[ad_1]

Kwarkot

As we’ve got seen over the previous 12+ months, we’ve got endured a quick elevating price atmosphere that has seen the Federal Reserve enhance the fed funds price 14 consecutive instances.

This has put intense strain on many REITs given their reliance on debt to proceed to develop. REITs are required to pay out at the least 90% of their taxable revenue to traders within the type of dividends.

As a long-term investor, I are inclined to take a contrarian strategy and as a substitute of chasing sizzling sectors, I search for worth within the crushed down sectors, considered one of which is the true property sector.

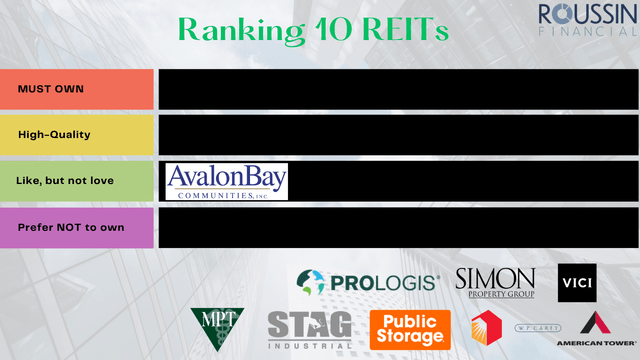

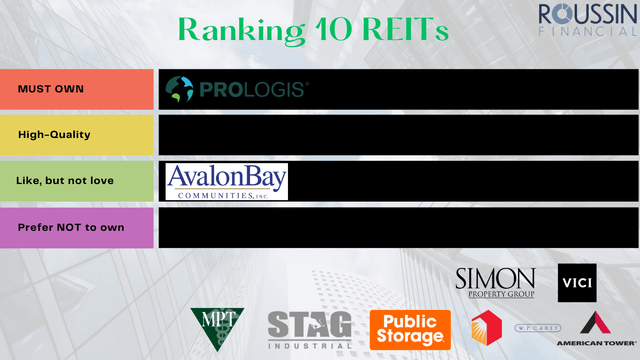

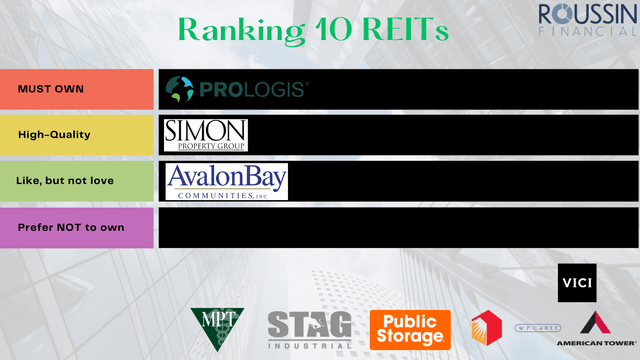

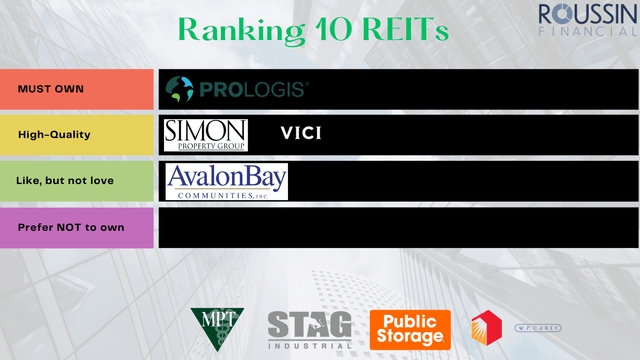

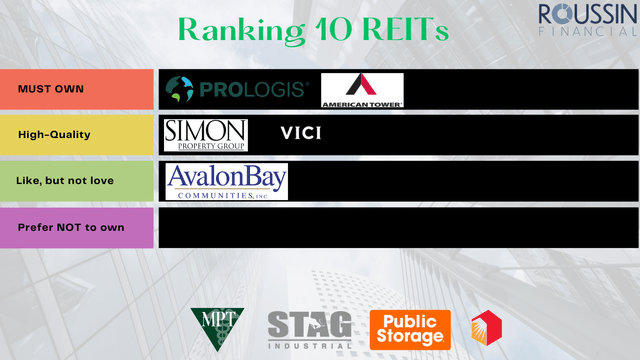

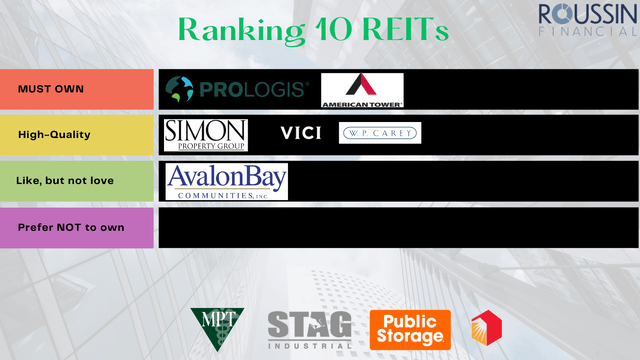

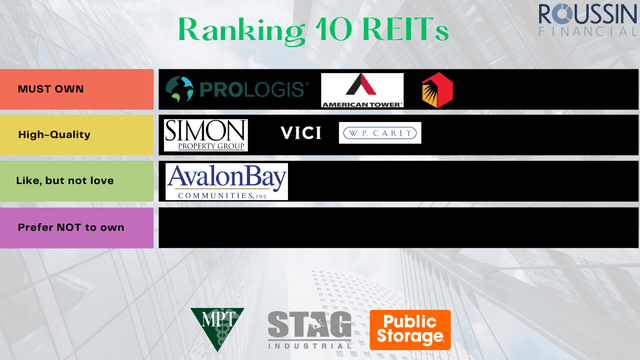

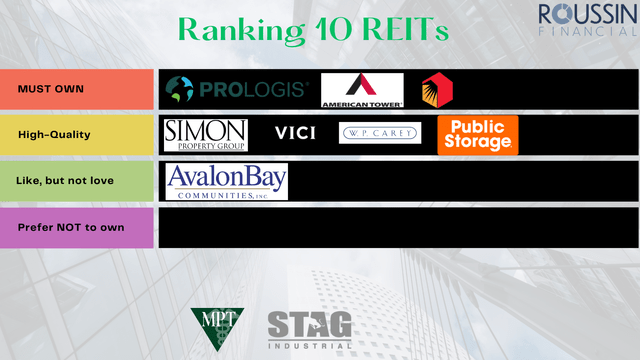

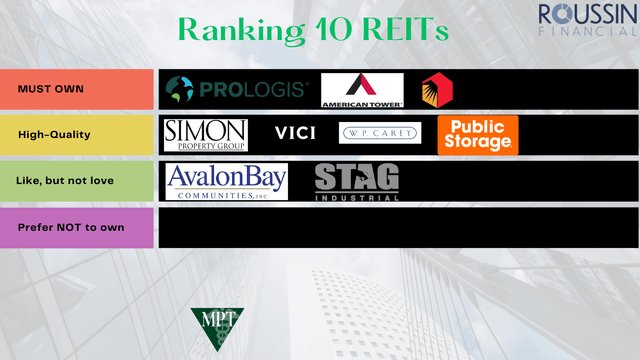

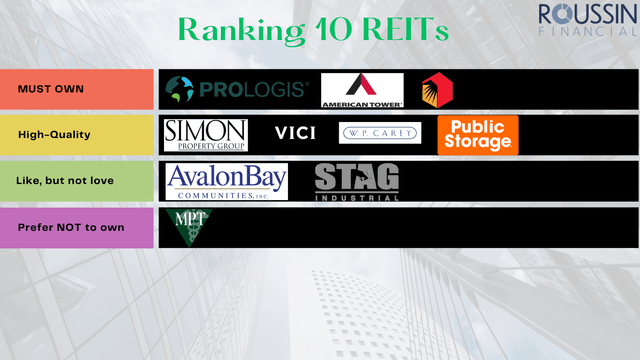

Right now, we’re going to take a look at 10 widespread REITs and I’ll briefly contact on every of them and in addition price them on the next scale:

MUST OWN- Fairly self explanatory, shares of the best high quality that belong in MOST dividend portfolios Excessive High quality – That is one other nice tier to be in, only a nudge beneath the BEST tier above it, so many nice shares or REITs right here Like however not love – These are stable shares, however not ones which are HIGH on my listing, however nonetheless some high quality names Choose NOT to personal – This isn’t a tier you wish to be in, and never shares I wish to personal

Created by creator

As we undergo these REITs, these scores are clearly my opinion and my opinion solely.

Now, here’s a take a look at the ten REITs we shall be rating in the present day

AvalonBay Communities (AVB) Prologis (PLD) Simon Property Group (SPG) VICI Properties (VICI) American Tower (AMT) W. P. Carey (WPC) Realty Revenue (O) Public Storage (PSA) STAG Industrial (STAG) Medical Properties Belief (MPW)

We are going to undergo these in no specific order, and price them as we undergo them. The scores are extra targeted on long-term high quality and never essentially a name to BUY at present valuations.

Rating 10 REITs

REIT #1 – AvalonBay Communities

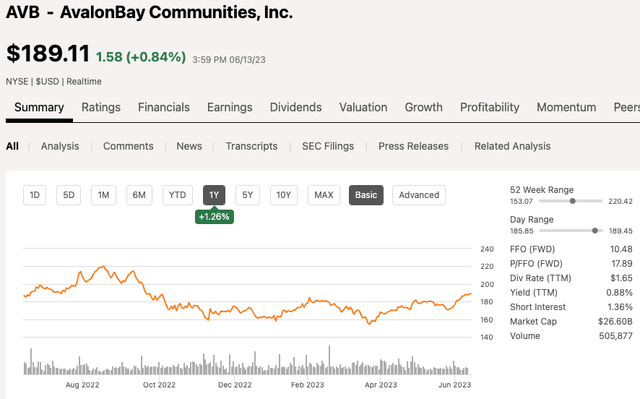

AvalonBay is among the two largest condo REITs within the US, and the sixteenth largest REIT general. The corporate has a market cap of $26 billion. Over the previous 12 months, shares of AVB are largely flat, up only one%, nonetheless, year-to-date shares of AVB have climbed 17%.

Looking for Alpha

In Q1, the corporate reported 13.7% Core FFO per share development and Identical-Retailer rental income development of 9.5%.

AVB Q1 Investor Presentation

REITweek, which is a big annual REIT convention, happened final week in New York the place we bought some updates from quite a few corporations. AvalonBay is a type of and administration gave an operations replace stating that via the primary two months of Q2, rental revenues are up 6.5%, 80 foundation factors increased than administration’s expectations. Additionally they talked about that occupancy ranges ended Might at 96.0%.

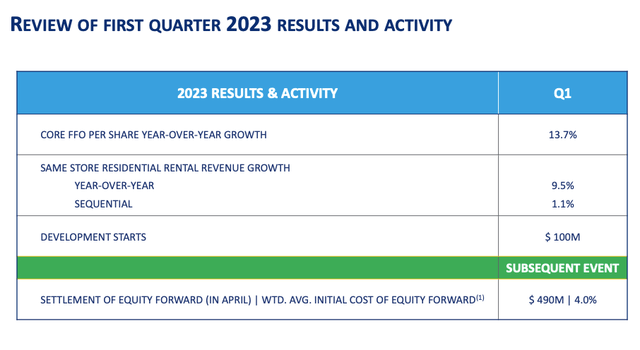

this chart you’ll be able to see nearly all of AvalonBay’s communities are discovered on each the West Coast and the East Coast

AVB Q1 Investor Presentation

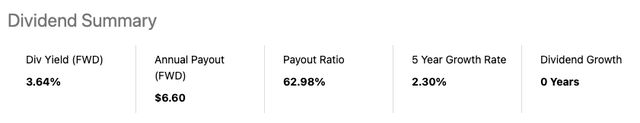

AVB pays an annual dividend of $6.60 which equates to a dividend yield of three.6%. AVB has been gradual to boost their dividend over time with a low five-year dividend development price of solely 2%. The dividend just lately bought a rise however previous to that traders haven’t seen a dividend hike since 2019.

Looking for Alpha

Analysts have a 12-mo common worth goal of $192, implying solely 5% upside from present ranges.

CNBC

So relating to score AVB, I’ve to put them within the LIKE however not love class. They’ve a fantastic portfolio and one of many largest Condo REITs, however the lack of dividend development and share worth development over the previous decade is what has me inserting the inventory on this tier.

Created by creator

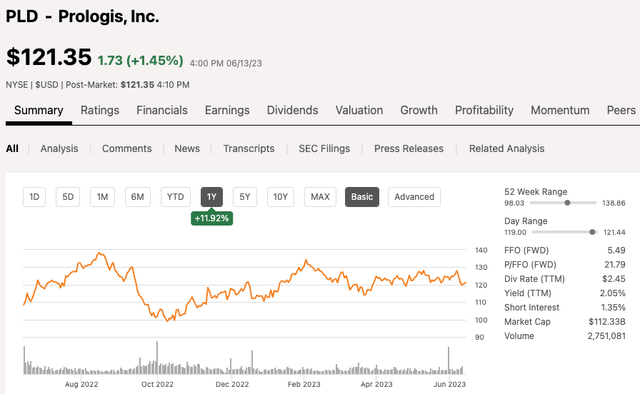

REIT #2 – Prologis

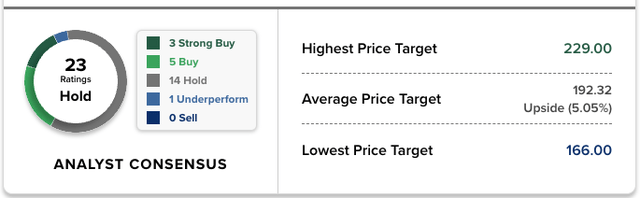

Prologis is the biggest industrial and warehouse REIT within the US, a inventory I personal inside my dividend portfolio. The corporate has a market cap of $112 billion. Over the previous 12 months, shares are up 12%, and year-to-date shares of PLD are up 8%.

Looking for Alpha

One of many causes I’m so excessive on Prologis is because of the continued development of e-commerce. If we fall right into a recession, e-commerce gross sales are prone to gradual, however long-term it is a development that’s anticipated to proceed to go increased.

There are quite a few methods to play e-commerce

You should purchase e-commerce corporations like Amazon (AMZN) or Shopify (SHOP) You should purchase logistics corporations like UPS (UPS) or FedEx (FDX) A 3rd manner is shopping for the warehouse homeowners, like PLD

If you end up a retailer that sells on-line, you want stock. When you might have a necessity for stock, you might have a necessity for area to retailer that stock. Once you want a spot to retailer that stock, odds are you name an organization like Prologis to lease area.

Amazon is the corporate’s largest tenant, and never a nasty tenant to have by way of high quality.

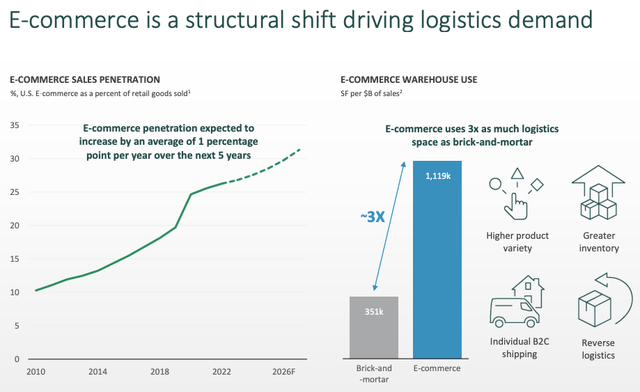

In 2010, e-Commerce gross sales accounted for under about 10% of retail gross sales. As of the tip of 2022, e-commerce gross sales now account for 1 / 4 of retail gross sales and economists imagine development shall be about 1% per 12 months over the following 5 years, which is attractive from an investor standpoint.

PLD Q1 Investor Presentation

E-commerce makes use of 3x extra logistics area than brick and mortar, which is sensible as a result of brick and mortar can maintain stock at their retailer after which wouldn’t have as massive of a necessity for warehouse area, however e-commerce alternatively wants to carry all stock in a warehouse.

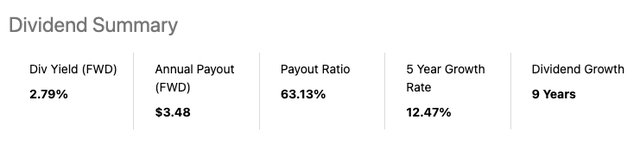

Trying on the dividend, Prologis yields a dividend of two.8% and in contrast to AVB, Prologis has been rising their dividend at a mean annual price of 12.5%.

Looking for Alpha

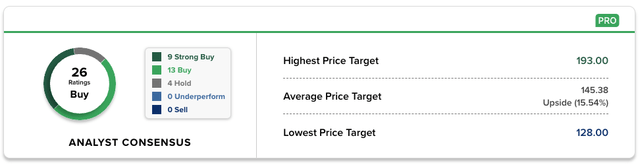

Analysts have a 12-month PT of $145 on the inventory, implying 15.5% upside from present ranges.

CNBC

In the case of score, Prologis is a REIT I imagine is among the highest high quality REITs in the marketplace in the present day and with the continued development development in e-commerce, it is a title I imagine is a MUST personal, so that’s the place we are going to put PLD, our first in that prime class.

Created by creator

REIT #3 – Simon Property Group

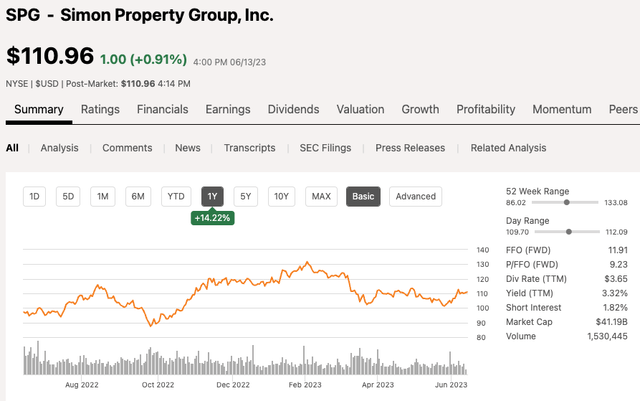

Now turning out consideration to malls with SPG, who occurs to be the biggest and highest high quality mall landlord in the marketplace in the present day. The corporate has a market cap of $41 billion. Over the previous 12 months, shares of SPG have climbed 14%, however year-to-date shares are down 5%.

Looking for Alpha

In case you are a believer that Malls are a factor of the previous, then SPG just isn’t a REIT for you. Nevertheless, in case you are like me and imagine that high-quality malls nonetheless have a spot on this earth, as not solely a spot for buying, but additionally leisure, and consuming, nicely then SPG could also be price a re-evaluation.

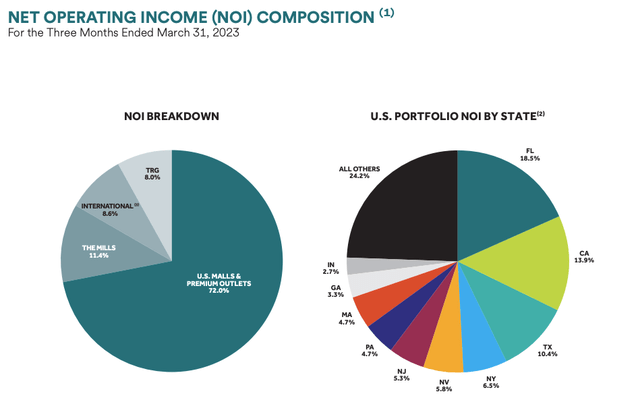

this chart you’ll be able to see an NOI breakdown by property kind in addition to the REITs publicity by state.

SPG Investor Relations

The bulk, roughly 72% of the corporate’s NOI comes from its mall and shops portfolio. The highest three states, accounting for 43% of NOI, are Florida, California, and Texas.

Through the firm’s most up-to-date quarter, SPG noticed 4% portfolio NOI development in Q1, which is a key stat to observe for SPG.

The corporate has a powerful administration staff which has constructed a powerful stability sheet and earned the corporate an A- credit standing to replicate its energy.

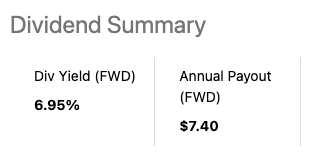

When it comes to the dividend, SPG needed to reduce their dividend throughout the pandemic however they’ve shortly elevated it again and now pay a dividend of $7.40 which equates to a yield of 6.95%.

Looking for Alpha

Analysts have a BUY score on the inventory with a mean 12-month PT of $130, implying almost 20% upside from present ranges.

CNBC

Now for score, I’ve owned SPG for fairly a while now and have a value foundation within the low $50 vary, so I’ve a number of love for this REIT. As I discussed earlier, I don’t imagine ALL malls shall be round, however high-quality malls as a spot of leisure shall be and SPG has the very best mall portfolio round, so they’re the one REIT I might belief on this sector. As well as, the corporate has a fantastic administration staff, so due to all of that, I place SPG within the Excessive High quality tier as they’re better of breed inside their sector.

Created by creator

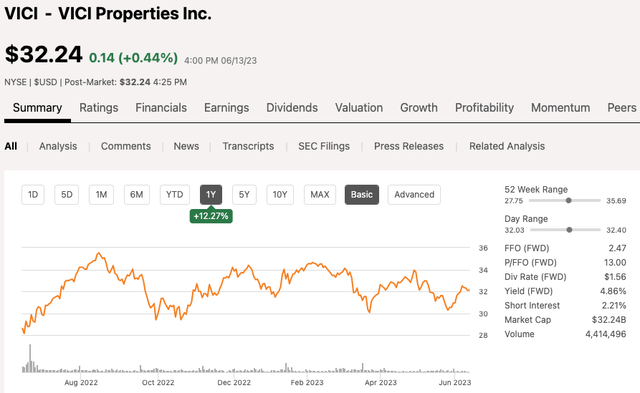

#4 – VICI Properties

VICI Properties is a on line casino and hospitality REIT and the biggest landlord on the Las Vegas strip. The REIT has not been round all that lengthy, however they’ve hit the bottom working, accumulating a number of the finest belongings in its class. VICI at present has a market cap of $32 billion. Over the previous 12 months, shares of VICI are up 12% and flat up to now in 2023.

Looking for Alpha

As I discussed, VICI is the biggest landlord on the Las Vegas strip, an space that hardly ever EVER has FOR LEASE indicators up as a result of these operators enter into long-term grasp lease agreements of 20+ years.

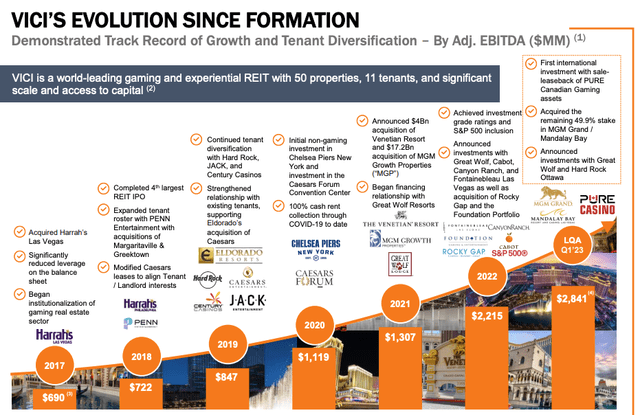

VICI went public in 2017 and has shortly been rising and increasing yearly.

VICI Investor Relations

The corporate at present owns nice properties resembling:

Caesars Palace The Venetian MGM Grand Park MGM Mandalay Bay New York, New York

Not solely has the corporate and portfolio continued to develop over time, however so has the dividend, rising at a close to 10% clip 4 out of 5 years. The dividend is nicely protected as even via the pandemic VICI maintained a 100% occupancy and hire assortment price. VICI at present pays an annual dividend of $1.56 per share which equates to a dividend yield of 4.9% and administration has a goal AFFO payout ratio of 75%.

Playing and On line casino visitors might stall if we fall right into a recession, which might be unlucky for the operators, however VICI is extra targeted on operators paying their rents, one thing they have been capable of do even via the pandemic. So, though operators might really feel some strain, odds have proven that even via a pandemic, these operators nonetheless made their month-to-month lease funds.

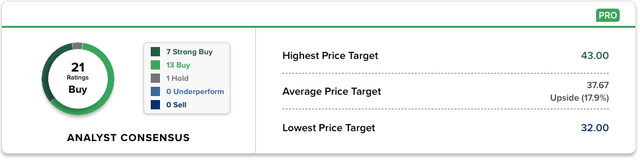

Analysts have a 12-month worth goal of about $38, implying 18% upside from present ranges.

CNBC

Now for my tier score. VICI is a inventory I really like, as it’s really my LARGEST particular person REIT holding, however the observe document remains to be early, so I’ll place them within the Excessive-High quality tier and I’ll search for them to make the leap within the coming years if the outcomes proceed to impress.

Created by creator

#5 – American Tower

American Tower is the biggest cell tower REIT in the marketplace in the present day. The demand for sound knowledge and cell service, as 5G and 5G continues to roll out round not solely the US, however internationally, their is loads of demand for an organization like AMT.

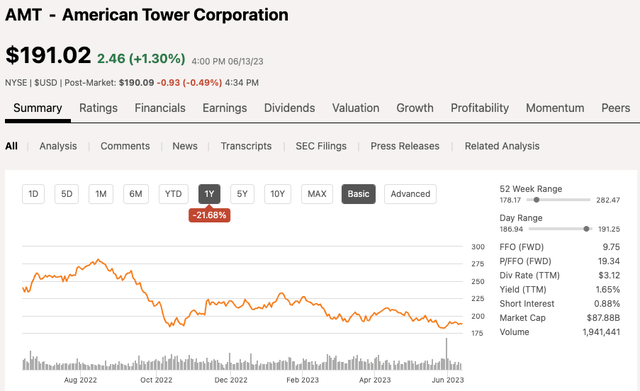

American Tower at present has a market cap of $88 billion. Over the previous 12-months, shares of AMT are down a staggering 21%, falling 12% in 2023 alone.

Looking for Alpha

American Tower is one other REIT that enters into long-term leases, leasing primarily to telecom giants like AT&T (T), Verizon Communications (VZ), and T-Cell (TMUS).

When American Tower builds a cell tower, it has the flexibility to lease out as much as three layers, which drastically improves the margins for that tower because the capex necessities are largely the identical whatever the variety of tenants.

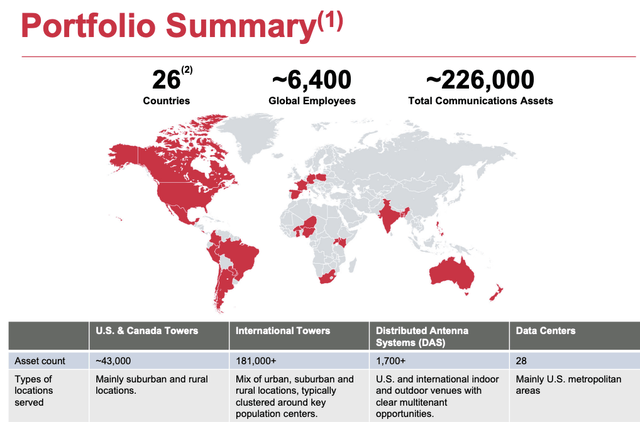

Along with robust development right here within the US, American Tower continues to broaden its attain internationally as nicely, which is one other space that would present a number of development for the corporate.

American Tower has a presence in 26 international locations and has over 226,000 communication belongings.

AMT Investor Relations

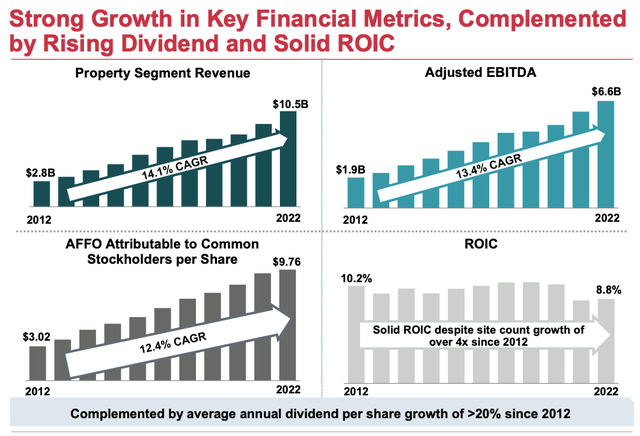

American Tower has had a tough go over the previous 12 months, however on the identical time, it has offered a fantastic alternative for long-term traders searching for a fantastic entry level. American Tower acquired one other cell tower REIT, Core Web site, for $10 Billion on the finish of 2021, which is proving dear in the intervening time. Certain the acquisition was poor timing trying again, but it surely was a long-term play for administration. As you’ll be able to see right here, administration has generated robust development throughout key metrics of the enterprise for years.

AMT Investor Relations

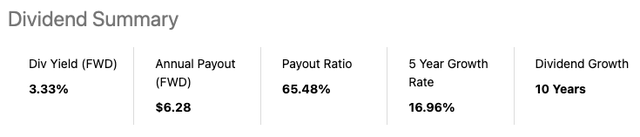

American Tower is exclusive in the truth that they’re a dividend development REIT, which isn’t one thing you see all that usually given how REITs are structured.

AMT at present yields a 3.3% dividend, which is excessive for them and over the previous 5 years, the dividend has grown at an avg annual price of 17%. As well as, administration has elevated the dividend for 10 consecutive years and counting.

Looking for Alpha

20 analysts have a BUY score on the inventory with a mean 12-month PT of $241, suggesting 27% upside from present ranges.

CNBC

AMT is a tough inventory to move up at present ranges and by way of tier score, knowledge and cell is just turning into extra in demand, which suggests a necessity for extra towers, particularly internationally. In my viewpoint, I price AMT as a MUST OWN REIT and particularly at these low-cost ranges.

Created by creator

REIT #6 – W.P. Carey

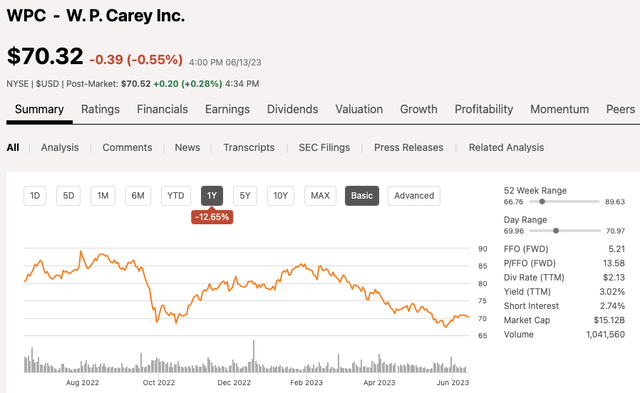

W.P. Carey is a diversified REIT that has adjusted into turning into extra of a participant within the Warehouse and Industrial property sector over the previous few years, a transfer that has confirmed to be fairly optimistic.

WPC at present has a market cap of $15 billion. Over the previous 12-months, shares of WPC are down 13%, together with being down 10% this 12 months alone.

Looking for Alpha

When it comes to the portfolio, WPC has 1,446 internet lease properties leased out to almost 400 tenants. These properties quantity to 176.1 million sq ft and as you’ll be able to see these properties are positioned not solely right here within the US however internationally as nicely, with the US accounting for 62% of ABR.

WPC enters into long-term leases and so they at present have a weighted common lease time period of almost 11-years as of the tip of Q1. The REIT operates with a really excessive occupancy price of 99.2%.

WPC Q1 Investor Presentation

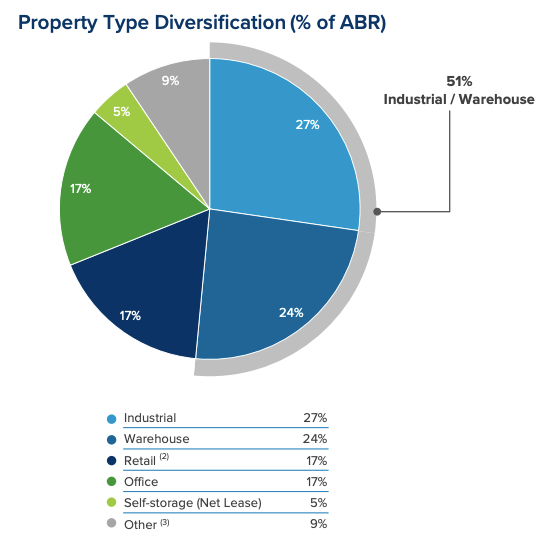

Here’s a take a look at the Property Kind Diversification based mostly on ABR.

WPC Q1 Investor Presentation

As you’ll be able to see, 51% ABR comes from Industrial and Warehouse properties with 17% every coming from each Retail and Workplace. Workplace is a quantity that has come down over time, and a quantity I imagine nonetheless must be decreased.

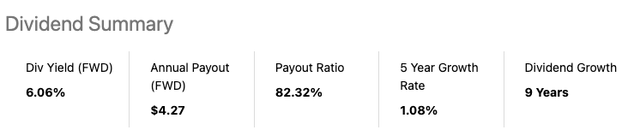

WPC has a excessive dividend yield of 6.1%, however that additionally comes with a low 1% 5yr DGR, which is commonly the case with increased yielding shares

Looking for Alpha

Analysts have a mean 12-month PT of $83 for shares of WPC, implying 19% upside from present ranges, which is sensible given their low a number of.

CNBC

The corporate is buying and selling extra in-line as an workplace REIT moderately than an Industrial/Warehouse REIT, which offers for some nice a number of enlargement transferring ahead. On condition that a number of enlargement alternative with their enlargement within the Industrial and Warehouse sector, the inventory just isn’t a MUST OWN, however it’s undoubtedly within the Excessive-High quality tier, which is the place I positioned them.

Created by creator

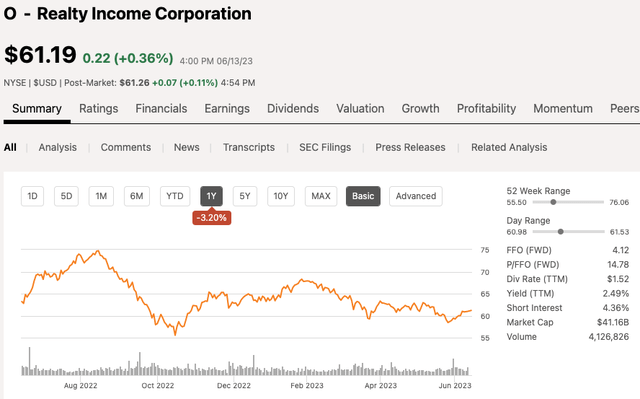

REIT #7 – Realty Revenue You possibly can’t rank REITs with out together with The Month-to-month Dividend Firm, Realty Revenue. I’ve coated Realty Revenue plenty of instances so I can’t go right into a ton of element across the enterprise, however they’re what I seek advice from because the ‘Gold Normal’ relating to REITs.

Realty Revenue at present has a market cap of $41 billion. Over the previous 12-months, shares of O are down 3%, and down 4% 12 months up to now.

Looking for Alpha

Even the very best corporations undergo powerful instances, and Realty Revenue is not any totally different. Over time, anytime Realty Revenue’s share worth has fallen to the place they yield a 5% dividend yield has confirmed to be a fantastic entry level for long-term traders.

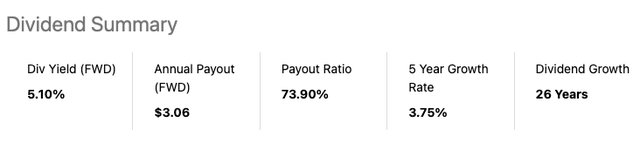

The dividend at present sits at 5.1% and that dividend is paid out on a month-to-month foundation. The corporate is considered one of solely 3 REITs on the Dividend Aristocrats listing having elevated their dividend for 25+ consecutive years. The dividend development is low however constant

Looking for Alpha

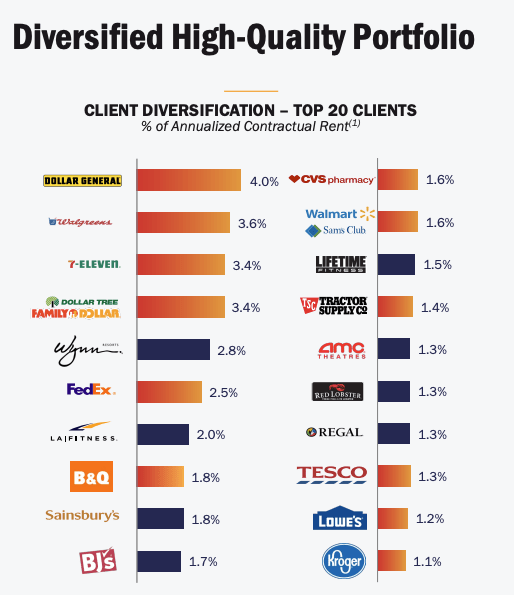

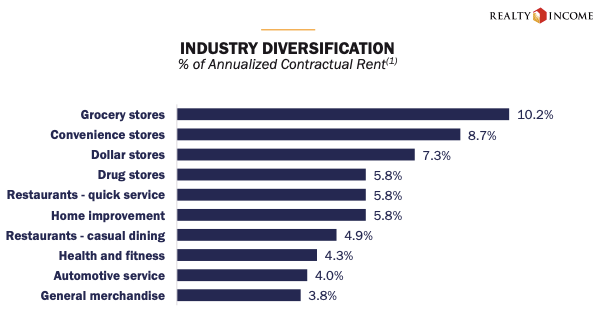

Realty Revenue companions with high-quality tenants, many being funding grade, which speaks to the security of Realty Revenue. Here’s a take a look at the highest 10 tenants based mostly on ABR:

Realty Revenue Investor Relations

Trying on the business diversification, you’ll be able to see how the corporate is nicely insulated from any pending recession within the US economic system, given their sector publicity. The highest industries, based mostly on ABR, are grocery, comfort, greenback shops, and drug shops, which all scream recession proof to a level.

Realty Revenue Investor Relations

Analysts have a mean Purchase score on the inventory with three analysts score the REIT a powerful purchase. The common 12-mo PT from analysts is $69, which means 15% upside from present ranges.

CNBC

Realty Revenue is a better of breed REIT with:

Robust Stability Sheet A rated credit standing Robust administration staff Confirmed Observe document In demand Properties

That is a type of MUST OWN REITs in my view, which is precisely the place I price this inventory in all probability, which in all probability doesn’t come as a lot of a shock.

Created by creator

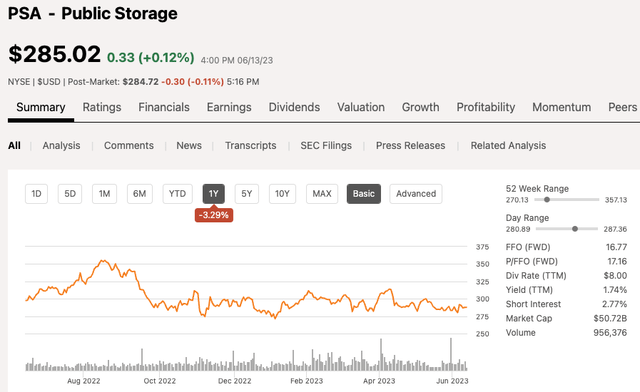

REIT #8 – Public Storage

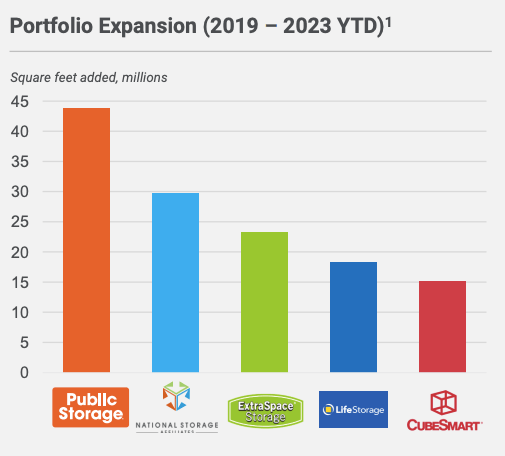

Now we’re transferring into the Self-Storage business with Public Storage, which occurs to be the biggest REIT within the sector by a fairly vast margin. Nevertheless, the REIT does have loads of competitors from different REITs in addition to personal traders throughout the business.

This has at all times been a favourite sector of mine as a result of in a manner, it’s a recession proof enterprise mannequin, particularly right here within the US. Reality of the matter is, Individuals have issues eliminating stuff.

Public Storage at present has a market cap of $51 billion. Over the previous 12-months, shares are down 3%, however up 4% in 2023.

Looking for Alpha

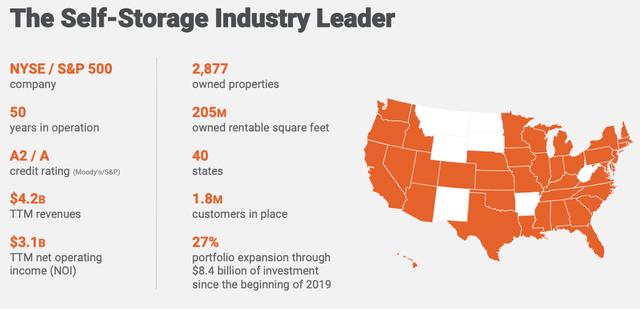

Public Storage has been in operation for 50 years now and they’re the 4th largest REIT by Enterprise Worth. The REIT additionally sports activities a excessive A credit standing based mostly on its constant efficiency and powerful stability sheet. PSA has 2,877 properties inside 40 states.

PSA Investor Relations

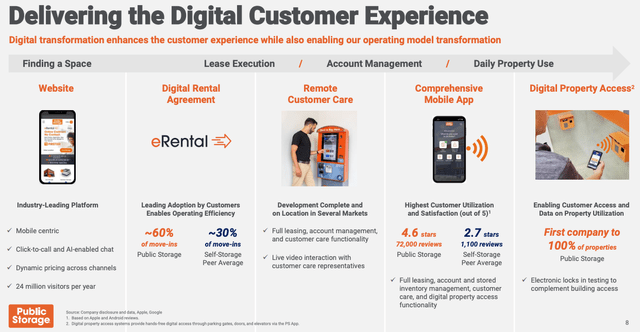

One of many drivers for the corporate lately has been their transformation to digital. You possibly can actually hire a self storage unit with none human contact in any respect and go to your unit with out interacting with an worker. PSA was the primary firm in its business to have 100% of their properties have digital entry.

PSA Investor Relations

Given the presence and scale, Public Storage has been capable of generate the best Identical-Retailer NOI margin, outpacing rivals resembling Additional House and CubeSmart, which is one other self-storage REIT I like and personal.

PSA Investor Relations

The corporate continues to broaden and develop to additional develop their portfolio, outpacing the competitors by way of sq. toes by a large margin.

PSA Investor Relations

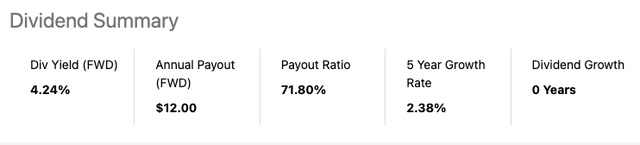

PSA pays an annual dividend of $12 which equates to a dividend yield of 4.2%. A stable yield, however the place the corporate has been missing has been within the dividend development class as PSA solely has a five-year dividend development price of two.4%, nonetheless, in 2022 traders acquired a shock $13.15 particular dividend.

Looking for Alpha

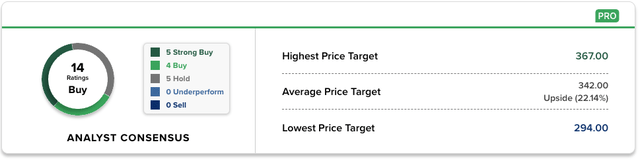

Analysts are additionally excessive on PSA with 5 analysts score the inventory a powerful purchase and 4 a purchase, with a mean 12-month PT of $342, implying 22% upside from present ranges.

CNBC

Public Storage is a really constant firm that can also be extra proof against financial slowdowns. As such, I place Public Storage within the Excessive-High quality tier.

Created by creator

REIT #9 – STAG Industrial

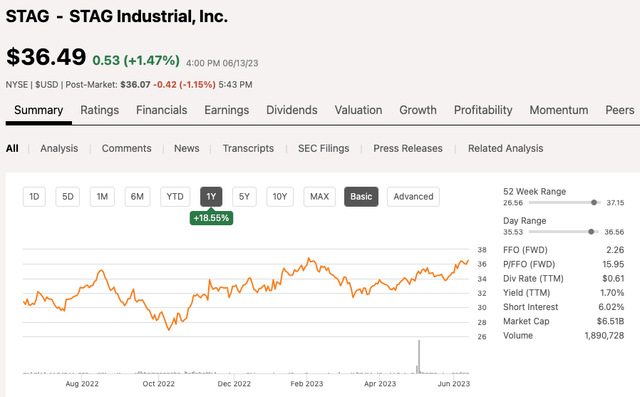

STAG Industrial, as you in all probability might guess, operates throughout the Industrial sector, competing with the likes of Prologis, a REIT we coated earlier. STAG at present has a market cap of $6.5 billion. Over the previous 12-months, shares of STAG are up 19%, rising 13% in 2023.

Looking for Alpha

STAG just isn’t on the identical stage as PLD however they’ve very related qualities and tenants, AMZN additionally being a prime tenant. I like STAG for lots of the identical causes I discussed with PLD with regard to e-commerce being a serious motive and the expansion anticipated over the following few years.

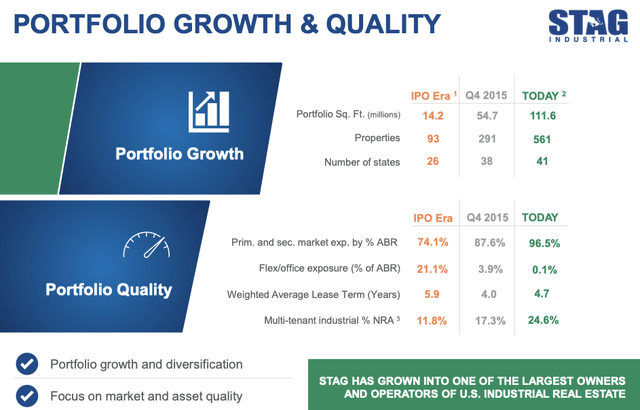

STAG is way smaller in dimension, however nonetheless rising. As you’ll be able to see right here when the corporate went IPO they’d about 93 properties and in the present day they’ve 561 properties inside 41 states.

STAG Investor Presentation

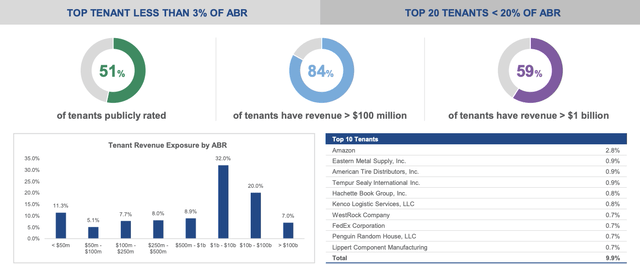

The REIT has a various tenant group with no tenant amounting to greater than 2.8% of ABR, which is AMZN and the highest 20 tenants account for lower than 20% ABR general.

STAG Investor Presentation

STAG pays a dividend yield of 4.2% with little to no dividend development, which isn’t very best. Nevertheless, like Realty Revenue, STAG does pay out their dividend on a month-to-month foundation which many retail traders like.

Analysts have a 12-month PT of $37 on the inventory implying simply 2.5% upside from present ranges given the run the inventory has already had this 12 months, so valuation just isn’t all that intriguing at this very second, however that doesn’t take away from the corporate as a complete.

CNBC

STAG is a type of corporations that is rather like AvalonBay. Constant in nature, albeit STAG remains to be smaller and increasing, however they aren’t going to knock your socks off and in that sector, I a lot choose Prologis, so by way of score, I place STAG within the Like, however don’t love class.

Created by creator

REIT #10 – Medical Properties Belief

We now have reached the FINAL REIT on our listing and I do know a lot of you might be desperate to see the place this REIT lands in my rating. Medical Properties Belief is a REIT working throughout the healthcare sector, primarily proudly owning Hospitals and healthcare associated amenities.

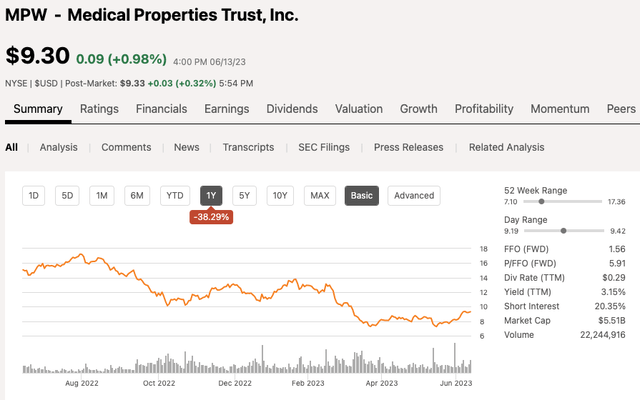

MPW at present has a market cap of $5.5 billion. Over the previous 12-months, it has been a troublesome time for MPW shareholders because the inventory has fallen almost 40%, and is down almost 20% in 2023 alone.

Looking for Alpha

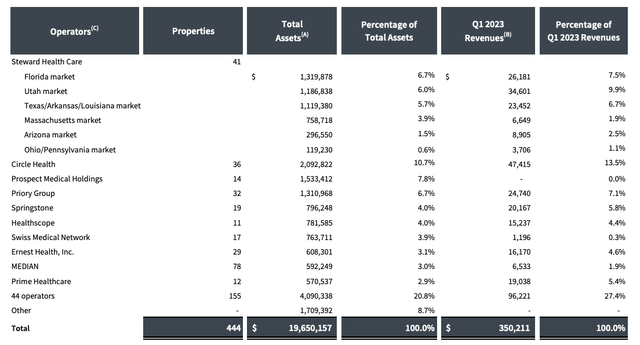

There have been quite a few studies which have come out over the previous 12-18 months relating to analysts who’ve shorted the corporate. The rationale has been associated to administration’s lack of transparency in addition to issues relating to their overexposure to its prime tenants.

On prime of that, 2022 was one of many worst years in a long time for the hospital sector usually.

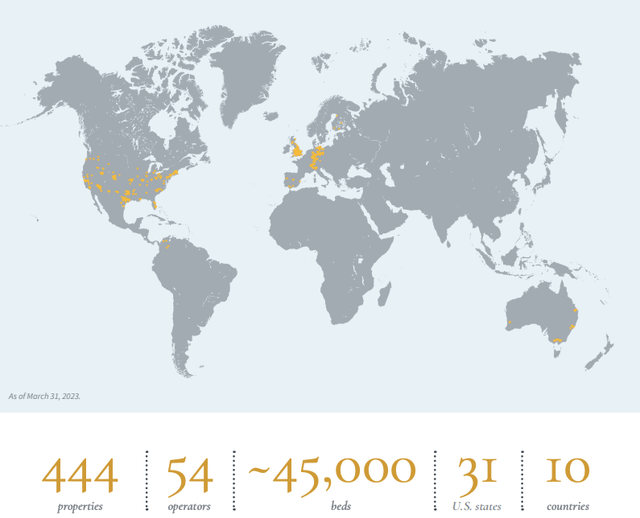

MPW has 444 properties leased out to 54 operators inside 31 states.

MPW Investor Relations

Nearly all of the income, about 72% comes from Basic Acute Care hospitals with 15% coming from Behavioral Well being Amenities.

MPW Investor Relations

MPW doesn’t provide the complete publicity by tenant, as a substitute it’s a must to do some extra work so as to add it up, however the REIT has giant publicity to a few of their prime tenants, to which traders see as a purple flag, particularly when these tenants seem like struggling.

MPW Investor Relations

Hospitals are a necessity and shall be round endlessly, however you continue to want a very good recreation plan and administration staff to generate stable returns.

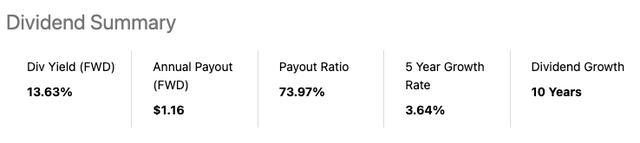

When it comes to the dividend, after the shares fall from grace, MPW yields a dividend of 13.6% which is EXTREMELY excessive. Administration believes the dividend is sustainable, however I’m not bought on that as a lot.

Looking for Alpha

This inventory has too many purple flags, however may very well be a candidate for a GREAT turnaround story in case you are searching for riskier shares like this. Don’t let the yield idiot you as it’s best to NEVER make investments based mostly on yield alone.

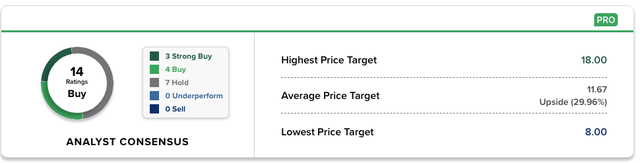

Analysts are hoping for that turnaround with an avg 12-month PT of $11.67 implying almost 30% upside from present ranges.

CNBC

For me although, I’ve to price this inventory as a Choose to not personal simply because of the lack of transparency, excessive publicity to single tenants, debt, and an absence of belief pertaining to the administration staff.

Created by creator

Investor Takeaway

Right now we checked out 10 REITs, rating them based mostly on high quality and long-term viability of the corporate. This isn’t meant to be a purchase listing by any means, as valuations look intriguing for some and fewer intriguing for others.

Within the remark part beneath, let me know what modifications, if any, you’d make to my rating of those 10 REITs.

Disclosure: This text is meant to offer info to events. I’ve no information of your particular person objectives as an investor, and I ask that you simply full your personal due diligence earlier than buying any shares talked about or advisable.

[ad_2]

Source link