[ad_1]

gpointstudio/iStock through Getty Photographs

Co-authored with PendragonY.

A Recession is Coming

The subsequent recession is all the time forward; the one query is how far. That’s the nature of our system. There will likely be booms and busts in a perpetual financial cycle. Market booms set up the circumstances for the next market bust. And that bust is important to scrub up the excesses of the final increase.

Normally, a giant increase units the stage for a giant bust or recession. And a small increase is usually indicative of a minor slowdown. The latest growth cycle took us to solely reasonably larger ranges than earlier than the COVID crash. So if the subsequent downturn happens quickly, we will count on it to be comparatively delicate.

The Federal Reserve hikes charges with the intention of slowing down the financial system. In principle, price hikes scale back inflation by making it costlier for shoppers to purchase and making it costlier for corporations to increase. This discourages financial exercise and reduces demand all through the system, which ought to trigger inflation to decelerate.

Over the previous 12 months, we have seen the Fed hike on the quickest tempo in 40 years. Whereas the tempo of price will increase has slowed and is probably going close to the highest, the Fed’s opinions and actions proceed to dominate the market. As we get nearer to 2024, the Fed will proceed to dominate the monetary information and affect the course of the markets, both by price will increase, pauses, or price reductions.

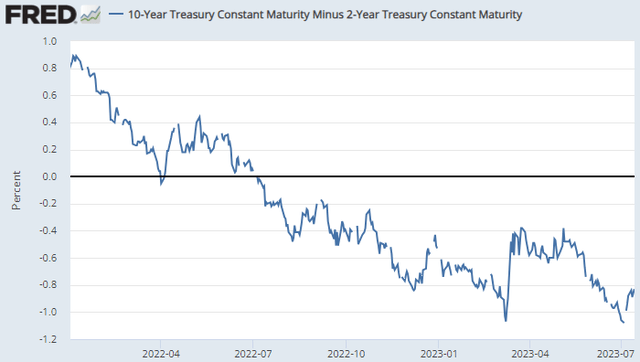

Traditionally, one of the crucial dependable indicators {that a} recession is nearing is the yield curve inverting. An “inverted” yield curve signifies that shorter-term U.S. Treasuries have the next yield than longer-term U.S. Treasuries. Many analysts often watch the 10-year Treasury minus the 2-year Treasury.

The yield curve stays inverted, pointing to a recession beginning in late 2023 or early 2024. Supply.

St. Louis Fed

At Excessive Dividend Alternatives, our focus over the previous 12 months has been figuring out high-yielding alternatives whose distributions are anticipated to be comparatively unimpacted by a recessionary financial system. We’ve been slowly shifting our portfolio right into a extra defensive place, one thing we count on to proceed doing till the subsequent recession begins.

Defending Your Earnings

We see 4 areas with securities able to overlaying and even rising their distributions within the face of a recession. Let’s look at why these areas ought to do properly over the subsequent 6 to 9 months. We will even discuss an instance funding in every space. Let’s dive in!

1) Bonds

Mounted-income investments have two benefits. Costs sometimes expertise decrease volatility than frequent inventory although in excessive occasions just like the COVID crash and quickly rising rates of interest, costs can decline. The first motive bonds defend your portfolio is that the revenue is safer. Not like frequent inventory dividends, the curiosity paid on fixed-income securities is an obligation to the issuer. In the event that they fail to pay, they are often sued. This makes for a extra dependable revenue stream whose significance is bigger when a struggling financial system pressures inventory costs.

Conventional bonds might be intimidating for retail buyers as it’s a must to purchase in $1,000 increments, are normally much less liquid than shares, and are accessed by the “fastened revenue” portion of your brokerage. Child bonds are extra simply accessible for retail buyers and might be an effective way to start out constructing your bond portfolio. Let’s look at child bonds in additional depth.

What are Child Bonds?

Many buyers have restricted information of child bonds or how they differ from common bonds or shares. Institutional buyers have a tendency to remain away from them due to every bond’s small face worth or the tiny problem dimension.

Child bonds are debt securities that commerce on exchanges, like shares, moderately than the normal bond markets. They’ve a typical face worth of $25, a lot smaller than the usual $1,000 for conventional bonds. Child bonds additionally commerce flat, that means the client does not pay the vendor for the accrued curiosity. As a substitute, accrued curiosity is assumed to be included within the safety’s market worth. Child bonds commerce with a “ticker” and might be purchased and bought by the identical interface you purchase frequent or most well-liked equities.

Distributions paid by these debt securities are thought of “curiosity revenue” for tax functions and are NOT eligible for the preferential 15% to twenty% tax price on frequent inventory dividends. Not like the semiannual funds of normal bonds, child bonds sometimes have quarterly curiosity funds.

Oxford Lane Capital Child Bond

Oxford Lane Capital (OXLC) is a Closed-Finish Fund (“CEF”) that primarily invests in collateralized mortgage obligation (“CLO”) fairness. OXLC makes use of most well-liked shares and child bonds to leverage its portfolio and spend money on extra CLO fairness. As with all CEFs, there are regulatory limits on leverage that such funds can make use of. This provides a security layer to the bonds and the popular shares.

Oxford Lane Capital Corp 6.75% Notes due 03/31/2031 (OXLCL) is among the child bonds issued by OXLC. On account of its present discounted pricing at $23.40, OXLCL’s yield to maturity is 8.0%.

The 2 child bonds issued by Oxford Lane, OXLCL and OXLCZ, are senior-most within the CEF’s capital construction. Mixed, they carry a $200 million face worth, with OXLCL representing $100 million of that. This places the bonds forward of a number of most well-liked points that the fund has issued for its leverage necessities.

The frequent inventory can be a part of the HDO portfolio however represents the next threat/reward. For instance, in the course of the COVID crash, whereas the distribution of the frequent shares was reduce, none of the popular points had their funds interrupted. The bonds are even decrease threat. This means the extent of security offered to the infant bond curiosity funds, even in black swan occasions.

Between the low cost to par and the reasonably excessive coupon, OXLCL gives a beneficiant revenue stream that’s a lot safer than the frequent fairness. Simply what one needs because the financial system slows down. OXLCL pays $0.421875 in quarterly curiosity funds. The present worth of round $23.40 produces a beneficiant 7.2% present yield to gather patiently.

2) Most popular Shares

As we progress in the direction of the again half of 2023, we wish to proceed specializing in rising our publicity to fastened revenue. Our perspective is that the Fed is close to the tip of its price will increase, so we’re possible the perfect costs on most well-liked shares. Now’s the time to buy these nice bargains.

Most popular shares are fairness however have precedence over the frequent shares. Most popular shares pay out a pre-determined dividend moderately than paying out regardless of the Board decides to pay out. Whereas most well-liked dividends might be suspended, they should be reinstated if the frequent shares are paid a penny. This gives a extra steady revenue that’s solely suspended when an organization is experiencing misery.

Most popular shares will present a extra steady revenue, significantly when the financial system turns bitter. Earnings stability gives general monetary safety when a recession begins and may also produce money flows to assist the acquisition of different income-producing securities that get discounted by the recession.

At HDO, we encourage members to have a various portfolio of most well-liked shares, with nearly 50 particular person picks in our Mannequin Portfolio. For these seeking to benefit from the present dip in most well-liked costs, pushed by the Fed’s price hikes, most well-liked funds might be an effective way to achieve publicity to most well-liked. Nonetheless, observe that these funds will present the underlying whole return of a most well-liked portfolio; they will not essentially have the identical revenue stability you will get from a portfolio you maintain straight. I would suggest holding these funds along with a fixed-income portfolio, not as an alternative.

PFFA

Virtus InfraCap U.S. Most popular Inventory ETF (PFFA) is an actively managed exchange-traded fund (“ETF”) constructed with a portfolio of most well-liked securities issued by American corporations with over $100 million in market capitalization. The fund focuses on present revenue by deep diversification, with its investments unfold throughout 213 most well-liked points.

PFFA at present pays a month-to-month dividend of $0.165. This calculates to a yearly cost of $1.98. For the reason that COVID crash in 2020, PFFA has modestly elevated its dividend yearly. This produces a really beneficiant yield of 10.0% from this income-oriented sector. The usage of modest leverage ranging between 20-30% enhances the manufacturing of revenue.

3) Power Pipelines

Power was a giant winner final 12 months, and whereas this 12 months has been typically flat, it has been a little bit of a wild journey in its personal approach. The power sector tends to be recession resistant. Regardless of the financial local weather, we have to hold the lights on, warmth our properties, and commute to work or for our errands.

The sanctions imposed on Russia because of the conflict in Ukraine will proceed and would possibly even intensify. The tensions with China would possibly enhance. Europe will proceed to develop its capability to import LNG, and Iran’s unrest may result in sanctions or different disruptions to the worldwide hydrocarbon provide. In response to a slowing world financial system, OPEC+ international locations simply expanded their manufacturing cuts by the tip of the 12 months. Presently, the U.S. is the one main supply of extra manufacturing, and midstream corporations serving the U.S. power trade will do properly underneath such circumstances.

Whereas the power sector tends to be recession-resistant, that is not the similar as recession-proof. Recessions may cause demand disruption, so sticking with corporations that may preserve dividend funds by short-term disruptions is essential.

Antero Midstream

Antero Midstream Company (AM) had a really constructive quarter, producing $46 million in Free Money Circulate (“FCF”) after dividends. Furthermore, administration raised the steering for FCF after dividends by $35 million to a $125-155 million vary.

AM’s purpose coming into FY 2023 was to get the debt-to-EBITDA ratio under 3.5x. Based mostly on present steering, the corporate will exceed that concentrate on with out paying off any debt. The corporate maintains a long-term purpose of 3x debt/EBITDA. Therefore, we do not count on AM to boost its dividend till that purpose is reached.

Presently, AM pays a quarterly dividend of $0.225. This represents a yearly dividend of $0.90 or a 7.4% yield at present costs. It is a stable revenue stream, even when the corporate doesn’t elevate dividends for a couple of years.

4) Company MBS

Proudly owning a house is a big a part of the “American Dream”, and one thing that the U.S. authorities has actively inspired. As a part of making properties extra accessible, government-sponsored enterprises have turn into an integral a part of the U.S. mortgage system. The “businesses” encourage buyers to offer capital for mortgages by guaranteeing them. If a mortgage assured by one of many businesses defaults, the company will purchase it again at par worth. By eradicating credit score threat, there are much more buyers prepared to offer extra capital at a lot decrease rates of interest.

Company MBS (mortgage-backed securities) normally have a barely larger rate of interest than U.S. Treasuries, and the Fed’s aggressive mountain climbing cycle has elevated this distinction. This creates a possibility to get larger coupon MBS at low cost costs. You may spend money on Company MBS straight by your dealer’s bond service and discover yields of 5-6%.

A extra aggressive approach to spend money on company MBS is thru company mortgage REITs. These mREITs spend money on company MBS on a leveraged foundation, permitting them to multiply their return and produce very massive dividends for shareholders. Traditionally, company MBS goes up in worth throughout recessions, whereas short-term rates of interest come down because the Fed cuts. This creates a really bullish surroundings for company mREITs to pay out dramatically larger dividends.

Annaly Capital Administration, Inc

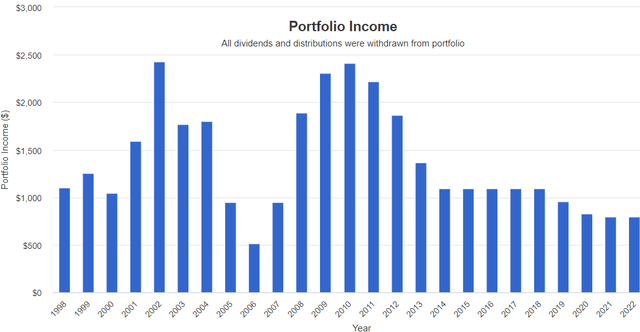

Think about the oldest publicly traded company mREIT, Annaly Capital Administration, Inc (NLY). It has been by the Dot-com bust and the Nice Monetary Disaster. Here’s a have a look at NLY’s dividend historical past with $10,000 invested (assuming no reinvestment). Supply.

Portfolio Visualizer

Be aware that NLY’s dividend has different fairly a bit through the years. A $10,000 funding in 1998 would have produced annual dividends starting from $500 to over $2400.

What’s most fascinating is to notice the timing of the upper dividend years – they had been within the coronary heart of recessions. When the recession is going on, and different corporations are at larger threat of slicing, company mREITs usually tend to be elevating. That is a fantastic function to have in a diversified portfolio – you need some shares which might be doing the other of all the things else!

Conclusion

As we stare into the recession barrel within the upcoming quarters, we count on fixed-income securities (child bonds and most well-liked inventory) from CEFs, and customary inventory in midstream power corporations and company MBS to offer safer revenue streams. Whereas this text presents a couple of enticing areas, a number of different investments are buying and selling at discount costs. We suggest that buyers consider their wants fastidiously and look carefully at every alternative to make sure it aligns with their portfolio objectives.

With the financial system weakening and the Fed altering its hawkish course by pausing the hikes on this previous assembly, it’s essential to be ready for a sudden coverage reversal. Buyers should store for bargains amidst worth volatility; what trades at an inexpensive worth right this moment could also be too costly subsequent week. Or the cut price could turn into extra enticing. We will’t time the market, however fastidiously making small purchases is prudent to deal with the uncertainty.

The 4 picks mentioned on this article current a supply for beneficiant revenue. Even when the recession arrives slower than anticipated, holding these investments offers you common money infusions. And when the recession does come, your revenue is secure, catering to your way of life wants or producing money to purchase extra bargains. This types the idea of the revenue methodology, and that’s the great thing about revenue investing.

[ad_2]

Source link