[ad_1]

Provide chain disruptions have been up 67% in 2020 and 83% % of those disruptions have been brought on by people someplace within the many transferring components that have to work in unison, whether or not on the provider, dealer, financial institution, or producer finish. The pandemic uncovered shortcomings that have been a long time within the making. The significance of how applied sciences can carry provide chain transparency and suppleness is now on the forefront with unprecedented consideration given to visibility and decision-making instruments to make sure that our international, interconnected provide chain stays as resilient as it may be. Leverage is an end-to-end provide chain visibility platform. Constructed with versatility in thoughts, the platform built-in with current methods to supply real-time visibility and automatic buy order and exception visibility leveraging AI. Leverage additionally makes use of AI to anticipate potential stock dangers by monitoring SKUs throughout distribution facilities. Final yr, the platform dealt with over $500M in buy order spend, working with among the world’s largest producers.

AlleyWatch caught up with Leverage Cofounder Nadav Ullman to be taught extra in regards to the enterprise, the corporate’s strategic plans, newest spherical of funding, which brings the corporate’s complete funding to $13.9M, and far, far more…

Who have been your traders and the way a lot did you increase?The $7M spherical was led by Chicago Ventures, with participation from Las Olas Ventures, Tensility Enterprise Companions, Outstanding Ventures, and Florida Funders.

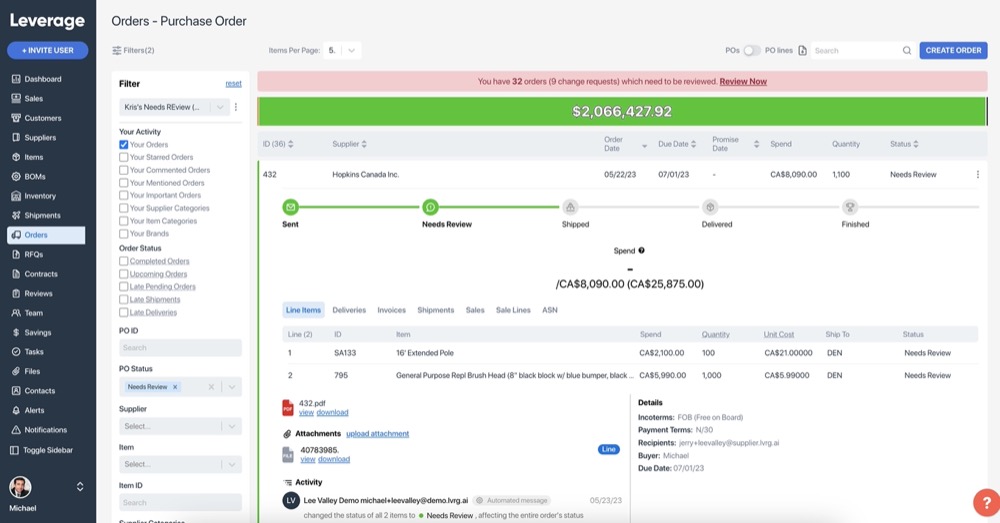

Inform us in regards to the services or products that Leverage gives.Leverage automates the beforehand extremely guide technique of processing buy order statuses from suppliers, whereas offering unprecedented visibility into each real-time and historic lead instances and prices for the merchandise they order. Provide chain groups can now lastly reply the elemental query, “The place’s my stuff?”

What impressed the beginning of Leverage? In March 2020, my cofounder Andrew Stroup and I began a nonprofit referred to as Mission N95.

In March 2020, my cofounder Andrew Stroup and I began a nonprofit referred to as Mission N95.

What began out as a number of Google types to assist join PPE suppliers to frontline employees, the non-profit turned the nationwide clearinghouse for vetted PPE through the peak of the PPE crises. The group grew to over 250 folks within the first 3 months, hiring of us targeted on vetting and distributing tens of millions of models of PPE to frontline employees from international suppliers

Mission N95 turned the first group within the nation vetting PPE from world wide, in addition to the go-to sourcing arm for the White Home.

The rationale we needed to construct such a big workforce there’s as a result of there was no good expertise the place our orders have been.

Because the PPE crises normalized, and PPE vetted went from a scarcity to an oversupply, we then got down to construct Leverage, to assist the broader provide chain area modernize these area processes.

How is Leverage completely different?At this time, producers who don’t use Leverage should gather standing updates from a worldwide provider base by manually making telephone calls and sending emails. Then, they take that knowledge and replace a spreadsheet or inner system of file. It’s extremely pricey, unreliable, and the dearth of constant order visibility finally results in sad clients and misplaced income.Leverage totally automates this workflow for them, which gives day-one ROI by automating guide workflows, in addition to company-wide visibility on how their clients and gross sales could also be impacted by their provide chain operations.

What market does Leverage goal and the way huge is it?Leverage targets firms with materials provide chain organizations. Our buyer verticals in the present day vary from attire to furnishings to industrial electronics. It’s roughly a $75B business that’s rising shortly. So, it’s fairly big- lots of alternatives for Leverage to make an influence on a worldwide scale.

What’s your online business mannequin?We’re a traditional subscription SaaS, with a pre-built platform that’s all primarily based on the cloud and able to use. Our clients pay an ongoing license price to make use of that platform, which retains us all aligned.

How are you getting ready for a possible financial slowdown?The macro state of affairs is certainly impacting lots of startups, relying on their business and enterprise mannequin.For example, I feel if I have been working a crypto or VR firm or a client product that hoped to determine income later, I’d be pondering actually exhausting in regards to the shifting appetites of capital allocators.We’ve been income producing since month one and are in an business that will likely be round without end. And the issue we’re fixing isn’t speculative – we’re offering the expertise to raised transfer issues world wide. The present volatility is in actual fact rising producers’ curiosity find options to seek out efficiencies and value financial savings with expertise.

We’ll after all follow prudent monetary administration, however being lean is in our DNA anyway. If we keep laser-focused on fixing our clients’ wants then I feel we’ll proceed to construct an ideal enterprise over the long run.

What was the funding course of like?Chicago Ventures led this spherical and they’re absolute professionals. After they have conviction in a workforce and firm, they transfer tremendous shortly. The remainder of the spherical was then oversubscribed from participation from a lot of our prior traders. We elevated the dimensions by about $1M alongside the way in which in roughly 5 weeks, together with paperwork. Shout-out to Peter Christman at Chicago Ventures.

What are the most important challenges that you just confronted whereas elevating capital?Since there’s lots of uncertainty within the startup and enterprise group, we weren’t positive what was going to occur getting into. There are fewer rounds closing partially as a result of nobody is aware of how one can value offers proper now. We finally determined to come back out with a good value on day one.

What elements about your online business led your traders to jot down the verify?I feel primarily, it’s the worth that we’re bringing our clients every single day – how a lot we’re really capable of assist them out. You communicate to some of our clients who all let you know “I’m getting 15x ROI on this platform, and earlier than this, we had no visibility on our buy order statuses, lead instances, prices and so on.”Then you definately understand the whole international provide chain has been working this identical precise manner. The scale of the issue we’re fixing begins to grow to be fairly clear, and it’s simple to get enthusiastic about being part of the journey.Provide chain is an inherently messy area, so kudos to our traders who picked up on this all fairly shortly.

What are the milestones you intend to attain within the subsequent six months?There’s a ton to do. We’ve an enormous product roadmap that features lots of novel functions of AI to area, which we’ll be excited to announce once we get there. We’ve lots of key hires to make throughout engineering, help, and gross sales. Based mostly on the demand and our gross sales pipeline, we’ll be investing at the beginning in guaranteeing our incoming clients are profitable.

What recommendation are you able to provide firms in New York that shouldn’t have a contemporary injection of capital within the financial institution?Simply don’t get distracted by the most recent zeitgeist or hype. Resolve your clients’ precise issues.

The place do you see the corporate going now over the close to time period?We’re going deep, not broad, so to talk. The issue we’re fixing—to automate provider visibility—is big. The problem will likely be to focus. In case you look throughout the provision chain operations, there’s a sea of inefficiencies that our clients are all the time asking our assist to resolve, so it will be simple to get distracted. Our job is to ensure we’re constructing what is really most impactful for them, and to be one of the best at what we doTo do it proper, it’ll be vital to proceed to rent, retain, and empower a champion workforce. Simpler stated than performed!

What’s your favourite summer season vacation spot in and across the metropolis?Going for runs down the Hudson River Park is fairly exhausting to beat.

You might be seconds away from signing up for the most well liked record in Tech!

Enroll in the present day

[ad_2]

Source link