[ad_1]

(Wednesday market open) Main indexes trip into Tesla’s (TSLA) earnings later in the present day on a protracted profitable streak that carried shares to new 15-month highs yesterday. Hopes for an financial “tender touchdown” based mostly on current optimistic information drove good points.

Buyers seem to anticipate extra optimistic information after the shut from Tesla (NASDAQ:). Its inventory climbed the previous eight buying and selling classes and is up greater than 160% yr thus far. The EV firm misplaced almost 70% in inventory worth in 2022 on account of financial and administration headwinds. See extra on Tesla beneath.

In addition to Tesla, a number of main firms report in the present day, together with Netflix (NASDAQ:), Haliburton (HAL), and U.S. Bancorp (USB). This morning’s earnings from Goldman Sachs (NYSE:) wrap up reporting from the nation’s largest banks, however smaller ones like First Horizon (NYSE:) in the present day and Areas Monetary (NYSE:) later this week might present extra colour on the credit score market and deposits after a number of small banks failed earlier this yr. There’ve been some struggles for regional banks given deposit slippage and better funding prices, however regional financial institution shares rose once more in premarket buying and selling after climbing yesterday.

Don’t overlook Treasuries’ position within the current inventory market upswing. A 20-basis-point plunge in yields since their current highs on July 5 early this month supplied some respiratory room. Stories like yesterday’s June Retail Gross sales, which confirmed moderating client spending, may need performed into concepts that the Federal Reserve may very well be nearing the tip of its rate-increase cycle. The bond market costs in another charge hike this yr and cuts subsequent yr, however quantitative tightening is prone to proceed, says Kathy Jones, Schwab’s chief mounted earnings strategist.

Morning rush

The ten-year Treasury word yield (TNX) fell 4 foundation factors to three.74%.

The ($DXY) climbed to 100.20 amid energy versus the Japanese yen.

Cboe Volatility Index® () futures have been regular at 13.33.

WTI (/CL) jumped to $76.23 per barrel.

Simply in

This morning’s June Housing Begins and Constructing Permits information failed to fulfill analysts’ lofty expectations. Begins of 1.434 million have been wanting the 1.475 million consensus estimate, whereas permits of 1.44 million missed analysts’ forecast of 1.472 million. Moreover, Could’s surprisingly robust begins determine was downwardly revised, although it stays above the long-term development that’s been roughly regular.

Constructing permits is a part of The Convention Board’s Main Financial Index (LEI), the June replace of which is due tomorrow morning. Analysts anticipate a 0.6% slip in LEI, in accordance with Briefing.com. The Main Index has declined in every of the final 14 months.

D.R. Horton (DHI), the most important U.S. house builder by quantity, studies Thursday morning.

Shares in Highlight

Heart stage: Tesla faces excessive expectations charging into this afternoon’s earnings report, having beforehand introduced blockbuster deliveries for Q2. Decrease costs, incentives, and extra fashions helped drive quarterly gross sales throughout the trade, however Tesla seems to have misplaced some market share to rivals, in accordance with analysis agency Cox Automotive. Even so, Tesla delivered 466,000 automobiles final quarter—properly above market expectations of 448,000.

The corporate could face questions on its name concerning stock and pricing, in addition to it plans to maintain these robust deliveries flowing. Tesla lowered costs earlier this yr but in addition noticed its gross margin fall in Q1 to 19.3%. One other factor to hear for is demand from China, the place competitors is heavy and financial progress continues to battle. Tesla might additionally focus on new merchandise after its first, long-awaited Cybertruck pickup mannequin lastly rolled off the meeting line this week.

Consensus estimate on Wall Road is for earnings per share of $0.82 on income of $24.48 billion. The outcomes are anticipated shortly after in the present day’s closing bell.

Slight stumble: Shares of Goldman Sachs misplaced floor early Thursday after the financial institution got here up wanting Wall Road’s common expectations on earnings per share (EPS). Revenues did surpass analysts’ estimates, and the corporate raised its dividend—two elements that may have prevented worse preliminary losses for its shares. The corporate’s Funding Banking enterprise hit velocity bumps through the newest quarter amid a scarcity of company merger and acquisition exercise, hurting income in that section. Buying and selling exercise was additionally a drag, as have been the corporate’s business actual property holdings.

Display share: Netflix additionally studies after the shut in the present day. Shares rallied Tuesday in what may need been anticipation of stronger income and subscriber progress. Final quarter, Netflix projected June quarterly income of $8.2 billion and earnings per share of $2.84, with subscriber progress close to the 1.75 million degree from Q1.

Eye on the Fed

Futures buying and selling signifies a 99.8% chance that the Federal Open Market Committee (FOMC) will increase rates of interest by 25 foundation factors at its assembly subsequent week, in accordance with the CME FedWatch Device.

There’s a rising sense that the anticipated charge hike subsequent week may very well be the ultimate one in every of this cycle, says Collin Martin, a director of mounted earnings technique on the Schwab Heart for Monetary Analysis. Though inflation remains to be elevated, “it’s transferring down in the fitting path,” he provides.

What to Watch

Tomorrow’s key information is June Present Dwelling Gross sales. The report, due out shortly after Thursday’s open, is anticipated to point out gross sales at a seasonally adjusted annual charge of 4.25 million, down from 4.3 million in Could, in accordance with analyst consensus from Briefing.com. Present house gross sales are down sharply from a yr in the past, partly as a result of many individuals are reluctant to promote properties purchased with reasonably priced mortgage charges.

Tomorrow morning additionally brings the federal government’s weekly preliminary jobless claims report. Consensus from Briefing.com is 240,000, up from 237,000 the prior week and close to the center of the current vary.

Speaking technicals: The S&P 500® Index’s (SPX) climb above 4,500 this week places it in shouting distance of a attainable resistance space close to 4,600, the place the index bumped into promoting again in early 2022.

Focusing on inflation: How far more does the Fed have to do to deliver inflation all the way down to its 2% long-term goal? Take a look at the evaluation from Schwab’s specialists within the newest Schwab Market Perspective.

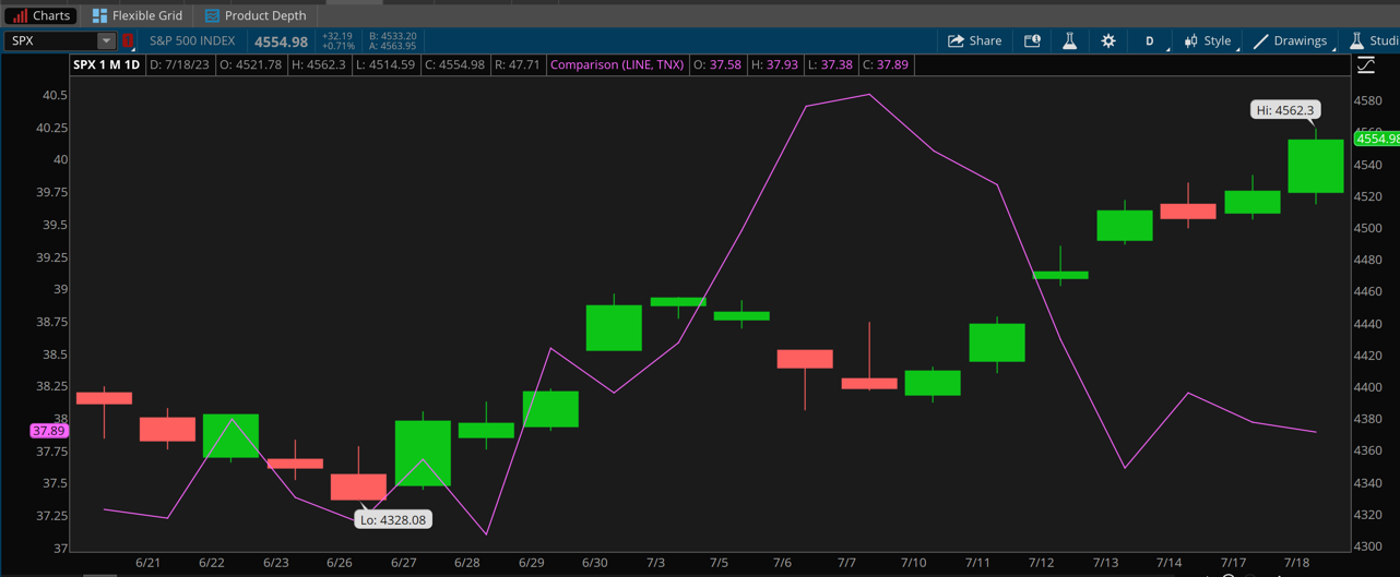

CHART OF THE DAY: SUMMER BREEZE. Cooler winds from 10-year Treasury word yields (TNX—purple line) during the last two weeks may very well be one main pressure serving to main indexes just like the S&P 500 (SPX—candlesticks) march larger. Knowledge sources: S&P Dow Jones Indices, Cboe. Chart supply: The thinkorswim® platform from TD Ameritrade. For illustrative functions solely. Previous efficiency doesn’t assure future outcomes.

Considering cap

Concepts to mull as you commerce or make investments

Mega mania: Tesla’s report in the present day is a reminder that earnings are underway for the so-called mega-cap firms that account for a lot of the SPX’s good points year-to-date. Tesla kicks issues off, adopted subsequent Tuesday by Alphabet (NASDAQ:) and Microsoft (NASDAQ:). Meta Platforms (META) comes proper on their heels subsequent Wednesday, adopted by Amazon (NASDAQ:) on Thursday, July 27. Apple (NASDAQ:) studies within the first week of August. All this might probably inject volatility subsequent week after so many months of relative calm, contemplating the Magnificent Seven collectively type greater than 25% of the SPX’s market capitalization. Any important misses might have an outsized affect on the index, and that’s when traders ought to think about paying shut consideration to particular person sector efficiency for a greater sense of how the opposite 493 SPX shares are doing. At such occasions, it may also be helpful to step again and assess the setting till cooler heads prevail.

Margin name: Revenue margins arguably develop extra necessary from right here, particularly if inflation is really easing. With excessive inflation, firms might typically develop margin by elevating costs together with rivals. That bumped into roadblocks earlier this yr because it turned tougher for firms to justify larger costs. In some circumstances, they confronted rising competitors from discounters. However wages proceed to rise—a value that’s powerful to keep away from. One strategy to develop margin with out alienating clients is thru elevated automation to enhance productiveness. That’s one thing PepsiCo (NASDAQ:) touts whereas acknowledging that larger costs damage demand in its newest quarter, CNBC reported. One other technique is to simply accept barely decrease margin in return for rising the enterprise footprint. That appears to be UnitedHealth’s (NYSE:) method, as margins for its Optum well being providers enterprise continued retreating final quarter even with double-digit gross sales progress. The decline in Optum margin mirrored investments in providers supplied to sufferers and clients to assist progress, the corporate mentioned in its earnings press launch. In a case like this, traders should resolve if they will settle for stress on near-term earnings if it’d gas income and earnings progress over time.

Can’t Purchase? Make investments! A long time in the past, a preferred tv advert featured the corporate’s CEO signing off with the phrases, “I favored (the product) a lot, I purchased the corporate.” The same technique helped Berkshire Hathaway (NYSE:) (BRK.A) Chairperson Warren Buffett make billions. However what for those who can’t purchase the corporate? There are different methods to go in case your takeover bid will get rejected, and chip agency Nvidia (NASDAQ:) seems to be mapping a contemporary route with U.Ok. chipmaker Arm, media studies mentioned final week. Arm is anticipated to go public after Nvidia’s takeover bid didn’t get regulatory approval, and Nvidia is reportedly contemplating an “anchor funding” in Arm’s preliminary public providing (IPO), Barron’s reported. Arm is owned by Japan’s SoftBank. After all, it’s not typically {that a} failed buy results in an IPO permitting an organization to put money into the agency it simply tried to purchase. Nonetheless, it’s an attention-grabbing method as U.S. and European regulators proceed taking a tricky stance on mergers and acquisitions (M&A). Main offers nonetheless on the desk embody Amgen’s (AMGN) proposed buy of Horizon Therapeutics (NASDAQ:), Microsoft’s (MSFT) proposed buy of Activision Blizzard (NASDAQ:), and Kroger’s (KR) of Albertson’s (ACI).

Calendar

July 20: June Present Dwelling Gross sales, June Main Indicators, and anticipated earnings from Abbott Labs (NYSE:), American Airways (NASDAQ:), Philip Morris (NYSE:), Johnson & Johnson (JNJ), D.R. Horton (DHI), Freeport McMoran (FCX), Vacationers (NYSE:), and CSX (NASDAQ:)

July 21: Anticipated earnings from American Categorical (NYSE:), AutoNation (NYSE:), and Areas Monetary (RF)

July 24: Anticipated earnings from Domino’s Pizza (DPZ) and Whirlpool (NYSE:)

July 25: July Client Confidence and anticipated earnings from Alaska Air (NYSE:), Archer Daniels (ADM), Biogen (NASDAQ:), Dow (DOW), Alphabet (GOOGL), Common Electrical (NYSE:), Common Motors (NYSE:), Kimberly-Clark (NYSE:), Verizon (NYSE:), Microsoft (MSFT), and Visa (NYSE:)

July 26: June New Dwelling Gross sales and anticipated earnings from AT&T (T), Boeing (NYSE:), Coca-Cola (NYSE:), Union Pacific (NYSE:), Chipotle (NYSE:), Meta Platforms (META)

Disclosure: TD Ameritrade® commentary for instructional functions solely. Member SIPC. Choices contain dangers and are usually not appropriate for all traders. Please learn Traits and Dangers of Standardized Choices.

[ad_2]

Source link