[ad_1]

Powell will get a second likelihood to persuade the market

The US greenback gained floor towards a lot of the different main currencies on Tuesday, dropping solely towards the Japanese yen. Though the strikes have been considerably reversed in the course of the Asian session as we speak, yesterday’s motion suggests a risk-off buying and selling exercise, forward of Fed Chair Powell look earlier than the US Home of Representatives’ Monetary Affairs Committee for his semiannual testimony on financial coverage.

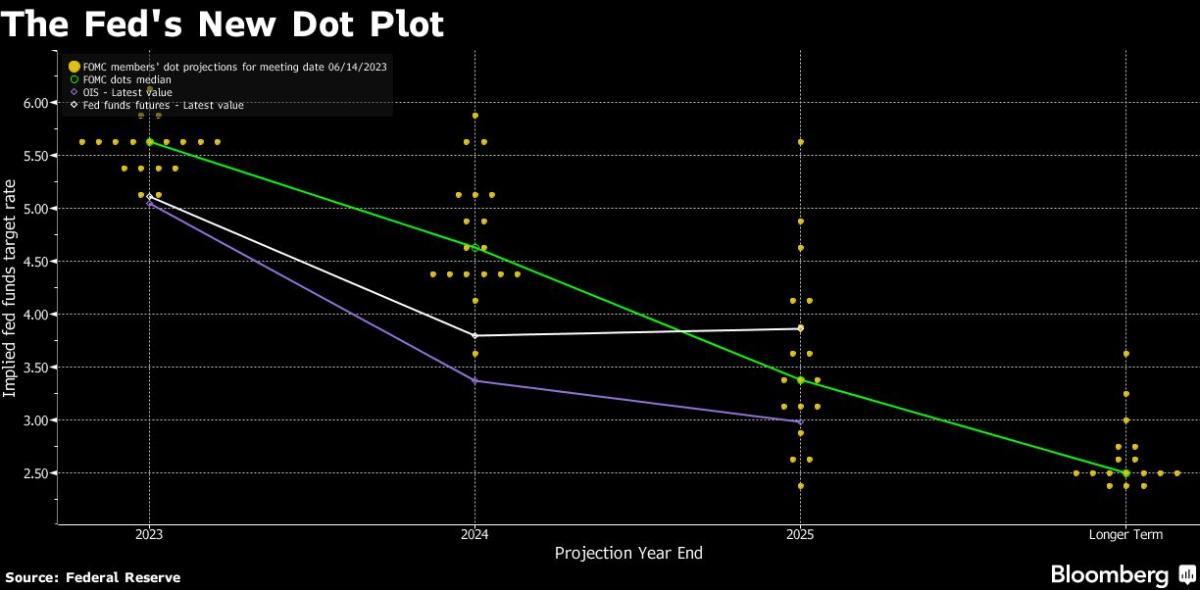

What inspired merchants to purchase some {dollars} might have been the surge in US housing begins and the rebound in constructing permits, which can have prompted some individuals to extend their Fed hike bets. Presently, they’re virtually sure {that a} 25bps hike could also be on the playing cards by November, however they continue to be unconvinced on whether or not one other one might materialize earlier than the top credit of this tightening marketing campaign roll.

At present and tomorrow, Chair Powell can have one other alternative to persuade buyers concerning the Fed’s intentions, however with a number of knowledge units pointing to easing worth pressures and softening wage progress, it might be exhausting for the Fed Chief to search out convincing arguments. In any case, the total impact of the prior fee will increase isn’t totally felt by the financial system but.

The surge in housing begins and the truth that 1-year inflation expectations stay nicely above the Fed’s goal of two%, regardless of sliding notably, could possibly be among the many few comparatively affordable arguments. So, if Powell stresses the necessity for maintaining charges increased for longer as a result of there’s nonetheless an extended option to go earlier than the job is finished, the greenback might acquire a bit extra.

That stated, calling for a bullish reversal nonetheless appears unwise as incoming knowledge pointing to additional cooling of worth pressures might translate into additional declines in inflation expectations and maybe permit market individuals to take care of their rate-cut bets for early subsequent 12 months, regardless of Powell saying ultimately week’s press convention that any fee cuts are “a few years out.”

UK knowledge provides to the case of a double BoE hikeOn the opposite facet of the spectrum is the BoE, which following as we speak’s higher-than-expected CPI numbers for Could is underneath stress to show extra aggressive. With the core CPI fee rising to 7.1% year-on-year, the likelihood of a 50bps hike on Thursday now stands at 40%, whereas forward of the info, it was hovering at round 30%. As for the foreseeable future, buyers are penciling in 160bps price of extra fee will increase, up from 140bps yesterday.

With such pricing, the stakes at the moment are excessive and something lower than a 50bps hike accompanied with a dedication to ship extra might push the pound off the cliff. The pound might acquire and lengthen its uptrend provided that Bailey and co rise to the event and meet buyers’ expectations, or higher say calls for. Nonetheless, the dangers appear asymmetrical. Any potential features attributable to a hawkish end result are unlikely to be as massive as any potential tumble within the case of disappointment.

Wall Road pulls again forward of Powell’s testimonyAll three of Wall Road’s fundamental indices traded within the crimson yesterday, with buyers maybe locking some income after a modest fee minimize by China did little to spice up their sentiment, but additionally attributable to lowering their threat publicity forward of Fed Chair Powell’s testimony.

Equities might lengthen their retreat ought to Powell persuade the market that a few extra hikes are looming and that fee cuts are unlikely to start as early as it’s presently priced in, however equally to the US greenback, it’s too early to argue a few reversal. With the Nasdaq round 47% up from its October lows, a good setback could also be a more-than-normal counterwave inside the broader uptrend, which might very nicely resume if market individuals keep bets a few sequence of Fed fee cuts subsequent 12 months.

[ad_2]

Source link