[ad_1]

Fast Take

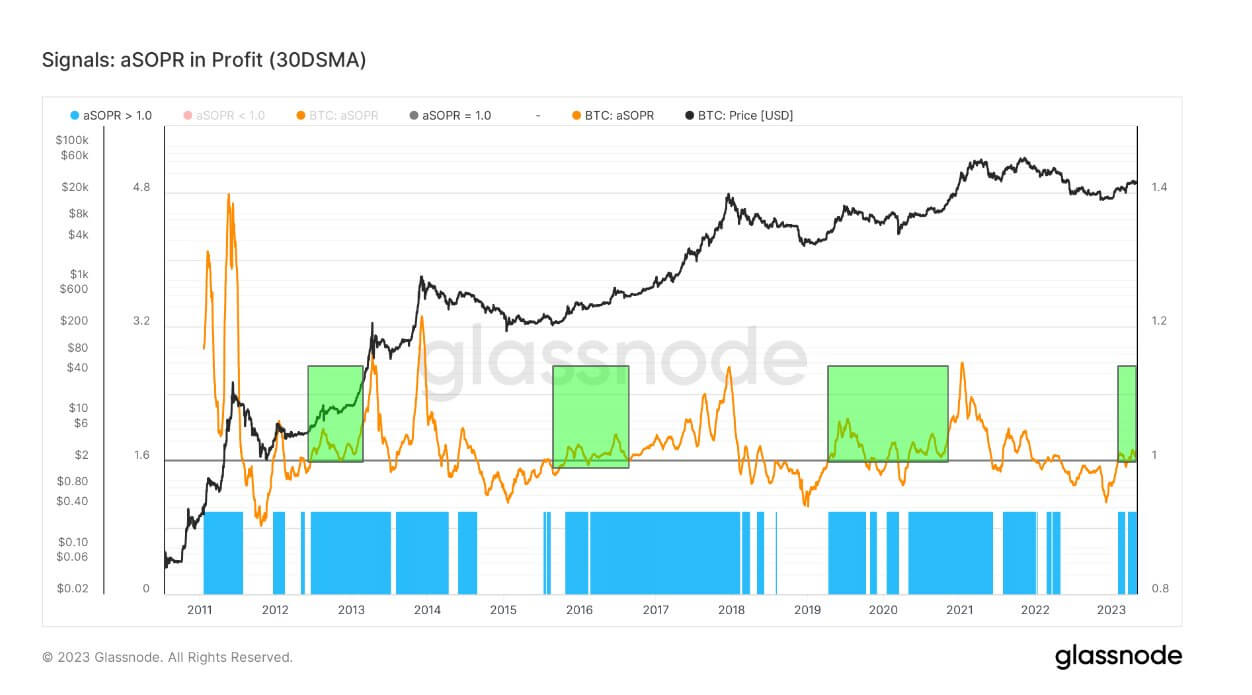

The Spent Output Revenue Ratio (SOPR) is computed by dividing the realized worth (in USD) divided by the worth at creation (USD) of a spent output — or just: worth bought / worth paid.

Adjusted SOPR is SOPR ignoring all outputs with a lifespan of lower than 1 hour.

aSOPR has been holding above 1.0 for the reason that SVB collapse again in March. This signifies that the market is now, on common, realizing income in on-chain spending.

This usually aligns with a more healthy influx of demand (to soak up profit-taking) and a extra constructive opinion of the asset.

We examined 1.0 on the finish of March, and I anticipate to check it a couple of extra instances — just like earlier bear markets. We will undershot 1.0 to flush out leverage, just like 2019.

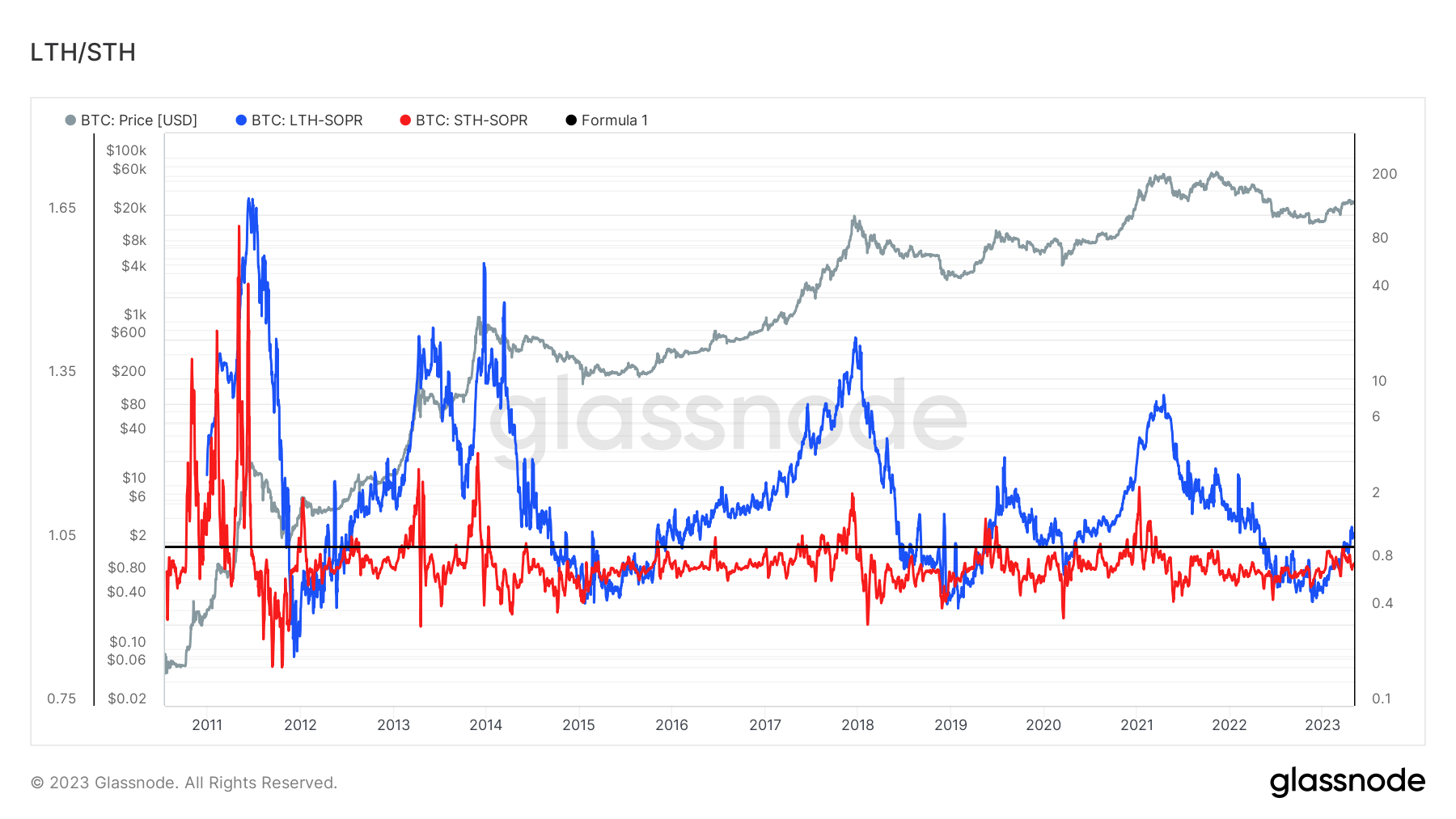

Whereas each lengthy and short-term holders realized income for the primary time since Might 2022, this was in a downtrend in worth. So we’re in an identical interval to early 2020 relating to worth ascending.

The publish Revenue realization on the rise: aSOPR holds regular above 1.0 since March’s SVB collapse appeared first on CryptoSlate.

[ad_2]

Source link