[ad_1]

There are a number of forms of charts that you need to use within the monetary market. What is just not recognized nicely by new merchants is on the significance of those charts.

You’ll be able to have a great instance of this within the chart under.

The chart exhibits a line graph of the USD/JPY pair and a candlestick chart of the EUR/USD pair. These two charts are obligatory!

The road chart is an effective one to point out the pattern of the pair. Nonetheless, it doesn’t inform merchants what to do. As such, it’s not a helpful chart to make use of when buying and selling.

That is not like candlesticks, that are the most well-liked charts. Different forms of charts you’ll encounter available in the market are bar charts, step strains, histograms, circles, renko, and columns amongst others.

On this article, we are going to spotlight a number of the finest candlestick patterns and the way to use them available in the market.

What’s a Candlestick Chart?

Japanese candlestick patterns are a number of the oldest forms of charts. These charts have been found a whole lot of years in the past in Japan, the place they have been used within the rice market. Right now, these charts are the default while you open most buying and selling software program (Ppro8 too!).

Candlesticks are vital charts utilized by monetary merchants and traders. They’re probably the most most well-liked charts available in the market since, not like line and bar charts, candlesticks present extra particulars about an asset value.

Transient Historical past of candlesticks

Candlesticks have been used for an extended interval than you assume. They have been initially utilized in Japan by rice merchants within the 1600s. On the time, these retailers and merchants relied on these charts to know the general pattern after which predict the long run costs.

Right now, candlesticks are used broadly within the monetary markets by each short-term merchants and traders. They’re normally very best as a result of they supply extra particulars. For instance, a line chart exhibits both the closing or opening costs whereas renko ignores the vital time issue of an asset.

Components of a Candlestick

Within the first chart above, you possibly can see {that a} line chart is fairly fundamental. It’s only a line. Not like a line chart, a candlestick has extra elements that assist merchants know when to purchase and when to promote.

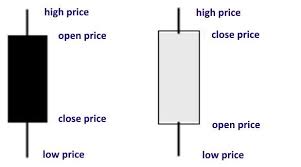

That is proven within the picture under.

The 2 photographs exhibits a bullish and a bearish candlestick. The black one is bearish candle whereas the one on the correct is the bullish candle. The black and white elements of the candles are generally known as the physique whereas the 2 strains are generally known as shadows.

The shadow and physique of a candlestick chart is so vital. For instance, in a hammer candlestick, a protracted shadow implies that the reversal is extra convincing. At instances, you’ll establish a candlestick with only a physique and with out shadows. This is named marubozu.

Due to this fact, in a day by day chart, a single candle normally represents a day. In a hourly chart, a single chart normally represents a hour. Candlestick patterns in day buying and selling normally work with minute chart.

Advantages of utilizing Candlestick Charts

There are lots of advantages of utilizing candlesticks patterns when buying and selling. A few of these advantages:

They inform us extra – Not like different forms of charts, candlesticks inform us extra concerning the monetary asset. For instance, they inform us when it opened and when it closed.Extra accuracy – Candlestick patterns are normally comparatively correct in predicting the long run value of an asset.Utilized by most merchants – These charts are utilized by most merchants available in the market. This implies you might be in good firm.Reversals and extensions – Candlesticks are glorious in serving to you establish reversals and extensions.

Candlesticks vs bar charts

A standard query is on the distinction between candlesticks and bar charts. The 2 charts have a detailed resemblance however they’ve a serious distinction.

Bar chart doesn’t have a physique as you possibly can see under. As such, it’s comparatively troublesome to commerce utilizing a bar chart. The chart under exhibits how a bar chart seems like.

How you can learn the candlestick in day buying and selling

As we noticed above, a candlestick is made up of two vital elements. First, there may be the higher and decrease wick or shadow.

The higher a part of the wick exhibits the very best level in a session whereas the decrease aspect exhibits the bottom level.

Second, there may be the physique, which exhibits the worth between the open and shut. In some instances, there are candlesticks that don’t have the higher and decrease wicks.

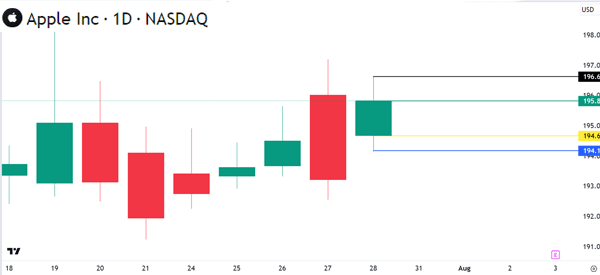

Candlesticks, however, have 4 vital elements: Open, Excessive, Low, and Shut. Allow us to take a look at this within the chart under.

In it, the open value was $194.67 whereas the closing value was $195.82. The very best level was $196.62 whereas the bottom degree of the session is $194.17.

The very first thing you might want to take a look at when analyzing candlesticks is the interval. If the chart is a day by day one, it implies that every candlestick represents a day. Equally, if the chart is a five-minute one, every bar represents 5 minutes.

The following factor to take a look at is the colour.

Within the instance above, we see that there are crimson and inexperienced candles. On this case, a inexperienced candle implies that an asset’s value rose throughout that interval whereas a crimson one implies that it dropped. Most charting platforms have instruments to allow you to change the default colours.

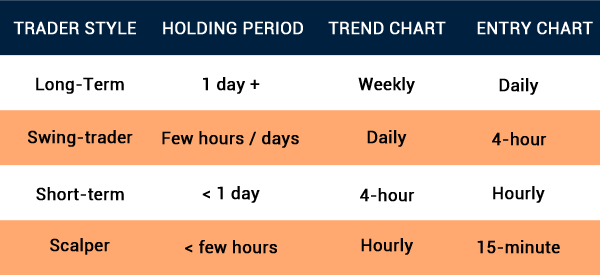

Candlestick chart timeframes

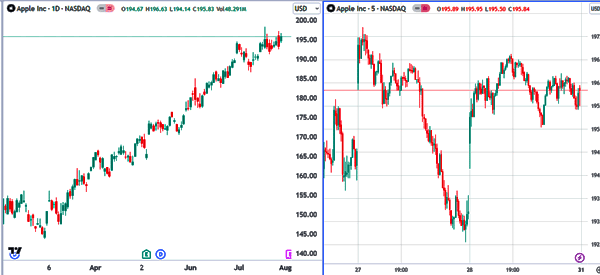

As talked about, a chart timeframe is a vital half available in the market since completely different merchants and traders have their very own methods. In most intervals, an investor who focuses on shopping for and holding belongings for a very long time makes use of longer charts like day by day and weekly. Such folks don’t use extraordinarily short-term charts in any respect.

Alternatively, scalpers, who open tens of trades per day, use extraordinarily short-term charts. In most intervals, these merchants use charts which are lower than 5 minutes. Additional, swing merchants use charts which are hourly or much less.

For instance, on the left aspect, we have now a day by day chart displaying that the Apple shares are in a bullish pattern. And on the correct aspect, the five-minute chart exhibits that the inventory is shifting sideways.

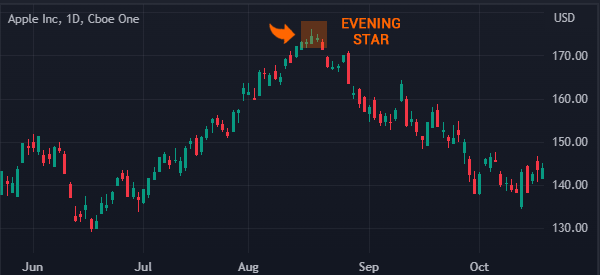

Some merchants search for affirmation of a reversal or a continuation in longer timeframes. For instance, the night star sample is invalidated if the worth ends the day above the higher a part of the sample.

How you can establish candlestick patterns

Beneath, We are going to clarify a number of the hottest candlestick patterns. Earlier than that, it is crucial so that you can know the way to establish candlestick patterns.

First, at all times begin your evaluation by doing a multi-timeframe research. That is the place you take a look at three timeframes and find out about every of them individually.

The good thing about doing a multi-timeframe evaluation is that you’ll discover patterns throughout all charts. For instance, yow will discover a hammer sample in a day by day chart and a bullish engulfing within the hourly chart.

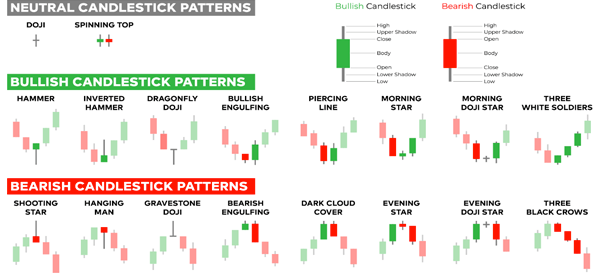

Second, if you’re new to those candlestick patterns, a easy means is to make use of a candlestick cheat sheet that lists all of them. instance of such a cheat sheet is proven under.

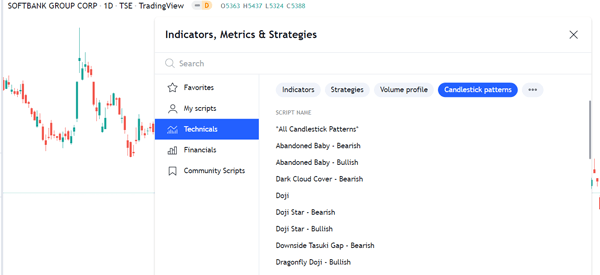

Lastly, you need to use an automatic technique to search out candlestick patterns.

TradingView has a superb instrument that does that. Simply open your chart, go to technicals, after which candlestick patterns as proven under. You’ll be able to then choose all candlestick patterns and the instrument will overlay them on the chart.

Associated » Actionable Inshigts to Enhance Your Candlestick Evaluation

What do candlestick patterns let you know?

Candlestick patterns can let you know lots of data. Probably the most fundamental ones are reversals and continuations. Some candlestick patterns like hammer and doji tells you that the present pattern is ending and a brand new one is about to type.

Second, the dimensions of a candlestick can let you know the energy of the sign. For instance, a hammer with a protracted decrease shadow implies that the reversal might be a lot sturdy.

Third, the sample can let you know the place to put your pending orders. For instance, with a bullish engulfing, it is sensible to set a buy-stop above the higher shadow and a sell-stop on the decrease shadow.

Fourth, it could actually let you know the help and resistance strains. These are vital strains that you simply at all times have to know when opening and shutting

Use candlestick patterns to search out help and resistance

An excellent technique for utilizing candlestick patterns is to search out help and resistance ranges. A help is a flooring the place an asset fails to maneuver under whereas a resistance is a ceiling the place it struggles to maneuver above.

Most candlestick patterns have these help and resistance ranges. For instance, the chart under exhibits a bullish engulfing sample, which is normally a constructive signal. On this case, the higher and decrease swings are resistance and help ranges.

As such, you possibly can place a stop-loss of a bullish commerce on the decrease aspect of the engulfing sample. Additionally, you possibly can place a buy-stop commerce above the bullish engulfing candle.

Candlestick patterns and market sentiment

Candlestick patterns are distinctive formations that occur in both a single candle or quite a few them. Examples of the most well-liked candlestick patterns available in the market are proven under, and every of those has its personal uniqueness.

These patterns may give you extra details about market sentiment. The most well-liked sentiments are generally known as reversal and continuation.

For instance, when reversal chart patterns like capturing star, morning star, and hammer type, it’s normally an indication that the temper available in the market is about to reverse.

Alternatively, when some patterns just like the three black crows and three white troopers type, it’s a signal that the pattern will proceed. Due to this fact, these candlestick patterns, when they’re supported by quantity, can let you know what to anticipate available in the market.

instance of that is proven within the chart under. In it, we see that the Apple chart fashioned a night star sample, resulting in a reversal.

The psychology behind candlestick patterns

Specialists consider that there’s normally a psychology behind most candlestick patterns like hammer, doji, and engulfing.

instance of that is the hammer sample, which is characterised by a small physique and a protracted decrease shadow. When it occurs, a bullish reversal is confirmed when the worth strikes above the asset’s physique.

There are different psychological elements of candlestick patterns. For instance, there are psychological occasions just like the worry and greed index and the market sentiment. Worry and greed are the most well-liked psychological elements available in the market since greed pushes costs increased and vice versa.

Due to this fact, candlestick patterns like hammer and bullish engulfing can set off greed available in the market whereas capturing stars can set off worry.

Candlestick patterns in several market circumstances

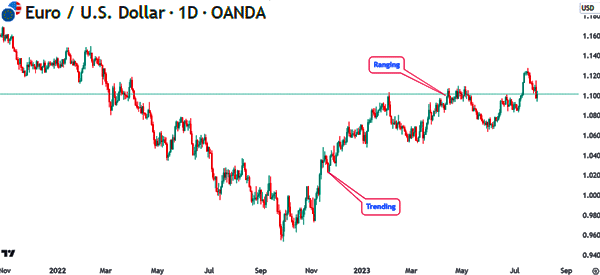

There are three important forms of market circumstances that you’ll expertise. First, there’s a market situation generally known as trending, which occurs when an asset is rising or falling.

It’s characterised by a sequence of upper highs and better lows and decrease lows and decrease highs. These are the very best market circumstances since you should buy low and promote excessive.

Second, there are unstable markets, which occurs when belongings are shifting in wider ranges. For instance, a inventory can open at $10, rise to $14, after which finish the day at $9.

Lastly, there are intervals when an asset is normally in a decent vary. The chart under exhibits when a foreign exchange pair is trending and in a decent vary.

Candlestick patterns are usually not normally relevant in range-bound markets. The most effective time to make use of them is when an asset is trending upwards or downwards. When it’s falling, candlestick patterns like doji and hammer are indicators {that a} reversal is about to occur.

Combining candlesticks with technical indicators

Day merchants use candlesticks in quite a few methods. First, they give attention to candlestick and chart patterns to foretell the subsequent actions. The opposite means is to make use of technical indicators. An indicator is derived utilizing mathematical calculations.

There are a whole lot of technical indicators available in the market. These indicators are divided into a number of classes like pattern, oscillators, quantity, and breadth amongst others. The most effective pattern indicators are shifting averages and Bollinger Bands.

Oscillators embody the Relative Power Index (RSI) and the Stochastic Oscillator. Quantity indicators embody the buildup/distribution (A/D), Quantity Weighted Common Value (VWMA), and Cash Circulate Index (MFI).

Breadth indicators embody McClellan Summation Index (MSI), McClellan Oscillator, and Internet New Excessive and Internet New Lows amongst others.

Merchants use candlesticks with technical indicators otherwise. Some merchants depend on one indicator whereas others add a number of indicators in a chart.

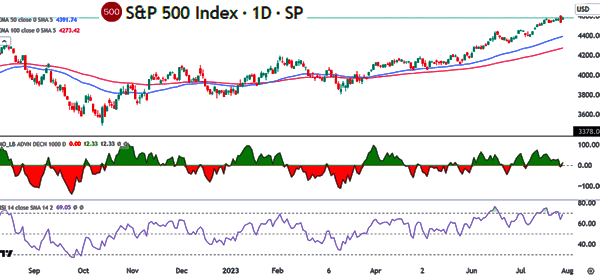

The most effective choices, as proven under, is to make use of pattern, quantity, and oscillators. This chart has shifting averages, McClellan Oscillator, and the RSI.

Greatest Candlestick Patterns for day buying and selling

A great way to make use of candlesticks is to make use of the favored patterns. There are lots of patterns which were recognized that assist to point out reversals and new patterns.

A number of the widespread forms of reversal candlestick patterns are:

amongst others. Different patterns are morning and night star, capturing star, and Dojis.

Backtesting candlestick patterns

Backtesting is a vital half when constructing a buying and selling technique. It’s the course of the place you employ historic information to evaluate the effectiveness of a chart sample.

Probably the most efficient approaches to backtesting an asset is to make use of a method tester, which is supplied by most platforms.

Nonetheless, for candlestick patterns, you possibly can solely use the handbook method to backtesting. The handbook course of is the place you dedicate a while to evaluate the efficiency of candlestick patterns throughout varied timeframes.

For instance, you possibly can take a candlestick sample just like the hammer after which see the way it trades in varied belongings. Usually, the hammer is adopted by a bullish reversal. Due to this fact, taking time to evaluate how these patterns work over time will enable you in your day buying and selling.

It is best to then use the backtesting information to do forward-testing, the place you employ a demo account to experiment these patterns.

Again and ahead testing will assist you understand how to make use of these candlestick patterns. It’s going to additionally enable you keep away from a number of the commonest challenges concerned available in the market.

Instance of Candlestick Sample at work

As you see, there are such a lot of candlestick patterns that you need to use available in the market. On this article, we are going to take a look at only one and see the way to use it when doing evaluation.

If you take a look at the EUR/JPY pair proven under, there are a number of candlestick patterns you can see.

one is the one we have now labelled a bullish engulfing.

To identify a bullish engulfing sample, you might want to first establish when a chart is shifting downward pattern.

On this, you might want to spot a chart with a number of consecutive bearish bars (on this case, we recognized a chart with a number of crimson bars). The candlestick sample is established when a protracted bearish candle is adopted and a smaller bullish candle.

This candle should be fully engulfed by the bearish candle. When this occurs, it’s normally a sign {that a} new upward pattern is beginning.

Widespread errors when utilizing candlestick patterns

There are a number of errors that individuals make when utilizing candlestick patterns. First, there may be the error of not incorporating quantity available in the market.

It is best to treatment this by basing all of your selections on the quantity. If a sample kinds in a interval with out quantity, it may very well be an indication that the thesis is not going to stick.

Second, there may be the error of dashing to open a commerce when a sample kinds. On this case, a dealer will open a bullish commerce when the hammer or doji sample kinds. That is improper. As a substitute, it’s best to wait to substantiate the pattern.

Third, not having a stop-loss and a take-profit. These instruments are vital for threat administration available in the market. All of your trades ought to at all times be protected. Lastly, it’s best to keep away from the error of not doing a multi-timeframe evaluation.

Abstract

We predict that is fairly clear: anybody who desires to day commerce must know and grasp candlestick charts.

You can not profitably commerce with candlestick-based patterns and indicators with out understanding first what an extended shadow or smaller physique means.

Neither is it essential to grasp all of the candlestick patterns (there are about 50 completely different ones); if you understand how to make use of those we have now listed, you should have all of the instruments you might want to develop into a superb dealer.

Exterior helpful sources

[ad_2]

Source link