[ad_1]

The US economic system is anticipated to enter a recession by the tip of the yr.

Regardless of the dangers, investing in equities should still be a viable choice.

The S&P 500 seems to be in an uptrend, however the 4200 stage stays a robust resistance.

It’s virtually sure that the US will enter a recession later this yr. The issue is nobody is aware of when it should truly occur or the direct impression of such an occasion on markets. We could possibly be years away from a market downturn, and buyers may lose potential beneficial properties by over-hedging dangers in the course of the course of. Within the meantime, the chances are high that a bigger share of money in portfolios will lose worth on account of inflation.

In line with the Nationwide Bureau of Financial Analysis, there have been 30 recessions since 1871. Bloomberg analyzed how the carried out 6 months earlier than every recession. They discovered that it had a optimistic whole return 21 occasions.

So having a very good share of equities within the portfolio within the months main as much as a recession would in all probability nonetheless be the best way to go, even when we knew {that a} recession was coming.

Moreover, equities additionally produced a optimistic whole return 15 occasions within the 6 months earlier than the tip of every recession. And in 12 out of 30 recessions, the market delivered a optimistic whole return.

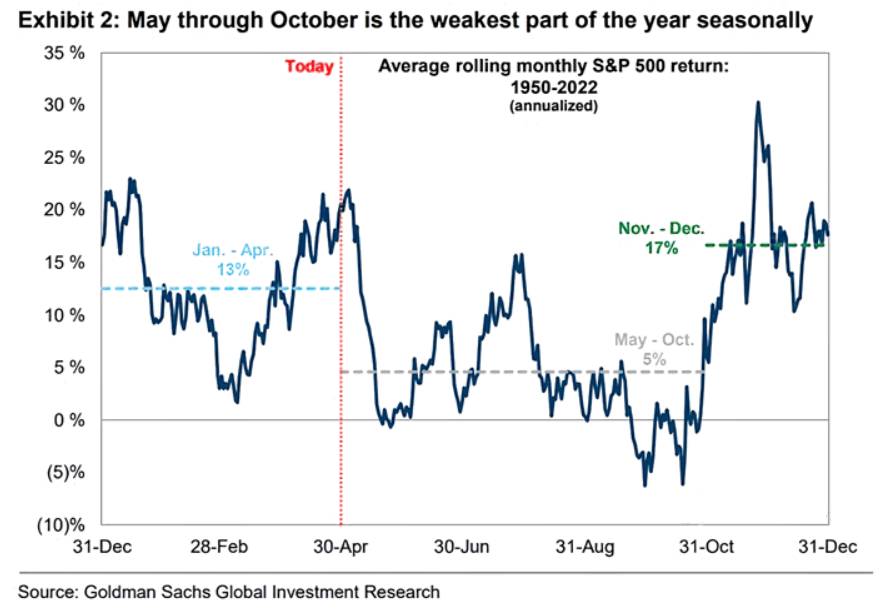

Furthermore, the typical annualized return of the S&P 500 from Could to October has been 5% traditionally (1950 to 2022).

This reveals that the inventory market and the economic system don’t essentially transfer in tandem. The recession will have an effect on all elements of the economic system, however not essentially in the identical manner.

That is additionally as a result of shares have a tendency to cost in these dangers properly upfront. So may or not it’s the case that the S&P 500 has already priced in recession fears over the previous yr and that the present efficiency is an indication that it’s already trying forward?

It’s tough to say. You can not make investments primarily based on financial forecasts. We did not count on it, however the S&P 500 survived April. The briefly dropped under 16 factors on the final buying and selling day of the month, returning to the identical stage as November 2021.

When investing, having an absolute conviction can result in a lack of alternative or capital. In spite of everything, the market doesn’t simply transfer in accordance with knowledge, it continuously adapts to occasions like a dwelling organism. Consequently, so should we.

To date, tech earnings have supported the market, and the general sentiment (Apple (NASDAQ:) and Microsoft’s (NASDAQ:) mixed weighting within the S&P 500 has risen to 14%).

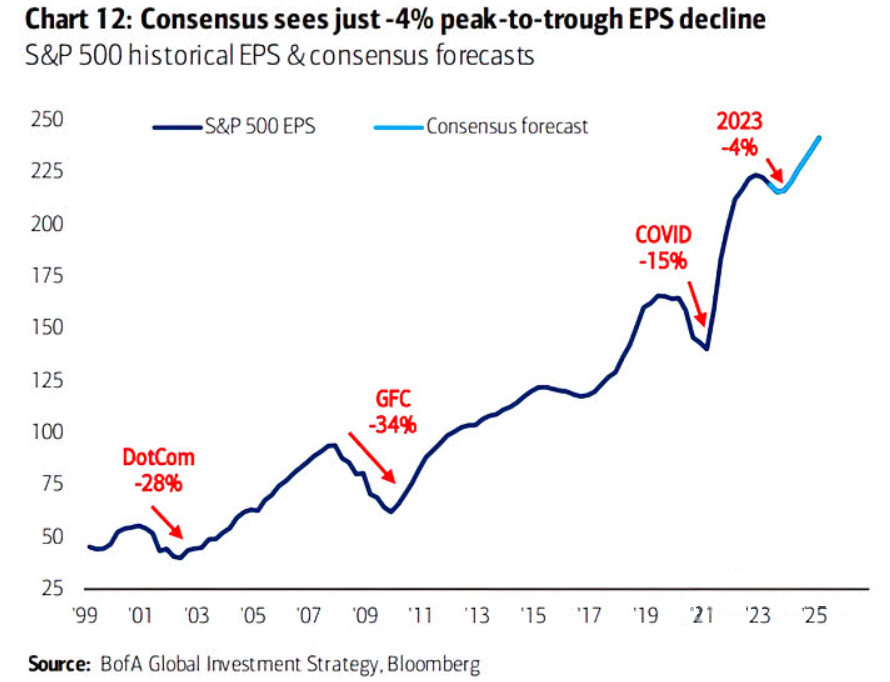

In actual fact, the consensus expectation was for EPS to fall by 7% year-on-year, however this isn’t occurring. 54% of corporations have crushed consensus estimates by not less than one customary deviation (versus the historic common of 48%).

The 5 greatest shares within the index had been answerable for many of the S&P 500’s beneficial properties:

Apple and Microsoft have accounted for practically 50% of the motion over the previous yr.

When you add the remainder of the FAANGs, you recover from 94% of the S&P 500’s return over the previous yr.

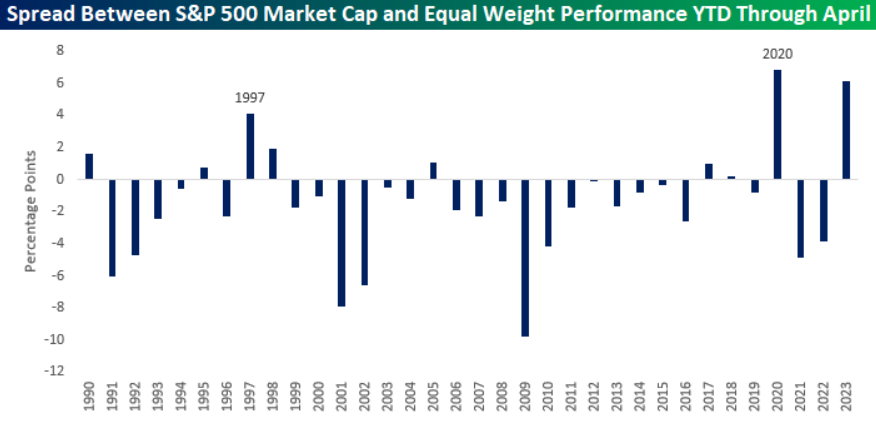

This slender lead is confirmed by the unfold on the capitalization-weighted S&P 500, which outperformed the by greater than 5% year-on-year. That is the second widest unfold within the final 34 years and is barely decrease than the 6.8% unfold recorded in 2020.

Nevertheless, this would possibly recommend that such a small proportion of equities is in a bear market. Nevertheless, the bearish thesis could possibly be disproved by 1997, one other yr by which the unfold hole was larger than 2%; in each circumstances (1997 – 2020), the efficiency of the S&P 500 over the remainder of the yr was greater than +20%.

We also needs to not neglect that April was the fourth month in a row that the S&P 500 closed above its 10-month shifting common. The market seems to be in an uptrend, however the 4200 stage stays a robust resistance.

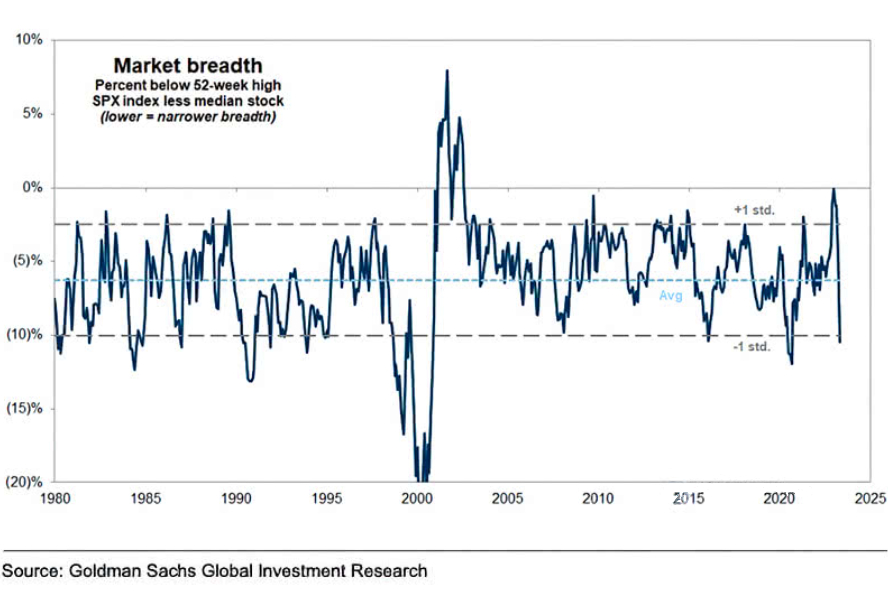

Certainly, the index’s breadth is narrowing because it touches lows. Is that this a bearish sign?

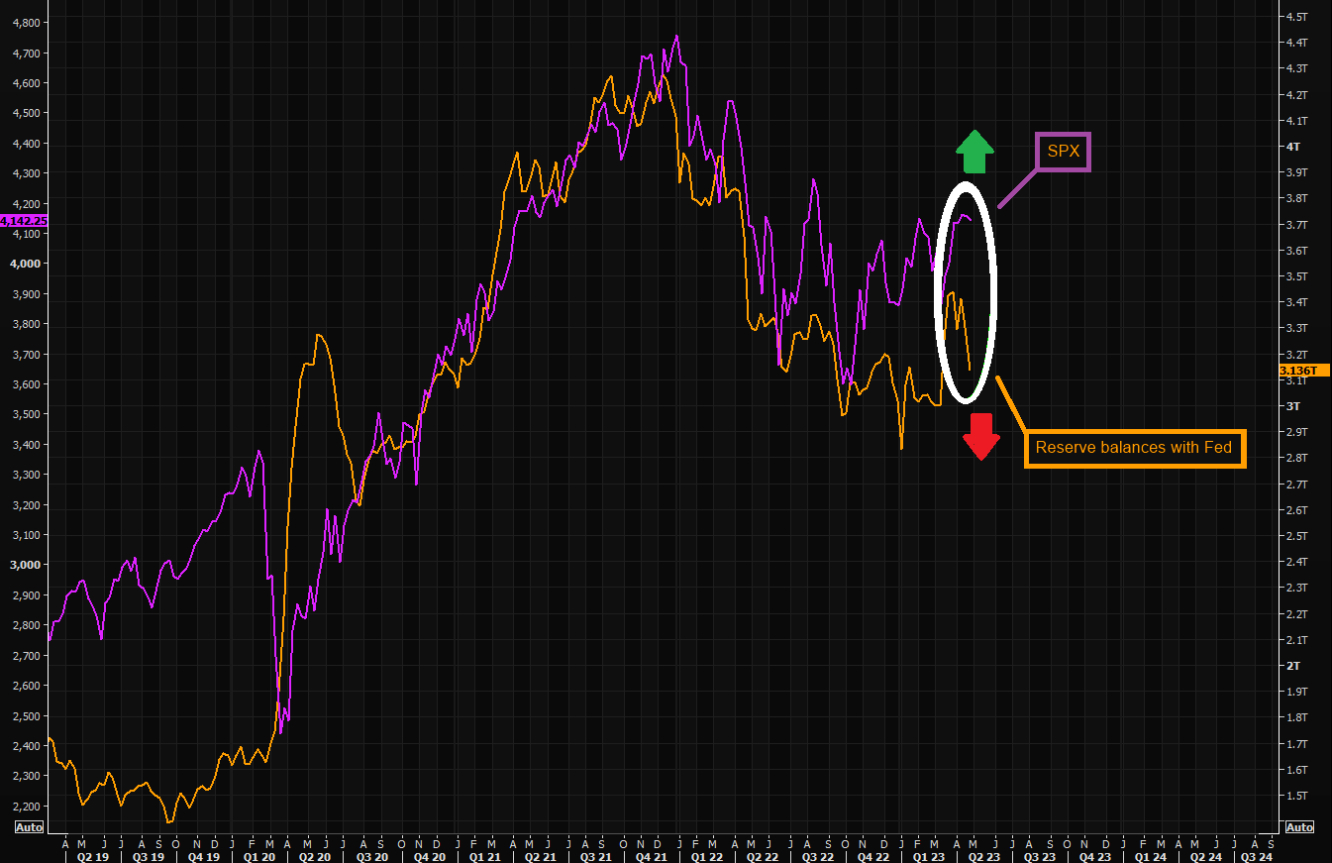

This thesis is supported by the liquidity issue, which is key to the market. Fed reserves proceed to fall.

And as we are able to see from the chart, the index has all the time adopted a drop in Fed’s reserves. Is it probably to take action once more?

***

Disclaimer: This text is written for informational functions solely; it doesn’t represent a solicitation, supply, recommendation, counseling, or suggestion to speculate as such it’s not supposed to incentivize the acquisition of belongings in any manner. I want to remind you that any kind of asset is evaluated from a number of factors of view and is very dangerous, and subsequently, any funding choice and the related threat stays with the investor.

[ad_2]

Source link