[ad_1]

Up to date on Could fifteenth, 2023 by Bob Ciura

On this planet of investing, volatility issues. Buyers are reminded of this each time there’s a downturn within the broader market and particular person shares which might be extra risky than others expertise monumental swings in value.

Volatility is a proxy for danger; extra volatility typically means a riskier portfolio. The volatility of a safety or portfolio in opposition to a benchmark known as Beta.

In brief, Beta is measured by way of a formulation that calculates the value danger of a safety or portfolio in opposition to a benchmark, which is usually the broader market as measured by the S&P 500.

Right here’s learn how to learn inventory betas:

A beta of 1.0 means the inventory strikes equally with the S&P 500

A beta of two.0 means the inventory strikes twice as a lot because the S&P 500

A beta of 0.0 means the shares strikes don’t correlate with the S&P 500

A beta of -1.0 means the inventory strikes exactly reverse the S&P 500

Curiously, low beta shares have traditionally outperformed the market… However extra on that later.

You may obtain a spreadsheet of the 100 lowest beta shares (together with vital monetary metrics like price-to-earnings ratios and dividend yields) beneath:

This text will talk about beta extra totally, why low-beta shares are inclined to outperform, and supply a dialogue of the 5 lowest-beta dividend shares within the Certain Evaluation Analysis Database. The desk of contents beneath permits for simple navigation.

Desk of Contents

The Proof for Low Beta Shares Outperformance

Beta is useful in understanding the general value danger stage for buyers throughout market downturns particularly. The decrease the Beta worth, the much less volatility the inventory or portfolio ought to exhibit in opposition to the benchmark. That is useful for buyers for apparent causes, significantly these which might be near or already in retirement, as drawdowns must be comparatively restricted in opposition to the benchmark.

Importantly, low or excessive Beta merely measures the dimensions of the strikes a safety makes; it doesn’t imply essentially that the value of the safety stays practically fixed. Certainly, securities may be low Beta and nonetheless be caught in long-term downtrends, so that is merely another instrument buyers can use when constructing a portfolio.

The traditional knowledge would recommend that decrease Beta shares ought to underperform the broader markets throughout uptrends and outperform throughout downtrends, providing buyers decrease potential returns in trade for decrease danger.

Nonetheless, historical past would recommend that merely isn’t the case. Certainly, this paper from Harvard Enterprise College means that not solely do low Beta shares not underperform the broader market over time – together with all market situations – they really outperform.

A protracted-term examine whereby the shares with the bottom 30% of Beta scores within the US have been pitted in opposition to shares with the best 30% of Beta scores steered that low Beta shares outperform by a number of share factors yearly.

Over time, this form of outperformance can imply the distinction between a cushty retirement and having to proceed working. Whereas low Beta shares aren’t a panacea, the case for his or her outperformance over time – and with decrease danger – is kind of compelling.

How To Calculate Beta

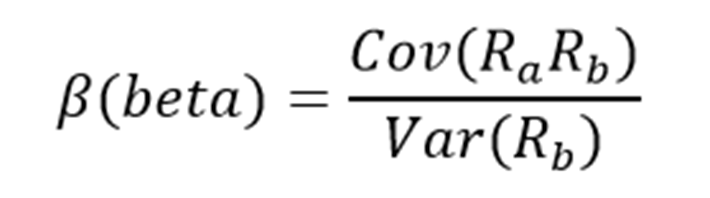

The formulation to calculate a safety’s Beta is pretty simple. The outcome, expressed as a quantity, reveals the safety’s tendency to maneuver with the benchmark.

For instance, a Beta worth of 1.0 signifies that the safety in query ought to transfer in lockstep with the benchmark. A Beta of two.0 signifies that strikes within the safety must be twice as massive in magnitude because the benchmark and in the identical course, whereas a unfavourable Beta signifies that actions within the safety and benchmark have a tendency to maneuver in reverse instructions or are negatively correlated.

Associated: The S&P 500 Shares With Adverse Beta.

In different phrases, negatively correlated securities could be anticipated to rise when the general market falls, or vice versa. A small worth of Beta (one thing lower than 1.0) signifies a inventory that strikes in the identical course because the benchmark, however with smaller relative modifications.

Right here’s a have a look at the formulation:

The numerator is the covariance of the asset in query with the market, whereas the denominator is the variance of the market. These complicated-sounding variables aren’t truly that tough to compute – particularly in Excel.

Moreover, Beta will also be calculated because the correlation coefficient of the safety in query and the market, multiplied by the safety’s customary deviation divided by the market’s customary deviation.

Lastly, there’s a tremendously simplified method to calculate Beta by manipulating the capital asset pricing mannequin formulation (extra on Beta and the capital asset pricing mannequin later on this article).

Right here’s an instance of the info you’ll have to calculate Beta:

Danger-free fee (usually Treasuries a minimum of two years out)

Your asset’s fee of return over some interval (usually one yr to 5 years)

Your benchmark’s fee of return over the identical interval because the asset

To indicate learn how to use these variables to do the calculation of Beta, we’ll assume a risk-free fee of two%, our inventory’s fee of return of seven% and the benchmark’s fee of return of 8%.

You begin by subtracting the risk-free fee of return from each the safety in query and the benchmark. On this case, our asset’s fee of return internet of the risk-free fee could be 5% (7% – 2%). The identical calculation for the benchmark would yield 6% (8% – 2%).

These two numbers – 5% and 6%, respectively – are the numerator and denominator for the Beta formulation. 5 divided by six yields a worth of 0.83, and that’s the Beta for this hypothetical safety. On common, we’d anticipate an asset with this Beta worth to be 83% as risky because the benchmark.

Enthusiastic about it one other manner, this asset must be about 17% much less risky than the benchmark whereas nonetheless having its anticipated returns correlated in the identical course.

Beta & The Capital Asset Pricing Mannequin (CAPM)

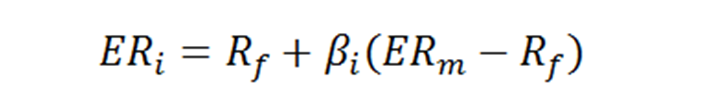

The Capital Asset Pricing Mannequin, or CAPM, is a typical investing formulation that makes use of the Beta calculation to account for the time worth of cash in addition to the risk-adjusted returns anticipated for a specific asset.

Beta is a vital part of the CAPM as a result of with out it, riskier securities would seem extra favorable to potential buyers. Their danger wouldn’t be accounted for within the calculation.

The CAPM formulation is as follows:

The variables are outlined as:

ERi = Anticipated return of funding

Rf = Danger-free fee

βi = Beta of the funding

ERm = Anticipated return of market

The chance-free fee is similar as within the Beta formulation, whereas the Beta that you simply’ve already calculated is solely positioned into the CAPM formulation. The anticipated return of the market (or benchmark) is positioned into the parentheses with the market danger premium, which can be from the Beta formulation. That is the anticipated benchmark’s return minus the risk-free fee.

To proceed our instance, right here is how the CAPM truly works:

ER = 2% + 0.83(8% – 2%)

On this case, our safety has an anticipated return of 6.98% in opposition to an anticipated benchmark return of 8%. Which may be okay relying upon the investor’s objectives because the safety in query ought to expertise much less volatility than the market due to its Beta of lower than 1. Whereas the CAPM definitely isn’t good, it’s comparatively straightforward to calculate and offers buyers a method of comparability between two funding options.

Now, we’ll check out 5 shares that not solely supply buyers low Beta scores, however engaging potential returns as nicely.

Evaluation On The High 5 Low Beta Shares

The next 5 low beta shares have the bottom (however optimistic) Beta values, in ascending order from lowest to highest. Additionally they pay dividends to shareholders. We targeted on Betas above 0, as we’re nonetheless searching for shares which might be positively correlated with the broader market:

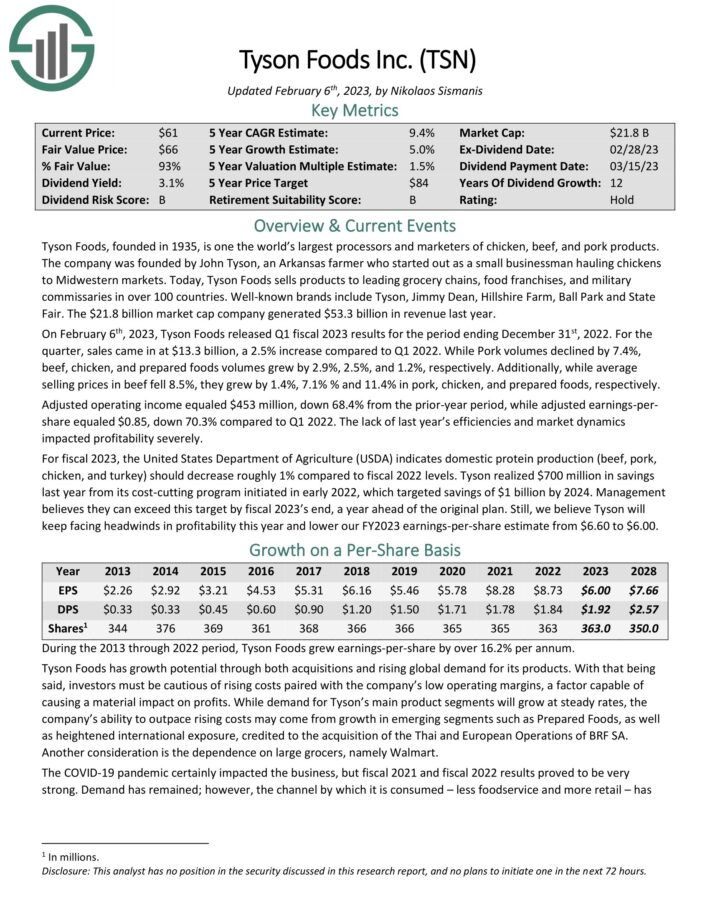

5. Tyson Meals (TSN)

Tyson Meals, based in 1935, is one the world’s largest processors and entrepreneurs of rooster, beef, and pork merchandise. The corporate was based by John Tyson, an Arkansas farmer who began out as a small businessman hauling chickens to Midwestern markets.

At present, Tyson Meals sells merchandise to main grocery chains, meals franchises, and navy commissaries in over 100 international locations. Effectively-known manufacturers embody Tyson, Jimmy Dean, Hillshire Farm, Ball Park and State Truthful. The corporate generated $53.3 billion in income final yr.

On February sixth, 2023, Tyson Meals launched Q1 fiscal 2023 outcomes for the interval ending December thirty first, 2022. For the quarter, gross sales got here in at $13.3 billion, a 2.5% improve in comparison with Q1 2022. Whereas Pork volumes declined by 7.4%, beef, rooster, and ready meals volumes grew by 2.9%, 2.5%, and 1.2%, respectively. Moreover, whereas common promoting costs in beef fell 8.5%, they grew by 1.4%, 7.1% % and 11.4% in pork, rooster, and ready meals, respectively.

DVA has a Beta rating of 0.67.

Click on right here to obtain our most up-to-date Certain Evaluation report on Tyson Meals (preview of web page 1 of three proven beneath):

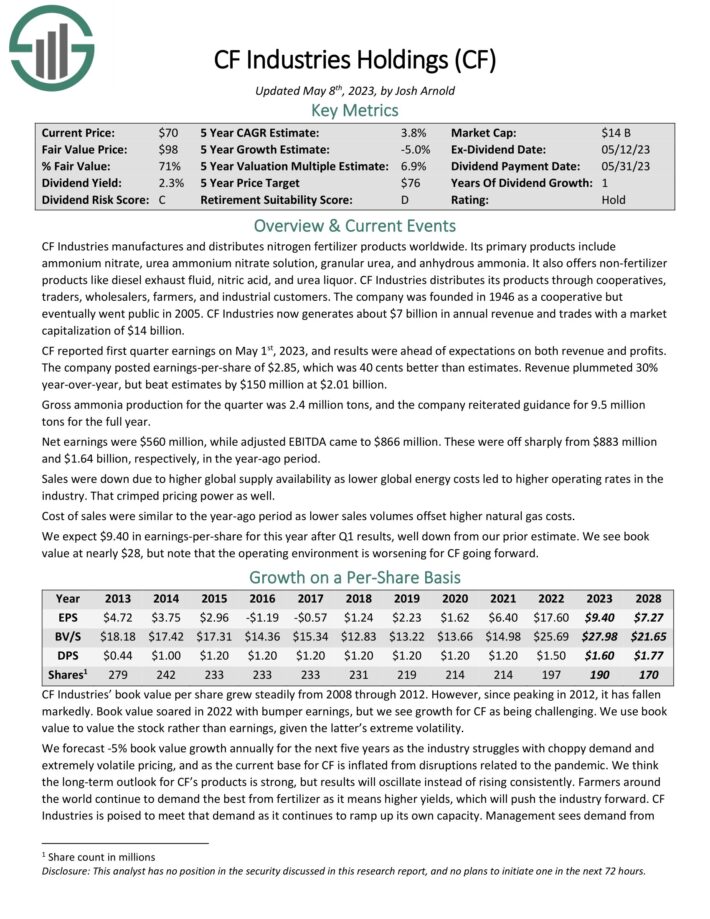

4. CF Industries (CF)

CF Industries manufactures and distributes nitrogen fertilizer merchandise worldwide. Its main merchandise embody ammonium nitrate, urea ammonium nitrate answer, granular urea, and anhydrous ammonia. It additionally presents non-fertilizer merchandise like diesel exhaust fluid, nitric acid, and urea liquor. CF Industries distributes its merchandise by way of cooperatives, merchants, wholesalers, farmers, and industrial prospects.

CF reported first quarter earnings on Could 1st, 2023, and outcomes have been forward of expectations on each income and earnings. The corporate posted earnings-per-share of $2.85, which was 40 cents higher than estimates. Income plummeted 30% year-over-year, however beat estimates by $150 million at $2.01 billion.

Gross ammonia manufacturing for the quarter was 2.4 million tons, and the corporate reiterated steering for 9.5 million tons for the total yr. Internet earnings have been $560 million, whereas adjusted EBITDA got here to $866 million. These have been off sharply from $883 million and $1.64 billion, respectively, within the year-ago interval.

CF has a Beta rating of 0.66.

Click on right here to obtain our most up-to-date Certain Evaluation report on CF Industries (preview of web page 1 of three proven beneath):

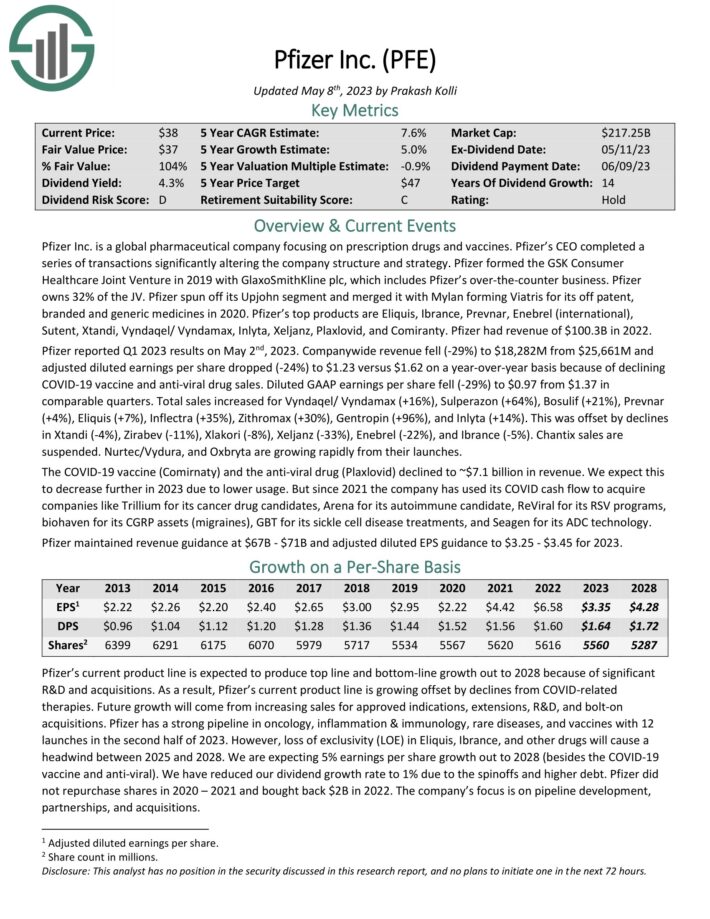

3. Pfizer Inc. (PFE)

Pfizer Inc. is a worldwide pharmaceutical firm that focuses on prescribed drugs and vaccines. With a market capitalization above $200 billion, Pfizer is a mega-cap inventory.

Pfizer’s high merchandise are Eliquis, Ibrance, Prevnar, Enebrel (worldwide), Sutent, Xtandi, Vyndaqel/ Vyndamax, Inlyta, Xeljanz, Plaxlovid, and Comiranty. Pfizer had income of $81.3B in 2021.

Pfizer reported Q1 2023 outcomes on Could 2nd, 2023. Firm-wide income fell (-29%) to $18,282M from $25,661M and adjusted diluted earnings per share dropped (-24%) to $1.23 versus $1.62 on a year-over-year foundation due to declining COVID-19 vaccine and anti-viral drug gross sales. Diluted GAAP earnings per share fell (-29%) to $0.97 from $1.37 in comparable quarters.

PFE has a Beta rating of 0.58.

Click on right here to obtain our most up-to-date Certain Evaluation report on Pfizer (preview of web page 1 of three proven beneath):

2. Cigna (CI)

Cigna is a number one supplier of insurance coverage services and products. The corporate’s merchandise embody dental, medical, incapacity and life insurance coverage that it offers by way of employer-sponsored, government-sponsored and particular person protection plans.

On February third, 2023, Cigna reported fourth quarter and full yr outcomes for the interval ending December thirty first, 2022. For the quarter, income grew 0.2% to $45.75 billion and was in-line with estimates. Adjusted earnings-per-share of $4.96 in comparison with adjusted earnings-per-share of $4.77 within the prior yr and was $0.09 higher than anticipated.

For the quarter, complete pharmacy prospects have been decrease by 1.6% to 105.6 million. Complete medical prospects grew 5.4% year-over-year to simply over 18 million. Adjusted income for the Evernorth phase, which is the biggest throughout the firm, elevated 3.1% to $36.2 billion attributable to natural development in specialty pharmacy providers.

Cigna has a Beta rating of 0.53.

Click on right here to obtain our most up-to-date Certain Evaluation report on Cigna (preview of web page 1 of three proven beneath):

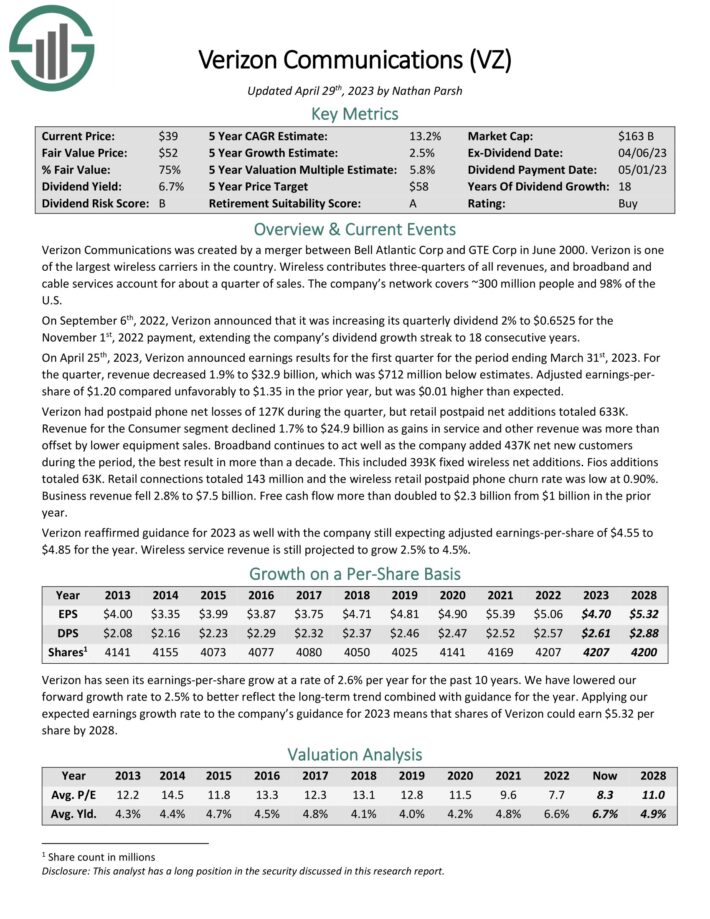

1. Verizon Communications (VZ)

Verizon is among the largest wi-fi carriers within the nation. Wi-fi contributes three-quarters of all revenues, and broadband and cable providers account for a few quarter of gross sales. The corporate’s community covers ~300 million folks and 98% of the U.S.

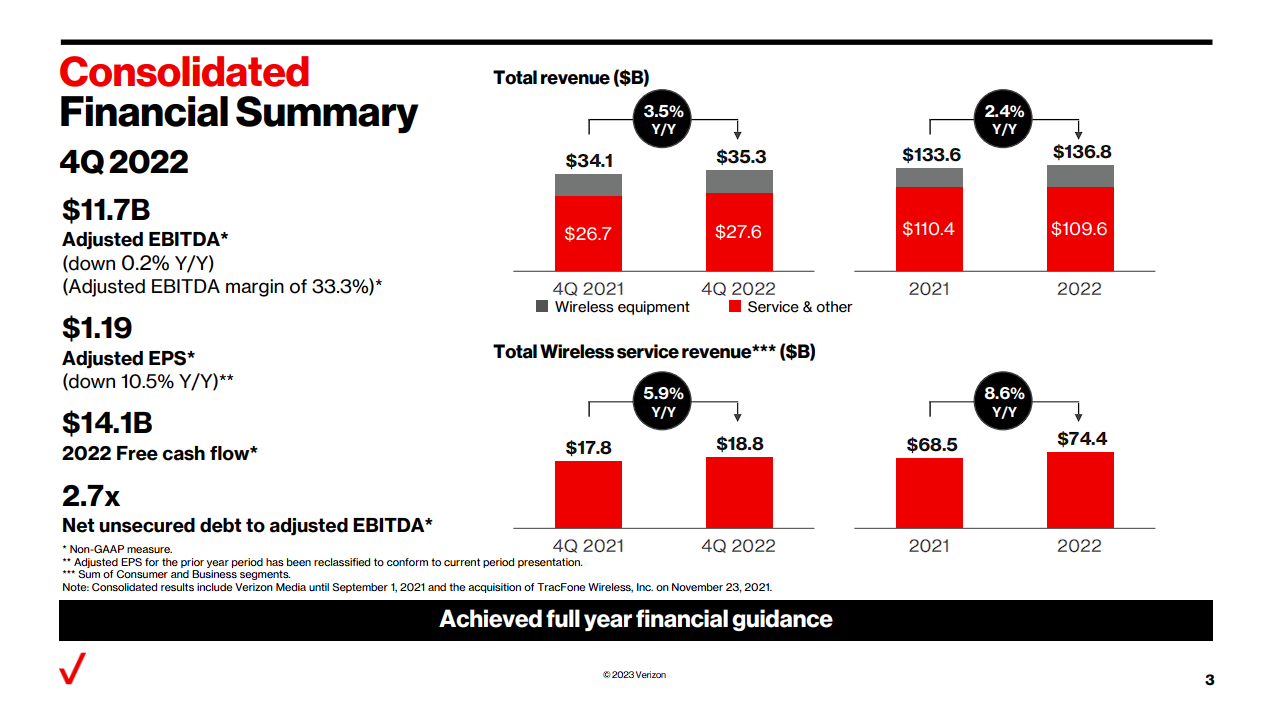

On January twenty fifth, 2023, Verizon introduced earnings outcomes for the fourth quarter and full yr for the interval ending December thirty first, 2022. For the quarter, income grew 3.5% to $35.3 billion, which topped estimates by $160 million. Adjusted earnings-per-share of $1.19 in contrast unfavorably to $1.11 within the prior yr however was in step with expectations.

For 2022, income improved by 2.4% to $136.8 billion, whereas adjusted earnings-per-share fell to $5.06 from $5.39 within the earlier yr. Verizon had postpaid telephone internet additions of 217K throughout the quarter, a lot better than simply the 8,000 internet additions within the third quarter.

Income for the Shopper phase grew 4.2% to $26.8 billion, once more pushed by increased tools gross sales and a 5.9% improve in wi-fi income development. Broadband had 416K internet additions throughout the quarter, which included 379K fastened wi-fi internet additions. Fios additions totaled 59K. Enterprise income elevated by 1.2% to $7.9 billion. Retail connections totaled 143 million, and the wi-fi retail postpaid telephone churn fee was low at 0.89%.

Supply: Investor Presentation

Verizon supplied steering for 2023 as nicely, with the corporate anticipating adjusted earnings-per-share of $4.55 to $4.85 for the yr. Wi-fi service income is projected to develop from 2.5% to 4.5%.

VZ has a Beta rating of 0.43.

Click on right here to obtain our most up-to-date Certain Evaluation report on VZ (preview of web page 1 of three proven beneath):

Closing Ideas

Buyers should take danger into consideration when choosing from potential investments. In spite of everything, if two securities are in any other case comparable by way of anticipated returns however one presents a a lot decrease Beta, the investor would do nicely to pick the low Beta safety as they could supply higher risk-adjusted returns.

Utilizing Beta can assist buyers decide which securities will produce extra volatility than the broader market and which of them could assist diversify a portfolio, comparable to those listed right here.

The 5 shares we’ve checked out not solely supply low Beta scores, however additionally they supply engaging dividend yields. Sifting by way of the immense variety of shares obtainable for buy to buyers utilizing standards like these can assist buyers discover the most effective shares to swimsuit their wants.

At Certain Dividend, we regularly advocate for investing in firms with a excessive likelihood of accelerating their dividends each yr.

If that technique appeals to you, it might be helpful to flick thru the next databases of dividend development shares:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].

[ad_2]

Source link