[ad_1]

Danger administration is a vital a part of any dealer or investor. It refers to a scenario the place merchants take measures to stop the draw back whereas working to maximise returns.

There are quite a few danger administration methods out there, together with:

Having a stop-lossChecking order sizesAvoiding extreme buying and selling

On this article, we’ll concentrate on overtrading, its dangers, and why it is best to overtrade at instances.

What’s overtrading?

Overtrading, because the title suggests, is the method of opening too many trades in a single buying and selling session. There isn’t any particular variety of every day trades which are characterised as overtrading.

To some folks, particularly swing merchants, opening at the least ten trades per day will be seen as overtrading.

To different dealer merchants, particularly scalpers, it’s not unusual for them to open over 50 trades per day. Usually, the optimum variety of trades one ought to make per day must be lower than 20.

Why is overtrading dangerous?

As talked about, the most effective approaches to stop or cut back dangers out there is to keep away from overtrading. There are a number of the explanation why overtrading is extraordinarily dangerous.

Lack of analysis

First, once you overtrade, there’s a risk that you’ll not do numerous analysis for all of your trades. That is harmful since you’ll be opening your trades blindly.

And as we now have usually had the chance to say, buying and selling may be very a lot based mostly on evaluation (and never on forecasting).

Info overload

Second, overtrading will be tiring and result in fatigue. This occurs if you find yourself doing too many evaluation on firms or different property in a given day. Usually, this can contain studying a number of information stories, analyst stories, and conducting technical evaluation.

Additional, managing lots of of trades in a day will be troublesome, particularly when the markets are unstable. That’s as a result of the variety of information occasions out there will be too excessive, which can make it troublesome.

Charges

The opposite danger is said to buying and selling charges. The advantage of shares buying and selling within the US is that many brokers have eliminated charges in a bid to compete with the like of Robinhood and WeBull.

Nonetheless, if you’re buying and selling different markets like foreign exchange and choices, there’s a main danger of spending some huge cash in buying and selling charges.

What causes overtrading?

There are a number of the explanation why folks overtrade. First, they overtrade due to their total technique. For instance, scalpers make cash by opening tens of trades per day after which taking a small revenue in every of them. Due to this fact, they overtrade as a part of their total technique.

Second, merchants overtrade due to greed. This occurs when a dealer has a superb successful streak after which assumes that extra trades will probably be worthwhile.

Additional, merchants open quite a few trades per day due to concern, particularly after they have been shedding cash. The hope is that opening extra trades will result in extra income and assist them recoup their losses.

Lastly, many new merchants overtrade due to their enthusiasm in regards to the market. This occurs when they’re beginning to commerce and assume that they are going to all the time make cash.

Associated » The Overconfidence bias defined

When it is best to overtrade

Whereas overtrading is dangerous, there are particular instances when it is smart to open extra trades than regular. A few of these durations are:

When the market is unstable

Whereas volatility is often dangerous for many merchants, the truth is that many merchants, particularly scalpers, discover it supreme. That’s as a result of this volatility makes it doable so that you can enter trades and shut them inside a couple of minutes with a revenue.

When the market is trending

The opposite time when it is best to contemplate overtrading is when the market is trending upwards or downwards. Such conditions make it doable for merchants to open trades after which comply with the traits.

For instance, if the market is rising sharply, you may open quite a few trades following the development and make cash.

When your technique permits

At instances, your buying and selling technique can permit you to overtrade. A great instance of that is if you find yourself utilizing a technique like arbitrage or pairs buying and selling.

It is a technique that includes shopping for and promoting property which are correlated. The purpose is to make cash from the general unfold that emerges.

Learn how to overtrade nicely

Whereas we don’t advocate overtrading, there are a number of methods that can assist you overtrade nicely. A few of these approaches are:

Do correct evaluation

No matter your technique, all the time make sure that you do correct evaluation on your trades. That is the place you guarantee that you’re doing sufficient evaluation earlier than you open a commerce.

In different phrases, all the time guarantee that you’ve got a motive or a catalyst for getting into a commerce, not only a forecasting.

At all times shield your trades

When opening quite a few trades per day, all the time make sure that they’re protected. Thankfully, there are instruments that assist merchants shield their trades.

Most firms present a stop-loss and a take-profit. A stop-loss robotically stops a commerce when it reaches a sure stage.

Commerce sizes

Since we don’t advocate overtrading, we propose that you just all the time use small commerce sizes to scale back your exposition and dangerous instincts.

The purpose is to make sure that you don’t lose an excessive amount of cash, which is feasible once you open too many trades in a day.

Learn about correlations

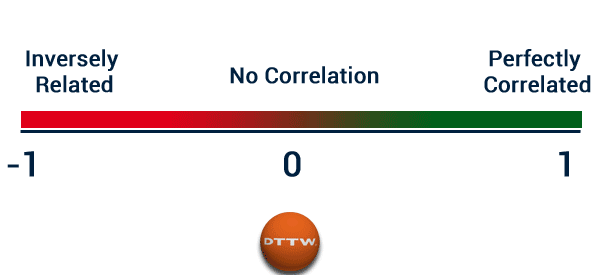

The opposite vital factor you might want to know when overtrading is on shares correlation. In most durations, firms in the identical trade tends to maneuver in the identical route. Due to this fact, it is best to make sure that you recognize about this.

For instance, in case you open purchase trades on shares like Apple and Microsoft, likelihood is that you’ll make cash when the shares rise. If expertise shares decline, there are probabilities that your trades will make a loss as nicely.

Abstract

On this article, we now have regarded on the idea of overtrading and why it is best to keep away from it. We’ve got additionally regarded on the dangers of this apply and when it is best to open quite a few trades in a given day. In all, we advocate that you just open a couple of trades per day as a substitute of lots of.

Exterior helpful sources

[ad_2]

Source link