[ad_1]

shaunl

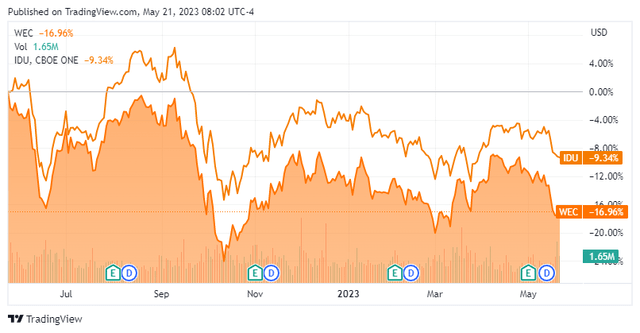

WEC Power Group (NYSE:WEC) is a regulated electrical and pure gasoline utility that primarily operates in Wisconsin and the encircling states. The utility sector typically has lengthy been among the many favourite investments for conservative traders, reminiscent of retirees. There are some excellent causes for this, together with the overall stability of the sector and the truth that many utility firms pay out remarkably excessive dividend yields. WEC Power Group is not any exception to this because the inventory’s present 3.47% yield is way larger than the broader S&P 500 Index (SPY) and even the U.S. Utilities Index (IDU). Sadly, the inventory has considerably underperformed the index recently, as WEC Power Group has dropped 16.96% over the previous 12 months in comparison with solely a 9.34% drop within the index:

Searching for Alpha

This doesn’t essentially imply that WEC Power Group is a foul funding, nonetheless. The corporate does boast lots of the traits that we normally respect within the utility sector, in addition to the potential for a strong whole return going ahead. As some readers might recall, I’ve mentioned this firm earlier than. However that was a couple of months in the past, so allow us to replace our thesis.

About WEC Power Group

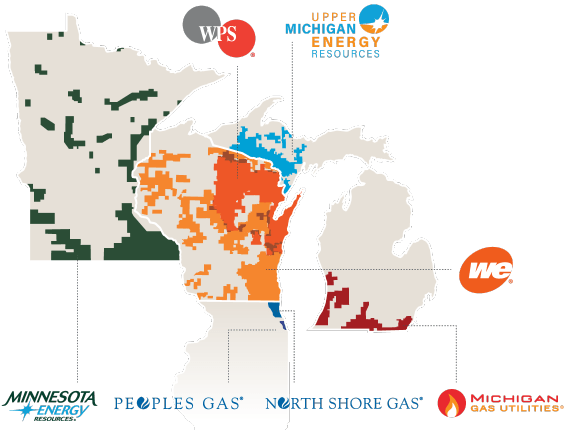

As acknowledged within the introduction, WEC Power Group is a regulated electrical and pure gasoline utility that operates in Wisconsin, Minnesota, and components of each Michigan and Illinois:

WEC Power Group

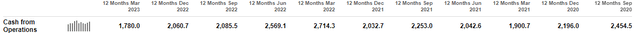

This isn’t typically thought-about to be one of the crucial extremely populated areas of america, though WEC Power Group does present pure gasoline service to the town of Chicago, Illinois, and the encircling suburbs. That alone represents a considerable variety of folks as Chicago is the third-most populous metropolis in america with a inhabitants of two.7 million. For its half, WEC Power Group has 4.6 million retail prospects in its service territory, which really makes it one of many largest utilities within the nation. The dimensions of a utility is mostly irrelevant to its traits, nonetheless, as most utilities have a really comparable enterprise mannequin. A very powerful of those traits is that WEC Power Group has very steady money flows over time and thru any financial situations. We will see this fairly clearly by trying on the firm’s working money circulation. Listed below are WEC Power Group’s working money flows for every of the previous eleven twelve-month durations:

Searching for Alpha

As we will see, the corporate’s working money flows have been typically very steady. We did see a little bit of a decline in the latest interval although, which was attributable to a hotter winter than regular. The corporate’s Government Chairman, Gale Klappa, defined within the first quarter 2023 earnings press launch:

We skilled one of many mildest winters in historical past. For instance, this was the second-warmest winter in Milwaukee since 1891. We proceed to give attention to the basics of our enterprise — monetary self-discipline, working effectivity, and buyer satisfaction. And we’re assured that we will ship one other 12 months of sturdy outcomes, according to our authentic steering for 2023.

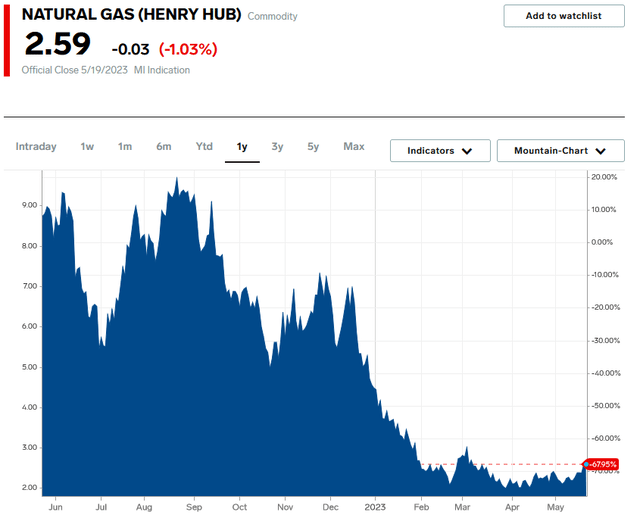

The truth that this was such a heat winter meant that the corporate’s prospects didn’t must eat as a lot pure gasoline as normal to warmth their properties and companies. That is the most important purpose why pure gasoline costs have declined as severely as they’ve over the previous few months:

Enterprise Insider

I mentioned this to a higher diploma in a current weblog put up. The truth that the corporate’s prospects used much less pure gasoline than regular over the course of the winter diminished the corporate’s gross sales of pure gasoline, and naturally, the income and money circulation that the corporate would obtain from these gross sales. This doesn’t alter our thesis, nonetheless, as such a heat winter is more likely to be a one-off occasion and we’ll most likely see pure gasoline consumption return to a traditional stage subsequent 12 months. We will nonetheless see that this didn’t have an outsized impression on the corporate’s trailing twelve-month working money flows although because the decline between the twelve-month durations ending on March 31, 2023 and December 31, 2022 was $280.7 million or 13.62%. That also exhibits far more stability than firms in lots of different sectors expertise from quarter to quarter.

The explanation for this stability is that WEC Power Group’s product is the supply of electrical and pure gasoline providers to properties and companies. Most individuals contemplate that to be a necessity for contemporary life, so they may normally prioritize paying their utility payments forward of constructing extra discretionary bills. That’s one thing that is essential immediately as we’re seeing a rising variety of indicators that the American economic system might enter a recession within the close to future. One of many defining traits of a recession is that many individuals see their monetary conditions worsen and discretionary earnings decline. The extremely excessive inflation that we’ve got skilled in america over the previous eighteen months has had the identical impact. Thus, an organization like WEC Power Group that won’t be significantly impacted by an financial downturn will probably show to be a greater near-term performer than one thing that’s extremely depending on shopper spending or enterprise growth.

WEC Development Prospects

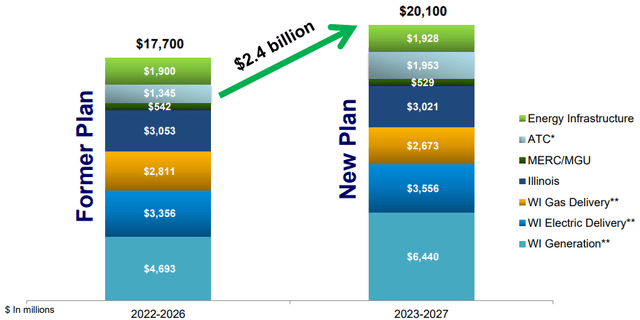

Naturally, as traders, we aren’t more likely to be happy by mere stability. We prefer to see an organization by which we’re invested develop and prosper over time. Luckily, WEC Power Group is well-positioned to perform this. The first approach by way of which the corporate will do that is by rising its price base. A utility’s price base is the worth of its property upon which regulators enable it to earn a specified price of return. As this price of return is a proportion, any improve to the speed base permits the corporate to positively regulate the costs that it expenses its prospects as a way to earn that allowed price of return. The same old approach by which a utility grows its price base is by investing cash into upgrading, modernizing, and probably even increasing its utility-grade infrastructure. WEC Power Group is planning on doing precisely this as the corporate lately unveiled an up to date five-year plan. Underneath this plan, WEC Power Group will spend $20.100 billion on infrastructure upgrades over the 2023 to 2027 interval:

WEC Power Group

This represents a $2.4 billion improve over the corporate’s earlier five-year plan. Sadly, it is not going to develop the corporate’s price base by $20.1 billion over the interval. Relatively, that is anticipated to take the corporate’s price base from $26.5 billion immediately to $38.4 billion on the finish of 2027. There are two the explanation why this plan is not going to develop the corporate’s asset base by as a lot as it’s spending. One purpose for that is depreciation, which is consistently lowering the worth of its property in service. Thus, one thing that’s put into service this 12 months might be price much less in 2027, which creates a drag on the corporate’s price base and forces it to spend sufficient cash to beat this impact and nonetheless develop the speed base. The second purpose why the projected price base development is lower than the cash that’s being spent is that the corporate might be retiring a few of its property over the interval. For instance, the corporate retired the Weston 2 energy plant again in February and is planning to retire 126 megawatts of outdated pure gasoline energy crops between now and the top of 2024. As soon as these energy crops are faraway from service, they won’t contribute their values to the corporate’s price base in any respect. It ought to be pretty simple to see how this can offset a number of the firm’s deliberate development spending.

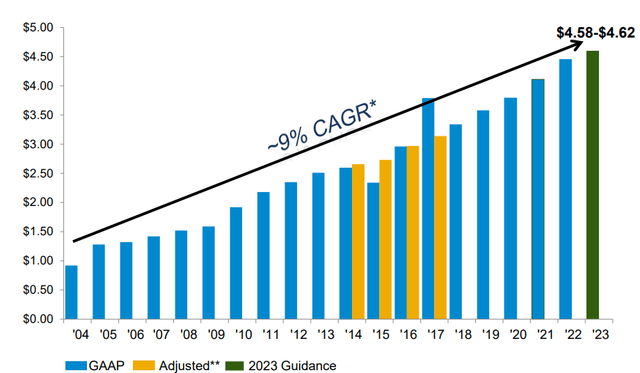

Even though not all the firm’s spending might be immediately accretive to the corporate’s price base development, its capital funding program ought to nonetheless lead to price base and earnings development. In actual fact, the plan as introduced ought to enable the corporate to develop its earnings per share at a 6.5% to 7% annual price over the 2023 to 2027 interval. This represents a continuation of the corporate’s historic earnings per share development. Over the previous twenty years, WEC Power Group has managed to develop its earnings per share at an approximate 9% compound annual development price:

WEC Power Group

Once we mix the corporate’s projected five-year development price and its present 3.47% yield, traders ought to have the ability to anticipate a ten% to 11% whole common annual return by way of 2027. That could be a very affordable return for a conservative utility inventory!

Monetary Issues

It’s at all times necessary to research the way in which that an organization funds its operations earlier than investing in it. It is because debt is a riskier option to finance an organization than fairness as a result of debt have to be repaid at maturity. That’s usually completed by issuing new debt and utilizing the proceeds to repay the prevailing debt, which might trigger an organization’s curiosity bills to extend following the rollover in sure market situations. As of immediately, rates of interest are on the highest stage that we’ve got seen since 2007 so that may be a very actual concern immediately. Along with interest-rate threat, an organization should make common funds on its debt whether it is to stay solvent. Thus, an occasion that causes an organization’s money flows to say no might push it into monetary misery if it has an excessive amount of debt. Though utilities like WEC Power Group are likely to have remarkably steady money flows, that is nonetheless a threat that we must always not ignore.

One metric that we will use to measure the monetary construction of an organization is the web debt-to-equity ratio. This ratio tells us the diploma to which an organization is financing its operations with debt versus wholly-owned funds. This ratio additionally tells us how effectively the corporate’s fairness will cowl its debt obligations within the occasion of chapter or liquidation, which is arguably extra necessary.

As of March 31, 2023, WEC Power Group has a web debt of $17.861 billion in comparison with $11.9877 billion in shareholders’ fairness. This provides the corporate a web debt-to-equity ratio of 1.49 immediately. Right here is how that compares to a number of the firm’s friends:

Firm Web Debt-to-Fairness Ratio WEC Power Group 1.49 CMS Power (CMS) 1.82 DTE Power (DTE) 1.83 Eversource Power (ES) 1.50 Exelon Company (EXC) 1.65 Click on to enlarge

As we will clearly see right here, WEC Power Group typically compares very effectively with its peer group by way of leverage. It is a clear signal that the corporate will not be relying too closely on debt to finance its operations, so traders shouldn’t have to fret in regards to the firm’s leverage.

Dividend Evaluation

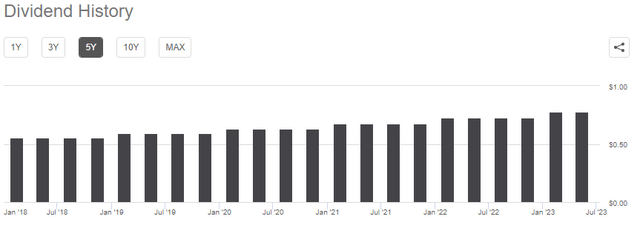

One of many main the explanation why traders buy inventory in utility firms is due to the very excessive yields that these firms usually possess. WEC Power is actually no exception to this as the corporate’s present 3.47% dividend yield is considerably larger than the 1.54% yield of the S&P 500 Index. Additionally it is larger than the two.55% yield of the U.S. Utilities Index. Thus, the inventory may very well be interesting to an income-seeking investor, though its present yield continues to be effectively beneath the present U.S. inflation price. Luckily, WEC Power Group has an extended historical past of elevating its dividend on an annual foundation. We will see this right here:

Searching for Alpha

That is very good to see in immediately’s inflationary atmosphere. It is because inflation is consistently lowering the variety of items and providers that we will buy with the dividends that the corporate pays out. The truth that it pays us extra money with every passing 12 months helps to offset this impact and makes it extra probably that the dividend can preserve its buying energy over time.

Naturally, although, it’s important that we be certain that the corporate can really afford the dividend that it pays out. In any case, we don’t wish to be the victims of a dividend reduce since that would scale back our incomes and virtually actually trigger the inventory value to break down.

The same old approach that we decide an organization’s potential to pay its dividend is by trying on the free money circulation. The free money circulation is the amount of cash that was generated by an organization’s extraordinary operations and is left over after it pays all its payments and makes all needed capital expenditures. That is due to this fact the cash that can be utilized for issues reminiscent of lowering debt, shopping for again inventory, or paying a dividend. Within the twelve-month interval that ended on March 31, 2023, WEC Power Group had a adverse levered free money circulation of $627.7 million. That’s clearly not sufficient to pay any dividends, but the corporate nonetheless paid out $934.4 million in dividends over the interval. That is more likely to be regarding at first look as the corporate’s free money circulation is clearly inadequate to cowl the payout.

Nevertheless, it’s common for a utility to finance its capital expenditures by way of the issuance of frequent inventory and debt. It’ll then pay for its dividends utilizing working money circulation. That is accomplished as a result of it’s extremely costly to construct and preserve utility-grade infrastructure over a large geographic space and consequently, a utility will virtually at all times have a adverse free money circulation that will in any other case preclude the issuance of dividends. In the course of the trailing twelve-month interval that ended on March 31, 2023, WEC Power Group had an working money circulation of $1.780 billion. That was adequate to cowl the $934.4 million in dividends that have been paid out over the interval with a considerable amount of cash left over. As already mentioned, the primary quarter of this 12 months was weaker than regular for the corporate and it nonetheless had no actual hassle protecting the dividend. Thus, traders shouldn’t have to fret about any potential dividend reduce right here.

Valuation

It’s at all times important that we don’t overpay for any asset in our portfolios. It is because overpaying for any asset is a surefire option to earn a suboptimal return on that asset. Within the case of a utility like WEC Power Group, we will worth it by utilizing the price-to-earnings development ratio. This ratio is a modified model of the acquainted price-to-earnings ratio that takes an organization’s ahead earnings per share development under consideration. A price-to-earnings development ratio of lower than 1.0 is an indication that the inventory could also be undervalued relative to its ahead earnings per share development and vice versa. Nevertheless, there are only a few firms which might be undervalued in immediately’s costly market. That is very true within the low-growth utility sector. As such, one of the simplest ways to make use of this ratio immediately is by evaluating WEC Power Group to its friends as a way to see which inventory affords probably the most engaging relative valuation.

In response to Zacks Funding Analysis, WEC Power Group will develop its earnings per share at a 5.76% price over the following three to 5 years. That’s lower than the earnings per share that we calculated primarily based on the corporate’s price base development, however it’s nonetheless adequate to supply an appropriate whole return when mixed with the corporate’s dividend. Assuming that the Zacks estimate is appropriate, WEC Power Group has a price-to-earnings development ratio of three.40 on the present value. Right here is how that compares to the corporate’s peer group:

Firm PEG Ratio WEC Power Group 3.40 CMS Power 2.52 DTE Power 2.93 Eversource Power 2.65 Exelon Company 2.54 Click on to enlarge

WEC Power Group seems to be very costly in comparison with its friends when utilizing this ratio. Nevertheless, this determine is utilizing the 5.76% earnings per share development assumption from Zacks. If we use the 7% determine that we calculated earlier primarily based on the corporate’s projected five-year price base development, WEC Power Group has a price-to-earnings development ratio of two.79 on the present value. That’s nonetheless a bit costly in comparison with its friends, however it’s not utterly out of line. The takeaway right here is that it might be finest to attend for WEC Power Group to drop a bit additional earlier than shopping for in, though it doesn’t look like horribly priced immediately.

Conclusion

In conclusion, our thesis for WEC Power Group nonetheless seems to be intact. The hotter-than-normal winter did have an hostile impression on the corporate, nevertheless it nonetheless continues to get pleasure from moderately steady money flows and strong ahead development prospects. The corporate’s steadiness sheet is kind of affordable, and the dividend is engaging. The one actual downside right here is that the inventory seems to be a bit costly immediately, however that would appropriate itself sooner or later. Particularly, a U.S. debt ceiling deal might push down inventory costs because of the fast decline of liquidity and provides a greater entry level for traders.

[ad_2]

Source link