[ad_1]

On the finish of June, the Biden Administration unveiled an formidable purpose to make sure dependable broadband web entry for the complete US, even essentially the most distant rural areas. The mission will contain a federal outlay of $42 billion, allotted to the states over the following two years. The President touts the initiative as a transfer to shut the ‘digital hole’ that separates the haves and have-nots on the earth of high-speed connectivity.

“It’s the most important funding in high-speed web ever, as a result of for as we speak’s economic system to work for everybody, web entry is simply as vital as electrical energy, water, or different fundamental providers,” Biden stated.

For retail buyers, the prospect of further federal cash flooding the broadband web ecosystem will open up alternatives. Broadband web suppliers will profit long-term, as they’ll be those constructing out networks, including capability, and enrolling new prospects.

So, let’s take a look at two shares which might be set to reap the rewards of the Administration’s largesse. These are well-known names on the earth of broadband service, and in line with TipRanks’ database, each maintain Purchase rankings from the Avenue’s analyst consensus.

Constitution Communications (CHTR)

We’ll begin with Constitution Communications, a agency that payments itself as a ‘connectivity firm.’ Constitution supplies superior Wi-Fi, quick web, and limitless cellular providers to greater than 30 million residential and small-to-medium enterprise prospects. It additionally helps providers for round 6.6 million cell phone traces. Constitution’s providers are branded below Spectrum, and the corporate launched Spectrum One as its flagship bundled bundle product this previous October.

Constitution generated roughly $54 billion in annual income final 12 months, primarily based on its 32 million buyer relationships. The corporate has practically 500 million IP units linked to its community, which spans throughout 41 states. In whole, there are over 30 Spectrum networks delivering a variety of content material, together with native information and sports activities.

Story continues

All of this provides as much as vital enterprise, and for the final two years, Constitution has persistently delivered over $13 billion in quarterly income. In the latest reported quarter, 2Q23, the corporate’s prime line reached $13.66 billion, a modest half-percent enhance year-over-year – nevertheless it fell wanting the forecast by over $180 million.

The income miss wasn’t the only real disappointment within the Q2 report; Constitution’s EPS additionally fell brief. The corporate reported earnings of $8.05 per share, a stable whole, however 5 cents decrease than expectations.

Benchmark analyst Matthew Harrigan is impressed by Constitution’s total place and its means to ship returns. He writes, “We proceed to imagine that Constitution affords a compelling vary of buyer providers, particularly the Spectrum One Web + Cell proposition. We imagine it could navigate the at the moment aggressive broadband setting. The 2Q23 outcomes have been largely passable, and administration maintains its purpose of surpassing 2023 broadband additions in comparison with final 12 months, benefiting from its rising rural footprint within the intermediate time period.”

“We view Constitution’s 3-year community improve initiative as ROI accretive with engaging value worth propositions for broadband + cellular, particularly Spectrum One, and even video resonate with prospects. A ~400K annual broadband unit add estimate after 2023 appears tenable. inclusive of RDOF construct exercise and BEAD (Broadband Fairness, Entry and Deployment) program advantages,” the analyst added.

To this finish, Harrigan places a Purchase ranking on Constitution’s inventory – and his $575 value goal implies a possible one-year upside of 37%. (To observe Harrigan’s monitor report, click on right here)

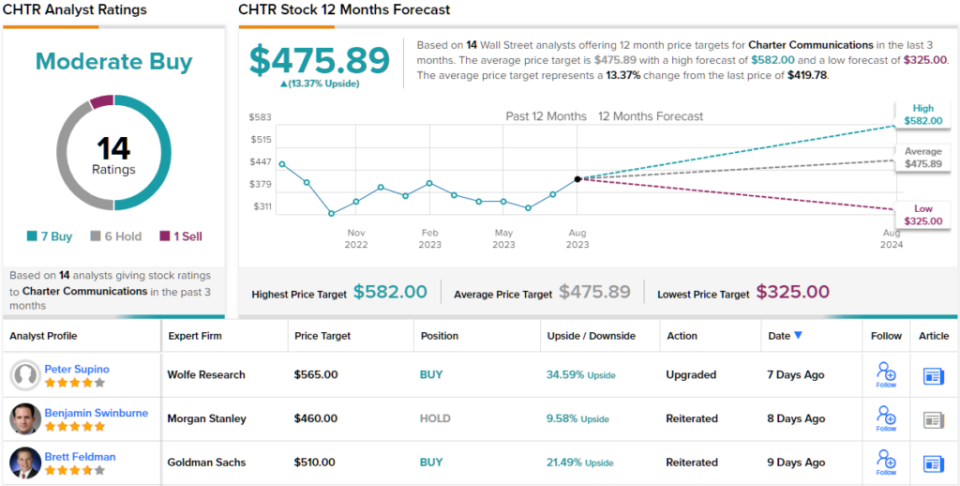

Zooming out to the macro view, Constitution reveals a Average Purchase consensus ranking primarily based on 14 analyst opinions, together with 7 Buys, 6 Holds, and 1 Promote. The shares are at the moment buying and selling at $419.78 and their common value goal of $475.89 suggests a 13% achieve within the 12 months forward. (See CHTR inventory forecast)

AT&T (T)

With a market capitalization of over $100 billion and 2022 revenues exceeding $120 billion, AT&T is without doubt one of the world’s largest telecom companies and the one largest supplier of cell phone providers within the US market. The corporate can hint its roots again to the times of the primary telegraph networks and was an early adopter of voice phone know-how (its identify even stands for American Phone and Telegraph).

Based mostly in Texas, the corporate operates throughout the spectrum of recent telecommunications, offering native and long-distance landline phone providers, mobile cellular providers, digital and wi-fi community communications, and is deeply concerned within the rollout of the brand new 5G networks. AT&T has lengthy been recognized for its expansive fiber optic cable community, providing prospects quite a lot of web packages.

In its current 2Q23 earnings report, the corporate’s top-line revenues barely missed the forecast by $30 million, coming in at $29.92 billion, reflecting a year-over-year achieve of slightly below 1%. Drilling down, nonetheless, reveals that AT&T’s quarterly working earnings of $6.4 billion was up 29% year-over-year, and the non-GAAP EPS of 63 cents per share exceeded estimates by 3 cents. The corporate’s standout efficiency was in its means to generate money flows. Money from working actions grew by 28% 12 months over 12 months, reaching $9.9 billion, whereas the free money circulate determine elevated to $4.2 billion. AT&T is projecting a full-year 2023 free money circulate of no less than $16 billion.

Due to its deep pockets, AT&T can comfortably cowl its dividend, which is without doubt one of the most dependable available in the market. The most recent declaration, at 27.75 cents per frequent share, ends in an annualized cost of $1.11 – providing a stable yield of seven.8%. The corporate has been persistently paying dividends, with out lacking 1 / 4, since 1984.

In mid-July, AT&T shares took a success when the ‘lead-lined cable’ controversy rocked the business. Legacy phone cables, insulated with lead sheaths, have been discovered to be way more widespread than beforehand thought, with lead posing a big environmental concern. Whereas AT&T had substantial publicity because of its community of telephone traces, the corporate’s measurement and assets permit it to soak up such impacts – and extra importantly, to switch the affected traces.

Among the many bulls is Raymond James analyst Frank Louthan who holds an optimistic perspective on AT&T’s sturdy business place – and its means to generate a horny money circulate.

“We proceed to see AT&T as undervalued with upside potential as we see the wi-fi development and FCF ramp as bringing buyers again to the identify. We stay assured in our evaluation that the lead-sheathed traces within the community are largely a non-issue within the near-to-medium time period and the remediation price is low as nicely, and we see AT&T as our greatest massive cap whole return story over the following 12 months. Administration upheld steerage and the simplified story is continuous to drive stable outcomes, and we imagine the Avenue ought to acknowledge this over the following few quarters, significantly as the extra $2B in price financial savings begins to materialize,” Louthan opined.

Louthan backs up his stance with a Sturdy Purchase ranking, whereas his $25 value goal reveals his perception in a 76% upside for the inventory within the subsequent 12 months. Based mostly on the present dividend yield and the anticipated value appreciation, the inventory has ~84% potential whole return profile. (To observe Louthan’s monitor report, click on right here)

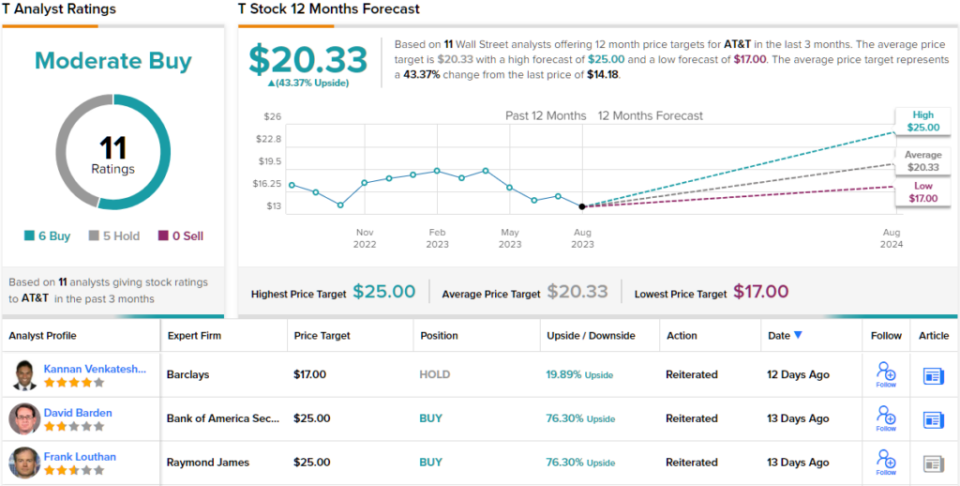

Turning now to the remainder of the Avenue, opinions are cut up nearly evenly. 6 Buys and 5 Holds add as much as a Average Purchase consensus ranking. At $20.33, the typical value goal brings the upside potential to ~43%.(See AT&T’s inventory forecast)

To seek out good concepts for shares buying and selling at engaging valuations, go to TipRanks’ Greatest Shares to Purchase, a software that unites all of TipRanks’ fairness insights.

Disclaimer: The opinions expressed on this article are solely these of the featured analysts. The content material is meant for use for informational functions solely. It is extremely vital to do your personal evaluation earlier than making any funding.

[ad_2]

Source link