[ad_1]

Quokka Household/iStock by way of Getty Photos

New Discovered Gold Replace

That is an replace on New Discovered Gold Corp. (NYSE:NFGC), a number one gold exploration firm, centered on advancing its high-grade Queensway property in Newfoundland, Canada, which was just lately ranked because the No. 4 greatest mining jurisdiction on the planet.

On Dec. 29, 2022, and subsequently, on March 7, I advisable shopping for New Discovered Gold inventory for a couple of key causes.

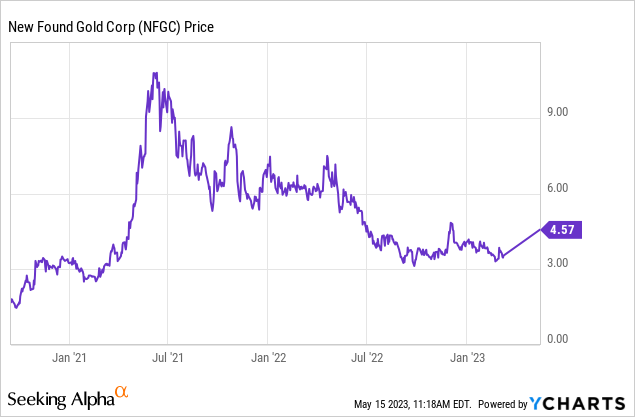

Despite the fact that the corporate’s inventory worth dipped by 40% in 2022, I believed New Discovered Gold Corp. made important strides through the yr, uncovering a number of high-grade gold zones on its in depth property. I additionally predicted further discoveries in 2023, which might doubtless result in a surge within the inventory worth.

My recommendation has labored out properly up to now: shares have soared 30% since my purchase suggestion in March, outperforming the S&P 500 Index (SP500), which has solely risen by 3.11%.

Nonetheless, regardless of current exploration successes and the sturdy efficiency, I believe it might be time to take a breather on shopping for New Discovered Gold inventory, as a greater shopping for alternative could also be coming quickly, as I clarify under.

New Discovered Gold: Extra Excessive-Grade Hits In 2023

New Discovered Gold

First, let’s discuss New Discovered Gold’s successes year-to-date. The corporate has been very energetic as it’s at present enterprise a 500,000m drill program at Queensway. Listed here are the highlights.

March 13. New Discovered Gold Intercepts 49.7 G/T Over 29.9 Meters at Iceberg Zone.

New Discovered Gold just lately introduced among the most excellent drill outcomes from its Queensway mission, together with a drill gap that returned a “gram x meter” studying (which is grams per ton, multiplied by meter width) of 1,486-considered glorious by trade requirements, as any end result over 100 is deemed good.

What’s extra: these spectacular outcomes are from a subsequent drilling program on the newly found Iceberg zone, a high-grade space situated 300 meters northeast of the Keats Foremost zone, the positioning of the corporate’s major discoveries to this point.

Earlier outcomes from the Iceberg zone included a results of 72.2 g/t over 9.65 meters. A brand new results of 14.60 g/t gold over 3.8 meters was drilled beginning simply 35 meters under the floor, which can point out the potential for shallow open-pit mining.

New Discovered Gold emphasizes that the mineralization sample noticed on this space aligns with that at Keats Foremost. That is important as it might substantiate the corporate’s speculation that Iceberg is probably going the jap extension of Keats Foremost, suggesting the zones type half of a bigger, interconnected zone.

April 4. New Discovered Hits 35.6 G/T Over 10.65 Meters at Iceberg.

New Discovered reported two diamond drill outcomes that have been accomplished at Iceberg on April 4. The outcomes proceed to impress the market, with highlights together with 35.6 g/t gold over 10.65 meters, 3.1 g/t over 13.90 meters, and 12.6 g/t over 7.60 meters.

Based on the corporate, at this cut-off date, mineralization at Iceberg has been drill-defined over 50 meters in strike size and traced to over 80 meters down-dip. However mineralization can be open alongside strike and to depth, indicating additional discoveries are more likely to come.

April 18. New Discovered Hits 4.27 G/T Over 31.55 Meters, Extends Keats West to 250 Meters Alongside Strike.

The corporate introduced the outcomes from 25 diamond drill holes that have been accomplished as a part of a drill program designed to broaden the Keats West zone, in addition to Keats North.

The corporate says step-out enlargement drilling elevated the strike size at Keats West to 250 meters. Highlights included 4.27 g/t over 31.55 meters at Keats West, and 16.0 g/t over 2.50 meters at Keats North.

Based on New Discovered Gold, the world of Keats North is prime for making further high-grade gold discoveries, as it’s situated between among the firm’s greatest drill holes to this point on the property.

Might 10. New Discoveries at Three New Gold Zones Reported.

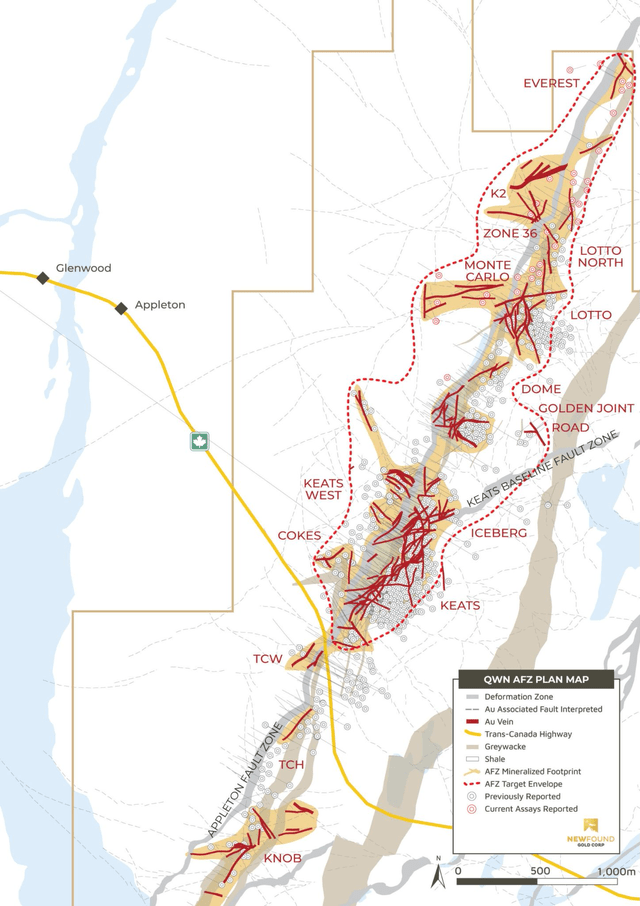

Maybe the largest information of the yr got here a couple of days in the past when the corporate reported the invention of three new gold zones – “Monte Carlo”, “K2” and “Everest.” These discoveries prolonged the mineralization over a powerful 4.1 km in strike size.

At Monte Carlo, located adjoining to Lotto however on the Appleton Fault’s western facet, the corporate reported hitting 12.3 g/t over 8.05 meters and 13.0 g/t over 4.75 meters.

At K2, situated 725 meters north of Lotto on the Appleton Fault’s western facet, the intervals included 28.6 g/t over 2 meters and 11.2 g/t over 4.25 meters.

Everest, positioned 1.5 km northeast of Lotto, unveiled high-grade drill outcomes of 36.7 g/t over 3.70 meters.

Lastly, the corporate additionally reported sturdy follow-up drill holes at Lotto North and Dome. Particularly, one drill at Dome hit 21.1 g/t over 7.65 meters.

These discoveries are important as they exhibit the expansive scale of the Queensway mission and trace at a probably higher quantity of gold assets than initially anticipated (Notice: an preliminary useful resource has not but been deliberate). The persistence of high-grade gold outcomes can be a promising signal.

The Appleton Fault Zone now boasts a number of high-grade gold zones: Keats, Keats North, Cokes, Iceberg, Keats West, Street, Golden Joint, Dome, Lotto, Monte Carlo, Lotto North, Zone 36, K2, and Everest.

Why New Discovered Gold Might Not Be A Purchase Proper Now

New Discovered Gold Corp.’s announcement of the invention of three new gold zones could be very bullish for its useful resource upside, nevertheless it additionally implies that it might want to broaden its drilling program even additional to check these new zones. That doubtless means a dearer exploration finances.

With roughly ~$60 million within the financial institution (as of Might 2023), the corporate is properly funded. However I believe it is more likely to faucet into the markets quickly to boost more cash in an effort to broaden the drill program all through 2023 and into 2024.

Usually, when a gold exploration firm raises funds, it includes issuing new fairness, which dilutes present shareholders and incessantly ends in a short-term inventory worth drop. For instance, on Dec. 14, 2022, the corporate concluded a $50 million financing spherical, led by investor Eric Sprott, issuing 6.25 million new shares at C$8.00 per share.

Whereas I anticipate favorable financing phrases by Canada’s “move by financing” profit, and foresee Sprott collaborating once more within the financing, there is a chance that the inventory worth could drop a bit following the announcement. Although the precise timing of latest financing is unsure, it would happen by the top of this quarter, or maybe in Q3/This autumn.

In fact, there are different components that would negatively impression its inventory worth. The value of gold, as an example, might fall if the U.S. efficiently negotiates to boost the debt ceiling and averts a default – which might subsequently result in a drop in New Discovered Gold shares.

Lastly, you too can argue that New Discovered Gold Corp. is trying somewhat costly for the time being. The corporate has a market capitalization of US$811 million, regardless of not having any said gold assets or reserves but. I’d argue that the drilling outcomes to this point recommend that, in due time, New Discovered Gold will possess a multi-million-ounce, high-grade useful resource, and, it is situated in a top-tier mining jurisdiction. Future technical research will doubtless reveal a extremely worthwhile operation, which is able to assist the excessive valuation.

Nonetheless, it is honest to argue that paying up in worth now for its future upside potential could be a difficult funding determination to make.

In conclusion, whereas I stay very bullish on New Discovered Gold Corp. shares and I really like the corporate’s success this yr, I imagine the short-term outlook is unsure. Present dangers could overshadow potential rewards for brand spanking new patrons. I am content material with sustaining my present place and sit up for a possible dip in New Discovered Gold Corp. shares sooner or later (at which level I will be an keen purchaser).

[ad_2]

Source link