[ad_1]

Galeanu Mihai

A few of chances are you’ll be sufficiently old to recollect the seminal enterprise fable that was revealed in 1998 by Spencer Johnson referred to as “Who Moved My Cheese? An Superb Method to Take care of Change in Your Work and in Your Life” that made the New York Instances bestseller checklist. The essence of the guide is {that a}) Change Occurs, b) you must anticipate change, c) you must monitor the change, d) it’s best to adapt to vary rapidly, e) make the change after which get pleasure from it, and f) be prepared to vary rapidly and luxuriate in it once more.

Once I first began my private, self-directed IRA to construct further long-term funding revenue for my pending retirement, I opened an account with a small on-line brokerage that was referred to as Scottrade. After some time, lots of the on-line brokers together with Scottrade started to cost $0 commissions on trades the place beforehand it might value round $7 per transaction to purchase or promote shares, whatever the inventory value. Then in 2017, TD Ameritrade introduced that they had been shopping for Scottrade. My cheese obtained moved!

I used to be anxious that I’ll lose my zero fee trades however that didn’t occur, and actually, TD Ameritrade launched some further services and products that had been even higher than what Scottrade provided on the time, together with the Thinkorswim digital buying and selling platform. Simply as I used to be beginning to modify to, and luxuriate in TDA, Charles Schwab Company (SCHW) introduced that they had been shopping for TDA! My cheese obtained moved once more.

Then I used to be involved that Schwab wouldn’t honor the DRIP insurance policies that sure CEFs permit for reinvesting shares at NAV and that commerce at a premium. For instance, I personal somewhat massive positions within the Cornerstone funds – Cornerstone Strategic Worth Fund (CLM) and Cornerstone Whole Return Fund (CRF). Each funds provide a excessive yield at the moment exceeding 18% and maintain prime quality equities of their portfolios which might be staples available in the market like Apple, Microsoft, Alphabet, Amazon, United Well being, and Berkshire Hathaway. Each funds have traded at very excessive premiums for the final a number of years and subsequently reinvesting at NAV presents a further low cost of 15-18% (primarily based on the present premiums) to the market value.

The transfer to Schwab was simply accomplished this week and on Might 30 after the Memorial Day weekend my TDA holdings grew to become Schwab holdings, and all of my data was seamlessly transferred. Contemplating that right this moment is simply June 3, 2023, it’s too quickly to say for positive whether or not the DRIP coverage might be honored however I’m being advised that it will likely be. That is excellent information, particularly in comparison with these traders who use brokers that don’t permit or make it troublesome to benefit from the DRIP at NAV coverage. There are a number of different funds that I maintain, and which additionally commerce at a considerable premium that permit the DRIP at NAV together with Guggenheim Strategic Alternatives Fund (GOF), which at the moment yields practically 14%, trades at a 28% premium and has by no means minimize the distribution since its inception in 2007.

Up to now, I’m having fun with the change to Schwab and right this moment I found one thing new that obtained me much more excited concerning the change. However first, let me evaluate my investing model, targets, and methods that can assist you perceive why that is thrilling to me.

The Revenue Compounder Again Story

With apologies and a nod of appreciation to my fellow SA analyst/writer Steven Bavaria, who first launched me to his idea of an Revenue Manufacturing facility (which he has trademarked, so I can’t use it), I’ve prior to now 12 months turn out to be an revenue investor with a purpose of producing a passive revenue stream for my retirement, which is now simply two months away. I name my strategy the Revenue Compounder portfolio as a result of like Steve’s manufacturing unit, my portfolio compounds the revenue earned by reinvesting and by shopping for extra shares at decrease costs to generate ever extra revenue rising my future river of money. At this stage of my life, I’m nonetheless constructing an revenue stream and never as involved with the overall worth of my portfolio, which signifies that I’m okay with unrealized losses on a lot of my holdings as a result of I’ve no intention of promoting these shares.

Previous to my Revenue Compounder technique, I used to be constructing my general portfolio worth and was extra fascinated by capital appreciation together with dividend revenue, which is extra of what I might name a complete return technique. Throughout that point, I used to be nonetheless a number of years away from retirement, and I used to be involved with unrealized losses and would commerce shares to seize income. Initially, I held a mixture of pure progress shares like Apple, AMD, and others that I might “swing commerce” to generate money which I might then use to purchase shares of excessive yield positions. This helped me to construct up my general portfolio worth however didn’t essentially generate long-term passive revenue.

Then in 2022, one other change occurred (cheese moved once more), and the multi-year low rate of interest bull market out of the blue ended with the Russian invasion of Ukraine adopted by skyrocketing inflation in a post-pandemic world. It was now not such a easy technique to seize income from swing buying and selling progress shares and I modified my funding strategy. I additionally started to comprehend after doing numerous analysis, that income-oriented funds equivalent to BDCs, MLPs, REITs, CEFs, and a few ETFs can generate a gentle and even rising stream of revenue even throughout rising inflation or a recession (in some instances).

In the meantime, I continued contributing to my employer retirement plans (401k and 457b) and am getting nearer to my official retirement date after I can gather a pension. In June of 2022 because the market was crashing and every thing from shares to bonds to gold and cryptocurrencies all declined in worth, I used to be getting involved about not having management over my comparatively few mutual fund choices in my employer retirement accounts. I discovered that I might do what’s known as an in-service rollover of my 401k, which means that I might rollover my 401k funds into my IRA although I’m nonetheless employed. This was an enormous reduction as I helplessly watched the general worth of my 401k drop in worth within the first half of 2022 and there was little or no that I might do about it. After the rollover, I now have full management of my investments and can buy all types of revenue producing funding merchandise versus a handful of mutual fund choices.

In order that leads me to the change that I found after the transfer to Schwab was accomplished. With the Schwab interface, I now can rapidly see in a bar chart what my precise and estimated revenue is for every month of the 12 months. Earlier than, with TDA I might have created a spreadsheet and made my very own bar chart from compiled knowledge taken off month-to-month statements, however that might have been time consuming and troublesome to simply replace as my particular person holdings change. It additionally helped me to comprehend the large change in my revenue stream that I’m now seeing in my No Guts No Glory Revenue Compounder portfolio, which I final wrote about right here.

I’m going to share some high-level data right here relating to the overall portfolio worth in my IRA, the estimated revenue, present yield on value (primarily based on statements from TDA), and present unrealized losses from January 2022 by means of the top of April 2023. Then I’ll present how that precise and estimated revenue is displayed utilizing the brand new Schwab platform. Be mindful as you take a look at these numbers that this is only one cog in my revenue retirement wheel. I’ve further revenue sources from my upcoming pension (each a lump sum and month-to-month annuity), Social Safety at any time when I determine to take it, and extra retirement financial savings in my employer plans that I’ve not but rolled over. Due to this fact, this portfolio represents about 25% of my complete web price at the moment (not together with different sources of revenue like actual property, Treasury bonds, and money). This additionally signifies that I’m keen to tackle extra threat on this portfolio than different, extra conservative traders could be keen to take.

I created a abstract of my portfolio stability and revenue primarily based on month-to-month statements, however I simply used quarterly numbers to maintain from getting too detailed. Listed below are the uncooked numbers in a desk.

Parameter 4/30/2022 7/31/2022 10/31/2022 1/31/2023 4/30/2023 Beginning Worth $ 76,000 $ 73,700 $ 168,000 $ 152,000 $ 209,637 Unrealized Loss $ $ (6,285) $ (4,875) $ (18,000) $ (6,955) $ (11,895) Unrealized Loss % -8.5% -2.9% -11.8% -3.3% -6.1% Yield 11.8% 11.1% 14.2% 10.6% 13.2% Est Annual Revenue $ 8,740 $ 18,705 $ 21,545 $ 22,312 $ 25,810 Contrib/Withdraw $ 2,000 $ 86,000 $ – $ 38,500 $ (2,000) Whole Portfolio Worth $ 73,700 $ 168,000 $ 152,000 $ 209,637 $ 196,173 Click on to enlarge

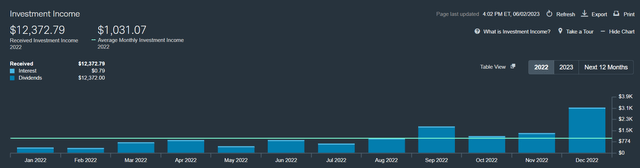

To place it in perspective, I’m together with a snapshot of the Funding Revenue chart from my Schwab account for 2022, which incorporates actuals. Observe the large leap in December when a number of of the shares and funds that I maintain paid particular or supplemental year-end dividends, regardless of the unrealized losses piling up. The yields additionally rose larger as costs of the underlying holdings fell, and in addition as a result of I shifted into larger yielding positions over time.

Schwab

I additionally obtained a bit bit fortunate with my timing as I used to be in a position to purchase a variety of positions in June at low costs, after which once more in October when the market bottomed. In March of this 12 months, there was additionally one other swoon that allowed me so as to add to current holdings or begin new positions at larger yields. I took benefit of the decrease costs in March so as to add to a number of BDC holdings together with ARCC, CSWC, FSK, CION, and TRIN.

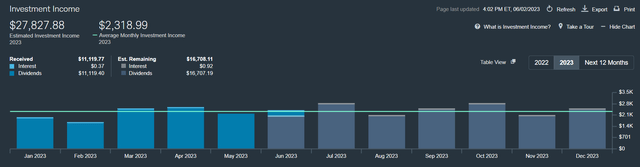

Though I don’t but have numbers for Might, the market continued to maneuver largely sideways through the month, but the dividend stream continued to extend as proven within the chart for 2023 with actuals by means of June 2 and estimated revenue for the rest of the 12 months. As you possibly can see, the estimated revenue now’s as much as practically $28,000 after being estimated at $25,800 on the finish of April.

Observe that December doesn’t look that a lot larger than different months as a result of there isn’t a strategy to estimate any particular or year-end supplemental distributions that will receives a commission out at 12 months finish. This chart is more likely to look even higher by this time subsequent 12 months as a number of of my holdings, together with OXLC and XFLT have just lately elevated the distribution.

Schwab

Moreover, I’ve been swapping out a few of my holdings this 12 months for even larger yielders as alternatives come up. For instance, I found a CEF that at the moment yields over 15% and invests within the midstream power sector. That fund, NXG Cushing Midstream Vitality fund (SRV), I wrote about right here and once more after I spoke with the fund supervisor which you’ll examine right here.

Earlier this 12 months I additionally added a place in Simplify Volatility Premium ETF (SVOL). That ETF generates revenue from shorting the VIX volatility index, which has been declining for a lot of the final 12 months. The present yield for SVOL is simply over 17% and it’s now certainly one of my largest holdings. It seems poised to proceed to carry out nicely as market volatility abates. You’ll be able to learn extra about my evaluation of SVOL right here.

One other current addition to my holdings this 12 months is the abrdn Revenue Credit score Methods Fund (ACP). The ACP fund accomplished a merger with one other CEF in March that had the ticker IVH, the Ivy Excessive Revenue Alternatives fund. After the merger, ACP started to commerce at a slight low cost after buying and selling at a premium for a lot of the previous 12 months. The present yield is almost 18% and the fund managers acknowledged on the Q123 earnings podcast that they haven’t any intention of slicing the $.10 month-to-month distribution, and actually the distribution protection is probably going to enhance due to the merger.

One remark that I usually learn when discussing these excessive yield investments is that they have to be very excessive threat. Whereas it may be true that an exceedingly excessive yield could point out a better diploma of threat, every investor must carry out their very own due diligence to find out if the potential reward is well worth the threat. A technique that I mitigate the chance to particular person holdings is to restrict publicity to not more than 2.5% of my complete portfolio worth, with some exceptions for people who I’ve a excessive conviction in such because the Cornerstone funds. For instance, CRF has now been in existence for 50 years and has paid out much more in distributions over that interval than it has misplaced in NAV. However these are usually not all “purchase and maintain” investments both. There may be some extent of market timing required to efficiently make investments with out dropping capital. The very best time to purchase is when concern is excessive, costs are low, and the perceived threat is far larger than the precise threat. Ay, there’s the rub.

Editor’s Observe: This text covers a number of microcap shares. Please pay attention to the dangers related to these shares.

[ad_2]

Source link