[ad_1]

kaedeezign

Bitcoin-related shares have been on a wild trip lately, and for good cause; the coin itself is on the verge of a serious technical breakdown, and the regulatory authorities within the US are on the prowl. Bitcoin has been weak since mid-April when it hit a relative excessive, however has drifted decrease ever since. That’s (rightfully) put stress on crypto-related shares, however this week’s information circulation has launched a extra pointed headwind for crypto corporations.

On the fifth, the SEC sued Binance for violating US securities rules, and on the sixth, Coinbase (NASDAQ:COIN) had an identical destiny befall it when the SEC sued it for working an unregistered securities dealer. To be clear, none of these items are bullish for crypto or crypto-related shares, which is a far cry from my final replace on Coinbase a couple of months in the past. At the moment, COIN was flying and had a pleasant uptrend in place; that’s all gone and we look like on the verge of a breakdown. On this article, we’ll discover why I’m downgrading Coinbase on this information.

Coinbase inventory – A tenuous maintain for the bulls

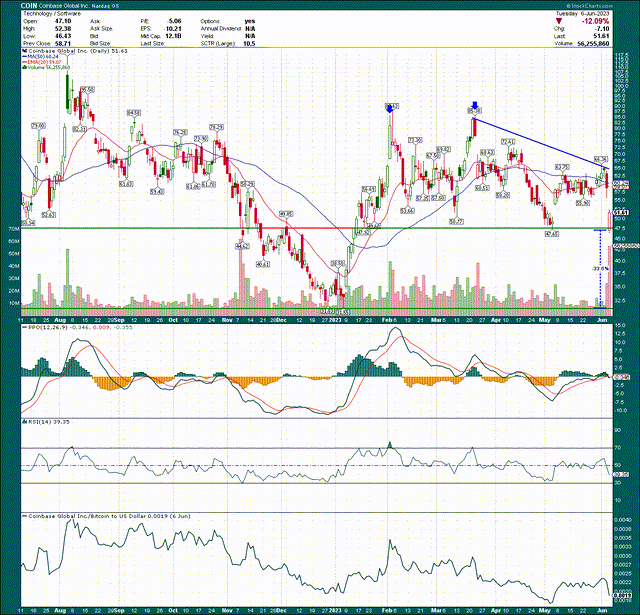

We’ll start with a each day chart, and as you possibly can see, the inventory has a precarious maintain on the prior relative low. Given the worth motion we’ve seen, I’m unsure that is going to carry.

StockCharts

We now have a decrease excessive put in at first of June, and yesterday, the inventory moved beneath the prior relative low at $47. It recovered to shut at $51, however this chart has a big quantity of harm on it. On the extra bullish facet, the PPO is buying and selling close to the centerline, and may the low from yesterday maintain, it might mark a constructive divergence. Nonetheless, given the high-volume promoting yesterday, it appears to me just like the bears are answerable for this one in the intervening time.

Ought to the low from yesterday break, I feel there’s draw back to the double backside the inventory put in at $31 a couple of month in the past; that’s 33% decrease from the low set yesterday if it had been to happen, so watching that degree is crucial. In the event you insist on proudly owning this inventory proper now, I might reduce losses and run if yesterday’s low is violated, as a result of it may get actually ugly after that.

The ultimate panel exhibits Coinbase’s efficiency relative to Bitcoin itself, and we will see this ratio has been in a gentle downtrend for the higher a part of the final 12 months. This argues that if you need crypto publicity, you’re a lot better off simply proudly owning Bitcoin than Coinbase. One thing to contemplate given the latest information circulation.

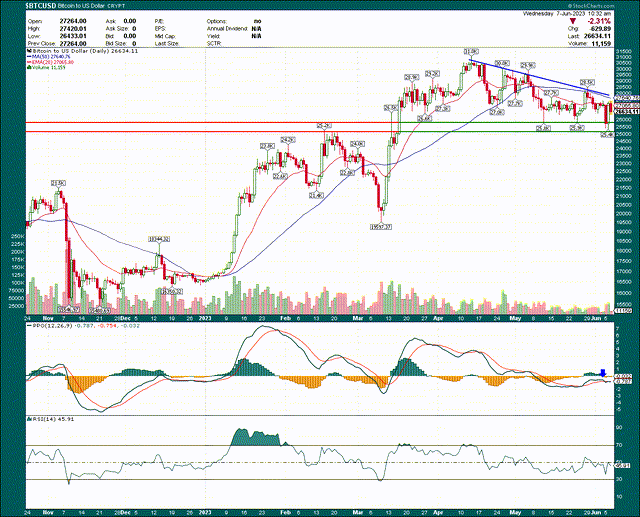

Talking of Bitcoin, I feel we’re at a crossroads right here, and we’re on the verge of a doubtlessly large transfer.

StockCharts

Bitcoin is placing in a somewhat bearish descending triangle proper now, however I’ll word that crucial assist continues to carry. We’re nearing the purpose the place Bitcoin is both going to breakout increased, or break down decrease, because the triangle closes up. My bias proper now, and it’s only a bias, is that we see Bitcoin break decrease. Descending triangles like this one typically resolve with a break decrease, and the PPO on this one suggests decrease is the trail of least resistance. None of it is a assure, however my most popular state of affairs for Bitcoin proper now’s a break decrease. Nonetheless, I’m open to both decision, and I’ll anticipate the chart to inform me which path it’s going.

If I’m proper and the subsequent transfer is decrease in Bitcoin, that’s one more headwind for Coinbase. However extra instantly, Coinbase faces authorized headwinds, which we’ll contact on now.

Authorized woes plague crypto sector

Everyone knows that crypto is topic to authorized headline threat. That’s been the case for years, and it’ll most likely stay the case till cryptos are regulated like shares and commodities are at present. This week’s information circulation appears to assist that because the SEC has made it clear it isn’t backing down on regulating this nook of the finance world.

Coinbase was sued by the SEC this week because the regulator alleges that Coinbase is working as an unregistered securities dealer. The SEC says that Coinbase has “unlawfully facilitated the shopping for and promoting of crypto asset securities” since at the very least 2019. Additional, the SEC says Coinbase commingled and unlawfully provided alternate, broker-dealer, and clearinghouse capabilities, that are to be separated in response to securities rules. The SEC is thereby alleging that cryptos are securities – not currencies – and ought to be regulated as such.

As ugly as that’s, Binance’s SEC swimsuit was a lot worse, alleging fraud and inappropriate utilization and motion of buyer funds. To be clear, Binance is basically being charged with fraud whereas Coinbase is extra of a regulatory play. Nonetheless, having a serious crypto participant like Binance being charged with some fairly nasty stuff shouldn’t be search for cryptos or different crypto-related corporations.

I feel that extra regulation of cryptos and the businesses that assist them would finally be good for the area. Whereas that is the precise reverse of what crypto fanatics need – which is complete freedom and lack of regulation – making crypto extra mainstream by having it regulated by the SEC would open up monumental sums of cash to put money into it. So, whereas these new flows are short-term headwinds, I feel in some unspecified time in the future down the highway this can all be good for crypto and the businesses which might be operating authentic companies to assist them.

Nonetheless, within the quick time period, these are vital headwinds for Coinbase, and I feel the inventory was rightly punished yesterday on the information. And as we’ll see beneath, even with the transfer decrease, shares aren’t even actually that low-cost.

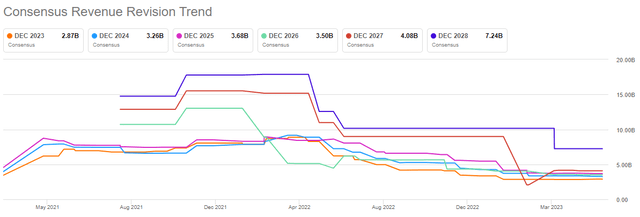

Estimates proceed to maneuver decrease

Let’s check out income revisions, which aren’t precisely inspiring numerous confidence within the bull case proper now.

Searching for Alpha

Income has plunged, each in actuals in latest quarters, and in expectations from analysts. Coinbase wants a raging bull market in Bitcoin specifically to drive quantity from clients, and we merely don’t have it. As I mentioned above, my outlook for Bitcoin isn’t precisely bullish in the mean time, and whereas I’m open to a bullish decision on the sample I famous, that’s not my base case. Provided that, my outlook for income estimates for Coinbase can also be flat to decrease.

Lastly, the valuation of the inventory isn’t even enticing. The inventory is close to relative lows, however the valuation continues to be in the midst of the vary for the previous 12 months.

TIKR

The inventory trades for 4.2X ahead gross sales, which is close to the common of 4.4X. If the inventory had been again at 2.5X ahead gross sales I’d be extra sympathetic to a bullish decision, but it surely isn’t, so I’m not.

The underside line right here is that authorized threat, a weak chart for Bitcoin, and a good weaker chart on the inventory itself has me pondering it’s time to maneuver on from Coinbase. I’m downgrading the inventory to promote as I merely don’t see the chance as being definitely worth the potential reward.

The important thing degree is $47 on Coinbase, and if that fails, I feel it could possibly be a really enticing quick. I’m not recommending anybody exit and quick as that includes numerous threat, but when that’s your factor, you possibly can quick Coinbase below $47, with a cease simply above that. My base case proper now’s we see a break of $47, and a possible transfer all the way down to the double backside at $31. It’s a promote.

[ad_2]

Source link