[ad_1]

Recession odds have climbed significantly since Jerome Powell’s testimony earlier than Congress and the most recent FOMC assembly. Nonetheless, the latest failures of Silicon Valley Financial institution and Credit score Suisse, as increased charges affect regional financial institution liquidity, additionally added to the dangers.

This isn’t the primary time we have now warned the aggressive charge climbing marketing campaign would both trigger a recession or “break one thing.”

You get the concept. We have now been warning of the chance for fairly a while. Nonetheless, the monetary markets proceed to disregard the warnings.

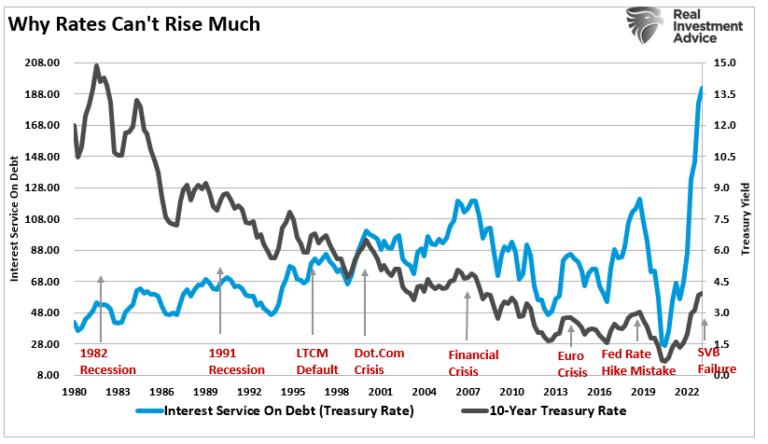

The Fed stays abundantly clear that it nonetheless sees inflation as a “persistent and pernicious” financial risk that have to be defeated. As we famous beforehand, the issue is that in an financial system depending on debt for financial progress, increased charges finally result in an “occasion” as borrowing prices and funds improve.

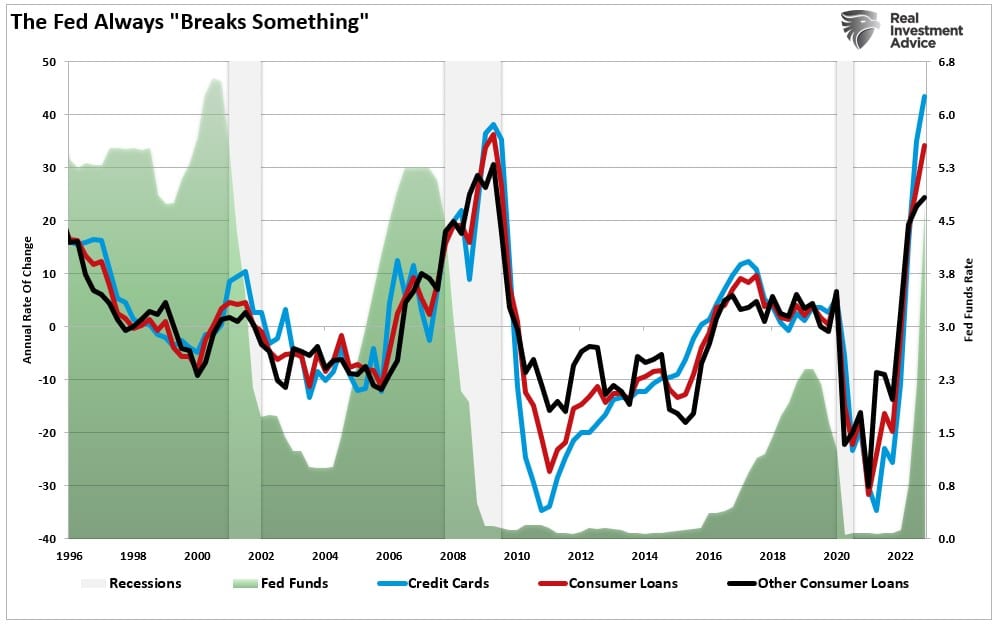

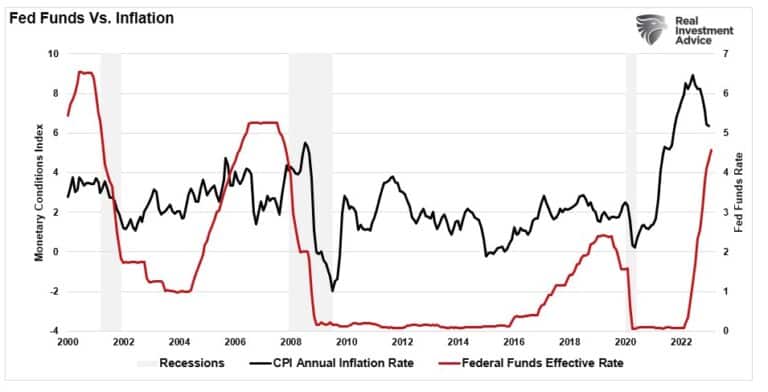

As debt service will increase, it diverts cash from consumption which fuels financial progress. Such is why client delinquencies at the moment are rising because of the huge quantity of client credit score at considerably increased charges. Discover that when the Fed begins chopping charges, delinquencies decline sharply. It’s because the Fed has “damaged one thing” economically, and debt is discharged by means of foreclosures, bankruptcies, and mortgage modifications.

After all, on condition that consumption is roughly 70% of the financial progress calculation, the patron is the lynchpin.

Ringing {Alarm (NASDAQ:)} Bells

Whereas the share of delinquent client loans just isn’t problematic, the sharply rising development is. Additional, Heather Lengthy of the Washington Put up notes:

“Many households are additionally behind on their utility payments: 20.5 million properties had overdue balances in January, in response to the Nationwide Power Help Administrators Affiliation.”

Per the article, the underside 60% of earners contribute about 40% of GDP progress. Individuals delinquent on loans are possible getting financially squeezed as a consequence of falling actual wages and will probably be pressured to cut back their consumption. If the unemployment charge rises, the issue will worsen. The article ends as follows:

“The flares are going off. If the financial system does fall right into a recession, it would solely get extra perilous for these on the backside.“

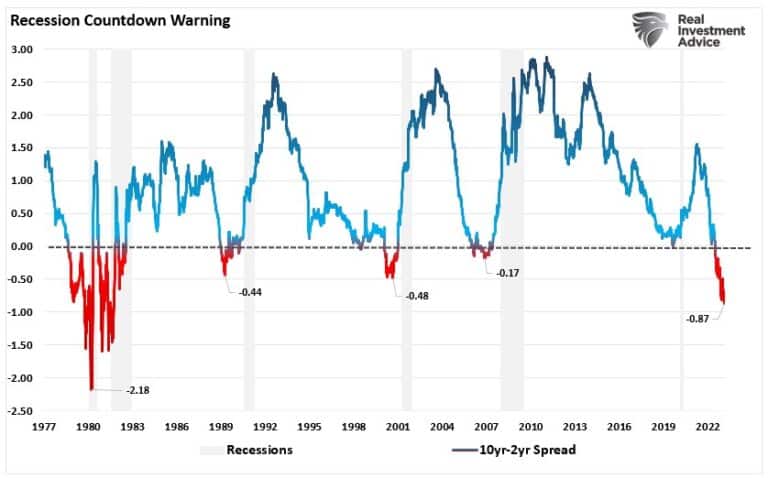

The deep inversions are an indication that recession odds are growing.

The present inversion of the rate of interest and the rate of interest is now on the deepest stage since Paul Volcker was engineering hikes that broke the again of double-digit inflation at the price of two back-to-back recessions.

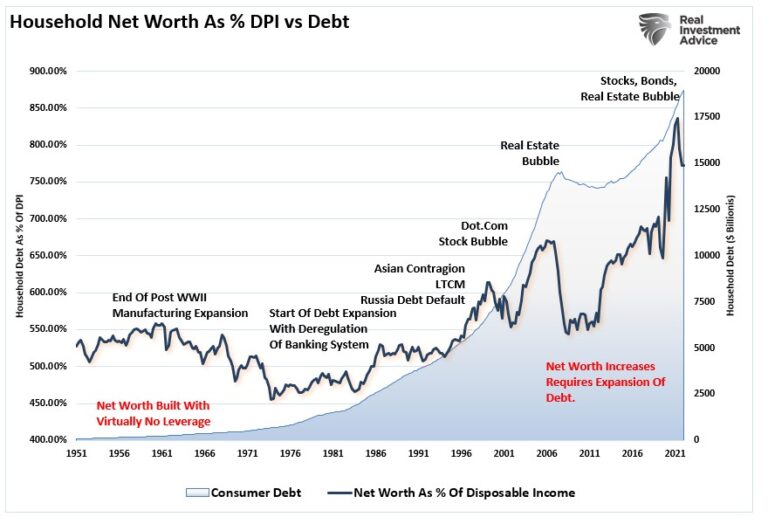

Nonetheless, there’s a important distinction between now and the Nineteen Seventies, which is the dependency on debt. As proven, family internet value has far outstripped beneficial properties in disposable earnings. Such was a operate of a steady decline in borrowing prices and big will increase in leverage.

Not surprisingly, as repeated all through historical past, sharp spikes in internet value as a share of disposable incomes are a operate of asset bubbles or different financial or monetary distortions. As recession odds improve, the result’s the reversion of these distortions.

Whereas typically villanized by the media and by politicians, recessions are a “good factor,” economically talking. If allowed to finish its full cycle, it removes the excesses constructed up within the system from the previous enlargement. This “reset” permits the financial system to develop organically sooner or later.

The issue in the present day is that the Federal Reserve has repeatedly lower quick the “recessionary cleaning” wanted to reset the financial system to a more healthy standing.

The Fed could also be tapped between two probably dangerous outcomes.

Mr. Powell Meets Rock

Mr. Powell, and the Federal Reserve, are caught between the proverbial “rock and a tough place.” On this case, the “rock” is the Fed persevering with to combat inflation by climbing rates of interest and slowing financial progress. Nonetheless, the “laborious place” is that every charge hike additional will increase the pressure on customers and, as seen with Silicon Valley Financial institution, the monetary system.

If Silicon Valley Financial institution was the warning shot of extra financial institution failures, the Federal Reserve should pivot on financial coverage to bail out extra banks. Nonetheless, such won’t be bullish for traders because the bailouts will happen throughout a deepening recession and falling earnings. This isn’t the setting you wish to personal overvalued devices primarily based on falling incomes estimates.

Moreover, if the Fed abandons its inflation combat and begins to bail out the financial system, it would trigger a resurgence of inflation. Such will both instantly Fed again right into a charge climbing marketing campaign, inflicting one other disaster, or they should let inflation ravage the financial system.

Critically, the Federal Reserve had by no means confronted needing to offer liquidity to the monetary system when inflation was excessive. Since 2008, inflation has been “properly contained,” permitting the Fed to decrease charges and supply “quantitative easing” to stabilize markets and monetary methods. That isn’t the case in the present day.

There appear to be no good selections for the Fed because the inflation-fighting credibility Powell has earned with the markets comes with a price.

“The difficulty is the tighter you retain borrowing situations for the non-public sector, the upper you retain mortgage charges, the upper you retain company borrowing charges, the upper the probabilities you’re going to freeze these credit score markets and principally sleepwalk into an accident or, on the whole, speed up a recession afterward.” – Alfonso Peccatiello.

The M2 Connection

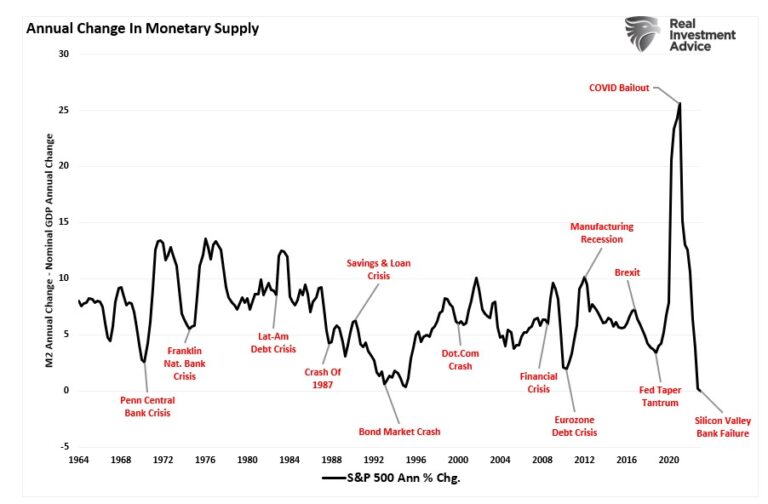

Alfonso is appropriate, and the contraction in nominal M2 is ringing alarm bells. Such was a degree Thorsten Polleit by way of The Mises Institute lately famous.

“What is occurring is that the Fed is pulling central financial institution cash out of the system. It does this in two methods. The primary just isn’t reinvesting the funds it receives into its bond portfolio. The second is by resorting to reverse repo operations, wherein it provides “eligible counterparties” (these few privileged to do enterprise with the Fed) the flexibility to park their money with the Fed in a single day and pay them an rate of interest near the federal funds charge.”

As proven, contractions in nominal M2 have coincided with monetary and market-related occasions up to now. Such is as a result of the Fed is draining liquidity out of the monetary system, which is finally deflationary. The rationale that recession odds are growing is that the drain is deflationary and financial progress is slowing. As Thorsten concludes:

“The Fed has introduced that it intends not solely to lift rates of interest additional but additionally to cut back its stability sheet and sponge up central financial institution cash.”

This, in flip, implies an actual threat that the Fed will overtighten, inflicting a recession.

Silicon Valley Financial institution is probably going the casualty of the approaching financial battle.

[ad_2]

Source link