[ad_1]

StockByM

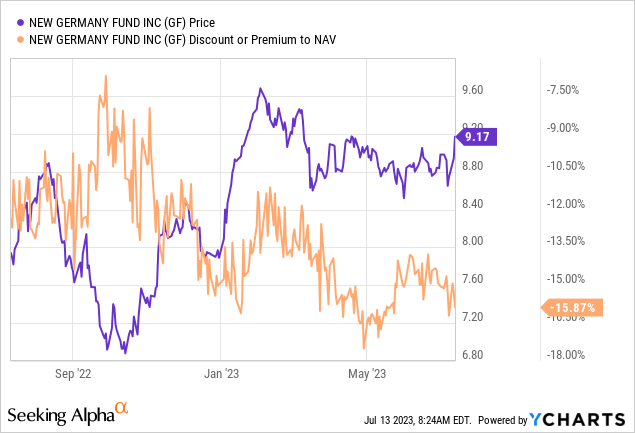

Since I final coated the DWS-managed New Germany Fund (NYSE:GF), financial knowledge in another country has been sobering, as a disappointing Chinese language reopening weighed on export and industrial manufacturing numbers. Current information that Germany had formally entered a technical recession this winter (albeit a shallow one) additionally weighed on investor sentiment, additional de-rating fairness valuations. Whereas my prior name for a China-led rebound most likely will not materialize this 12 months, the GF funding case nonetheless has silver linings. For one, excessive order backlogs collected throughout the pandemic proceed to help top-line developments. And beneath the Q1 GDP hood, funding remained robust throughout gear and development regardless of the tightening credit score situations. So even in an prolonged ECB tightening situation, GF’s portfolio of cash-rich companies is greater than adequately funded to maintain their capital expenditures.

Equally, German family steadiness sheets stay robust, helped by a red-hot labor market and regular wage progress, so GF might nonetheless profit from a consumer-led rebound going ahead. To be clear, this lively fund is not the most cost effective approach to acquire German publicity, and the current administration turnover is not superb both; but the traditionally large mid-teens share NAV low cost means affected person buyers ought to nonetheless come out forward.

Fund Overview – New Supervisor, New Portfolio Combine in Q2

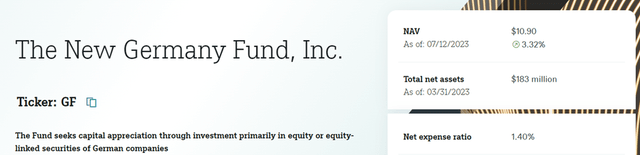

DWS Group’s closed-end German mid-cap fund, the New Germany Fund, noticed a gentle enhance in its web asset base to $190m on the time of writing (up from $183m in Q1) regardless of the underperformance of German equities final quarter. The large unfavorable is the upper expense ratio at 1.4% (up from 1.1% prior), screening expensively relative to comparable US-listed German choices. Moreover, the fund has seen some notable modifications on the prime – Leon Cappel (previously the GF deputy portfolio supervisor) and Daniel Hann take over as lead managers from the long-tenured Valerie Schueler and Alexander Lippert.

DWS

According to the supervisor reshuffle, GF has seen some notable modifications to its single-stock portfolio composition as properly. German flag service Deutsche Lufthansa (OTCQX:DLAKY), previously the most important holding, has been displaced by actual property platform Scout24 (OTCPK:SCOTF) and luxurious clothes model Hugo Boss (OTCPK:BOSSY) at 3.9%. German protection contractor Rheinmetall (OTCPK:RNMBY), previously the most important holding pre-Q1, has additionally been faraway from the portfolio, with dealing with gear firm Jungheinrich AG’s (OTC:JGHHY) preferreds and braking methods producer Knorr-Bremse AG (OTCPK:KNBHF) rounding up the portfolio top-five.

DWS

Fund Efficiency – Nonetheless on a YTD Uptrend; All Eyes on the Distribution

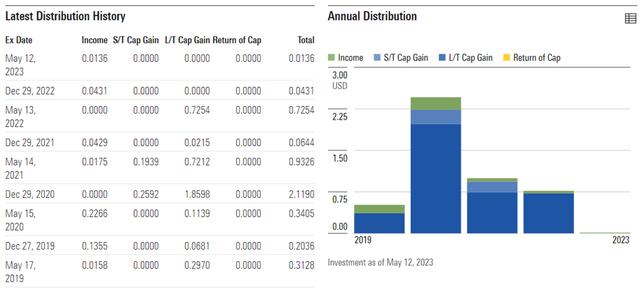

On a YTD foundation, the GF fund’s complete return is as much as +16.4% in market value phrases (+17.6% in NAV phrases), additional reversing the 2022 underperformance. A key contributor to the YTD power is the GF fund benefiting from an improved vitality value atmosphere; given its cyclical energy-intensive sector publicity (observe industrials and supplies are a few of GF’s largest sector allocations), GF has led this 12 months’s rebound. However zooming out, the fund’s monitor document has typically been robust via the cycles – at a high-single-digit complete return since inception, GF has outperformed its composite benchmark (the German Mid and Small Cap indices), in addition to passive alternate options such because the iShares MSCI Germany ETF (EWG).

DWS

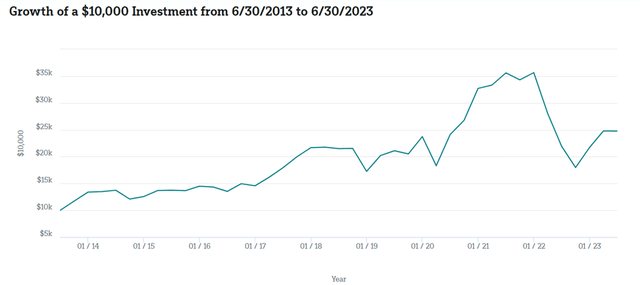

The GF fund’s distribution might disappoint this 12 months, nonetheless. Whereas the earnings portion has positively stunned in Might 2023, the shortage of contribution from quick and long-term beneficial properties poses draw back to the high-single-digit trailing yield. Nonetheless, it stays early days, and with 2023 shaping as much as be a much-improved 12 months for earnings progress, there might nonetheless be upside to the distribution yield within the coming months. An accelerated payout or buybacks would go an extended approach to additional narrowing the cussed mid-teens share NAV low cost.

Morningstar

Indicators of Manufacturing Weak point however Loads of Mitigating Elements

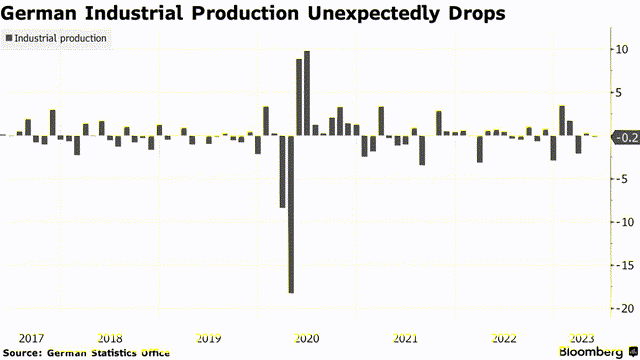

In mild of the declining inflation numbers all through the EU (all the way down to +5.5%) and the US (now at +3%), the worst of the worldwide financial tightening cycle is probably going behind us. However a pivot is not coming anytime quickly, and within the interim, German corporates nonetheless must navigate declining industrial manufacturing and exports amid tighter credit score situations. Main indicators just like the manufacturing PMI are additionally signaling additional contraction forward, shifting all the way down to its lowest ranges for the reason that pandemic. The crux of the difficulty is the continued China slowdown – given Germany’s publicity to Chinese language commerce, primarily by way of capital items, company earnings have suffered in tandem. Nonetheless, there are silver linings to the German outlook. For one, the Q1 GDP report confirmed sequential funding progress regardless of rising rates of interest, highlighting the resilience of German industrials. And with GF’s portfolio corporations sustaining cash-rich steadiness sheets, funding might grow to be much less of a problem than anticipated.

Bloomberg

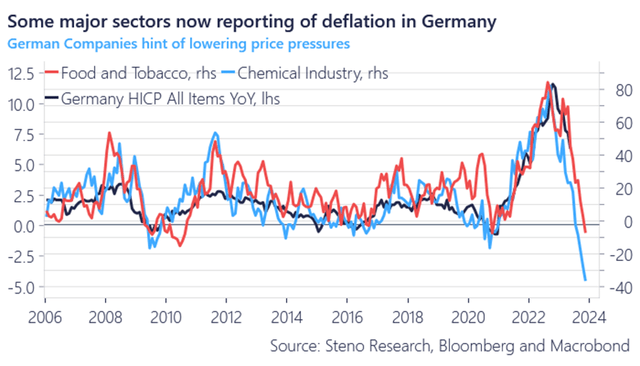

Not like most German large-cap portfolios, which are typically heavy on multinationals moderately than domestically oriented, GF’s mid-cap focus grants the fund distinctive leverage to the home financial system. Additionally notable is the fund’s expanded shopper publicity, which leaves it well-positioned to profit from a restoration of personal and public consumption within the coming quarters. Given the continued labor market tightness in Germany and the ensuing actual disposable earnings progress, in addition to the nation’s extra family financial savings post-pandemic, the buyer ought to stay resilient via any turbulence forward. Mixed with lowered uncertainty and easing inflationary pressures (in some circumstances, even deflation), I count on customers might quickly return as a significant driver. Relative to the present de-rated fairness valuations, a shopper increase bodes properly for the GF portfolio outlook.

Steno Analysis

Conserving the Religion on this German Mid-Cap Fund

For essentially the most half, financial knowledge out of Germany has taken a flip for the more severe, culminating in Germany formally being in recession as of Q1. However for all of the doom and gloom in regards to the state of producing globally, a more in-depth take a look at German industrial knowledge signifies shocking resilience. Not solely are capital items backlogs supporting income progress this 12 months, however investments additionally turned out to be a optimistic contributor to the Q1 GDP print – regardless of the continued financial tightening. And backed by robust steadiness sheets, German company and family resilience stay firmly intact – even with the ECB set to take care of ‘larger for longer’ charges.

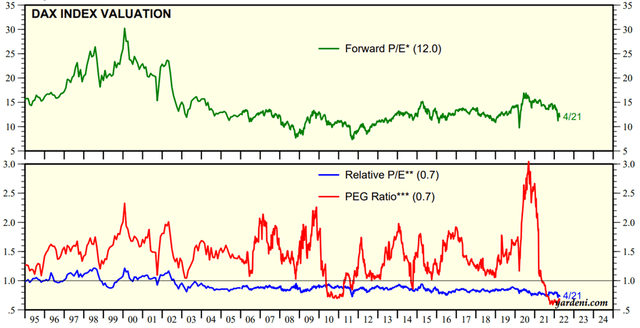

Alongside a fading inflationary impulse, I stay optimistic on the near-term financial outlook; relative to de-rated P/E valuations (utilizing the DAX index as a proxy per the chart beneath), optimistic mid-cap earnings momentum might drive some upside surprises within the coming months. For all its flaws (excessive expense ratio, administration reshuffle, and so on.), GF’s mid-teens share NAV low cost provides buyers compelling publicity to the German restoration by way of the mid-caps.

Yardeni

[ad_2]

Source link