[ad_1]

Darren415

This text was first launched to Systematic Earnings subscribers and free trials on June 18.

Welcome to a different installment of our CEF Market Weekly Evaluate, the place we focus on closed-end fund (“CEF”) market exercise from each the bottom-up – highlighting particular person fund information and occasions – as properly because the top-down – offering an outline of the broader market. We additionally attempt to present some historic context in addition to the related themes that look to be driving markets or that traders must be conscious of.

This replace covers the interval by the third week of June. Be sure you try our different weekly updates protecting the enterprise improvement firm (“BDC”) in addition to the preferreds/child bond markets for views throughout the broader earnings area.

Market Motion

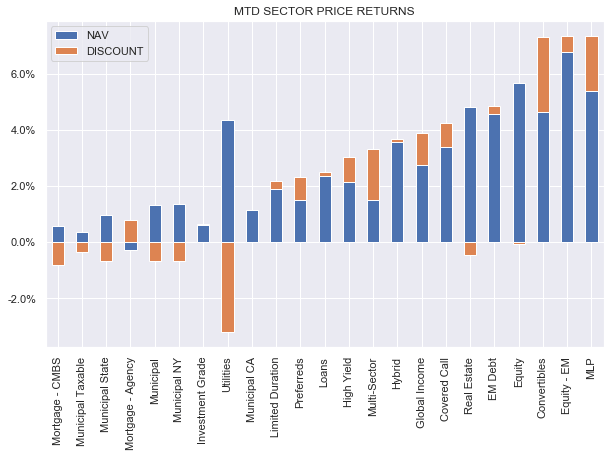

CEFs have been largely up on the week as robust danger sentiment pushed up inventory costs and tightened credit score spreads. Increased-beta sectors like Convertible and Fairness CEFs outperformed. Month-to-date, all sectors save for CMBS are up.

Systematic Earnings

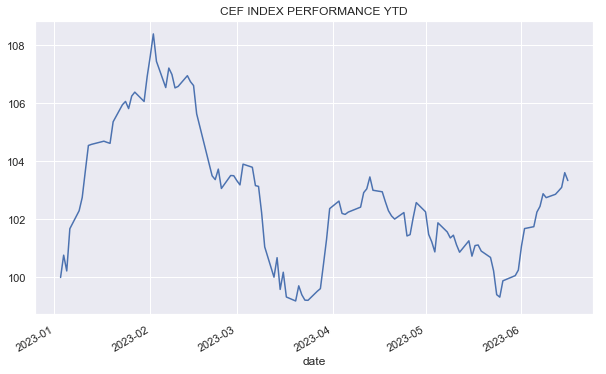

CEFs have bounced increased from their latest trough and are buying and selling on the higher a part of their 4-month vary.

Systematic Earnings

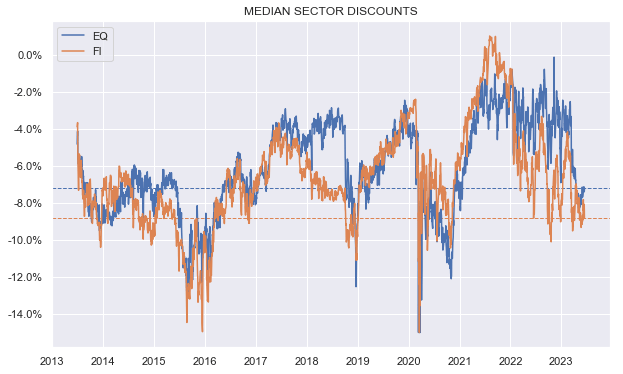

Reductions stay pretty extensive as latest optimistic sentiment has not translated into important low cost tightening. That is presumably in response to the truth that the Fed has flagged up two extra potential hikes which is more likely to maintain distributions beneath strain.

Systematic Earnings

Market Themes

One of many key dangers for CEF traders has to do with, what we name, a triple whammy, of underperformance, decreased distributions and premium deflation. These sorts of triple whammies can do critical injury to investor portfolios and restrict whole wealth creation. This triple whammy lately occurred with the Duff & Phelps Utility and Infrastructure Fund (DPG) which we focus on right here.

DPG lower its distribution the opposite day by 40% from $0.35 to $0.21. It maintained the unique $0.35 distribution since inception which has grown to 12.5% relative to the NAV (because of NAV deflation). Till now the fund had a “secure managed distribution coverage” the place it will attempt to pay out $0.35 by internet earnings, realized positive aspects or ROC. Over the past 2 years the fund has generated $0.12 in annual internet earnings which involves round a internet funding earnings yield of 1% on NAV.

Extraordinarily low protection for CEFs that maintain shares (even excessive dividend shares) is quite common so by itself it isn’t a pink flag. A pink flag is when an fairness CEF will not be in a position to generate long-term returns commensurate with its distribution. DPG 10Y whole NAV return is 2.9%. This may be OK if the inventory market have been down 50% however shares are effective (Utilities are a bit beneath the place they have been at first of 2022). For sure sooner or later a 3% annual return cannot help a 12.5% distribution.

What’s ironic right here is that DPG was one of many worst performers within the Utilities CEF sector (worst by 10Y whole NAV returns and second worst by 5Y whole NAV returns). Regardless of that, it traded at a 13% premium (second highest within the sector and 13% above the median valuation). No prizes for guessing why its valuation was so wealthy regardless of its poor return (its distribution was the very best within the sector). No prizes as soon as once more for guessing what has now occurred to the worth of DPG in gentle of the distribution lower (it is down over 20%).

All of this creates a form of triple whammy for low-information traders. Underperforming CEFs that do not like slicing the distribution will are likely to have a comparatively excessive distribution fee (as a result of their NAV will are likely to fall greater than that of different funds because of underperformance and because of overdistribution being financed by the NAV). This causes the fund’s valuation to richen as low info traders flock to the fund.

Ultimately, traders get 1) underperformance in whole NAV phrases, 2) an eventual distribution lower, leading to a really disappointing yield on their price foundation and three) a valuation collapse, leading to poor whole worth return.

Earnings allocation is as a lot (if no more) about enjoying protection as offense and avoiding triple whammies is a key a part of the protection playbook.

Market Commentary

A few semi-annual CEF shareholder studies have come out lately. The CLO Fairness / Mortgage CEF (XFLT) noticed a rise in internet earnings of about 15% from the earlier fiscal yr. Given what’s occurred to Libor during the last 6 months or so there may be in all probability one other 15% internet earnings increase on the playing cards given the lags with which CEFs report their internet earnings and the truth that semi-annual reporting covers a really extensive earnings interval.

That is to be anticipated – XFLT has a floating fee asset profile and has a fixed-rate most well-liked that’s a few quarter of its leverage. The fund additionally tends to keep away from deleveraging when the NAV falls. Whereas this helps maintain internet earnings elevated, it additionally boosts the fund’s leverage – leverage now’s above 40% – which is pretty excessive given the high-beta belongings of the corporate’s portfolio.

Looking at shareholder studies from CMBS CEF (IHIT) and most well-liked CEF (JPI). Each funds have seen a drop in internet earnings from the prior reporting interval. The drops within the studies nevertheless will are likely to overstate the fund’s cashflows as not all cashflows will feed into earnings. For instance, JPI receives Libor (i.e. 5+%) and pays round 2% on its rate of interest swaps for a internet cashflow of three% on $157m. What internet earnings will flag up is the 6% or in order that the fund pays on its $265m of borrowings however not the three% that comes again on $157m. The story is analogous with IHIT. This is among the ways in which GAAP internet earnings could be deceptive.

Each IHIT and JPI are time period CEFs with JPI more likely to supply traders a young supply at NAV, monetizing its 6% low cost. We presently maintain JPI in our earnings portfolios.

[ad_2]

Source link