[ad_1]

Up to date on July thirteenth, 2023

The enchantment of progress shares is that they’ve the potential for enormous returns. Take into account the large rally by Tesla, Inc. (TSLA); previously 5 years, the inventory has returned over 1,000% to shareholders. That’s a lifetime of returns for some buyers, and Tesla has performed this in a comparatively brief time period.

The draw back of progress shares is that volatility can work each methods. Tesla has just lately develop into constantly worthwhile, however that was not all the time the case. And the corporate had a mounting debt load, along with share issuances that diluted shareholders to help progress.

Development shares can generate robust returns but in addition carry the burden of excessive expectations attributable to their sky-high valuations, and Tesla is definitely no completely different.

Plus, Tesla doesn’t pay a dividend to shareholders, which can be an necessary issue for revenue buyers to think about. Because of this, we consider revenue buyers in search of decrease volatility ought to take into account high-quality dividend progress shares, such because the Dividend Aristocrats.

The Dividend Aristocrats are a bunch of 67 shares within the S&P 500 Index with 25+ consecutive years of dividend progress. You’ll be able to obtain an Excel spreadsheet of all 67 (with metrics that matter, similar to dividend yield and P/E ratios) by clicking the hyperlink under:

Over time, any firm – even Tesla – may make the choice to start out paying dividends to shareholders if it turns into sufficiently worthwhile. Up to now decade, different expertise corporations, similar to Apple, Inc. (AAPL) and Cisco Methods (CSCO), have initiated quarterly dividends.

These had been as soon as quickly rising shares that matured, and Tesla may observe the identical means in the future.

Nevertheless, the flexibility of an organization to pay a dividend is dependent upon its enterprise mannequin, progress prospects, and monetary place. Even with Tesla’s enormous run-up in share value, whether or not an organization pays a dividend is dependent upon the underlying fundamentals.

Whereas many progress shares have made the transition to dividend shares lately, it’s uncertain that Tesla will be part of the ranks of dividend-paying shares any time quickly.

Enterprise Overview

Tesla was based in 2003 by Martin Eberhard and Marc Tarpenning. The corporate began out as a fledgling electrical automobile maker, however has grown at a particularly excessive price previously a number of years. Tesla’s present market capitalization is above $800 billion, making it a mega-cap inventory.

Amazingly, Tesla’s present market capitalization is greater than seven instances the mixed market caps of auto {industry} friends Ford Motor (F) and Common Motors (GM).

Tesla has a rising lineup of various fashions and value factors and is wanting into increasing that lineup additional to develop into a full-line automaker. Since going public in 2010 at a split-adjusted value of simply $1.13 per share, Tesla has produced virtually unbelievable returns for shareholders in hopes of large future progress, in addition to large progress that has already been achieved.

Since then, it has grown into the chief in electrical autos and enterprise operations in renewable power. Tesla is slated to supply about $103 billion in income in 2023.

Supply: Investor Replace

On April nineteenth, the corporate reported adjusted earnings-per-share of $0.85 for the primary quarter, according to the analysts’ estimates. Earlier than the primary quarter, Tesla had exceeded the analysts’ earnings-per-share estimates for eight consecutive quarters. Consequently, the outcomes of the corporate considerably upset buyers, thus leading to a 2.5% decline of the inventory after the earnings launch.

However, Tesla confirmed that its optimistic enterprise momentum is unbroken. Quarterly income grew 24% over the prior 12 months’s quarter, from $18.8 billion to $23.3 billion. This was the second-highest quarterly income within the historical past of the corporate.

The one caveat was the automotive gross margin, which shrank from 29.1% to 19.3% attributable to excessive value inflation of uncooked supplies, commodities and logistics. On the brilliant facet, we view the problems behind margin compression as short-term and therefore we consider that gross margins ought to rise again above 30% within the comparatively close to future.

Analysts appear to agree on this view. They count on a brief 14% decline in earnings per share this 12 months however a powerful restoration of 44% in 2024, to a brand new all-time excessive degree.

Development Prospects

Tesla’s major progress catalyst is to broaden gross sales of its core product line and generate progress from new autos. The corporate’s S/X platform, which gave it the primary bout of strong progress, has light in reputation, and Tesla is as a substitute centered on ramping up its 3/Y platform.

Certainly, the three/Y platform accounted for about 95% of all deliveries in 2022 and 97% of all deliveries within the first quarter of 2023.

Supply: Press Launch

As well as, Tesla is continuous to develop new fashions, with a pickup truck rumored, a semi-truck, and even a less expensive, extra attainable mannequin than the three.

The corporate has begun delivering its semi-truck as manufacturing of that new automobile begins to ramp up. Will probably be a while earlier than that’s a significant income, nevertheless it’s a very new product line that ought to assist future top-line progress.

Tesla is investing closely in strategic progress by acquisitions in addition to inner funding in new initiatives. First, Tesla acquired SolarCity in 2016 for $2.6 billion.

The corporate can be ramping up automobile manufacturing. Tesla now operates “Gigafactories” in Nevada, New York, Texas, Germany, and China, with extra to return to help its burgeoning demand.

Tesla’s aggressive benefit stems primarily from its best-in-class software program and different applied sciences, together with full self-driving mode.

Supply: Investor Replace

The corporate can be doing its greatest to cut back bottlenecks in its processes and supply instances. Whereas these efforts led to a discount in supply instances in China for its rear-wheel-drive mannequin Y in 2022, as of early 2023, it seems these supply instances have once more elevated from 1-4 weeks to 2-5 weeks. This could possibly be attributable to elevated demand because of current value cuts.

Tesla’s progress in income per share has been nothing wanting excellent. It produced almost 4 hundred instances extra income per share in 2022 than 5 years earlier. That degree of progress is tough to seek out anyplace, which is why Tesla’s shares have carried out so effectively.

Whether or not Tesla can proceed to take care of its excessive progress price is one other query. Administration just lately said that it expects to develop automobile deliveries by 50% per 12 months on common within the upcoming years.

Supply: Investor Replace

Such a progress price is undoubtedly excellent and bodes effectively for the corporate’s future potential. Some buyers could view the steerage of Tesla as too aggressive, however we word that electrical automobile gross sales are rising at a wide ranging tempo. Electrical autos are the clear and unwavering path ahead for cars, and Tesla is the definitive chief within the area.

As well as, greater than another automaker, Tesla has delivered excellent progress 12 months after 12 months. With an increasing product line and its current, confirmed winners, we consider the expansion outlook for the corporate is vibrant.

Will Tesla Pay A Dividend?

Tesla has skilled speedy progress of cargo volumes and income previously a number of years. However in the end, an organization’s capability to pay dividends to shareholders additionally requires success on the underside line.

Whereas Tesla has been the epitome of a progress inventory by its top-line progress and large share value positive factors, its profitability continues to be diminutive in relation to its market cap. To make sure, the inventory is presently buying and selling at greater than 47 instances its anticipated earnings this 12 months.

With out reaching regular profitability, an organization can’t pay dividends to its shareholders. In reality, constantly shedding cash means an organization may have hassle maintaining its doorways open if losses persist over time.

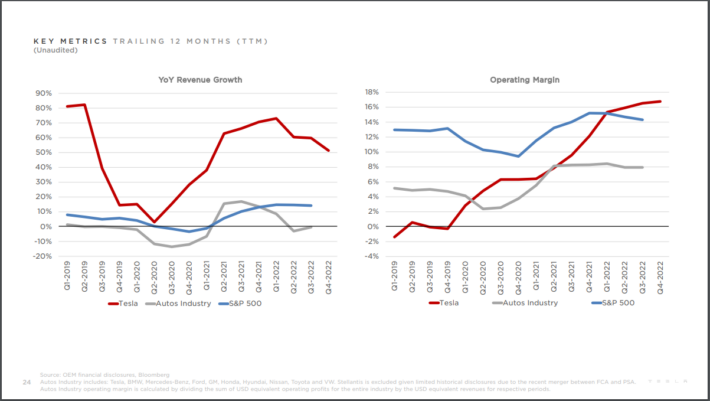

Nevertheless, whereas this was a problem for Tesla, these points appear to have been mounted by ever-rising supply volumes. We are able to see under that the corporate’s working margins have soared in current quarters to an industry-leading 16%+.

Supply: Investor Replace

Tesla misplaced cash because it turned publicly traded again in 2010, up till 2020. It goes with out saying {that a} money-losing firm has to lift capital to proceed to fund operations. To that finish, Tesla has bought shares and issued debt to cowl losses and fund growth lately, each of which make paying a dividend much more tough.

Nevertheless, since 2020, Tesla has quickly expanded its profitability and produced virtually $13 billion in web revenue in 2022. The corporate additionally produced almost that a lot in free money movement, making it a lot simpler to service its debt obligations and keep away from future dilutive share issuances.

Moreover, the corporate doesn’t pay any web curiosity expense, as its curiosity revenue exceeds its curiosity expense. As well as, its long-term debt of $0.8 billion is a small fraction of its earnings. In different phrases, Tesla has improved its profitability a lot that its debt has develop into primarily negligible.

We see the sizable enchancment in profitability and free money movement, in addition to the improved stability sheet, as supportive of the corporate’s capability to finally pay a dividend.

Nevertheless, Tesla continues to be very a lot in hyper-growth mode, and we count on any dividend which may be paid to be a few years away. In different phrases, it’s rather more worthwhile for Tesla to reinvest its earnings in its enterprise than to distribute them to its shareholders.

Even when Tesla determined to provoke a dividend, it could be meaningless for its shareholders as a result of inventory’s excessive valuation.

As an example, if Tesla decides to distribute 30% of its earnings to its shareholders within the type of dividends, the inventory will supply only a ~0.3% dividend yield. Such a yield might be immaterial for the shareholders, however the dividend will deprive the corporate of treasured funds, which could be utilized in high-return progress initiatives.

Tesla’s Inventory Dividend

Tesla’s CEO, Elon Musk, mentioned in early 2022, that he needs Tesla to “enhance within the variety of approved shares of widespread inventory … with a view to allow a inventory cut up of the Firm’s widespread inventory within the type of a inventory dividend.”

Basically, a inventory dividend is the place an organization splits its inventory, and the affect on shareholders is that the corporate’s worth doesn’t change, however the share value is decrease as a result of there are extra excellent shares.

Certainly, Tesla carried out a 3-for-1 cut up on its inventory, which got here into power on August twenty fifth, 2022. Because of this, its excellent share depend rose from 1.155 billion to three.465 billion post-stock dividends, and the inventory value adjusted from about $900 earlier than the cut up to about $300.

A inventory dividend is just not essentially a cloth occasion for shareholders as a result of their relative stake within the firm stays the identical; they’ve extra shares at a cheaper price. Nevertheless, buyers are likely to view inventory dividends and splits as bullish occasions; thus, inventory dividends can set off rallies within the share value.

Last Ideas

Tesla had been among the many market’s hottest shares because the begin of the pandemic, producing an enormous rally that had taken it above a trillion {dollars} in market cap. Shareholders who had the foresight to purchase Tesla in 2019-2020 or earlier have been rewarded with huge returns by a hovering share value.

Nevertheless, buyers in search of dividends and security over the long term ought to in all probability proceed to take a move on Tesla inventory. The corporate appears dedicated to utilizing all of the money movement at its disposal to enhance its operations’ profitability and put money into progress initiatives.

Whereas there’s all the time a chance that Tesla’s large share value rally may regain steam, additionally it is attainable that the inventory may fall. Traders ought to do not forget that volatility can work each methods, and certainly, the shareholders of Tesla had been reminded of this in 2022.

Extra defensive buyers, similar to retirees, who’re primarily involved with defending principal and dividend revenue, ought to as a substitute give attention to high-quality dividend progress shares, such because the Dividend Aristocrats. It’s unlikely that Tesla will ever pay a dividend, or not less than not for a few years.

See the articles under for an evaluation of whether or not different shares that presently don’t pay dividends will in the future pay a dividend:

Will Amazon Ever Pay A Dividend?

Will Shopify Ever Pay A Dividend?

Will PayPal Ever Pay A Dividend?

Will Superior Micro Gadgets Ever Pay A Dividend?

Will Chipotle Ever Pay A Dividend?

In case you are all for discovering extra high-quality dividend progress shares appropriate for long-term funding, the next Certain Dividend databases might be helpful:

The foremost home inventory market indices are one other strong useful resource for locating funding concepts. Certain Dividend compiles the next inventory market databases and updates them month-to-month:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].

[ad_2]

Source link