[ad_1]

Robert vt Hoenderdaal/iStock Editorial through Getty Pictures

Introduction

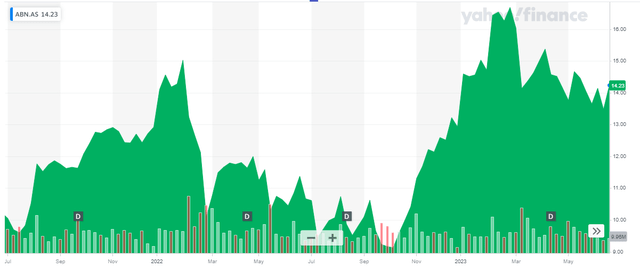

ABN AMRO (OTCPK:AAVMY) (OTCPK:ABNRY) is likely one of the largest banks in Europe, and after a couple of years of poor efficiency (together with the fallout of the COVID pandemic), the Dutch financial institution seems to be heading in the right direction once more and the share value has greater than doubled since I rated it a purchase in Might 2020. I offered my place earlier this yr on valuation considerations however because the share value has decreased once more since March, I wished to have one other look to see if it is a good second to get again in.

Yahoo Finance

ABN AMRO’s essential itemizing is on Euronext Amsterdam, the place it’s buying and selling with ABN as its ticker image. The common each day quantity within the Netherlands is roughly 2.9M shares for a complete financial worth of in extra of 40M EUR per day. I’ll use the Euro as base forex all through this text.

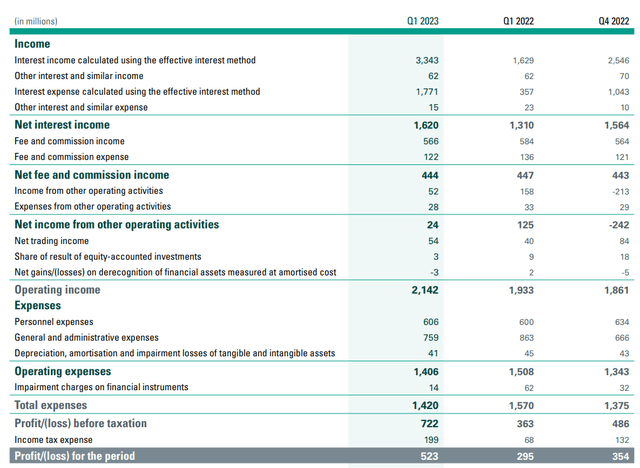

The growing internet curiosity earnings in Q1 bodes properly

It shouldn’t come as a shock to see ABN AMRO’s internet curiosity earnings elevated within the first quarter of the yr. Whereas the overall curiosity bills 5 folded in comparison with the primary quarter of 2022, the overall curiosity earnings doubled as properly and this was nonetheless ample to report a rise within the internet curiosity earnings by greater than 20% to 1.62B EUR. And though the curiosity bills elevated by a shocking 70% in comparison with the ultimate quarter of final yr, ABN AMRO was capable of improve its curiosity earnings by just a bit bit extra which signifies that even on a QoQ foundation the web curiosity earnings elevated by just below 4%.

ABN Investor Relations

That’s most likely nearly as good because it will get as of late and within the subsequent few quarters it is going to be fascinating to keep watch over the web curiosity earnings improvement. Be mindful the ECB began to hike rates of interest later and at a slower tempo so you can argue the European banks nonetheless should take care of the total affect of the speed hike cycle.

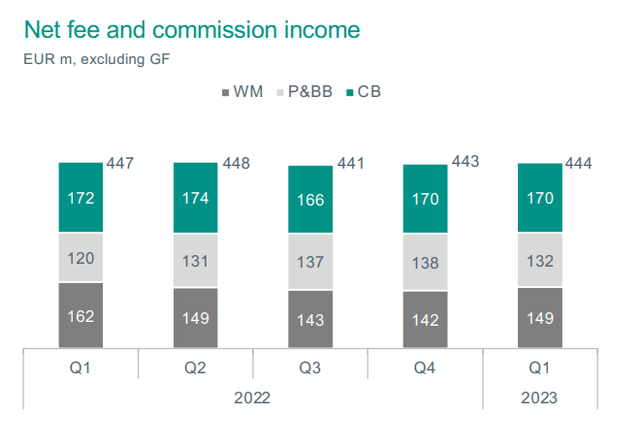

One in all ABN’s benefits is its comparatively secure payment and fee earnings consequence, which historically is available in at round 400-500M EUR per quarter. That’s vital because it principally covers a considerable a part of the personnel bills. Within the first quarter of the present monetary yr, ABN AMRO reported a complete non-interest expense of 1.41B EUR whereas its complete quantity of non-interest earnings was roughly 470M EUR, leading to a internet non-interest expense of 940M EUR.

ABN Investor Relations

The overall pre-tax consequence was 722M EUR on which about 199M EUR in taxes had been due. This resulted in a internet earnings of 523M EUR or 60 cents per share based mostly on the present share depend of 866M shares.

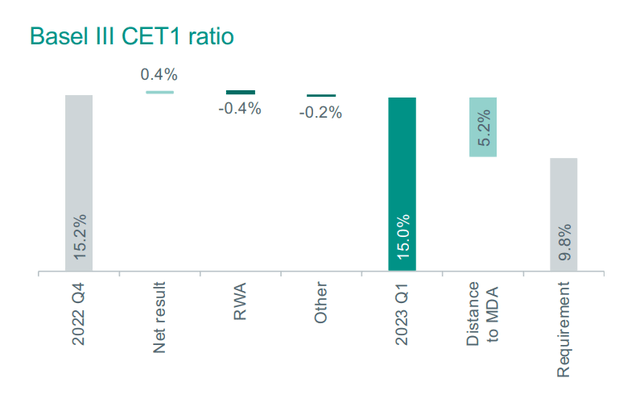

One of many components I am maintaining a tally of within the European banking sector is the capital ratio of a financial institution. As of the top of Q1, ABN AMRO’s CET1 ratio got here in at 15%, which is roughly 520 bp above the minim necessities for the financial institution.

ABN Investor Relations

As the overall quantity of risk-weighted property on the steadiness sheet is just below 132B EUR, a 520 bp in “extra” capital represents a capital surplus of roughly 6.85B EUR or 8 EUR per share. This clearly doesn’t imply ABN will distribute that “extra” capital to its shareholders nevertheless it does point out the financial institution has a strong buffer to take care of financial shocks.

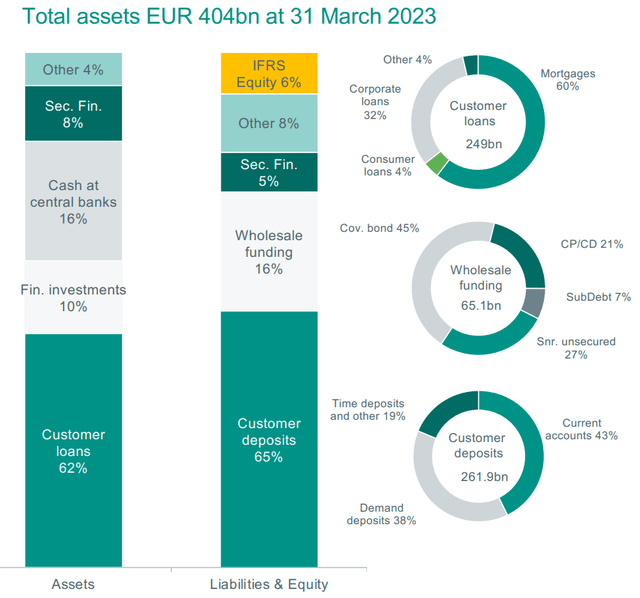

Of the 404B EUR in property, about 250B EUR encompass loans.

ABN Investor Relations

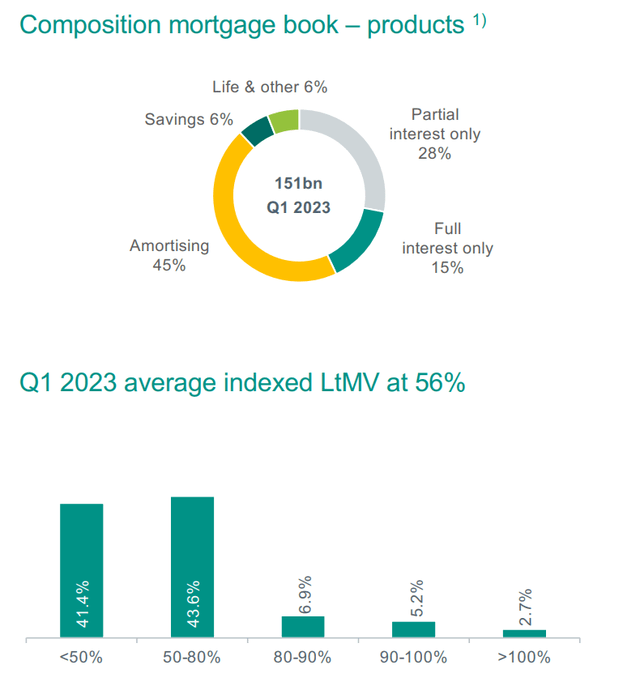

And inside that 250B EUR mortgage e-book, about 60% consists of mortgages. And as you possibly can see beneath, in extra of 40% of the overall quantity of mortgages has an LTV ratio beneath 50% with the common LTV ratio at 56%. Based on the financial institution, a 20% home value lower would end in about 12% of the mortgages being underneath water. And even when they’re underneath water that clearly nonetheless doesn’t imply the financial institution would notice a complete loss as the vast majority of the mortgage could possibly be recouped when an property will get foreclosed.

ABN Investor Relations

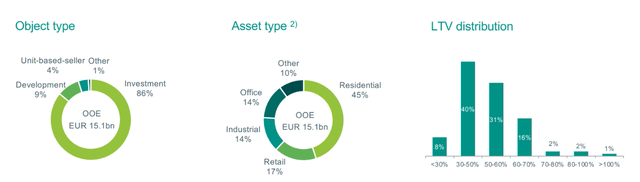

Additionally vital. The overall publicity to industrial actual property is simply 15B EUR, which is simply 6% of the mortgage e-book. And the LTV ratios are fairly low right here in addition to virtually 50% of the CRE loans has an LTV ratio of lower than 50%. And solely a small portion of the CRE loans is expounded to workplaces.

ABN Investor Relations

Funding thesis

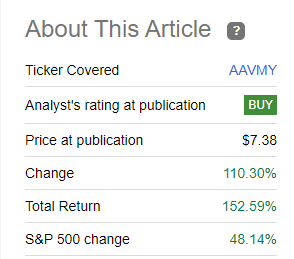

I used to have an extended place in ABN AMRO after shopping for the inventory in 2020 when the COVID pandemic was inflicting volatility within the European banking sector. Because the ECB compelled the banks underneath their supervision to droop the dividend, ABN AMRO was hit fairly exhausting. In my Might 2020 article I believed the inventory was too low cost. Since that decision, the share value has greater than doubled and the overall return exceeded 150%.

Looking for Alpha

I offered my place based mostly on the valuation of the financial institution, and though there nonetheless was room for progress, the potential returns had been decrease than what I’m often aiming for. Nevertheless, up to now 4 months, the share value has misplaced about 15% and is presently buying and selling at simply over 14 EUR per share. The elevated volatility additionally made the choice premiums extra engaging and I not too long ago began to jot down out of the cash put choices once more.

Editor’s Notice: This text discusses a number of securities that don’t commerce on a serious U.S. alternate. Please pay attention to the dangers related to these shares.

[ad_2]

Source link