[ad_1]

Pornpak Khunatorn

Introduction

TG Therapeutics, Inc. (NASDAQ:TGTX) develops and markets therapies for B-cell malignancies and autoimmune illnesses. Their FDA-approved product, Briumvi, is a monoclonal antibody remedy for numerous kinds of grownup a number of sclerosis (MS).

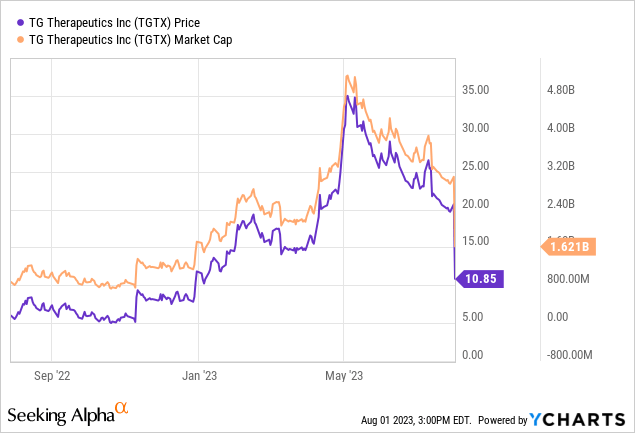

In my earlier evaluation, I famous the current progress in MS therapies with Roche’s Ocrevus, a possible competitor to TG Therapeutics’ Briumvi. Each being anti-CD20 therapies, Ocrevus’ handy administration may problem Briumvi. The current 15% drop in TG Therapeutics’ share worth appeared overly drastic, as remedy alternative in MS is multifaceted. I really helpful monitoring additional knowledge from the Ocrevus trial and Briumvi’s gross sales. Contemplating the aggressive dynamics within the MS market, I reaffirmed my “Promote” suggestion. Since my “Promote” suggestion, shares of TG commerce ~50% decrease.

Current developments: TG Therapeutics shares fell ~45% Tuesday after lacking Q2 2023 forecasts, regardless of robust Briumvi gross sales. elevated R&D and SG&A bills widened web loss to $47.6M. The corporate additionally introduced a $645M take care of Neuraxpharm for Briumvi’s ex-U.S. rights.

The next article analyzes TG Therapeutics’ monetary efficiency, current share worth drop, and a $645M take care of Neuraxpharm for Briumvi’s ex-U.S. rights, culminating in an improve from “Promote” to “Maintain.”

Monetary Efficiency

For the three and 6 months ending June 30, 2023, TG Therapeutics reported product income of $16.0 million and $23.8 million, largely from Briumvi gross sales within the U.S., in comparison with considerably decrease income in 2022. R&D bills had been $28.1 million and $44.0 million, reflecting a lower resulting from lowered manufacturing and trial prices. SG&A bills rose to $30.7 million and $58.8 million, primarily from Briumvi commercialization prices. Web loss for the interval was $47.6 million and $86.8 million, an enchancment from 2022. Money and equivalents stood at $144.9 million, anticipated to fund future operations.

Inventory Analysis

In search of Alpha knowledge: TG Therapeutics presents a blended funding image. On the optimistic aspect, the corporate’s EPS and gross sales forecasts exhibit substantial progress, shifting to profitability in 2024 with vital subsequent progress. The robust momentum of the inventory, outperforming the S&P 500 (SP500) over most time frames, and 88% upward revisions in earnings additional strengthen its attraction. Moreover, there’s a strong YoY income progress and a excessive gross revenue margin of 89.68%.

Nonetheless, the valuation of TGTX appears difficult with excessive P/E and EV/Gross sales ratios, doubtlessly indicating overvaluation. Profitability metrics like a -170.41% return on fairness and a -40.71% return on belongings are regarding, reflecting underlying points within the firm’s capital effectivity. The dearth of progress particulars in some areas, equivalent to diluted EPS and levered free money movement, may additionally be trigger for warning.

At writing, the market cap stands at $1.6B, with average whole debt of $108.43M and money and equivalents of $144.9M.

TG Therapeutics and Neuraxpharm: European Commercialization Deal

TG Therapeutics and Neuraxpharm Group introduced a commercialization settlement for Briumvi outdoors the U.S., Canada, and Mexico, specializing in Europe. The deal consists of an upfront fee to TG Therapeutics of $140 million, $12.5 million upon the primary EU nation launch, and potential further milestone funds as much as $492.5 million, totaling a worth of $645 million. TG may also obtain tiered double-digit royalties on web product gross sales as much as 30%. Neuraxpharm beneficial properties unique commercialization rights in specified territories, whereas TG Therapeutics retains an possibility to purchase again the rights inside two years if there is a change answerable for TG.

My Evaluation & Advice

In my opinion, the current occasions surrounding TG Therapeutics are indicative of a broader and extra advanced image. First, let’s focus on the earnings launch. The Q2 outcomes had been disappointing, and the truth that Briumvi’s income fell under analyst projections can’t be ignored. Whereas the expansion and optimistic features are there, the figures do not justify earlier optimism. This truth alone considerably contributed to the steep drop in TG’s inventory.

Now, let’s flip to the EU take care of Neuraxpharm. The settlement, valued at $645 million, is actually substantial, however in my eyes, it would not replicate a deal for a multi-billion-dollar drug. Maybe expectations had been too excessive, or perhaps there’s one thing extra nuanced at play right here. Both manner, this deal, coupled with the earnings miss, popped the balloon of optimism that appeared to encompass TG Therapeutics.

It is important to emphasize that each the earnings and the EU deal are according to my earlier “Promote” thesis. I had beforehand projected not more than $500 million in peak annual income for Briumvi, and these current developments solely reinforce that perspective. Nonetheless, I have to acknowledge that the sharp drop in TG’s valuation has shifted the chance/profit evaluation considerably. The corporate’s inventory, which as soon as appeared overvalued, now appears appropriately valued given the brand new panorama.

Subsequently, whereas I stay cautious and acknowledge the challenges that TG Therapeutics should overcome, notably with aggressive dynamics within the MS market and the shadow of Roche’s Ocrevus, I’m upgrading my score from “Promote” to “Maintain.” The downgrade within the valuation and the blended funding image imply that holding the inventory may be the clever alternative for now. As with all evolving scenario, continued monitoring of Briumvi’s gross sales and the broader market will probably be important. However for now, the stability of danger and reward appears to have discovered a extra even keel.

[ad_2]

Source link