[ad_1]

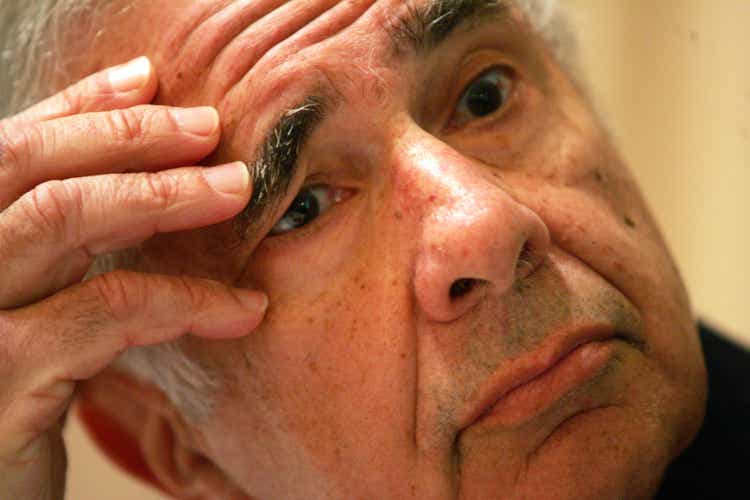

Michael Nagle

Pay attention beneath or on the go on Apple Podcasts and Spotify

That is an abridged transcript of the podcast.

Our prime story to date in right now’s session:

Icahn Enterprises (IEP) is up following a report that Carl Icahn has disconnected his private loans from the value of his firm’s shares.

IEP’s shares have dropped about 40% up to now two months after brief vendor Hindenberg sounded warnings over the ties between Icahn’s private loans and his firm’s shares. Icahn owns about 85% of IEP and about 60% of his shares have been put up as collateral.

With the worth of Icahn’s collateral towards the loans dropping, lenders turned alarmed and sought extra. After months of negotiating with the banks, Icahn amended his mortgage agreements on Sunday, the Wall Avenue Journal reviews. He severed his private loans from the value of IEP models, will improve his collateral, and has arrange a plan to totally repay the loans in three years.

Below the amended settlement, the one scenario that might set off a margin name could be if the web asset worth of this firm’s investments considerably slides.

Now, right here’s a take a look at how buying and selling is shaping up. Cash is shifting from development to cyclical shares, with Industrials (XLI) the best-performing sector. All three megacap sectors are within the crimson.

The Dow (DJI) is main the way in which larger, whereas the S&P (SP500) is little modified and the Nasdaq (COMP.IND) is struggling.

Barclays boosted its 2023 S&P value goal to 4,150, however says equities ought to stay range-bound by means of the rest of the yr. A tech-centric rally received’t broaden to the remainder of the S&P, the fairness crew stated, advising traders to tactically add secular development publicity.

Charges are fairly quiet. The ten-year Treasury yield (US10Y) is little modified above 4%.

Crude oil (CL1:COM), gold (XAUUSD:CUR) and bitcoin (BTC-USD) are additionally struggling to seek out agency path.

Amongst shares to look at, Helen of Troy (HELE) rose after it reported Q2 outcomes that beat estimates and higher gross revenue margin. Outcomes have been helped by a powerful efficiency within the firm’s flagship manufacturers resembling backpack maker Osprey, kitchen utensils producer OXO and cough & chilly medication Vicks.

Morgan Stanley raised its estimates on Netflix (NFLX) forward of the July 19 earnings report. Analyst Benjamin Swinburne has an Equal Weight on the inventory. He now expects the corporate so as to add 2.2 million subscribers within the second quarter, up from a previous 1.55 million because of “extra modest churn” and “strong” app obtain traits.

JMP Securities analyst Devin Ryan raised Schwab (SCHW) to Outperform from Market Carry out, saying latest numbers point out that “money sorting” has stabilized. Money sorting is when shoppers pull their money out of low-interest fee accounts and put it into higher-yielding property.

In different information of observe, SVB (OTCPK:SIVBQ) has sued the FDIC to get well greater than $1.9 billion seized by the regulator when it took over the financial institution in March.

In its go well with, SVB stated the dearth of entry to its core property asset is “impeding its skill to reorganize, and inflicting hurt on a steady foundation,” including that the funds needs to be producing greater than $100 million in annual curiosity at present charges.

A chapter decide in Could ordered the FDIC to return $10 million in seized tax refund checks to SVB.

There might be growing nervousness within the auto sector over the following two months because the expiration of the United Auto Staff contract with the Huge Three Detroit automakers will get nearer. The present collective bargaining settlement – which covers greater than 150,000 workers – will expire on September 14.

Stellantis (STLA) would be the lead negotiator with the UAW this cycle to set the stage for later talks with GM (GM) and Ford (F).

The labor talks are anticipated to focus on key sticking factors resembling job safety throughout the electrical car transition, value of residing changes, organizing EV Gigafactories, in addition to the tiered pay construction of the UAW

Evercore ISI analyst Chris McNally says “this yr’s version of negotiations represents a a lot larger, 50/50 probability of strike, properly past our regular’ base case (of 25%) however a (manageable) danger to shares.”

Within the Wall Avenue Analysis Nook –

BTIG technical strategist Jonanthan Krinsky is anticipating a retracement for the broader market within the second half of the yr following the robust good points to date. However he does see some promising charts in high-conviction names.

Krinsky famous that in the event that they yr ended now it will be the ninth-best yr on file for the Nasdaq (COMP.IND), however upside it at the moment restricted.

He says that if “that is actually a brand new bull market, it’s in contrast to any we’ve seen within the trendy period by means of the primary 9 months. We suspect any materials upside from right here is pushed by rotation into the laggards fairly than a sustained divergence into the mega-caps.”

Amongst 11 shares he picked which are value highlighting from a technical evaluation perspective are Abbott Labs (ABBT), Boot Barn (BOOT) and Seadrill (SDRL).

In the meantime, Goldman turned its consideration to Healthcare (XLV) after its annual convention.

Healthcare is the third-worst performing sector within the S&P to date, down about 5%. That’s one of many lowest first-half performances in no less than three many years as shares face regulatory points, development considerations, macro rotations and a choice for large-cap tech shares.

In a Goldman small investor survey simply 46% anticipated healthcare to outperform the S&P within the second half of the yr. However they stated of all of the subsectors MedTech was most probably to outperform given robust Q2 volumes.

Analyst Asad Haider additionally says that regardless of regulatory uncertainty, “the baseline expectation is that there’s going to be continued M&A,” with pharma “sitting on an amazing amount of money.”

[ad_2]

Source link