[ad_1]

Dragon Claws/iStock by way of Getty Pictures

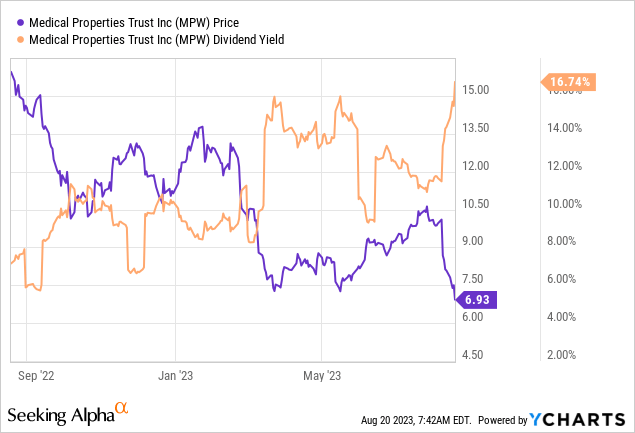

Shares of Medical Properties Belief (NYSE:MPW) slid greater than 12% on Friday after it was reported {that a} deal between the well being care REIT and one among its tenants, Prospect Medical, was held up by a California regulator. Medical Properties restructured its relationship with its tenant again in Might when the REIT responded to cost challenges on the a part of its tenant by providing a recapitalization bundle. The deal is topic to regulatory approval and the setback signaled to buyers that the REIT may lower its dividend… which MPW simply did. The ensuing uncertainty has pushed Medical Properties’ yield to nearly 17% (9% post-dividend lower). Given the extraordinarily low valuation of Medical Properties based mostly off of normalized FFO, I consider that the market is overly pessimistic and that the dividend lower has already been totally priced into the REIT’s valuation.

Current market turmoil and restructuring associated to Prospect Medical

Shares of Medical Properties crashed on Friday after a Wall Avenue Journal report mentioned that the hospital REIT may run into bother with its recapitalization deal it struck with one among its core tenants, Prospect Medical, in Might that restructured the connection between the tenant and the hospital landlord.

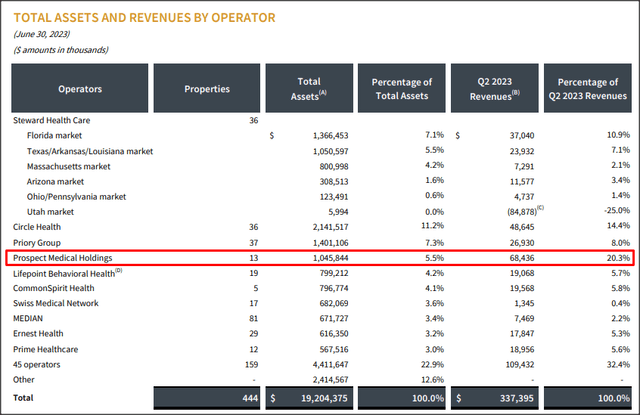

Given liquidity issues for Prospect Medical, Medical Properties agreed in Might to take an fairness place in its struggling tenant in alternate for deferred rents, permitting the well being care REIT, doubtlessly, to later promote its fairness portion within the restructured managed care enterprise. The aim of the recapitalization deal was to bail out its struggling tenant, which accounts for a big income share, and take stress off of Prospect Medical’s money circulation whereas additionally permitting Medical Properties an fairness exit sooner or later.

Prospect Medical is a crucial tenant for MPW and it accounted for 20.3% of revenues within the second-quarter. What has pushed considerations in regards to the WSJ report was that Medical Properties did not disclose this truth in its Q2 earnings sheet… which added to appreciable promoting stress on Friday. Nevertheless, the well being care REIT made its personal assertion on its web site in response to the WSJ report and said that the “California Division of Managed Well being Care’s maintain [on the transaction] is a non-controversial a part of the approval course of.” Medical Properties additionally clarified that it expects to obtain in the end approval from the California state regulator.

Supply: Medical Properties

The report from the Wall Avenue Journal strongly affected market sentiment and precipitated MPW to drop by greater than 12% in some unspecified time in the future, earlier than shares recovering in the direction of the tip of the buying and selling day. Nonetheless, buyers went right into a full-blown panic and drove Medical Properties’ share worth to a brand new 1-year low.

Present transaction troubles are to be seen in context of already current dividend fears

Buyers have been scared of a dividend lower for some time, which has been expressed within the REIT’s excessive dividend yield. The REIT simply introduced that it lower its dividend to $0.15 per-share quarterly, exhibiting a 48% draw back adjustment.

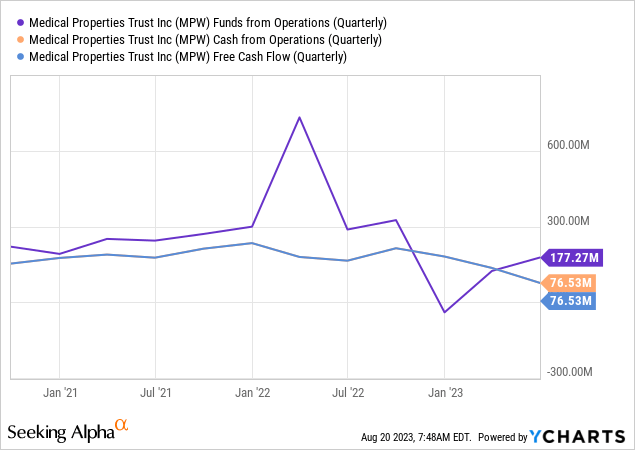

Within the second-quarter earnings launch, the well being care REIT narrowed its steerage for its FY 2023 normalized funds from operations from $1.50-1.61 per-share (Q1 steerage) to $1.53-1.57 per-share (Q2 steerage). The outlook itself has not been affected by the recapitalization deal, and the REIT is ready to simply cowl its dividend with normalized funds from operations this 12 months. The brand new dividend payout, annualized, is $0.60 per-share and MPW goes to make use of the money it freed as much as scale back its leverage. By redirecting money circulation to its steadiness sheet and to the reimbursement of debt, Medical Properties has the potential to recuperate a few of the losses it sustained within the final 12 months, for my part.

All of the unhealthy information is priced in, very enticing NFFO multiplier

I’m not invested in Medical Properties for causes of securing a dividend. The true upside right here is within the REIT’s working portfolio… which buyers should purchase into at a ridiculously low NFFO multiplier issue in the meanwhile.

Shares of MPW traded at $6.93 on Friday and assuming the mid-point of steerage for normalized funds from operations, $1.55 per-share, shares of the REIT are valued at a ridiculous 4.5X NFFO. So even within the case that the REIT have been to lose its fairness cope with Prospect Medical and was pressured to work out one other restructuring association, MPW would nonetheless be an enormously low cost cut price on a money circulation foundation.

Medical Properties earns a big sum of money circulation/funds from operations every quarter and with greater than $324M in money as of June 30, 2023, I consider all of the unhealthy information that would come out of the present restructuring deal are already priced into MPW’s shares.

Dangers with Medical Properties

It’s self-explanatory that an funding in Medical Properties presently of the restructuring has sure dangers (the transaction with Prospect Medical could fall by means of, the dividend could get lower), however as I mentioned beforehand, these considerations have already been totally priced into Medical Properties’ valuation, for my part. As a hospital landlord, MPW operates in a recession-resistant a part of the economic system and has little or no macro dangers. The most important danger, within the brief time period, was the dividend lower.

Closing ideas

To me, Medical Properties seems like a really enticing speculative purchase, since shares have slumped on Friday on overblown considerations in regards to the cope with Prospect Medical being held up by a California regulator. The dividend is now lower in half, however the market already anticipated this.

Whereas Medical Properties could also be deeply out of favor with dividend buyers, the well being care REIT really helps its new dividend with NFFO and the valuation is so low cost by way of normalized funds from operations, that the worst information are probably already totally mirrored into MPW’s valuation. I consider buyers are overreacting to the information, and I consider MPW has very enticing restoration potential over the following 12 months because the REIT works by means of its restructuring and makes use of extra money circulation to pay down its debt!

[ad_2]

Source link