[ad_1]

takasuu

Exxon Mobil Company (NYSE:XOM) is a stellar revenue era alternative. In a previous article, Exxon Mobil Has Ample Upside In Present Atmosphere (hyperlink right here), I lined my reasoning for why XOM inventory may very well be conservatively value ~$122 per share (versus ~$105 per share as of this writing). Exxon Mobil can also be a good way to generate significant revenue and I’ll spotlight why that’s the case on this article.

Superb Monetary Turnaround

Over the previous few years, Exxon Mobil turned what was a bloated steadiness sheet into one which’s comparatively sturdy for the business, all whereas sustaining its massive dividend payouts. In contrast to a few of Exxon Mobil’s friends, the corporate didn’t minimize its dividend through the oil pricing bust of late 2014 to early 2021, highlighting one of many explanation why I’m an enormous fan of the title. Certain, that call damage its previous monetary power, but it surely additionally highlighted how administration was prepared to do something and all the pieces to make sure that revenue looking for buyers didn’t get a payout minimize.

To get an thought of why the current enhancements to Exxon Mobil’s steadiness sheet power are so spectacular, let’s take a step again and have a look at the detrimental influence the oil pricing bust had on its monetary power. Particularly, the interval from 2015-2017 was significantly brutal as uncooked power useful resource costs had been fairly subdued at some time when Exxon Mobil had a number of main initiatives below growth (similar to huge Gorgon LNG export undertaking in Australia) that wanted to get accomplished earlier than it might materially decrease its capital investments to preserve money.

On the finish of December 2017, Exxon Mobil had $3.2 billion in money and money equivalents available versus $17.9 billion in short-term debt and $24.4 billion in long-term debt, good for a internet debt load of ~$39.2 billion. Put one other approach, its steadiness sheet was extremely bloated.

Whereas Exxon Mobil generated $24.4 billion in cumulative free money flows (outlined as internet working money flows much less capital expenditures) from 2015-2017, the corporate spent $38.1 billion protecting its complete dividend obligations (money dividends to Exxon Mobil shareholders and noncontrolling pursuits) throughout this era. Moreover, Exxon Mobil spent $5.8 billion cumulatively shopping for again its inventory from 2015-2017. This money circulate outspend resulted within the firm’s steadiness sheet power considerably deteriorating through the center of the 2010s decade. For reference, Exxon Mobil’s internet debt load stood at $24.5 billion on the finish of December 2014.

Quick ahead to 2021 and 2022, and issues began to lookup for Exxon Mobil. Sharp will increase in uncooked power useful resource pricing because of myriad components together with provide shortfalls after years of subdued upstream capital funding through the 2010s decade, recovering power demand as COVID-19 pandemic lockdown measures had been eased, and efforts by the OPEC+ oil cartel to restrict output all helped drive up power costs. After producing detrimental free money flows in 2020, surging power costs enabled Exxon Mobil to generate $94.4 billion in cumulative free money circulate in 2021-2022. Through the 2021-2022 interval, Exxon Mobil spent $30.4 billion protecting its complete payout obligations together with $15.3 billion shopping for again its inventory, actions that had been simply lined by its free money flows.

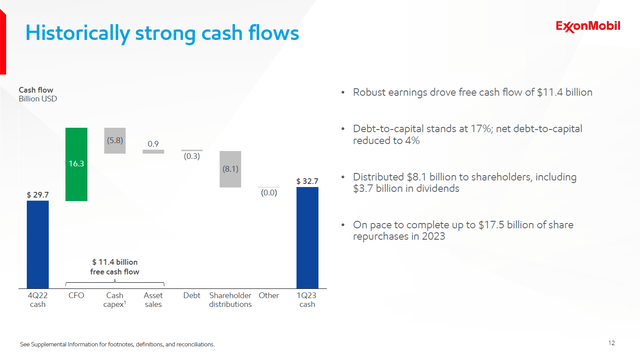

Most of Exxon Mobil’s remaining free money circulate, after protecting dividend payouts and share repurchases, went in direction of repairing its steadiness sheet. By the top of December 2022, Exxon Mobil had $29.7 billion in money, money equivalents, and short-term investments available versus $0.6 billion in short-term debt and $40.6 billion in long-term debt. That’s good for a internet debt load of ~$11.5 billion.

The nice occasions continued to roll in through the first quarter of 2023. Exxon Mobil generated $10.9 billion in free money circulate final quarter whereas spending $3.9 billion protecting its complete payout obligations together with $4.3 billion shopping for again its frequent inventory. Once more, each of those actions had been absolutely lined by its free money flows with room to spare. It exited March 2023 with $32.7 billion in money, money equivalents, and short-term investments available versus $2.3 billion in short-term debt and $39.2 billion in long-term debt, equal to a internet debt load of ~$8.8 billion.

Exxon Mobil’s steadiness sheet is comparatively sturdy, although a internet money place could be most popular over a internet debt load. (Exxon Mobil – First Quarter of 2023 IR Earnings Presentation)

Structural Value Financial savings and Favorable Outlook

Right here I have to stress how spectacular it’s that Exxon Mobil minimize its internet debt load by $30+ billion inside just a little greater than 5 years, all whereas sustaining its dividend and shopping for again its inventory. That’s gorgeous, and these efforts ought to put substantial downward stress on Exxon Mobil’s annual financing bills. In 2020, Exxon Mobil spent $1.2 billion on its curiosity bills, which fell all the way down to $0.8 billion in 2022 whilst rates of interest continued to rise on a macro foundation. Moreover, right here is an excerpt from my previous article on Exxon Mobil (cited within the opening paragraph of this text) protecting the corporate’s working price financial savings initiatives:

Exxon Mobil is nicely on its method to reaching $9.0 billion in annualized price reductions this 12 months versus 2019 ranges. Reductions within the measurement of its workforce have been a part of this course of, alongside company consolidation efforts. Final 12 months, Exxon Mobil mixed its petrochemicals and downstream operations into one unit often called ExxonMobil Product Options.

Productiveness enhancements are being utilized to allow Exxon Mobil to do extra with much less. When Exxon Mobil printed its first quarter of 2023 earnings replace in April, administration famous that the agency had achieved $7.2 billion of its price discount goal to this point and that Exxon Mobil remained on observe to realize its remaining price discount objectives by the top of this 12 months.

Working expense financial savings mixed with financing price financial savings will go a great distance in direction of bettering Exxon Mobil’s earnings potential and future money circulate producing skills in any atmosphere. Moreover, power costs ought to stay favorable going ahead as Chinese language demand for crude oil is rising at a strong tempo. Right here is an excerpt from a current article of mine protecting the outlook for world power costs (hyperlink right here):

In accordance with the market analysis service Vitality Intelligence, China’s estimated oil demand hit over 16.05 million barrels per day in April 2023 primarily based on refinery throughput volumes (how a lot crude oil China’s huge downstream business is processing) and internet imports of refined petroleum merchandise. Demand for petroleum merchandise and in the end crude oil is recovering robustly as COVID-19 lockdowns are eased, as figures from Vitality Intelligence point out that China’s oil demand was up greater than 26% year-over-year in April 2023.

Going ahead, Exxon Mobil’s free money flows within the present atmosphere ought to be capable to simply cowl its dividend obligations, permitting buyers to sleep a bit simpler at night time.

Issues Over Proved Reserves

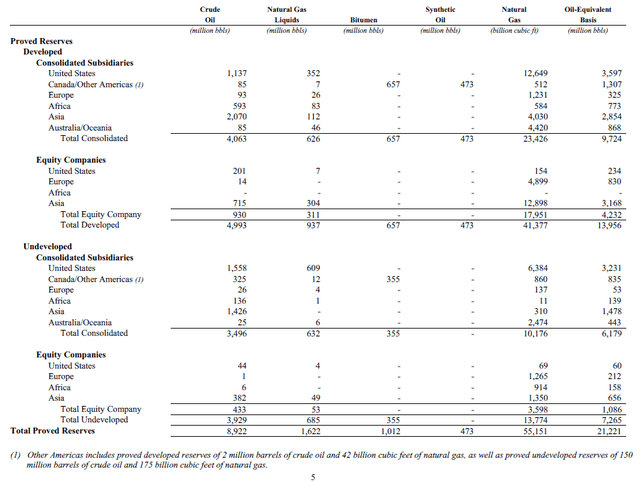

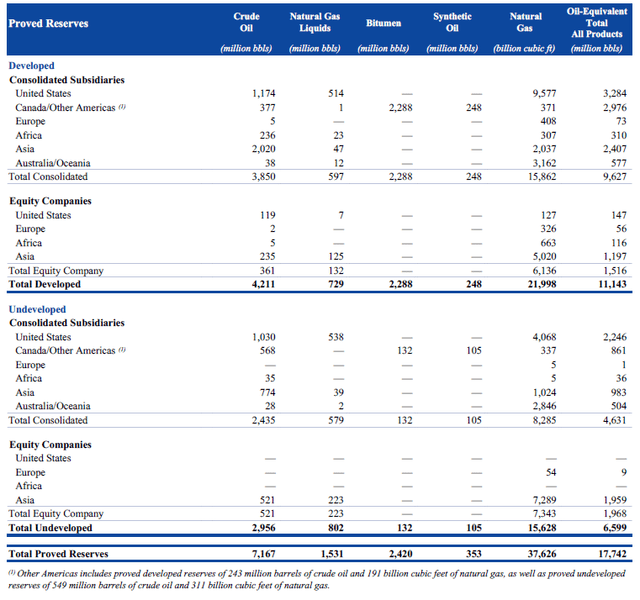

Exxon Mobil is dealing with hurdles arising from its shrinking proved reserve base. On the finish of December 2017, the corporate had 21.2 billion barrels of oil equal [‘BBOE’] in proved reserves. By the top of December 2022, Exxon Mobil’s proved reserves had declined to 17.7 BBOE as massive elements of its asset base continued to mature. Nevertheless, some optimistic indicators are rising that would assist flip this round.

Exxon Mobil’s proved reserve base has been sliding decrease in recent times. (Exxon Mobil – 2017 Annual Report)

Exxon Mobil has give you a number of methods to reverse the slide in its proved reserve base seen in recent times. (Exxon Mobil – 2022 Annual Report)

Throughout a current investor convention, Exxon Mobil’s CEO and Chairman Darren Woods famous that the agency was targeted on boosting the restoration price from shale performs throughout the US (any enhancements is also utilized in shale performs in Canada and Argentina as nicely). Usually talking, Exxon Mobil and different upstream corporations solely get better round 10% of the oil in place from shale fields and different unconventional alternatives which can be developed by horizontal drilling and hydraulic fracturing actions (shale, limestone, chalk, sandstone, and different formations are developed through “fracking” actions).

For reference, typical oil fields typically see restoration charges of ~30% (as a rule of thumb, the geological and engineering complexities range from subject to subject) and in locations just like the North Sea, onshore US belongings developed through CO2 injection actions, and the US Gulf of Mexico, restoration charges (as a share of oil in place) can rise to ~50% or extra.

The corporate’s CEO goals to “double recoveries” throughout Exxon Mobil’s US shale belongings through new fracking applied sciences over the approaching years, which if achieved might considerably develop the agency’s proved reserve base by boosting the quantity of oil in place that is in the end recovered. A part of this technique includes determining maintain the fissures created through the hydraulic fracturing course of open for longer. Historically, sand is used to maintain these fissures open. Exxon Mobil goals to determine what mixture of hydraulic fracturing methods and proppant (similar to sand) methods might enhance oil flows and thus restoration charges at horizontal wells creating shale and different formations. Moreover, Exxon Mobil goals to additional optimize its horizontal drilling methods because it issues creating shale performs by guaranteeing its wells are hitting extra of the supply rock.

Final 12 months, Exxon Mobil’s Permian Basin operations represented over half of its internet US oil and pure fuel manufacturing at ~550,000 barrels of oil equal per day [‘BOE/d’], a determine that’s set to rise to 800,000 BOE/d by 2027 in response to the agency’s forecasts. Any efforts that improve its proved reserve base within the US would have a fabric influence on Exxon Mobil’s long-term money circulate development outlook and manufacturing development forecasts. Up to now, issues have been progressing favorably, with the agency’s Permian Basin manufacturing rising by 20% in 2022 on an annual foundation.

One other area Exxon Mobil has had ample successes of late is in Guyana. The corporate, together with its companions Hess Company (HES) and China’s state-run power agency CNOOC (OTCPK:CEOHF), have remodeled 25 discoveries off the coast of the South American nation since 2015. Here’s what I needed to say relating to Guyana’s rising oil business in an article protecting Hess again in Might 2023 (hyperlink right here, reasonably edited):

Hess is working with Exxon Mobil and the Chinese language state-run agency CNOOC to develop immense crude oil assets within the Stabroek Block, which covers 6.6 million acres off the coast of Guyana. In Might 2015, Exxon Mobil caught liquid gold and since then the consortium has introduced a string exploration and appraisal successes. The group estimates that there are greater than 11 billion barrels of recoverable crude oil within the area on a gross foundation. Exxon Mobil is the operator of the endeavor with a forty five% stake alongside Hess’ 30% stake and CNOOC’s 25% stake.

Exxon Mobil has a big stake in these belongings, making its place in Guyana needle-moving even for an power big of its measurement. Moreover, here’s what I needed to say in my earlier article protecting Exxon Mobil regarding its place in Guyana (reasonably edited):

By 2027, Exxon Mobil goals to have ~1.2 million barrels of gross every day crude manufacturing capability in Guyana, up from slightly below 0.4 million barrels per day at present. Creating new floating manufacturing storage and offloading (‘FPSO’) belongings is how Exxon Mobil intends to realize its objectives in Guyana…The subsequent FPSO growth anticipated to come back on-line is the Payara asset, with first-oil focused by subsequent 12 months.

Guyanese oil manufacturing development and the prospect for future discoveries within the Stabroek Block ought to assist enhance Exxon Mobil’s useful resource base and manufacturing development trajectory going ahead. For reference, Exxon Mobil produced 3.8 million BOE/d internet from its upstream manufacturing base through the first quarter of 2023, up 4% year-over-year, aided by the uplift present by its belongings within the Permian Basin and Guyana.

Hidden LNG Development Alternative

Farther out, Exxon Mobil’s presence in Tanzania’s rising pure fuel business offers the power main with out one other potential development driver. Exxon Mobil and its companions, together with Equinor ASA (EQNR) and Shell Plc (SHEL) together with different companies, personal sizable pursuits in offshore concessions in Tanzania and dealing in direction of a future LNG export undertaking within the area. Right here’s what I needed to say on the endeavor in a current notice (hyperlink right here, reasonably edited):

Exxon Mobil owns 35% of Tanzania’s Block 2 offshore concession alongside its joint-venture accomplice Equinor, the state-run Norwegian power agency. Tanzania Petroleum Growth Company [‘TPDC’] is the nation’s nationwide oil firm and in response to Equinor, TPDC has the fitting to accumulate a ten% stake within the Block 2 concession…

A part of the rationale why this potential LNG export undertaking in Tanzania that, if accredited, could be value tens of billions of {dollars} is just not well-known is because of this endeavor getting placed on ice a number of years in the past. The JV commenced exploration drilling within the Block 2 concession again in 2011 and after 15 exploration wells had been drilled, the enterprise decided that there have been over 20 trillion cubic ft of pure fuel in place. Future exploration and appraisal actions might uncover extra assets…

You will need to bear in mind Shell’s position in a possible LNG export undertaking in Tanzania. After Shell acquired BG Group again in 2016, it grew to become the operator of the offshore Block 1 and Block 4 concessions in Tanzania. Shell’s companions in these blocks are… Medco Energi and Pavilion Vitality… After 22 exploration and appraisal wells had been drilled in Block 1 and Block 4, Shell and its companions decided that these concessions home 16 trillion cubic ft of pure fuel in place (these are the assets found to this point)…

Exxon Mobil, Equinor, Shell, Medco Energi, Pavilion Vitality, TPDC, and Tanzania reached an settlement to develop these offshore pure fuel assets and to assemble an onshore LNG export terminal in Tanzania as a part of a mixed effort that was introduced in Might 2023… In accordance with Reuters, Tanzania’s chief negotiator on the event framework expects that the power companies and authorities might attain a last funding resolution in 2025.

Please notice that it’s unlikely that the useful resource base of those Tanzanian belongings are absolutely booked as a part of Exxon Mobil’s proved reserves, on condition that this undertaking was successfully left for useless a number of years in the past and solely very just lately was given a second probability. Ought to the potential Tanzanian LNG endeavor get the inexperienced mild, that might additional enhance the outlook for Exxon Mobil’s longer-term manufacturing and money circulate development.

Concluding Ideas

Exxon Mobil is a stellar firm with a brilliant manufacturing development outlook that’s underpinned by a big useful resource base. Technological enhancements that enhance oil restoration charges from US shale performs, future oil discoveries in Guyana, and the prospect {that a} huge LNG export endeavor in Tanzania will get sanctioned ought to assist Exxon Mobil develop its proved reserve base going ahead. Placing this collectively, oil and pure fuel manufacturing development ought to drive money circulate and earnings development over the lengthy haul, enabling Exxon Mobil to proceed rewarding revenue looking for buyers.

Enhancements in its steadiness sheet additional strengthen Exxon Mobil’s revenue era prospects, as massive internet debt masses are likely to finally drive companies to chop their payout as their money circulate is diverted to cowl their monetary obligations. Exxon Mobil has ample money available to fulfill its near-term funding wants and within the present atmosphere, the agency ought to proceed producing monumental quantities of free money circulate.

Through the last quarter of 2022, Exxon Mobil raised its quarterly dividend from $0.88 per share beforehand to $0.91 per share, equal to three% sequential development. There’s ample room for Exxon Mobil to continue to grow its quarterly dividend going ahead. Shares of XOM yield ~3.5% as of this writing on a forward-looking foundation.

Editor’s Be aware: This text discusses a number of securities that don’t commerce on a significant U.S. trade. Please concentrate on the dangers related to these shares.

[ad_2]

Source link