[ad_1]

hapabapa/iStock Editorial through Getty Photos

Funding thesis

Our present funding thesis is:

Puma is a number one enterprise within the sportswear section resulting from its extremely regarded model however has no clear benefit relative to its main friends. Income development is enhancing and appears sustainable, pushed by its high quality product providing within the informal section, alongside trade tailwinds. Relative to friends, Puma’s margin weak point is evident to see, with doubtlessly one other quarter of abrasion as inventory is quickly bought. Puma appears barely undervalued however there is no such thing as a materials worth mechanism at present.

Firm description

Puma (OTCPK:PMMAF) is a globally acknowledged German sportswear model that designs, manufactures, and markets footwear, attire, and equipment for athletes and sports activities fans. With a wealthy heritage courting again to 1948, Puma has established itself as a number one participant within the sports activities and life-style market.

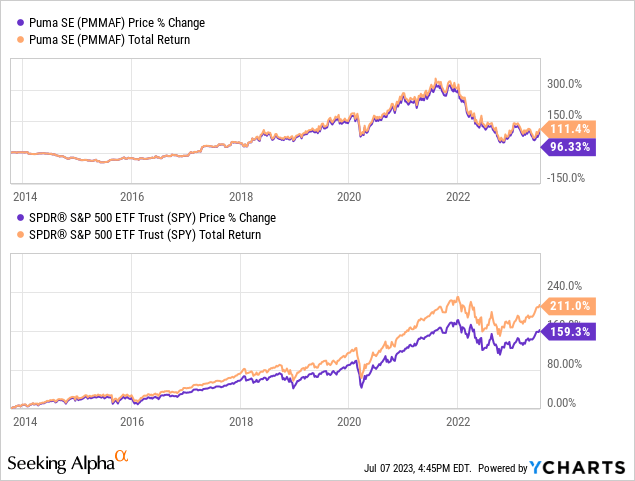

Share value

Puma’s share value has underperformed the market, due partially to inconsistent monetary efficiency and a extremely aggressive trade. Regardless of this, Puma has usually improved all through the interval.

Monetary evaluation

Puma financials (Capital IQ)

Introduced above is Puma’s monetary efficiency for the final decade.

Income & Industrial Components

Puma’s income has grown at a CAGR of 10% over the last 10 years, a powerful achievement in what’s a mature trade. Throughout this era, income development has been risky, with 3 durations of decline.

Enterprise Mannequin

Puma affords a various vary of athletic footwear, attire, and equipment throughout varied sports activities classes, together with soccer, operating, coaching, basketball, and golf. The corporate has an extended historical past courting to its basis alongside sister model adidas (OTCQX:ADDYY).

The corporate has a robust presence in Europe however has aggressively expanded abroad, notably within the Americas and Asia, creating a really diversified enterprise throughout merchandise and geographies. In the previous couple of quarters, Puma has achieved constant development throughout all key markets excluding China, reflecting its world energy.

Gross sales development by geography (Puma)

The weak point in China is a mirrored image of the nation’s zero-covid coverage which was in place till late 2022. This prompted vital disruption to the nation via varied lockdowns, miserable demand. As this has now been completely lifted, we imagine demand will slowly enhance within the coming quarters, representing a near-term tailwind for Puma.

The corporate positions itself as a performance-oriented model that mixes performance, innovation, and elegance to fulfill the wants of athletes and shoppers in search of an energetic life-style. This can be a technique carried out by a lot of its friends, because the efficiency focus acts as a proof of capabilities to draw the mass market. Most shoppers are targeted on model, with Puma doing a great job of manufacturing a spread of trendy merchandise within the DNA of its athletic items. Compared to its friends, we imagine Puma is creating enticing merchandise, which is illustrated by the under graph, exhibiting an enchancment in shopper engagement. This has been enhanced by restricted version collabs, a technique that has been extremely profitable for a lot of in the previous couple of years.

Puma (Google Tendencies)

Operationally, Puma sells its merchandise via varied channels, together with company-owned shops, e-commerce platforms, and impartial retailers. In a extremely aggressive trade, shelf house is important to shopper visibility as shoppers buying on-line and in-store will usually evaluate the alternatives offered to them. This stated, companies (together with Puma) are more and more in search of to develop their very own distribution channels. The advantage of that is that Puma can minimize out the intermediary, enhancing its gross sales economics. This has been doable resulting from its world manufacturing community.

Puma strategically invests in advertising campaigns and sponsorships to boost model visibility and join with goal shoppers. The corporate is at present partnered with a number of soccer groups, F1 groups, Golf and Basketball athletes, in addition to a variety of different sports activities. This provides the enterprise vital publicity to shoppers globally, creating the model and its affiliation with athleticism. The latest uptick in F1 viewership has doubtless contributed to Puma’s improved efficiency, illustrating the success potential of creating strategic gambles in a section its rivals lack publicity.

Aggressive Positioning

We imagine Puma has two key aggressive benefits.

Puma has a market-leading model, with a robust affiliation with sports activities and athletics, in addition to high-quality. That is constructed on the corporate’s heritage of being a number one participant within the trade, alongside its model partnerships that act as a stamp of approval.

Secondly, the corporate has a confirmed monitor file of profitable product growth, primarily resulting from its present personnel and deep catalog of previous designs to make use of as inspiration. These designs have proven themselves to be enticing to shoppers and positioned properly to reply to altering shopper pursuits.

General, we imagine Puma’s enterprise mannequin is powerful. The corporate is persistently creating its merchandise to stay aligned with shopper pursuits, it’s investing closely in advertising to enhance its model, it’s increasing globally, and maintains operational excellence. Our key concern is that nothing it’s doing is materially above-and-beyond what its giant friends are. The enterprise is basically working a parallel technique however at a smaller scale (and thus with small sources), with variations in gross sales within the close to time period pushed by the energy of the present product providing.

Attire Trade

Firms within the trade differentiate themselves via product innovation, model picture, pricing methods, and advertising. Puma faces competitors from different world sportswear manufacturers similar to NIKE (NKE), Adidas, Below Armour (UA), Lululemon (LULU), ANTA (OTCPK:ANPDY), and New Steadiness. As a result of variety of giant friends, profitable unique sponsorships is very aggressive. Soccer, for instance, is dominated by Nike and adidas.

We imagine there are a number of developments driving improved development available in the market.

Growing give attention to health and well-being is contributing to heightened demand for sports activities attire and footwear, as shoppers are closely influenced by socioeconomic situations which can be encouraging bodily well being.

With a better variety of folks concerned in actions, we now have seen the convergence of sportswear and vogue, as shoppers search snug but fashionable attire (the important issue is versatility). As we mentioned beforehand, Puma has transitioned properly to this, focusing an increasing number of on model visibly, however using its core innovation methods (similar to supplies) to take care of operate.

Digital transformation and the rise of on-line buying platforms supply new alternatives for producing direct-to-consumer gross sales. Puma’s response has been to develop its web site and app to be extra user-friendly and aesthetically pleasing.

Financial & Exterior Consideration

Present financial situations characterize a near-term threat to the enterprise. With heightened charges and excessive inflation, shoppers are deterred from making discretionary purchases. This stated, the present financial weak point is not like earlier downturns, with employment remaining excessive, wage inflation being current, and shopper demand remaining resilient.

In the newest quarter, Puma achieved a powerful YoY development fee of 14%, implying demand is wholesome. It’s troublesome to evaluate if it will proceed given the uncertainty, nonetheless, a decline is trying more and more unlikely.

Margins

Traditionally, Puma’s margins have been risky, though the final trajectory is upward, with EBITDA-M enhancing to 9%. Apparently, Puma has skilled a decline in GPM from its 10Y excessive whereas offsetting this via a discount in S&A spending.

The latest GPM erosion is a mirrored image of inflationary pressures, alongside the unwinding of its built-up stock. This could normalize within the coming quarters however stays a regarding growth. This could enable the enterprise to persistently obtain an EBITDA-M of c.10%.

Steadiness sheet & Money Flows

As beforehand talked about, Puma has mismanaged its stock, contributing to a build-up, as illustrated by its decline in stock turnover. The chance right here is that this inventory is bought at a reduction and is problematic as a result of money dedication. Administration doubtless wants yet one more quarter to succeed in a wholesome stage, implying an enchancment in money stream is forward, though margins might quickly slip additional.

Stock (Puma)

Puma’s distributions to shareholders as been minimal and scarce, primarily resulting from its low FCF-M.

Outlook

Outlook (Capital IQ)

Introduced above is Wall Road’s consensus view on the approaching 5 years.

Analysts are forecasting a continuation of Puma’s enticing development, with a mean fee of 9%. This appears cheap based mostly on the trajectory to this point, particularly if situations enhance in China, a key marketplace for the enterprise.

Additional, margins are anticipated to enhance in FY24F following an inventory-led decline of 0.6ppts in FY23F.

Trade evaluation

Attire trade (Searching for Alpha)

Introduced above is a comparability of Puma’s development and profitability to the typical of the Attire, Equipment, and Luxurious Items trade, as outlined by Searching for Alpha (33 firms).

Puma performs properly from a development perspective, having achieved nearly double the speed on a 3Y and 5Y foundation. This stated, the delta is predicted to shut on a ahead foundation to parity.

Puma’s key space of weak point is its margins, with a noticeable delta to the typical. Even when Puma achieves an enchancment of 1-3%, it’ll stay at a deficit.

Primarily based on this, we imagine Puma ought to commerce at a small low cost to the valuation of its peer group. Given this can be a mature trade, we favor margins to development. This stated, as the expansion forecast over 5 years is near 10%, we imagine the low cost shouldn’t be overly extreme.

Valuation

Valuation (Capital IQ)

Puma is at present buying and selling at 13x LTM EBITDA and 9x NTM EBITDA. This can be a low cost to its historic common.

Puma’s historic buying and selling vary has been extremely risky, with a number of durations of huge a number of enlargement resulting from varied short-term points. Because of this, we don’t put a lot weight towards its historic buying and selling low cost, though imagine the enterprise is probably going at a small low cost. We imagine its truthful worth relative to its historic common could be a slight premium, given the improved development trajectory and margin enchancment.

In comparison with its friends, Puma is buying and selling at a 12% low cost on an LTM EBITDA foundation, however an 11% premium on a NTM EBITDA foundation. This can be a reflection of its poor bottom-line margins. Given our evaluation above, it suggests Puma is buying and selling on the small low cost anticipated.

General, if each factors are taken in conjunction, it’s doubtless there’s small upside with Puma, though its efficiency volatility makes this troublesome to cleanly assess.

Closing ideas

Puma operates in a extremely aggressive trade, with no clear superiority over its straight comparable friends however a horny market place behind the likes of Nike. It appears to be on an improved trajectory, with development enhancing and margins set to succeed in a decade excessive within the coming 12-24 months.

Puma’s relative place to friends implies no materials upside, though is probably going barely undervalued. Given the dearth of clear worth, we imagine there are higher choices for traders’ consideration.

Editor’s Be aware: This text discusses a number of securities that don’t commerce on a significant U.S. trade. Please pay attention to the dangers related to these shares.

[ad_2]

Source link