[ad_1]

Wachiwit

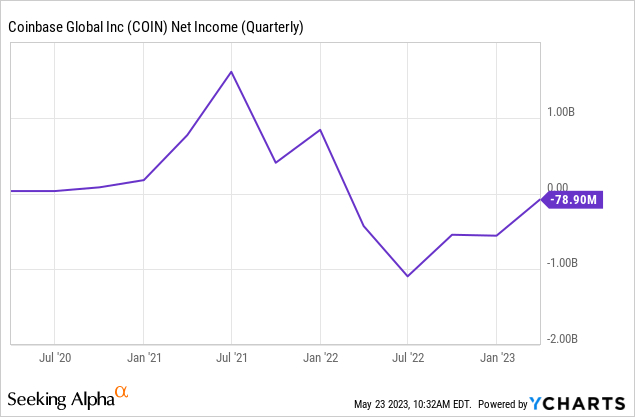

On Could 4th, Coinbase (NASDAQ:COIN) reported a surprisingly respectable earnings replace highlighting efficiency within the first quarter of 2023. Coinbase’s web income elevated 22% sequentially to $736 million and the corporate concurrently decreased recurring opex by 37%. Regardless of these efforts, Coinbase nonetheless generated a web lack of $79 million within the interval:

Internet loss apart, Coinbase simply had its greatest quarter because the crypto market prime again in This autumn 2021 and I believe it is price inspecting how the corporate’s income era story has tailored over the past 18 months.

Income Breakout

Income (Tens of millions USD) Q1-22 Q2-22 Q3-22 This autumn-22 Q1-23 Whole Transaction Income 1,013.0 655.2 365.9 322.1 374.7 Whole Subscription & Service Income 151.9 147.4 210.5 282.8 361.7 Internet Income 1,164.9 802.6 576.4 604.9 736.4 Click on to enlarge

Supply: Coinbase

Coinbase breaks income out into two fundamental classes consisting of transaction income and income from subscriptions and providers. Transaction income is damaged out into institutional and retail buyer buckets. Subscription and repair income is damaged out a bit additional:

Blockchain rewards Custodial price income Curiosity revenue Different

The mixed income progress from these 4 segments has rapidly pushed the subscription and providers class from simply 13% of whole income in Q1 2023 to over 49% as of the final quarter. This has been pushed primarily by curiosity revenue earned from a USD Coin (USDC-USD) income sharing settlement with token issuer Circle.

Subs & Service Income (tens of millions) Q1-22 Q2-22 Q3-22 This autumn-22 Q1-23 Blockchain rewards 81.9 68.4 62.8 62.4 73.7 Custodial Charge Rev 31.7 22.2 14.5 11.4 17.0 Curiosity revenue 10.5 32.5 101.8 182.2 240.8 Different Sub & Service Rev 27.8 24.3 31.4 26.7 30.1 Whole Subscription & Service Income 151.9 147.4 210.5 282.8 361.7 Click on to enlarge

Supply: Coinbase

At just below $241 million in quarterly income, a 3rd of the Coinbase’s whole Q1 income got here from curiosity revenue. At $74 million, blockchain rewards have additionally been a major sequential income progress driver quarter over quarter.

Projecting Q2 Income

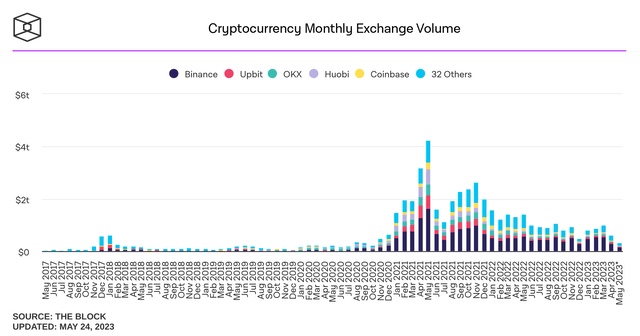

On the final name, CFO Alesia Haas talked about simply $110 million in April transaction income and cautioned utilizing that as a baseline for projecting class income for the rest of the quarter. Nonetheless, the month so far indications from Could transaction quantity do not look constructive. In keeping with information from The Block, Could is on tempo to be the trade’s lowest transaction quantity month since October 2020:

Month-to-month Trade Quantity (The Block)

Utilizing margin estimates from April’s $34.8 billion in transaction quantity, Coinbase at the moment has roughly $65 million in Could transaction income heading into a vacation weekend on the finish of the month:

Tens of millions Quantity Income April $34,800 $110 Could* $20,300 $65 June** $27,550 $88 Click on to enlarge

Sources: Coinbase, The Block, *Via Could twenty fourth, **Writer’s estimates

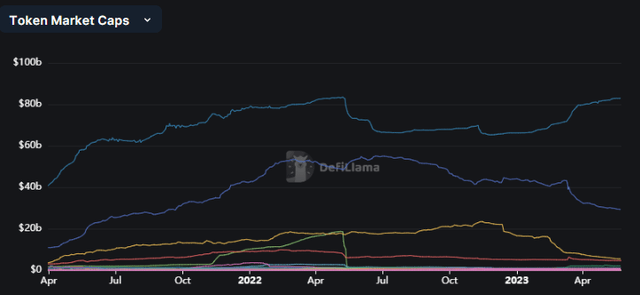

If we common April and Could to undertaking June figures, Coinbase’s transaction income for the second quarter is pacing simply over $263 million. On the decision, Haas was keen to provide extra concrete steering on the subscriptions and providers income class. There the corporate is guiding for $300 million this quarter and attributes the sequential decline from $361.2 million to exercise within the stablecoin market:

This decline is essentially pushed by USDC market cap which fell 23% in April from the Q1 common ranges immediately correlated with the banking disaster.

That decline has since continued 4% decrease from the $30.4 billion finish of April market cap to $29.2 billion as of article submission (blue line under is USDC):

Stablecoin market caps (Defi Llama)

Moreover, blockchain rewards may probably be a smaller driver of income going ahead as nicely. Regardless of the approximate 2 million ETH influx following Ethereum’s (ETH-USD) Shanghai improve, Coinbase is struggling the second largest web outflow from ETH staking behind solely Kraken:

Entity (ETH) Influx Principal Outflow Rewards Outflow Internet Circulate Kraken 106,560 -562,783 -115,127 -571,350 Coinbase 257,824 -316,064 -164,255 -222,494 Huobi 32,448 -59,616 -11,417 -38,585 stakefish 32,416 -25,248 -24,515 -17,347 Stkr (Ankr) 32 -10,522 -5,865 -16,355 Click on to enlarge

Supply: Dune Analytics/Hildobby, as of 5/23/23

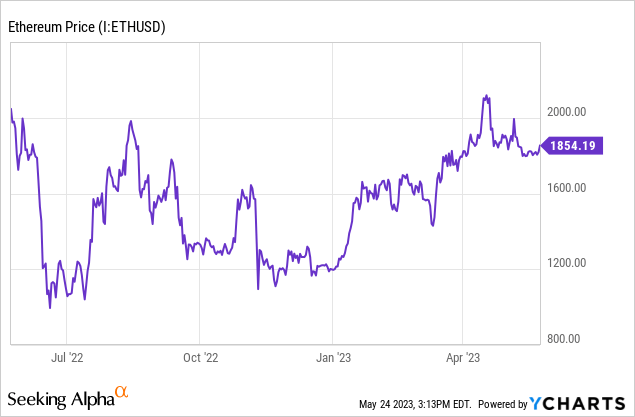

This discount in combination ETH staking could also be partially offset by the US greenback denominated improve within the worth of ETH over the past a number of weeks:

Nonetheless, even we undertaking a flat quarter in rewards income and take the $300 million from the corporate’s subscription & service income steering as the proper estimate, we nonetheless get to simply $563 million in Q2 income given the anticipated decline in income from transaction volumes. However I’ve to warning that estimate is assuming June quantity is bigger than Could and that could be overly optimistic given the macro atmosphere. Frankly, even Coinbase’s $300 million subscription and repair income steering could be optimistic. Circle’s treasury holdings mature on the finish of Could. To what diploma USDC is monetized going ahead is not precisely clear because the US debt ceiling showdown continues.

Dangers

I detailed a few of the regulatory implications from the Wells Discover Coinbase obtained in a earlier article for Searching for Alpha. I will not make those self same arguments right here past merely acknowledging the crypto market typically is experiencing outflow. The regulatory local weather domestically continues to be a significant headwind for US-based companies throughout the trade. Regardless of placing up a combat within the courts, Coinbase will not be immune from that.

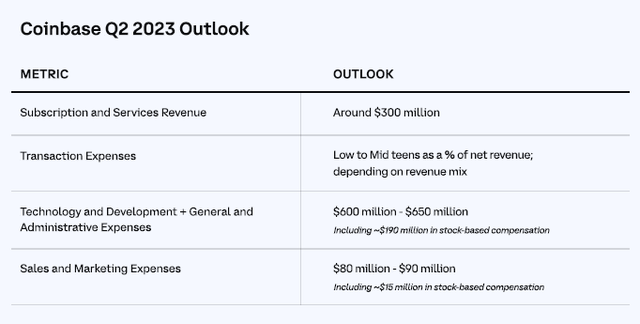

The corporate is projecting expertise and improvement and common and administrative bills will likely be between $600 million and $650 million within the second quarter.

Q2 Steering (Coinbase)

A big portion of that expense continues to be stock-based compensation and the corporate is not guiding for any additional head depend discount this quarter that would probably mitigate a few of that. Moreover, gross sales and advertising expense will improve sequentially. That is coupled with what is sort of definitely going to be a dramatic discount in income from Q1 to Q2.

Abstract

Q1 was a stable quarter for Coinbase. The corporate nonetheless misplaced some huge cash however it was a lot lower than throughout the earlier 4 quarters. The corporate grew money and investments over This autumn however it’s troublesome for me to see that proceed given what I consider will likely be one other 9-figure loss in Q2. Coinbase is a crucial enterprise within the crypto trade however it’s a fish swimming upstream in the mean time. I anticipate Q2 income to say no between 20-25% sequentially. In my opinion, it is troublesome to justify going lengthy on this atmosphere.

[ad_2]

Source link