[ad_1]

Tim Boyle

Funding Thesis

Firm Overview

Whirlpool Company (“Whirlpool”), based in 1911 with headquarters in Benton Constitution Township, Michigan, is likely one of the greatest world kitchen and laundry tools suppliers on the planet.

Earnings Overview

From Whirlpool’s Q2 earnings report, the corporate’s internet gross sales up by 3.1% QoQ however down 6% YoY. Web earnings had been $85 million, higher than the adverse $179 million losses of Q1 and $371 million losses of Q2 final yr. Each its working money stream and free money stream had been down by $190 million YoY. Total, it is a combined bag outcomes however tilted to the draw back. We are going to dig into its fundamentals to evaluate.

Power

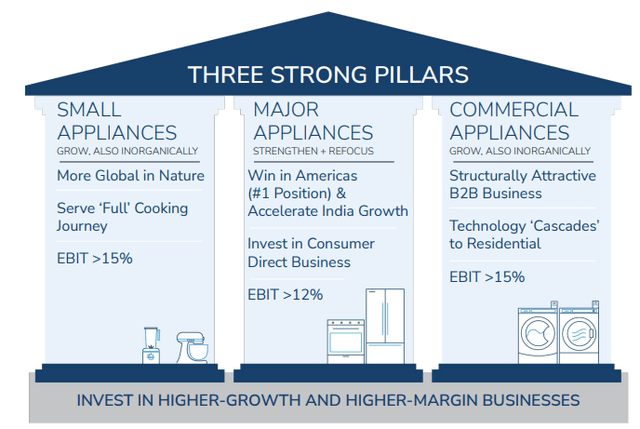

The three pillars of progress for Whirlpool are Small Home equipment, Main Home equipment and Industrial Home equipment in kitchen and laundry capability.

From Firm 2023 Presentation

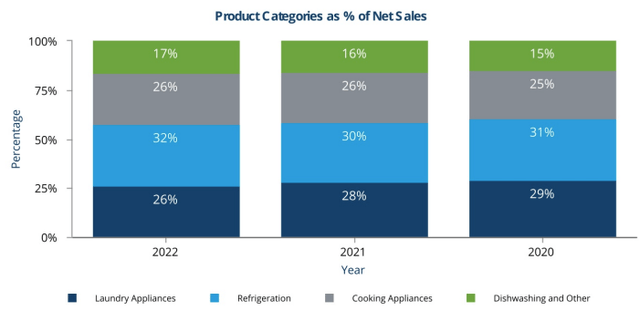

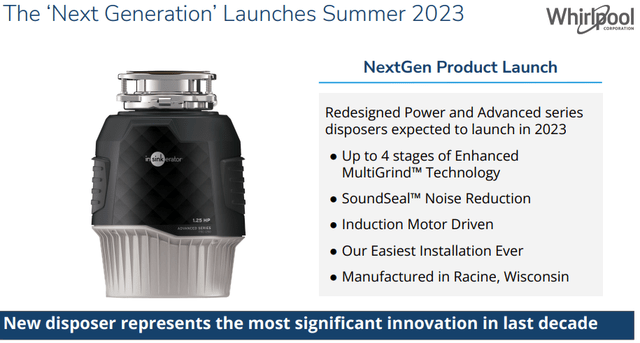

In This autumn of 2022, Whirlpool acquired InSinkErator, the world’s largest producer of meals waste disposers and immediate sizzling water dispensers. It hasn’t disclosed all of the monetary phrases but and expects inside a yr from the announcement date the financials shall be reconciled. But it surely did report that it has used $2.5 billion from its credit score facility to fund this acquisition. This goals at increasing the general product portfolio whereas boosting “Dishwashing and Different” from its internet gross sales class. That is the smallest product class for the corporate.

whr (From 2022 10K)

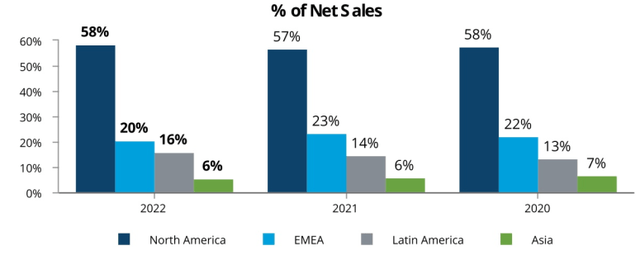

Regionally, Whirlpool continued to see the most important contribution from North America whereas slight progress from Latin America. The corporate has divested investments from China and Turkey in 2021 and Russia in 2022. It is usually anticipated to have divesture from main European home equipment companies in 2H of 2023. North American market’s presence in its gross sales channel shall be ever extra pronounced. From its Q2 earnings report, the EBIT progress had been strongest in EMEA at 750% YoY, however North America was down by 30% YoY. Whereas the web gross sales has solely seen progress of 4.1% in Latin America, with the remainder of the areas declined by 4.7% in North America to fifteen.3% in EMEA.

whr (From 2022 10K)

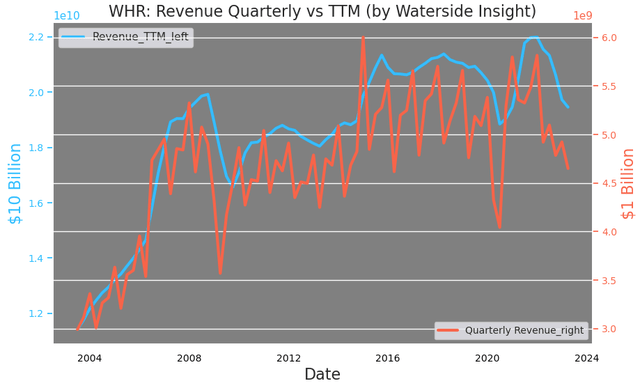

The corporate’s income has been normalized from the pandemic increase. Though it’s not in a very sturdy place, the present stage is concerning the common of the previous ten years on a TTM foundation. It anticipated InSinkErator will present $550 million carry in income for 2023 fiscal yr.

Whirlpool: Income (Calculated and charted by Waterside Perception with information from firm)

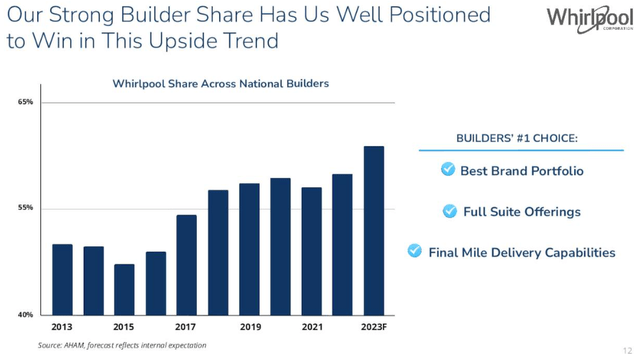

Behind the top-line progress is Whirlpool’s sturdy shares amongst homebuilders. It takes over 60% of the full market shares throughout nationwide builders.

whr (whr)

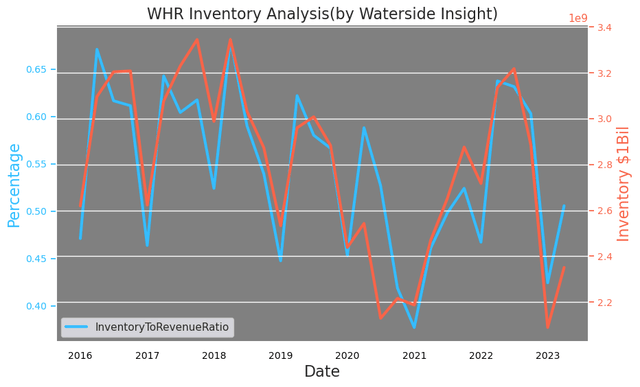

The corporate has overcome the upper stock ranges from late 2021 to early 2022, and has managed to chop it by nearly 30% since then.

Whirlpool: Stock (Calculated and charted by Waterside Perception with information from firm)

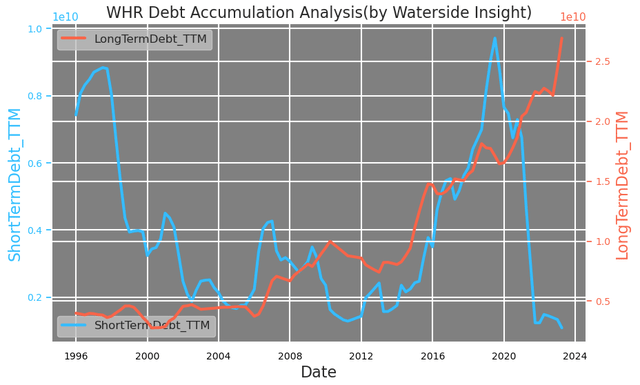

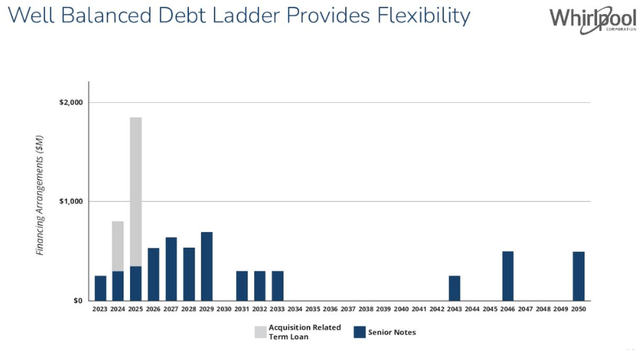

Its debt construction has a serious overhaul in comparison with even simply three years in the past. Its short-term debt has been drastically lowered, changed principally with long-term debt. That is on the heel of its acquisition of InSinkErator.

Whirlpool: Debt Accumulation Evaluation (Calculated and charted by Waterside Perception with information from firm)

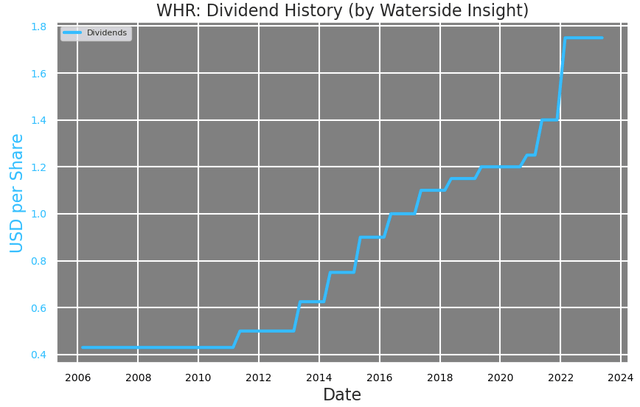

Whirlpool is in its highest dividend payout prior to now three many years.

Whirlpool: Dividend Historical past (Calculated and charted by Waterside Perception with information from firm)

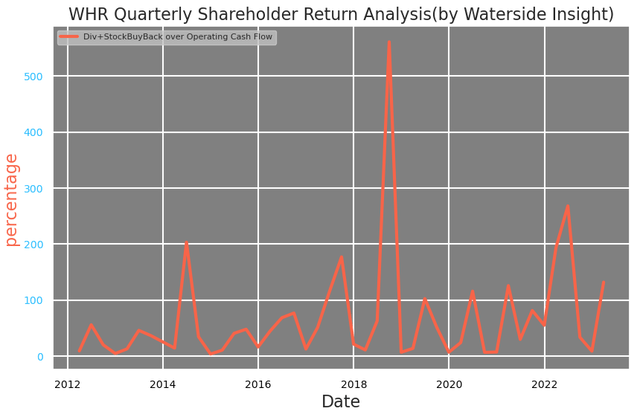

The corporate has held regular and common returns to the shareholders over time, with its dividends payout mixed with share buybacks round 100% of its working money stream. This ratio was as excessive as 2.5x in early 2022.

Whirlpool: Quarterly Shareholder Return (Calculated and charted by Waterside Perception with information from firm)

Coming quickly this summer season is its “Subsequent Gen” disposer launch. We anticipate the approaching earnings report might make an announcement on this regard or set a date.

whr (From Firm 2023 Presentation)

Weak point/Dangers

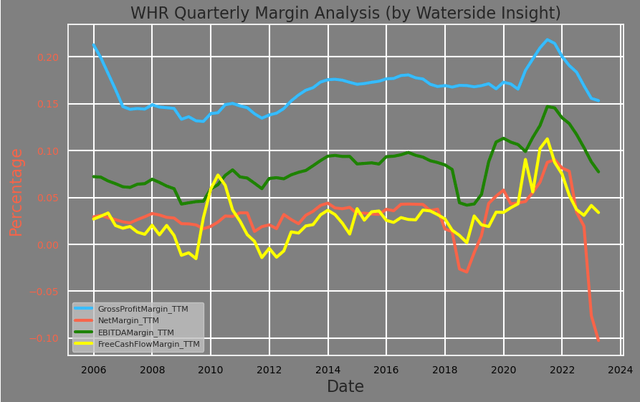

Most of Whirlpool’s margins are normalizing again to their ranges in 2019 from the heights they reached prior to now two years. However amongst all of the margins, its internet margin has struck a steep decline. On a TTM foundation, its internet margin was nearly adverse 10% within the newest quarter.

Whirlpool: Quarterly Margins (Calculated and charted by Waterside Perception with information from firm)

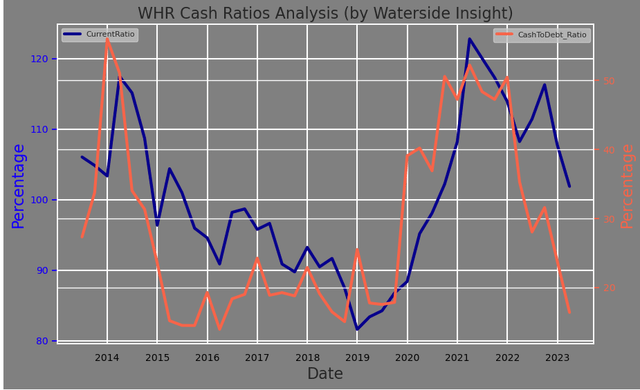

Its present ratio remains to be above 1x, however its cash-to-debt ratio has fallen to solely 20%. It has been right here earlier than, for nearly 5 years earlier than 2020. However nonetheless, given the completely different rate of interest atmosphere, it’s not the most effective place to be in for the corporate.

Whirlpool: Money Ratios (Calculated and charted by Waterside Perception with information from firm)

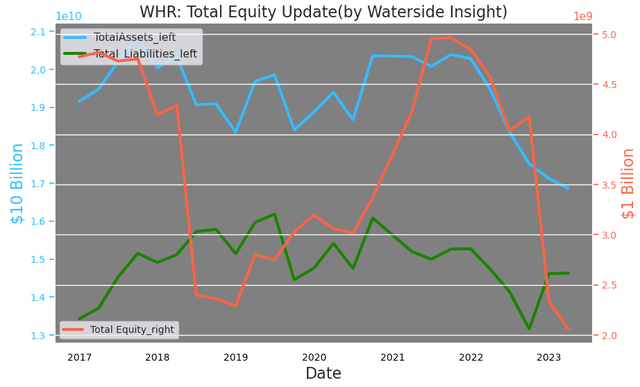

Whole fairness has fallen to about $2.2 billion, among the lowest ranges. As we alluded to earlier that its debt construction was revamped and mirrored a greater composition of brief and long-term debt, however little question the acquisition nonetheless elevated its complete liabilities. Alternatively, its declining complete property have begun since early 2022, from $20.8 billion right down to final quarter’s $16.8 billion.

Whirlpool: Whole Fairness Replace (Calculated and charted by Waterside Perception with information from firm)

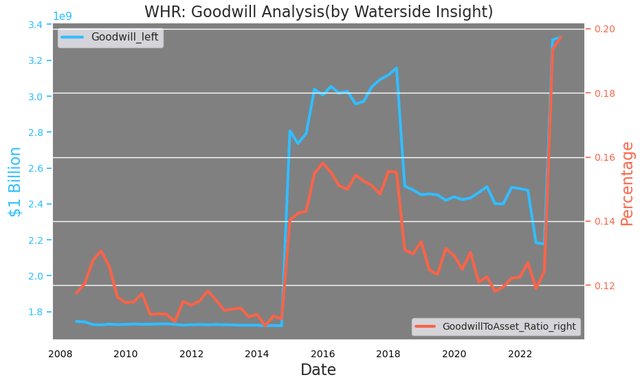

And Whirlpool’s goodwill now accounts for 20% of its complete asset. In accordance with its 2022 annual report, this improve in its goodwill is primarily pushed by the InSinkErator acquisition, after a partial offset from the complete impairment of EMEA goodwill in Q2 of 2022. Whirlpool has a powerful model popularity, however this addition has introduced its goodwill to the very best stage traditionally. Future impairment could possibly be anticipated.

Whirlpool: goodwill evaluation (Calculated and charted by Waterside Perception with information from firm)

Massive Image

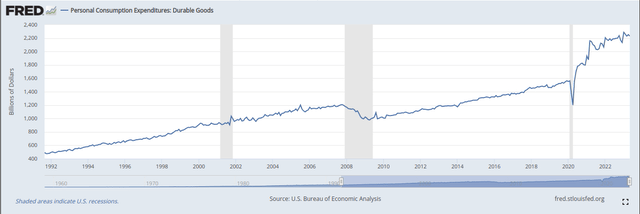

From the macro perspective, the expansion of non-public consumption expenditure of sturdy items has stalled because the starting of 2022, though it’s at present at one of many highest ranges and nearly 50% increased in comparison with the tip of 2019.

Private Consumption Expenditure: Sturdy Items (From FRED)

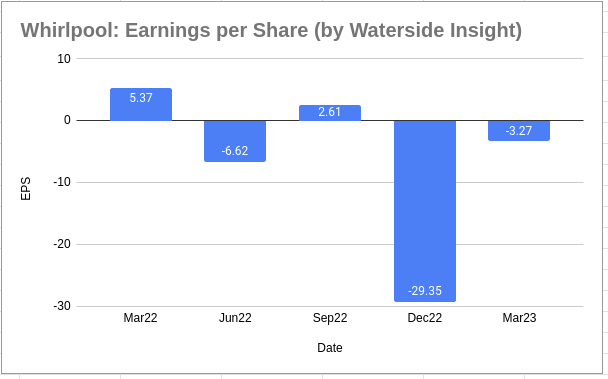

In the mean time, Whirlpool’s earnings-per-share had been already exhibiting indicators of stress throughout this time. Its full-year earnings-per-share of 2022 had been adverse $27.18. If the large ticket merchandise spending goes into decline, the corporate is in a susceptible place to defend its earnings and financials.

Whirlpool: Earnings-per-share (Charted by Waterside Perception with information from firm)

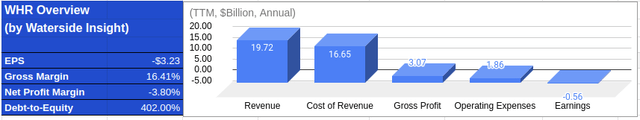

Monetary Overview

Whirlpool: Monetary Overview (Calculated and charted by Waterside Perception with information from firm)

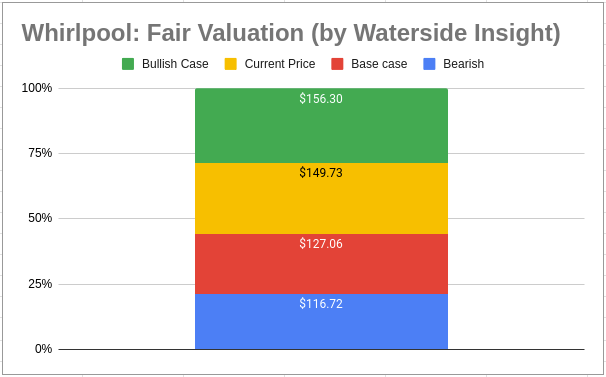

Valuation

Based mostly on our evaluation above, we use our proprietary fashions to evaluate the truthful worth of Whirlpool by projecting its progress ten-year ahead. We assumed Price of Fairness to be 7.95% and WACC to be 8.54%. In our base case, Whirlpool has double-digit declines within the free money stream in ’23 and ’24, adopted by a normalized progress path just like its pre-pandemic period; it was priced at $127.06.

Whirlpool: Truthful Valuation (Calculated and Charted by Waterside Perception with information from firm)

Within the bullish case, much less decline in contrast with the bottom case was anticipated within the close to time period whereas every part else is identical; it was priced at $165.37. Within the bearish case, extra volatility down the street than the bottom case was anticipated as a result of long-term debt fee’s construction, though the expansion path stays secure; it was priced at $116.72.

Whirlpool: Debt Ladder (Firm Presentation Q2 2023)

Conclusion

Whirlpool has sturdy model recognition in households and business areas. The previous three years residential property booms have introduced its income and earnings to new highs. However the normalization of this cycle has begun in 2022, with each its toplines and margins seeing a decline. Its latest acquisition aiming at increasing its kitchen portfolio with a powerful model addition will create extra progress alternatives in the long run, however with the decline in internet earnings, complete fairness and with tepid money stream, we see extra draw back dangers than upside at this level. The advice shall be a maintain on the present ranges.

[ad_2]

Source link