[ad_1]

Day merchants and buyers use quite a few instruments to find out whether or not to purchase or promote monetary property like shares, commodities, cryptocurrencies, and foreign exchange. They use technical indicators and different particular instruments to additionally decide their entry and exit factors.

On this article, we’ll have a look at the Fibonacci Retracement indicator and easy methods to use it available in the market, going into one of the best methods during which this device is usually a sport changer.

What’s the Fibonacci sequence?

The idea of the Fibonacci Retracement device is predicated on the Fibonacci sequence. For starters, the Fibonacci sequence was found a few years in the past to elucidate a sequence of how numbers observe one another.

The sequence works by including the 2 numbers earlier than it. The primary quantity on this case is 0 whereas the following one is 1, adopted by 1. Subsequently, on this case, the primary few numbers of the sequence are:

On this case, the following quantity on this sequence is 13 (8+5) whereas the following one is 21 (13+8).

Subsequently, the rule of the Fibonacci sequence is:

On this case, Xn is the quantity “n” whereas Xn-1 is the earlier time period (n-1) whereas Xn-2 is the quantity earlier than that (n-2). A very good instance is time period 9, which is calculated as:

What’s the Fibonacci Retracement?

The Fibonacci Retracement is a device utilizing the identical ideas because the Fibonacci sequence. On this case, this device makes use of a number of numbers within the sequence.

The primary Fibonacci sequence numbers within the sequence are 23.6%, 38.2%, 61.8%, 78.6%, and 100%. Whereas the 50% determine is positioned within the retracement, the quantity is normally included to point out the impartial level.

The Fibonacci Retracement device isn’t an indicator. As a substitute, it’s a mathematical device that merchants and buyers use to establish potential assist and resistance ranges.

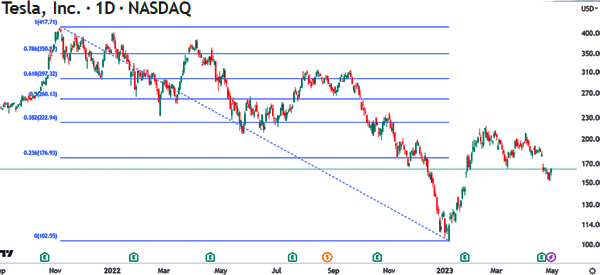

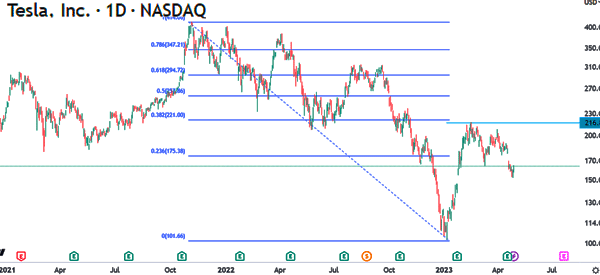

Additionally it is used to establish potential areas of pullbacks and continuations. The chart under reveals the Fibonacci retracement device utilized on the Tesla chart.

Fibonacci extension

The preferred device on this is called the Fibonacci retracement. Nevertheless, many individuals nonetheless use one other device often known as the Fibonacci extension.

The extension is used to foretell the following key ranges to look at sooner or later if the worth strikes above the higher or decrease sides of the preliminary device. The figures of the extension are sometimes 1.61, 1.50, 1.38, and 1.23 amongst others.

Why use the Fibonacci retracement?

There are a number of the explanation why merchants and buyers use the Fibonacci retracement. Listed below are probably the most related the explanation why these folks use the Fibonacci retracement instruments.

To establish assist and resistance

The preferred motive why folks use the Fibonacci retracement is to establish assist and resistance ranges. Assist is outlined as an space the place the worth struggles to maneuver under. It’s usually seen as an asset’s flooring.

However, resistance is outlined as a ceiling the place an asset struggles to maneuver above. As such, it’s usually seen as a ceiling.

These are the 2 most vital ranges {that a} dealer makes use of to function within the markets. Within the chart under, we see that the inventory discovered a robust resistance at ~$257, which was the 50% Fibonacci retracement stage.

To establish areas of potential breakouts

The opposite method is to make use of the device to establish breakouts. A breakout is a value the place an asset all of the sudden rises or falls out of a spread.

Within the instance above, a bullish breakout could be confirmed if the worth strikes above the 50% retracement stage. If this occurs, it signifies that the worth will possible proceed rising as patrons goal the 61.8% retracement stage at $295.

To establish stop-loss and take-profit ranges

The subsequent principal motive why merchants use the Fibonacci retracement device is to establish the stop-loss and take-profits. In most durations, merchants place their stop-loss and take-profit barely above or under the important thing retracement ranges.

Fibonacci retracement methods

After having seen what are one of the best makes use of for the Fibonacci retracement device, let’s go forward and take a look at what methods it may be utilized in.

Utilizing Fibonacci retracement in development following

Development-following is a buying and selling technique the place a dealer goals to purchase and maintain an asset as its value continues rising. In the identical interval, it entails shorting and holding the asset because it continues falling.

In trend-following, the Fibonacci retracement may also help you establish when there are pullbacks the place you should purchase the dip and the vice versa.

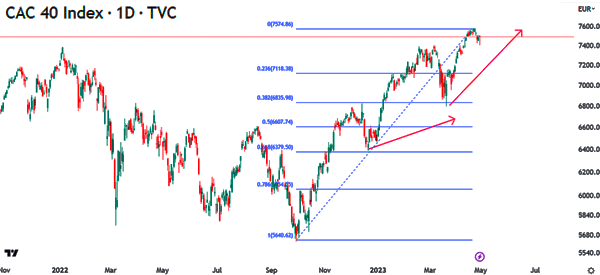

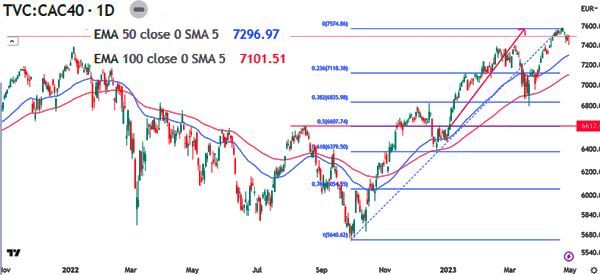

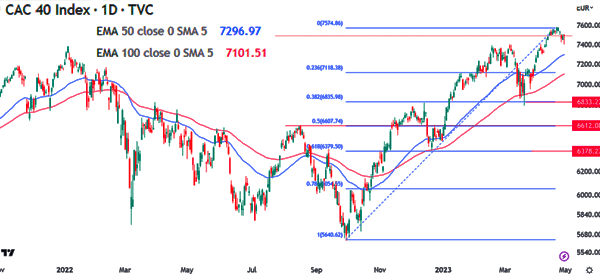

A very good instance of that is proven under. As you may see, the CAC 40 index is rising when it pulls again to six,824 (38.2% Fibonacci retracement) after which resume the uptrend.

Utilizing Fibonacci to commerce reversals

A reversal is a crucial idea in trend-following. It occurs when an current development fades after which a brand new one begins. In most durations, all developments normally finish with a reversal. Merchants use a number of instruments to know easy methods to establish reversal factors.

For instance, they use the transferring common crossover just like the golden cross to establish these reversals. In addition they use the Fibonacci Retracement device. For instance, within the chart under, we see that the CAC index made a bullish crossover. The bullish breakout was confirmed when the worth moved above the 50% Fibonacci Retracement stage at 6,612.

Place stop-loss and take-profits

The opposite method for utilizing the Fibonacci retracement device is to put a stop-loss and a take-profit. Within the instance under, suppose you got the CAC 40 index on the 50% retracement stage at 6,612.

On this case, you possibly can place a take-profit on the 61.8% retracement level at 6,800 and a stop-loss at 6,400. If the commerce works out effective, the take-profit at 6,833 can be triggered whereas a stop-loss at 6,378 can be triggered if the commerce fails.

Utilizing the Fibonacci Retracement for psychological ranges

The opposite method for utilizing the Fibonacci retracement is to establish psychological ranges in an asset A psychological stage is a value the place an asset behaves in a novel manner. Typically, probably the most psychological ranges are normally even numbers like 100, 20, and 30. In lots of circumstances, merchants use these Fibonacci retracement ranges as psychological factors.

Combining Fibonacci with different instruments

The truth of Fibonacci retracement is that it’s nearly inconceivable to make use of it alone. Subsequently merchants use it in a mix with different instruments. The preferred instruments that merchants use when utilizing the device are indicators just like the transferring common and the Relative Energy Index (RSI) and the MACD.

Merchants additionally use a number of approaches like candlestick patterns like head and shoulders and rising wedge patterns to foretell the following actions in an asset. Additional, merchants additionally mix it with instruments like Andrews Pitchfork. Gann Fann, and Fib Circles amongst others.

Abstract

The Fibonacci Retracement is a crucial device that makes it attainable for merchants to establish key assist and resistance ranges. It additionally serves quite a few roles within the monetary market similar to figuring out stop-loss and take-profit ranges and psychological factors.

[ad_2]

Source link