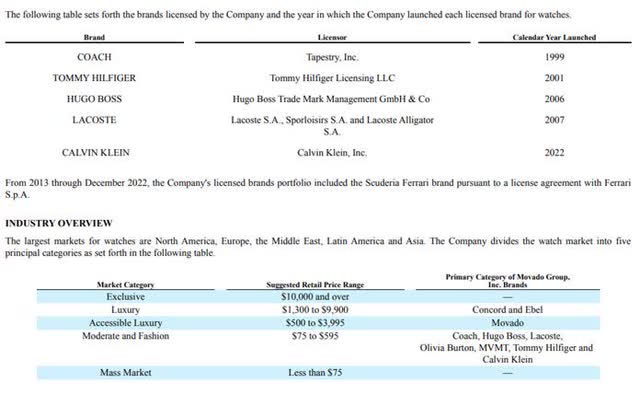

First a bit in regards to the firm. Cherry-picking items from its 10k:

Movado Group designs, sources, markets and distributes high quality watches globally. Its portfolio of watch manufacturers is at the moment comprised of owned manufacturers MOVADO, CONCORD, EBEL, OLIVIA BURTON and MVMT in addition to licensed manufacturers COACH, TOMMY HILFIGER, HUGO BOSS, LACOSTE and CALVIN KLEIN. The Firm is a frontrunner within the design, growth, advertising and marketing, and distribution of watch manufacturers bought in nearly each main class comprising the watch business. The Firm additionally designs, sources, markets, and distributes jewelry and different equipment beneath most of its manufacturers.

As well as, the corporate additionally claims that

it’s extremely selective in its licensing technique and chooses to enter into long-term agreements with solely highly effective manufacturers which we deem to have sturdy positions of their respective companies.

In essence, MOV has two main kinds of enterprise fashions:

“Owned Manufacturers” the place the enterprise has full management over their gross sales channels and product growth. This offers them extra management, which may result in larger revenue margins and scalability beneath the correct management.

“Licensed Manufacturers” the place the corporate is leveraging their associate model’s fairness and buyer base. Gross sales channels will embrace associate’s retailers, whereas a dialogue on design and advertising and marketing can even happen between MOV and associate advertising and marketing’s group. With skilled companions, this could supply a extra steady income stream and decreased MOV’s overhead.

Benefits of MOV

Whereas its share costs may need fallen, MOV’s enterprise is on no account fledging. Many MOV manufacturers have skilled super success in latest occasions. MOV’s Olivia Burton acquisition pumped up group gross sales in Nice Britain, which is Burton strongest market. Harmony is powerful within the Center East. Ebel is a family identify in Europe, in addition to the Center East. In Latin America, each Movado and the style manufacturers are sturdy. Lastly, Movado is the chief in Asia.

Diversified Attribute of Its Merchandise

MOV’s model portfolio has a differentiated regional enchantment. Greater than only a collection of buzzwords, MOV has neatly studied the totally different markets and positioned all its merchandise to keep away from any type of self-cannibalization. Which means no two merchandise are in competitors. This text helps the truth that diversification has additionally allowed MOV to construct:

regional strengths throughout the model portfolio. In Europe, for instance, the licensed manufacturers are stronger than Movado. So, regardless that their gross sales have been mushy within the U.S., the licensed model division grew by double-digits in FY 2019 because of sturdy abroad gross sales. Tommy Hilfiger and Hugo Boss watches posted document gross sales for the yr. Lacoste watches gross sales have been up by double-digits.

Value Vary of Manufacturers (FY2023 10K)

A regionally diversified portfolio additionally permits MOV to investigate a wide range of buyer sorts. As seen from the desk above, it caters to an entire spectrum of various clients with starkly totally different spending energy. This makes it simpler for the corporate to interrupt into new markets and seize them. As well as, there may be normally a direct correlation between the advertising and marketing price and a model’s product price. On the whole, a less expensive purse will price much less to market. This may give MOV a bit extra wiggle room when adapting to totally different market circumstances. For instance, demand for a extra reasonably priced purse ought to improve when occasions are robust, which is able to permit MOV to conveniently minimize down the bigger advertising and marketing spend on the extra high-end luxurious merchandise of their repertoire to save lots of much more prices for the corporate whereas not shedding out on gross sales.

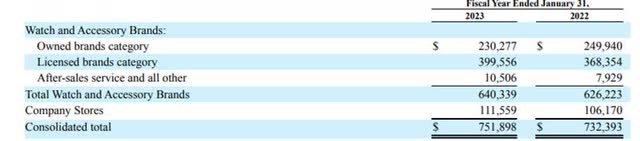

Partnership enterprise mannequin with Profitable Manufacturers

The corporate has a long-term partnership enterprise mannequin the place it collaborates with main style manufacturers. This mannequin permits MOV to leverage on the companions’ model fairness and faucet into the model’s followers. This win-win partnership mannequin presents an enormous alternative for development, each by including extra manufacturers into its portfolio, in addition to increasing the partnerships into different merchandise reminiscent of jewelry. As proven within the image, the corporate’s licensed manufacturers have been a powerful supply of development, because it boosted total income regardless of decrease owned manufacturers’ gross sales.

Breakdown of Gross sales (FY2023 10K)

General, this collaborative model partnership mannequin seems to be a sustainable long-term strategy that may drive regular income and earnings development as it really works with extra main manufacturers.

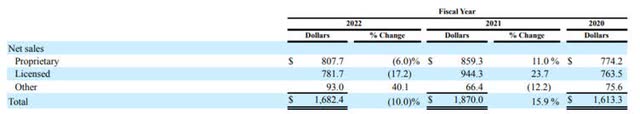

Downfall of The Foremost Competitors: Fossil Group (FOSL)

Whereas FOSL operates in the identical licensed style watch enterprise as MOV, it has seen declining gross sales from its licensed merchandise in recent times. Not like the worthwhile MOV which has a clear stability sheet, FOSL is loss-making and has long run debt excellent. In line with the identical article, Fossil’s troubles stem from its unsuccessful foray into the smartwatch section, an space that MOV averted.

Breakdown of Gross sales (FY2022 10K)

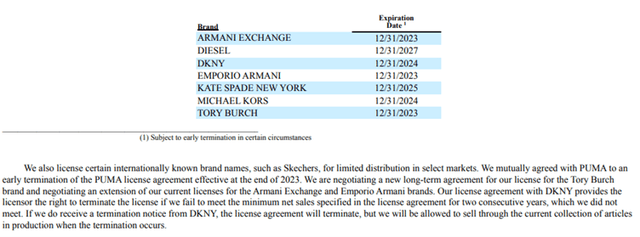

As license agreements are depending on gross sales efficiency, FOSL’s declining gross sales put lots of its model partnerships that expire in 2023 in danger. If MOV can seize a few of these licenses, it might signify an enormous alternative for all. For the licensed companions, a steady and worthwhile firm like MOV would imply greater and extra steady returns over time. And for MOV, taking up their foremost competitor’s constituent manufacturers will imply greater market share and pricing capacity.

Maturity Date of Manufacturers that Fossil Carries (FY2022 10K)

Whereas it’s nonetheless early and fairly speculatory, MOV appears properly positioned to achieve market share from FOSL’s troubles. Successful FOSL’s licenses over to its portfolio might speed up MOV’s development and profitability, which might be a optimistic sign for buyers.

Danger

Whereas MOV’s model partnership mannequin supplies important alternatives, it additionally poses some dangers for buyers to contemplate.

Model Picture Dilution

MOV’s affiliation with mid-tier style manufacturers can dilute its picture as a purveyor of luxurious manufacturers and items amongst extra discerning collectors and customers. Engaged on mid-range style manufacturers could painting MOV as a mere contractor somewhat than a premier luxurious watchmaker, which may damage its premium positioning in the long term.

Fall In Shopper Spending

Sadly, the increase in client spending from authorities stimulus in 2021-2022 will taper off going into 2023 as inflation rises and folks look to chop again on discretionary spending. This macro pattern can considerably impression MOV’s gross sales and make 2023 outcomes look weak compared to the prior yr peaks.

Valuation

To guage MOV’s valuation throughout its sector, I’ll make the most of EV/EBITDA with knowledge from In search of Alpha. This metric incorporates the corporate’s debt ranges and money era capacity. Any EV/EBITDA ratio beneath the common sector EV/EBITDA ratio will counsel that the corporate could also be undervalued relative to its friends.

Moreover, I’ll evaluate the corporate’s annual common PE over time utilizing knowledge from ROIC.ai web site. Analyzing the corporate’s PE ratio over an prolonged timeframe will present perception into how buyers worth the corporate. Any PE ratio beneath the long-term medium PE ratio will suggests the corporate could also be undervalued relative to the market.

EV/EBITDA (TTM) Throughout Sector

The Swatch Group AG (OTCPK:SWGAY) – 8.19

Fossil Group, Inc. (FOSL) – 12.48

Movado Group, Inc. (MOV) – 2.99

Business common – 9.64

If we evaluate the 4 ratios above, MOV undoubtedly has the bottom EV/EBITDA throughout its friends and the business common. This unambiguously alerts that MOV is undervalued in comparison with its sector and rivals.

PE Throughout Time

Movado PE Ratio from 2008 to 2023 (Roic.ai)

When inspecting the PE ratio over the interval from 2008 to 2023, the median worth is 9.5. Based mostly on the FY2023 EPS of US$4.20, this may end in a share value of US$39.90 – a 50% potential upside.

This valuation appears truthful as it’s near the 52-week excessive of $39.80 after a interval of serious surge in client demand together with its current enterprise mannequin.

Conclusion

The latest decline in MOV’s share value will be attributed to lackluster steerage reflecting a peak in client spending. However MOV’s sturdy fundamentals and dividend fee will present assist for its down trending share value.

The result of how their foremost competitor, Fossil Group, manages their enterprise within the present enterprise local weather may have a big potential upside impression to MOV.

Regardless, with compelling merchandise and a premium model, Movado inventory retains the potential for share value upside ought to client demand and spending get better sooner or later.

Editor’s Word: This text discusses a number of securities that don’t commerce on a significant U.S. change. Please pay attention to the dangers related to these shares.

[ad_2]

Source link