[ad_1]

Revealed on June 4th, 2023 by Samuel Smith

Mortgage Actual Property Funding Trusts (i.e., “REITs”) – also known as “mREITs” – can present a really enticing supply of earnings for traders. It’s because they spend money on mortgages which are sometimes backed by laborious property (industrial and/or residential actual property) with pretty conservative loan-to-value ratios. They finance these portfolios with a mix of fairness (that they increase by promoting shares to traders) and debt that they often increase at an curiosity value that’s meaningfully decrease than the rates of interest they will command on their actual property mortgage investments. The result’s vital and secure money stream for the mREIT.

Furthermore, as REITs they’re exempt from having to pay company taxes on their web curiosity earnings and are required to pay out not less than 90% of their taxable earnings to shareholders through dividends. This typically signifies that mREIT shareholders earn very excessive dividend yields, making mREIT shares an distinctive supply of passive earnings.

In fact, there isn’t a such factor as a free lunch, and mREITs – resulting from their vital quantity of leverage – do include dangers that sometimes result in dividend cuts. Consequently, traders must be prudent when deciding on which mREITs to spend money on. This text will have a look at 10 of essentially the most attractively priced mREITs within the market at the moment.

You may obtain your free 200+ REIT checklist (together with essential monetary metrics like dividend yields and payout ratios) by clicking on the hyperlink beneath:

Desk of Contents

You may immediately leap to any particular part of the article by utilizing the hyperlinks beneath:

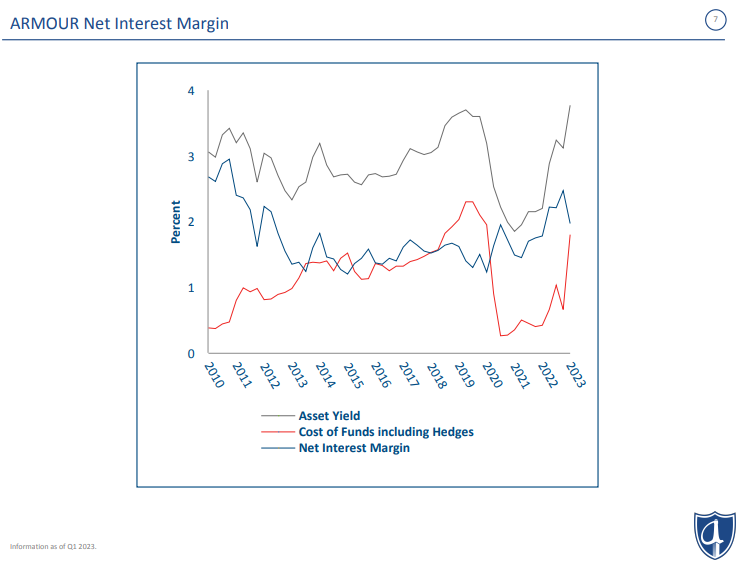

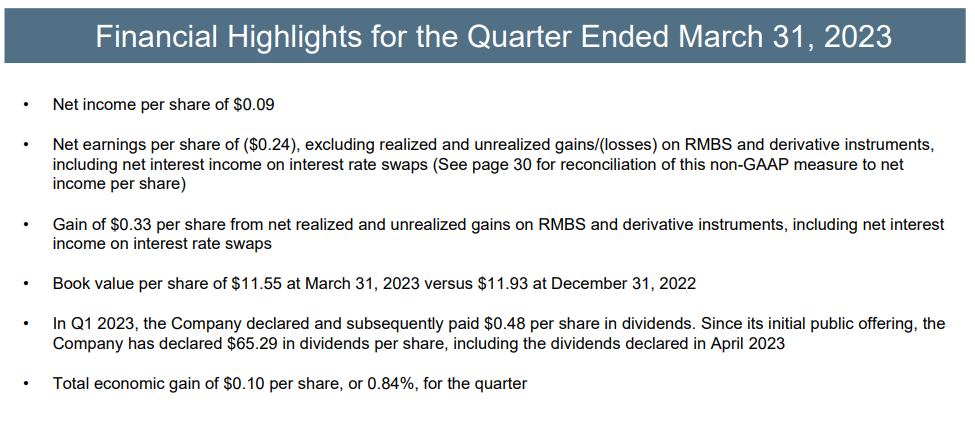

#1: ARMOUR Residential REIT (ARR)

ARMOUR Residential is an mREIT established in 2008. Its predominant focus is investing in residential mortgage-backed securities assured or issued by US authorities entities like Fannie Mae, Freddie Mac, and Ginnie Mae. ARMOUR has skilled volatility in its money stream since its inception, resulting in dividend cuts in some circumstances.

Supply: Investor Presentation

Luckily, ARMOUR is at present present process a restoration part, which is anticipated to proceed within the coming quarters and years. Nonetheless, the corporate’s progress is predicted to be comparatively flat, that means it can seemingly take a major period of time for ARMOUR to rebuild its earlier ranges of guide worth and earnings energy. Within the meantime, it presents traders a really enticing – although not fully reliable – 20.1% dividend yield and trades at a steep low cost to its guide worth.

Click on right here to obtain our most up-to-date Positive Evaluation report on ARMOUR Residential REIT (ARR) (preview of web page 1 of three proven beneath):

#2: Two Harbors Funding Corp. (TWO)

Two Harbors Funding Corp. is a residential mREIT that focuses on residential mortgage-backed securities (RMBS), residential mortgage loans, mortgage servicing rights, and industrial actual property. The belief generates the vast majority of its income by curiosity earned on available-for-sale securities. Regardless of a decline in guide worth per share through the years, Two Harbors has a observe report of delivering robust complete returns to traders because of its hefty dividend payouts.

Supply: Investor Presentation

To spice up its share value and entice extra funds, Two Harbors lately accomplished a 4-for-1 reverse inventory cut up. Since its institution in October 2009, the inventory has outperformed the overall return of the BBG REIT MTG index. This outperformance may be attributed to a number of components, together with pairing mortgage servicing rights (MSR) property with Company RMBS, using numerous devices to hedge in opposition to rate of interest publicity, and sustaining a novel portfolio of legacy non-Company securities.

Nonetheless, resulting from financial and trade challenges and a excessive payout ratio, it’s projected that the guide worth per share of Two Harbors will solely expertise a slight enhance over the subsequent 5 years. Regardless of this weak progress outlook, the 19.5% dividend yield and deep low cost to guide worth at current ought to reward shareholders handsomely assuming the dividend doesn’t get minimize and the guide worth per share doesn’t plunge resulting from financial turmoil.

Click on right here to obtain our most up-to-date Positive Evaluation report on Two Harbors Funding Corp. (TWO) (preview of web page 1 of three proven beneath):

#3: Orchid Island Capital, Inc. (ORC)

Orchid Island Capital, Inc. is an mREIT that’s externally managed by Bimini Advisors LLC and focuses on investing in residential mortgage-backed securities (RMBS), together with pass-through and structured company RMBSs. These monetary devices generate money stream primarily based on residential loans reminiscent of mortgages, subprime, and home-equity loans.

Supply: Investor Presentation

Orchid Island has skilled vital earnings volatility lately, with web losses in 2013 and 2018 and a number of other years the place income had been minimal. Trying forward, the guide worth per share of Orchid Island is anticipated to get well, though the excessive payout will seemingly weaken earnings per share and dividends per share. Nonetheless, the 19.1% dividend yield and enormous low cost to guide worth make it a gorgeous funding for traders with a comparatively high-risk tolerance.

Click on right here to obtain our most up-to-date Positive Evaluation report on Orchid Island Capital, Inc. (ORC) (preview of web page 1 of three proven beneath):

#4: AGNC Funding Company (AGNC)

American Capital Company Corp is an mREIT based in 2008. It primarily invests in company mortgage-backed securities (MBS). Its portfolio consists of residential mortgage pass-through securities, collateralized mortgage obligations (CMO), and non-agency MBS, many assured by government-sponsored enterprises. Most of American Capital’s investments are fixed-rate company MBS, specializing in 30-year maturities. The belief’s counterparties are primarily positioned in North America, with a major share of the portfolio represented by European counterparties. American Capital generates most of its income from curiosity earnings.

Supply: Investor Presentation

As a result of its extremely leveraged enterprise mannequin and sensitivity to rates of interest, American Capital’s monetary outcomes have been risky through the years. Nonetheless, the present decrease rate of interest atmosphere ensuing from weak world progress and the Federal Reserve’s accommodative stance through the COVID-19 pandemic is anticipated to assist the corporate navigate challenges by sustaining enticing spreads and stability within the mortgage market.

In the long run, the corporate’s substantial dividend payout and the inherent volatility of its enterprise mannequin are anticipated to hinder earnings per share progress. It’s also projected that dividend progress shall be minimal or non-existent within the foreseeable future. That mentioned, risk-tolerant traders may generate enticing risk-adjusted returns between its steep low cost to guide worth and its 15.8% dividend yield.

Click on right here to obtain our most up-to-date Positive Evaluation report on AGNC Funding Company (AGNC) (preview of web page 1 of three proven beneath):

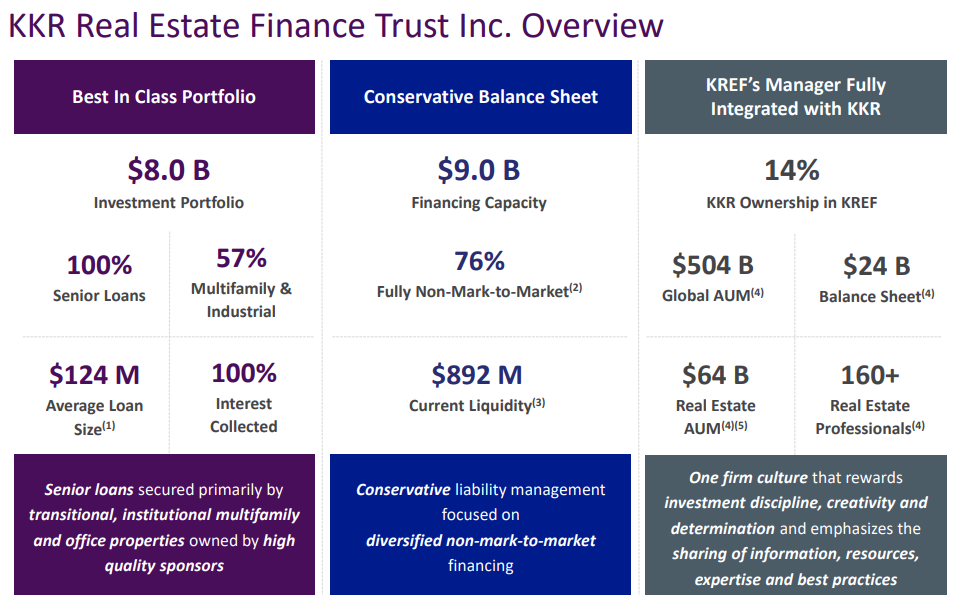

#5: KKR Actual Property Finance Belief Inc. (KREF)

KKR Actual Property Finance Belief (KREF) is an mREIT that makes a speciality of originating and buying senior loans to industrial actual property properties which are owned and operated by skilled sponsors in liquid markets with robust underlying fundamentals. KREF has constructed a multi-billion portfolio of senior loans primarily secured by multifamily and workplace properties owned by respected sponsors.

Supply: Investor Presentation

Since its preliminary public providing (IPO), KREF has skilled fast progress in its mortgage portfolio by borrowing at decrease charges and issuing shares with a decrease value of fairness in comparison with the spreads it earns as web curiosity earnings. The corporate has leveraged its supervisor’s (KRR) entry to low-cost financing in a positive low-rate atmosphere. KREF’s time period mortgage financing services present KRR with matched-term financing on a non-mark-to-market and non-recourse foundation, strengthening the corporate’s legal responsibility construction and enhancing its danger administration capabilities and liquidity place.

Whereas this technique has been profitable, KREF’s profitability sooner or later is delicate to adjustments in rates of interest as its complete portfolio is tied to floating charges. Due to this fact, KREF may benefit from the continued rising-rate atmosphere if its financing stays cost-effective.

Though KREF has elevated its dividend according to its rising earnings per share, the dangers related to mortgage REITs pose a possible compression of earnings, leaving restricted room for progress. Contemplating the unsure actual property market, no dividend progress is anticipated sooner or later. That mentioned, not a lot progress is required to generate passable complete returns on condition that the present yield is 15.5%.

Click on right here to obtain our most up-to-date Positive Evaluation report on KKR Actual Property Finance Belief Inc. (KREF) (preview of web page 1 of three proven beneath):

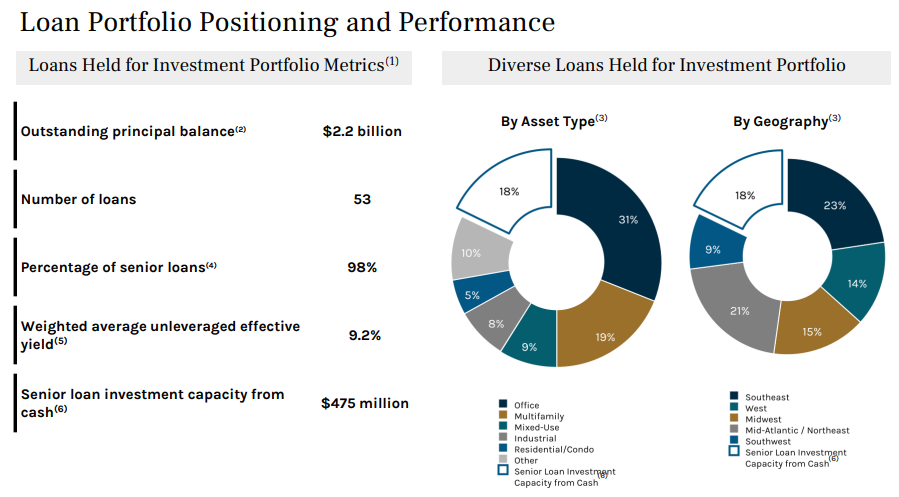

#6: Ares Industrial Actual Property Company (ACRE)

Ares Industrial Actual Property Company (ACRE) is an mREIT that’s externally managed by a subsidiary of Ares Administration Company, a globally acknowledged various asset supervisor.

Supply: Investor Presentation

ACRE has grown its asset base through the years right into a well-diversified mortgage portfolio at the moment. This strategy has contributed to comparatively robust earnings per share (EPS) efficiency over the previous decade. Fluctuations in EPS are influenced by components reminiscent of funding yields, rates of interest, the share of contractual funds acquired, and the weighted common remaining lifetime of the portfolio. Shifting ahead, the influence of rising charges could also be offset by increased borrowing prices, leading to no forecasted progress in EPS within the medium time period.

Whereas little to no dividend progress is anticipated sooner or later, the present yield of 14.4% signifies that shareholders needs to be richly rewarded so long as the corporate can maintain its present payout.

Click on right here to obtain our most up-to-date Positive Evaluation report on Ares Industrial Actual Property Company (ACRE) (preview of web page 1 of three proven beneath):

#7: Annaly Capital Administration (NLY)

Annaly Capital Administration, Inc. is an mREIT that invests in residential and industrial mortgages. The belief’s investments embrace company mortgage-backed securities, non-agency residential mortgage property, residential mortgage loans, industrial mortgage loans, securities, and different industrial actual property investments. Annaly operates as a broker-dealer, financing middle-market companies backed by non-public fairness.

Supply: Investor Presentation

Trying forward, additional will increase in rates of interest may result in diminished refinancing exercise. So long as the true property market stays secure, Annaly is anticipated to expertise gradual progress and keep its vital dividend. Nonetheless, any vital market downturn may severely influence the corporate, doubtlessly leading to a dividend minimize. The present yield of 14.1% compensates traders fairly properly for the elevated danger, particularly on condition that Annaly is taken into account one of many increased high quality publicly traded mREITs available in the market at the moment.

Click on right here to obtain our most up-to-date Positive Evaluation report on Annaly Capital Administration (NLY) (preview of web page 1 of three proven beneath):

#8: Apollo Industrial Actual Property Finance (ARI)

Apollo Industrial Actual Property Finance, Inc. is an mREIT specializing in investing in numerous debt securities, together with senior mortgages, mezzanine loans, and different industrial actual estate-related debt sorts. The underlying properties collateralize Apollo’s investments, that are made in america and Europe. The corporate is externally managed by ACREFI Administration, LLC, which is an oblique subsidiary of Apollo World Administration, LLC.

Supply: Investor Presentation

Apollo Industrial Actual Property Finance maintains a big industrial actual property portfolio valued at billions of {dollars}. Its portfolio composition consists of 26% in accommodations, 17% in workplace properties, 14% in city redevelopment, 12% in residential-for-sale stock, and 11% in residential-for-sale building. Geographically, roughly 34% of the portfolio relies in Manhattan, New York, 14% in the UK, 13% within the Midwest, 12% within the West, and 11% within the Southeast.

Apollo Industrial Actual Property Finance faces vital challenges to its progress prospects within the close to future. The corporate’s predominant progress drivers are its mortgage portfolio growth and better returns on its loans. Nonetheless, it’s anticipated to come across headwinds resulting from rising rates of interest and a decline in demand for brand spanking new mortgage loans. If the economic system enters a extreme recession, Apollo could expertise a better fee of mortgage defaults, additional decreasing its earnings.

Regardless of these headwinds, ARI is well-managed and presents traders a gorgeous present yield of 13.8%, so traders who belief administration to maintain the dividend within the face of macroeconomic headwinds ought to discover the inventory enticing.

Click on right here to obtain our most up-to-date Positive Evaluation report on Apollo Industrial Actual Property Finance (ARI) (preview of web page 1 of three proven beneath):

#9: Blackstone Mortgage Belief Inc. (BXMT)

Blackstone Mortgage Belief is an mREIT specializing in originating and buying senior loans secured by industrial properties in North America and Europe. Nearly all of its asset portfolio consists of floating-rate loans secured by first-priority mortgages, primarily in workplace, resort, and manufactured housing properties. Managed by a subsidiary of The Blackstone Group, the corporate advantages from its father or mother’s market knowledge and model benefit.

Supply: Investor Presentation

As the corporate’s mortgage portfolio is predominantly tied to floating rates of interest, Blackstone Mortgage Belief’s earnings progress is immediately influenced by adjustments in rates of interest. Its affiliation with a big father or mother firm grants entry to a variety of profitable offers, supporting gradual progress over time. The corporate has a observe report of issuing shares at a premium to guide worth, indicating its skill to entry inexpensive capital for earnings-per-share and guide value-per-share progress.

Nonetheless, Blackstone Mortgage Belief has confronted challenges in rising its dividend in recent times, and this pattern is anticipated to persist. Moreover, the present headwinds within the mortgage and actual property trade could lead to a slight decline in earnings per share and doubtlessly a dividend minimize sooner or later. That mentioned, given its robust observe report and high-quality exterior administration, the present 13.5% dividend yield appears to be like enticing.

Click on right here to obtain our most up-to-date Positive Evaluation report on Blackstone Mortgage Belief Inc. (BXMT) (preview of web page 1 of three proven beneath):

#10: Starwood Property Belief (STWD)

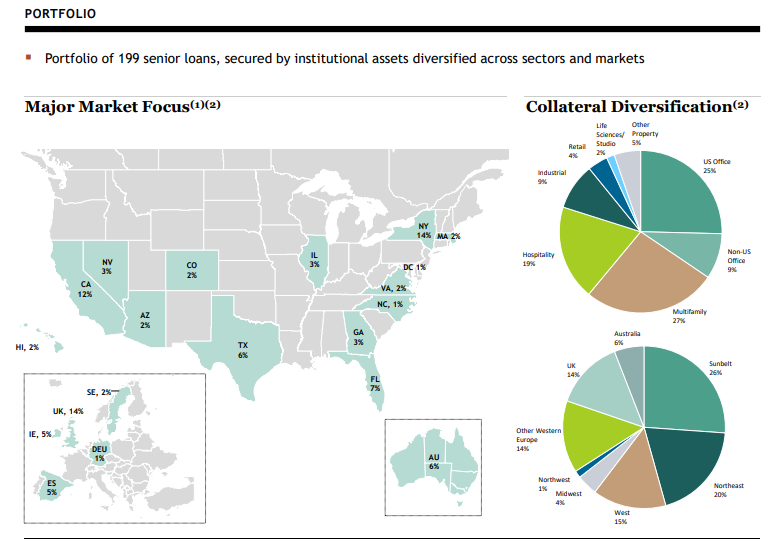

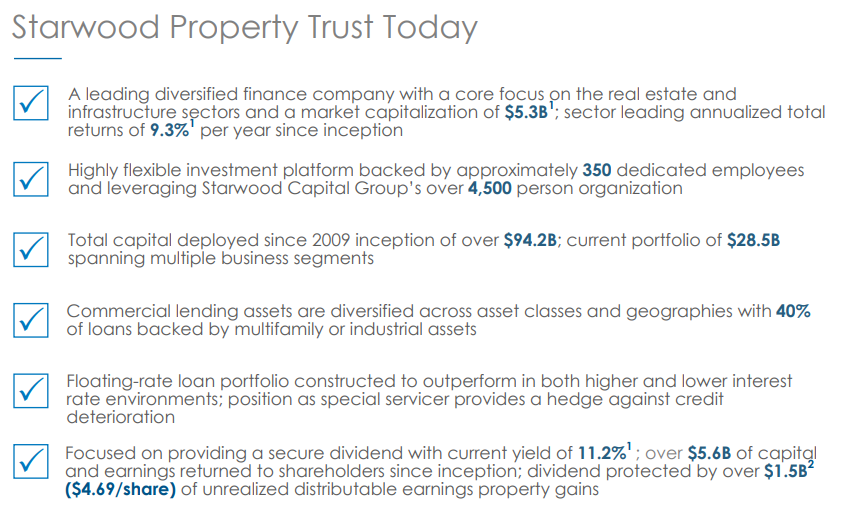

Starwood Property Belief, Inc. is an mREIT that originates, acquires, funds and manages industrial mortgage loans and different debt and fairness investments. It operates throughout a number of segments, together with Actual Property Lending, Actual Property Property, and Actual Property Investing and Servicing. The Actual Property Lending section focuses on numerous sorts of industrial and residential loans, whereas the Actual Property Property section includes buying fairness pursuits in industrial actual property properties. The Actual Property Investing and Servicing section primarily invests in industrial actual property property of various credit score scores.

Supply: Investor Presentation

Starwood demonstrated sturdy efficiency within the face of the COVID-19 lockdowns resulting from its portfolio of high-quality property, which allowed it to keep away from reducing its dividend at a time when practically all of its friends had been reducing theirs. With latest acquisitions at enticing costs, the corporate’s monetary efficiency is anticipated to stay strong within the medium time period. However, each the earnings per share (EPS) and dividends per share (DPS) are anticipated to remain stagnant going ahead, as any incremental income from capital deployment are sometimes offset by a rise within the firm’s share rely. The ten.9% dividend yield is enticing for a high-quality mREIT like Starwood.

Click on right here to obtain our most up-to-date Positive Evaluation report on Starwood Property Belief (STWD) (preview of web page 1 of three proven beneath):

Conclusion

As you’ll be able to see from the dividend yields provided by the ten shares mentioned on this article, mREITs may be highly effective passive earnings mills. Nonetheless, traders must be cautious earlier than investing on this sector, on condition that dividend cuts may be frequent during times of financial stress. Consequently, diversification and a give attention to high quality are important.

You may see extra high-quality dividend shares within the following Positive Dividend databases, every primarily based on lengthy streaks of steadily rising dividend funds:

Alternatively, one other excellent spot to search for high-quality enterprise is contained in the portfolios of extremely profitable traders. By analyzing the portfolios of legendary traders working multi-billion greenback funding portfolios, we’re capable of not directly profit from their million-dollar analysis budgets and private investing experience.

To that finish, Positive Dividend has created the next two articles:

You may additionally be seeking to create a extremely personalized dividend earnings stream to pay for all times’s bills.

The next lists present helpful info on excessive dividend shares and shares that pay month-to-month dividends:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].

[ad_2]

Source link