[ad_1]

CUTWORLD

Within the aggressive panorama of the power sector, there are a plethora of metrics by which to guage an organization. Nevertheless, for Power Fuels (NYSE:UUUU), the highlight is firmly on its asset worth, notably their stock. As buyers and market analysts search for indicators of power and resilience, the corporate’s tangible belongings and their potential future value are onerous to disregard. Nevertheless, the present market dynamics present minimal income relative to the belongings they’ve and an unprofitable enterprise resulting from elevated SG&A bills. Based mostly off of those challenges and potential upside, we record UUUU as a maintain. This is a better have a look at Power Fuels.

Distinctive Strengths:

UUUU

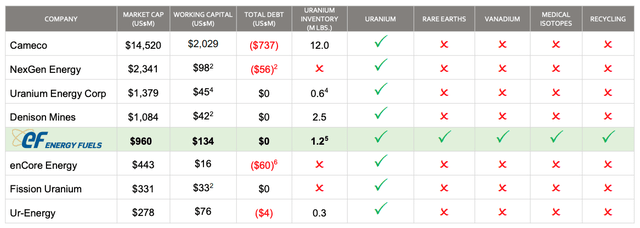

Power Fuels is not only one other identify within the power sector; its numerous product portfolio uniquely positions the corporate to faucet into completely different market tendencies and calls for. The corporate’s monetary well being is obvious from its strong working capital of $134 million, coupled with the absence of any excellent debt, guaranteeing agility in funding its operations and exploring new progress avenues.

In search of Alpha

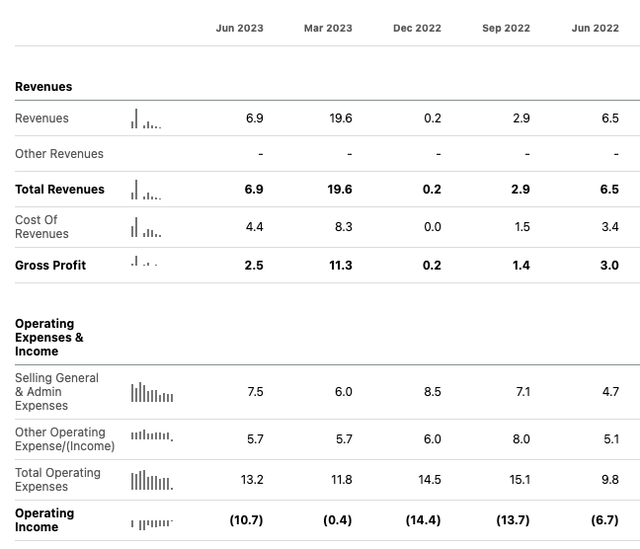

Power Fuels, with its market cap at present hovering across the $1 billion mark, presents a perplexing monetary narrative. The corporate’s revenues have been characterised by important fluctuations throughout the vary of $.2 Million and $19.6 Million per quarter. It isn’t simply the erratic nature of the revenues but in addition the minimal gross earnings that deepen the conundrum. For an organization of its measurement and valuation, one would anticipate steadier financials and bigger financials. As a substitute, Power Fuels finds itself ready the place its income story appears at odds with its market cap, and the gross earnings do not align with the expectations set by its billion-dollar stature.

In our opinion, the corporate’s valuation is only buoyed by the belongings administration estimates at being value roughly $1 billion. This features a ready-to-go stock which consists of 766,000 kilos of completed uranium, 900,000 kilos of completed vanadium, and 37 tons of uncommon earth carbon. In Q2 they offered 80,000 kilos of uranium for $4.3 Million or $54 per pound of uranium. Which means that based mostly off of that sale they’ve roughly $41 Million in Uranium and assuming a worth of $11 per pound for the vanadium we see an extra $10 million. Administration additionally highlighted that they’ve the flexibility to flex their Vanadium stock IP to an extra 3 million kilos from their mill tailings options if wanted. Based mostly off of able to go stock, we estimate it to be value ~$51 Million.

One in every of Power Fuels’ standout options is its method to infrastructure. By leveraging present belongings for brand spanking new ventures, such because the Uncommon Earth Separation undertaking, the corporate not solely reduces prices but in addition accelerates undertaking timelines. Their distinctive mill, able to processing uranium, vanadium, and uncommon earths, mixed with a phased manufacturing scaling technique, speaks volumes of their preparedness for future market calls for and their quest towards additional vertical integration. Much like MP, they’re making an attempt to “reshore” uncommon earth mineral manufacturing into the US and allied international locations whereas concurrently shifting up the availability chain in to extra completed product markets.

Inherent Dangers and Challenges:

Like several important participant in a risky market, Power Fuels faces its set of challenges. The corporate’s profitability is closely tethered to commodity costs, making it prone to market fluctuations. From a macro perspective, geopolitical disturbances, particularly in uranium-abundant territories like Niger, have the potential to introduce turbulence within the provide chains and market dynamics. Such disruptions can have cascading impacts, reshaping pricing fashions and probably unsettling established market equilibrium.

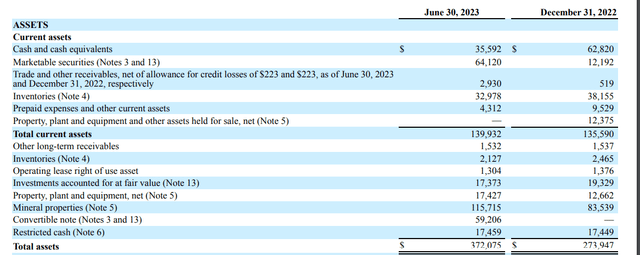

With UUUU having a such massive operation, they may be capable to probably profit considerably from any disturbances. At present, the US portfolio alone can present as much as 2 million lbs of Uranium per yr, with 3 extra crops having the potential so as to add one other 4 million per yr. For perspective, the US civilian plant utilization was 40.5 million kilos in 2022. Which means that, at present, UUUU alone might present ~5% of the US’s complete uranium wants. The problem for UUUU is discovering prospects which might be prepared to simply accept that quantity of Uranium. They lately introduced that they signed a contract for a base supply over the subsequent 8 years of three million kilos of uranium or roughly 375,000 kilos per yr. Which is ~10% of the capability of their web site. Additionally, whereas administration talked about $1 billion on their newest earnings name. The most recent 10q solely exhibits $372 million in belongings on the books. Whereas this stage of discrepancy will be brought on by quite a lot of causes, we sometimes worth firms extra in step with what the books present vs what administration says.

UUUU

Along with this, as Power Fuels shifts gears from a standby stance to energetic operations, the opportunity of surprising challenges or inefficiencies can’t be dismissed. One of many obvious areas of concern is the current surge in G&A bills. Although these are linked to enlargement, it is essential to make sure they align with income progress. Lastly, with a number of tasks of their portfolio, the dangers related to delays, unexpected prices, or undertaking setbacks are omnipresent.

Conclusion:

Power Fuels presents itself as an attractive entity within the power area. Because the sector continues its evolution, adaptable, strategically astute, and financially resilient firms like Power Fuels are poised to probably take the lead. For stakeholders and potential buyers, a holistic understanding of each its strengths and challenges is essential. At Scouting Shares, we battle to see upside potential from present costs. As we outlined to start with, a lot of the worth right here is within the belongings that UUUU holds and never within the earnings of the corporate. With small and fluctuating income tied to commodities and with it being difficult for us to correctly worth UUUU’s belongings, we battle to be patrons at present multiples with an FWD P/E of 28+ and a worth to ebook of three.04. With the massive stock they’ve they may profit drastically from any spikes in demand for his or her commodities which makes us within the firm over the long run, and with a comparatively low IV, this might be a possible choices play for us sooner or later however as of proper now we record UUUU as a maintain.

[ad_2]

Source link