[ad_1]

StockByM

The WisdomTree Japan Hedged Fairness Fund ETF (NYSEARCA:DXJ) is a technique to get Japan publicity whereas avoiding Yen publicity. We are literally bullish on the Yen, however we acknowledge that the market may very well favour the USD within the close to and medium time period. Whereas DXJ will probably be unaffected on a direct foundation by the Yen decline relative to the greenback, they are going to profit on a enterprise foundation, as a result of holdings do higher when the Yen is cheaper. There are nonetheless dangers for its holdings because it pertains to the credit score atmosphere, however the USD power is a plus. We in all probability would not really go lengthy DXJ, additionally as a result of we consider the speed regimes should not everlasting, however ETF traders ought to take into consideration the places and takes across the Yen decline for DXJ.

Fast DXJ Breakdown

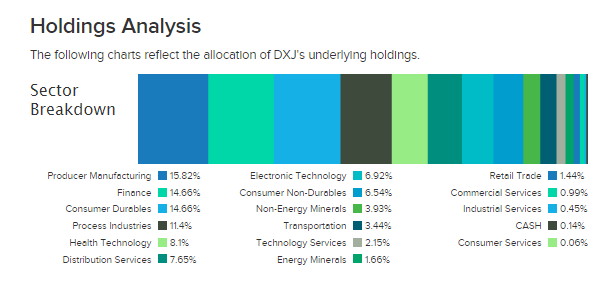

DXJ is a value-weighted publicity to the Japanese markets, so plenty of financials, plenty of shopper discretionary primarily being pushed by automotive, and plenty of industrial exposures.

Sectors (ETFDB.com)

Whereas having these exposures, the ETF is hedged in order that declines within the Yen don’t have an effect on the inventory value worth of the inventory holdings in USD phrases, impartial of the consequences of Yen declines on the basic outlook of the holdings.

For this reason the expense ratio is a little bit excessive at 0.48%, despite the fact that Japan is a liquid market and the DXJ theme is broad.

Yen Declines

The Yen declines are being pushed by a few components as of now, and weak spot could persist into the medium time period for a few causes.

As of now, the Fed is showing to be sustaining some hawkishness regardless of easing inflation, particularly wholesale inflation which signifies much less scary pricing spiral dynamics, that will lend power to the USD. Greater charges plus respectable inflation situations might result in USD power, because it has from hypothesis to this point.

We predict these good points might proceed because the debt ceiling problem develops. The USA’s hegemony relies upon in all probability in biggest half on the reserve forex standing of the USD. A default would absolutely jeopardise that, and would with out hyperbole be the top of the present world order. There may be little or no probability that these governing the US would enable that to occur. Some decision will probably be discovered, and Biden cancelled his Asia journey to return house and check out make it possible for occurs ASAP, since there is not a lot time left in any respect earlier than the federal government wants to begin chopping programmes to maintain paying out lenders. An eventual decision of the debt ceiling problem will restore among the misplaced confidence within the USD.

Backside Line

Because the USD good points, Yen-denominated shares would decline in USD worth, nevertheless DXJ hedges this. In the meantime, Yen declines really imply extra Yen earnings for the holding firms, that are centered on shopper discretionary and industrial, with these markets being considerably export oriented for Japan. A weaker Yen means higher aggressive standing on worldwide export markets – these merchandise are cheaper for purchasers to import. The online impact so far as the Yen declines go will probably be optimistic for DXJ.

Nonetheless, moreover the truth that as soon as inflation cools divergence between financial insurance policies ought to revert, DXJ does have a difficulty insofar the sources of demand for USD. Greater charges within the US can even imply weaker demand for credit-financed spending, together with automotive and industrial. In Germany, we’re already seeing recession as a result of falling industrial demand and manufacturing. The spending cycles by corporates are positively coming down on the commercial facet, which is able to stress these export markets for Japan. However, China is at the least recovering, so there may be ambiguity right here. Nonetheless, automotive continues to be skating on the pent-up demand from the pandemic. Weaker credit score situations might imply this demand goes off a small cliff instantly as soon as pent-up demand is exhausted. Automotive nonetheless must take a success and DXJ wouldn’t profit from that.

Total, DXJ is not at all a transparent purchase, though they’ve some favour in being positioned in opposition to what ought to be a robust USD over the following 6 months.

[ad_2]

Source link