[ad_1]

Roland Magnusson

Expensive readers/followers,

I’ve coated corporations in metals and mining, with latest updates on friends and corporations like Boliden (OTCPK:BDNNY). Now it is time for an replace on SSAB (OTCPK:SSAAF), which is not an organization basically mining or metals, however metal. Swedish metal is a traditional funding – the one factor extra traditional can be Swedish timber.

In my newest article, I made it clear that I would made triple-digit returns on SSAB – greater than 4x as a lot because the S&P500 in the identical timeframe. That is my typical M.O. for a corporation like this – shopping for it extraordinarily low cost, which I did, then holding it for a number of years, if wanted. Once more, I did.

You’ll be able to’t actually say how rapidly recoveries occur. It is determined by a mess of things. All you may normally say once you put money into a enterprise such as SSAB is that “Yeah, I bought this low cost on a relative foundation”. Generally it takes much more than 5-7 years for a corporation to succeed in the degrees the place I might say it is time to trim or promote it off. Generally it won’t occur in any respect.

For SSAB, my first promote got here in 2022 – the second not that way back, although, at that time, my place was right down to a really restricted quantity.

Since that final article after I went “HOLD” on the enterprise, the corporate has moved, however not a lot in both course. We’ll re-review SSAB right here, and present you the place the corporate is perhaps going.

SSAB – Assessment, 1Q23 and the potential draw back.

So, to be clear – there’s loads of potential draw back in SSAB. Like most mining/metallic or primary supplies corporations, SSAB is primarily a play on commodities and enter pricing. When these traits are favorable, issues are working positive – when these traits are actually good, these issues would possibly even be completely spectacular, like we noticed in 2022.

Nonetheless, when these issues flip adverse, which is the present expectation for the following 3 years, issues are going to be terrible. We’re speaking double-digit lack of capital even with dividends included, every year.

This is the reason valuation is essential in each funding that you simply care to exemplify or make. In case you purchase one thing secure, and you purchase it at worth, and also you’re prepared to carry it by way of thick and skinny, I argue that there are only a few situations the place you are not going to be popping out on high.

In case you’re then again shopping for one thing nice, however costly, you do not need to maintain it if it drops and also you’re liable to make emotional choices… that is a setup for absolute catastrophe, sadly.

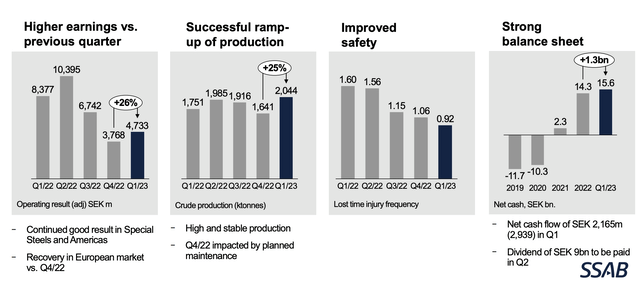

The most recent SSAB report confirms the start of the draw back for the corporate right here. Whereas the corporate managed to really enhance earnings, that is far, far beneath the ATH ranges seen within the 1Q-2Q22 ranges – and that is with improved manufacturing ranges.

What’s optimistic for Boliden and SSAB, and different corporations in unstable sectors, is that they’ve taken benefit of the huge inflow of money from ATH’s, to essentially resolve their debt conditions. SSAB is a good instance. The corporate now has a internet money place.

SSAB IR (SSAB IR)

General, the metal market hasn’t dropped as arduous as a number of the different commodity markets have been doing – and SSAB additionally has the benefit of being among the many world leaders in ESG-friendly metal, which will increase its relative attraction in dwelling markets right here.

Nonetheless, bother and indicators of downturns are beginning to seem throughout the corporate’s operations. Ruukki Building was the section in 1Q23, with a extra pronounced downturn and decrease income, along with weak margins. The sector generated adverse working outcomes total.

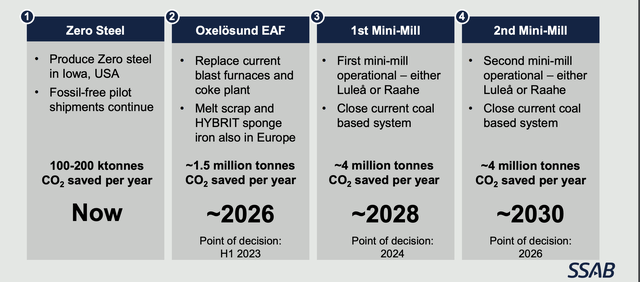

However extra on the positives. SSAB managed to launch SSAB Zero, its zero-carbon metal section, with third-party verification. This metal is predicated on recycled uncooked supplies, fossil-free electrical energy, biocarbon, and biogas. No carbon emissions must be offset – and the corporate already has important order quantities from main prospects like Volvo (OTCPK:VOLAF), Epiroc (OTCPK:EPOKY), and PEAB. The transformation to fossil-free is on monitor as effectively.

SSAB IR (SSAB IR)

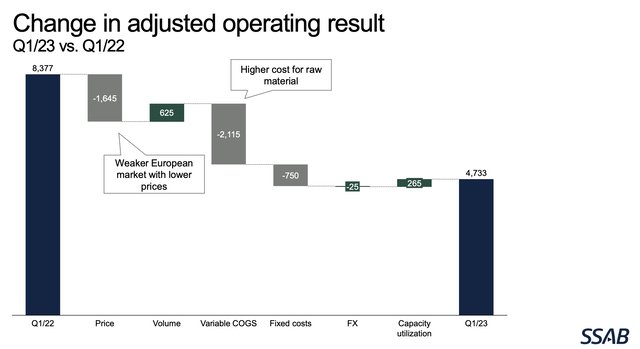

Nonetheless, not one of the adjustments or pushes right here take away from the truth that EBITDA on a per-tonne foundation is down from the highs – considerably down, EBITDA is down as effectively, and income is in decline. Even when the corporate manages to develop barely right here when it comes to EBITDA and revenue, the corporate will nonetheless see earnings which are considerably beneath the 2022 ranges.

Headwinds hail from enter, weaker markets, greater fastened prices, FX, and different headwinds (logistics and different issues) with quantity and efficiencies solely managing to offset these negatives ever-so-slightly.

SSAB IR (SSAB IR)

No firm, not SSAB both, can battle the “tide” right here – and that tide is popping. And when the tide turns, we are able to anticipate that the premiums that have been beforehand paid for corporations like SSAB will now not be paid.

The positives for the corporate embody the rock-solid monetary place, with a debt/fairness of -22%, which means we now have adverse debt, and over 15B SEK of money on the books as of the quarter’s finish. Some will go to dividends – however even internet of dividends, that leaves the corporate with virtually 6B SEK of internet money.

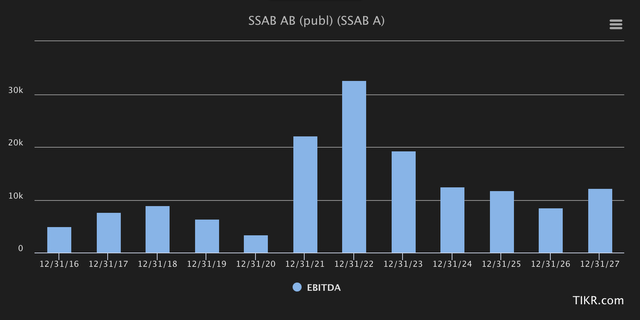

The present upkeep cycle is effectively in hand, and CapEx will eat about 1.5B SEK value of capital, with most anticipated to be carried out in 4Q23. What I’m saying, and repeating, is that this paves the way in which for a large drop in earnings and EPS. FactSet is anticipating a adverse 44.7% YoY for 2023, for adjusted EPS. For S&P International, it appears a lot the identical. Check out forecasted EBITDA and the EBITDA growth till 2026-2027E.

SSAB EBITDA (TIKR.com/S&P International)

Once more, not a reasonably image – and you’ll anticipate what this kind of growth will do to the corporate’s share worth and valuation. This is the reason I offered. Not as a result of SSAB is a foul firm, or as a result of I do not need to personal it.

I need to personal SSAB – but when I’ve generated over 100% RoR, and I see with a comparatively excessive diploma of certainty that issues are shifting down versus up, I do know that I can put money into higher corporations at higher valuation.

However when the corporate drops (not if – when – that is how the market works) I might be glad to select up shares at a reduction and begin the cycle over once more.

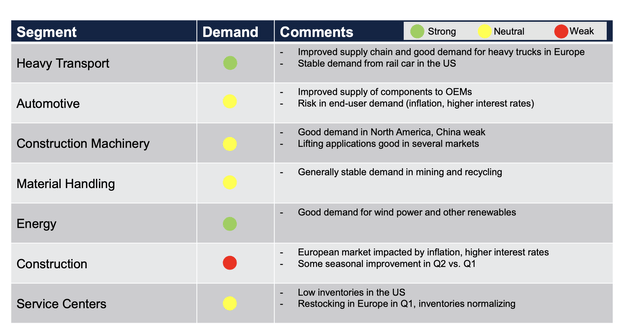

That is what differentiates me from different traders. I am not a B&H-forever investor. I am conscious of valuation cycles, particularly in these sectors, and I “Play” them. The worsening outlook is confirmed in many of the firm’s key segments.

SSAB IR (SSAB IR)

Except for this, only a few elementary dangers exist for SSAB. The corporate has almost 40B SEK value of money and amenities obtainable, and might “push” what course it considers vital. Nevertheless it can not management the market – and the market and commodity cycles dictate the place this stuff go.

For now, and for the following few years, I anticipate we’ll “brown-town”, and for that purpose, I offer you my valuation thesis for SSAB – and it isn’t a optimistic one at this worth.

SSAB – Nonetheless costly for what it’s – I say “Watch out”, and definitely not a purchase right here.

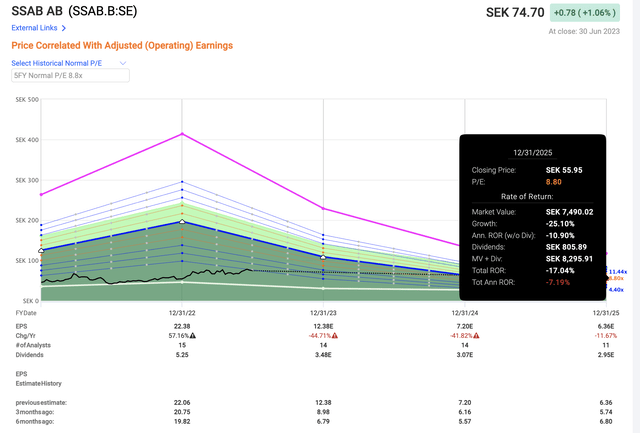

SSAB is solely put, a cyclical commodity play getting into a really anticipated and currently-forecasted downturn. At a normalized P/E for SSAB, this firm is predicted to generate adverse development even with dividends included for the following few years.

SSAB draw back/upside (F.A.S.T graphs)

This isn’t rocket science – it is what occurs to commodity performs. They go up – then they go down. I imagine we’re at a blessing right here as a result of you may nonetheless truly promote SSAB at an incredible revenue. If I nonetheless held SSAB, I might not take an opportunity that the corporate would possibly attain greater right here – I might rotate and reinvest in lots of different extra enticing corporations.

In instances of volatility, this firm’s earnings go adverse, and the dividend goes to zero – it requires you to behave and make investments accordingly. This has been confirmed time and again by historical past, and even when the corporate this time round has the bottom to really hold paying a dividend, it can not transfer mountains, which means change the commodity market. In case you put money into SSAB at present, you are investing in an organization going right into a forecasted earnings decline with an anticipated adverse 60% EPS decline for 2023E, one other 35% decline in 2024, adopted by one other 2% in 2025E.

That is harmful.

I coated in my final article why there are severe points that are not talked about usually – close to vitality provide for SSAB, which is a completely essential piece of their transformation, and why I imagine this can initially fail.

The corporate is priced as if none of those challenges exist. analyst estimates, you may be excused for considering me being too adverse. 12 analysts cowl the corporate with averages from 65 SEK on the low facet to 116 SEK on the excessive facet, with a PT common of 90 SEK. Nonetheless, earlier than you go inserting “BUY” orders based mostly on this knowledge, please notice that out of 12 analysts, solely 3 are literally at a “BUY” – absolutely the majority of analysts are both at “HOLD” or “underperform” right here, which makes me query the conviction of those analysts in addition to what these expectations are based mostly on. I anticipate positives from zero-carbon metal and applied sciences, however I don’t anticipate they are going to overcome the commodity cycle.

In my final article, I made a case for why I view SSAB as being value round 50 SEK – and I contemplate that to be excessive for a downcycle SSAB. Keep in mind, the bottom PT for SSAB throughout the downcycle was truly 12 SEK/share (Supply: S&P International) – now individuals, lower than 2 years later, are saying it is value a minimum of 60 SEK. Does that make sense?

It does to not me, a minimum of. It reveals me that this firm is cyclical, and I deal with a cyclical in a cyclical method.

This implies I “BUY” it when it is dirt-cheap, and when analysts are giving it triple-digit share costs, I promote.

Which is what I’m score it right here – it is a rotation goal. I will not go full “SELL”, as a result of I reserve this for corporations in bother, however SSAB is a rotation goal for certain.

Right here is my thesis.

Thesis

Investing in commodity corporations/metallic corporations reminiscent of SSAB is at all times a tough factor. They’re unstable and fickle investments, much more so within the Nordics the place dividend stability is not essentially a factor. Which means traders must be ready for such volatility not solely within the share worth, however in different metrics as effectively. SSAB needs to be seen as a really long-term funding. When seen in such a method, investing in SSAB at a ahead valuation of beneath 10X (when it comes to a normalized EPS; not the present one) is not all that unappealing. Nonetheless, that additionally means you must be an lively disposer of the corporate’s shares once they do go up in valuation. Because of this, and since I not too long ago offered off most of every little thing I had left, I’m at a “HOLD” right here. I view SSAB as considerably overvalued, with little left going for it. PT for SSAB is 50 SEK – no extra, and I am not altering this goal as of July 2023.

Keep in mind, I am all about:

1. Shopping for undervalued – even when that undervaluation is slight, and never mind-numbingly large – corporations at a reduction, permitting them to normalize over time and harvesting capital positive factors and dividends within the meantime.

2. If the corporate goes effectively past normalization and goes into overvaluation, I harvest positive factors and rotate my place into different undervalued shares, repeating #1.

3. If the corporate does not go into overvaluation, however hovers inside a good worth, or goes again right down to undervaluation, I purchase extra as time permits.

4. I reinvest proceeds from dividends, financial savings from work, or different money inflows as laid out in #1.

Listed here are my standards and the way the corporate fulfills them (italicized).

This firm is total qualitative. This firm is basically secure/conservative & well-run. This firm pays a well-covered dividend. This firm is at the moment low cost. This firm has a practical upside based mostly on earnings development or a number of enlargement/reversion.

The corporate is a transparent “HOLD” to me right here – and needs to be thought of a goal for rotation.

Editor’s Notice: This text discusses a number of securities that don’t commerce on a serious U.S. alternate. Please pay attention to the dangers related to these shares.

[ad_2]

Source link