[ad_1]

welcomeinside/iStock through Getty Photos

Within the years I’ve adopted the oil market, I’ve by no means seen the Saudis this decided to push oil costs up. This contains the “no matter it takes” second we noticed in 2017 when the earlier Saudi vitality minister, Khalid Al-Falih, began focusing on US inventories, and the value struggle of 2020 when the Saudis went out to crush the Russians for not agreeing to a manufacturing reduce.

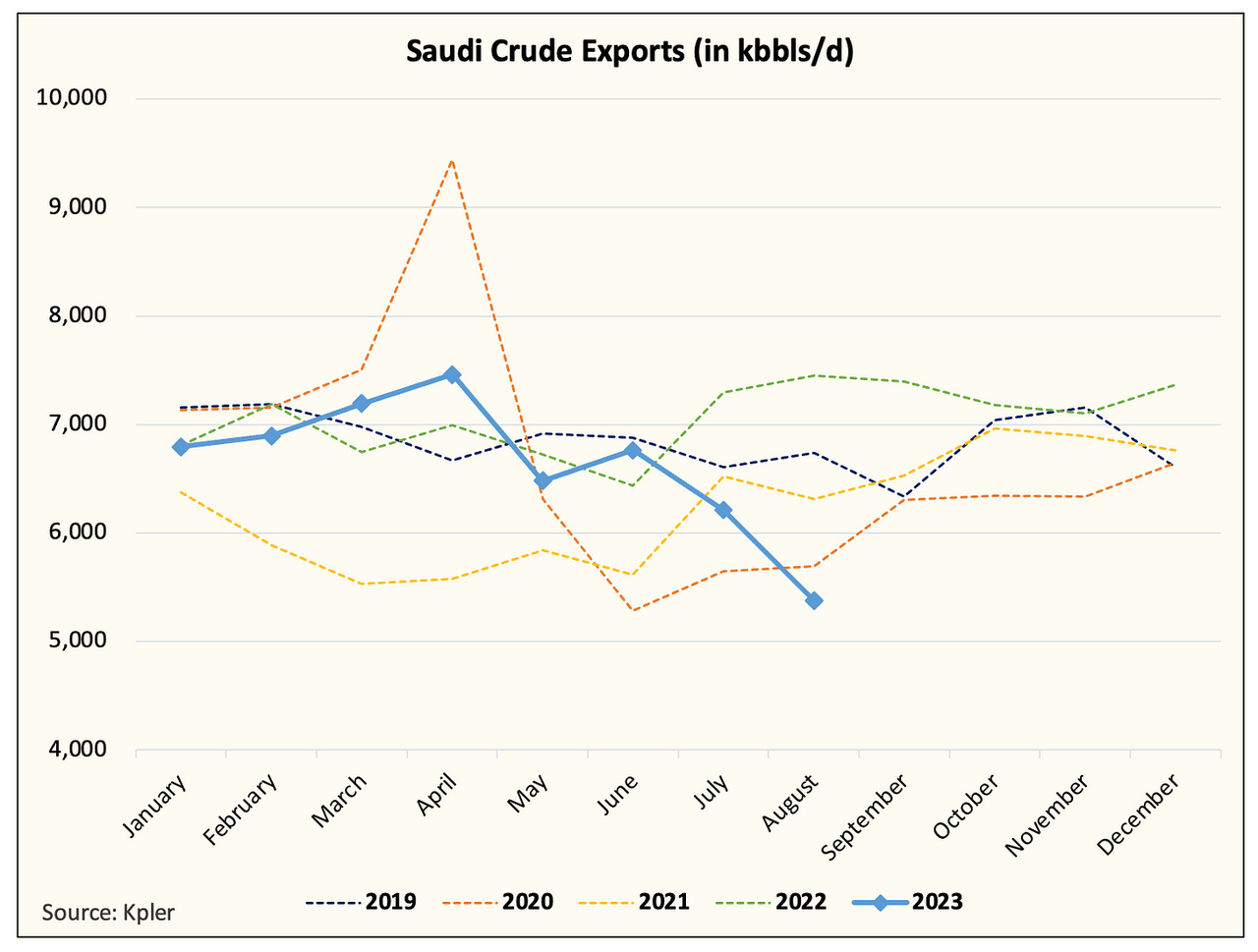

Kpler

Saudi crude exports for the primary 24 days of August are averaging on the lowest stage since June 2020. At ~5.3 million b/d, Saudis may have diminished crude exports by ~1 million b/d since July. Now we do not count on this determine to be closing. Crude exports for the upcoming week are exhibiting a rebound, so closing figures could possibly be nearer to five.6 to five.8 million b/d.

However that does not change the purpose of this text, that is loopy, and I’ve by no means seen the Saudis this decided.

These of you who comply with us carefully will know that our base case view is for the Saudis to increase the voluntary reduce into year-end. We defined that it is due to the logistical timing subject of when exports hit bodily inventories and the impression on market sentiment. However with the newest Saudi crude export determine, I can not assist however marvel if the reduce will doubtless be prolonged into Q1 of 2024.

Let me clarify.

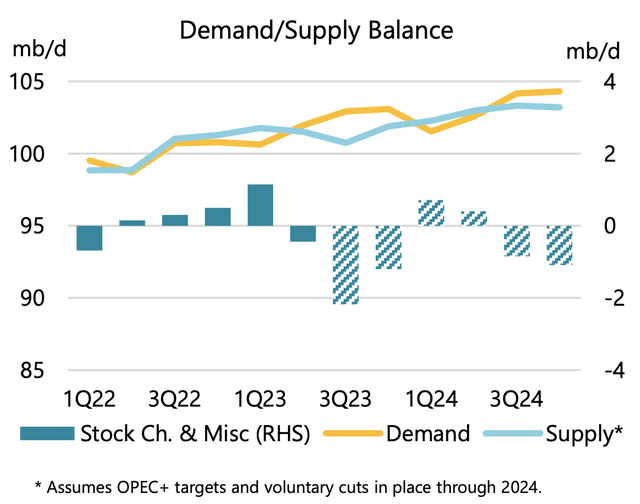

IEA

Right here is IEA’s assumption for international oil provide & demand steadiness into the tip of 2024. Out of the entire IEA studies we have learn thus far, the August OMR was probably the most balanced (shocking).

Now you’ll discover that each Q1 and Q2 of 2024 present stockbuilds. Take into account that the IEA isn’t assuming the voluntary reduce of ~1 million b/d into its steadiness in 2024. As an alternative, it’s assuming that the Saudis will proceed its authentic ~500k b/d voluntary reduce.

For my part, the Saudis performed this one superbly. By preserving it on a month-to-month foundation, it deters speculators from bidding up the lengthy finish of the curve and retains the market at bay. The month-to-month motion additionally prevents speculators from front-running costs, which prevents any potential danger of demand destruction amidst a weakening international economic system. As an alternative, the voluntary reduce does the only function it was meant to do, cut back international inventories.

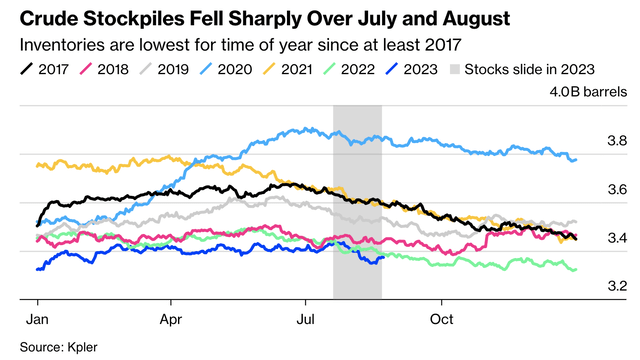

So now think about this state of affairs, as we strategy the tip of October, oil continues to commerce within the vary of $80 to $90. Whereas international oil inventories have drained materially, sentiment stays weak, and speculators consider the approaching recession will damage oil demand. Saudis at the moment are deciding whether or not to increase to the tip of December, however as they have a look at international oil provide & demand balances, Q1 exhibits a construct. All the efforts of the voluntary reduce as much as that time can be pointless if storage will get to construct again up once more.

With the voluntary reduce already in place, what’s to cease the Saudis from slowly unwinding the reduce? Maybe it is best to after Q1 to slowly unwind the ~1 million b/d reduce as to keep away from any stock build-up. As well as, with Russia cooperating (lastly), and if the Russians lengthen their voluntary reduce into year-end, then it is bodily very tough for Russia to extend manufacturing in the course of the coronary heart of winter. All of this stuff recommend to me that it’s higher than 50% probability that the Saudis lengthen this voluntary reduce (in some kind or form) into the tip of Q1 and presumably Q2 of 2024.

Now this isn’t the consensus view and most of the oil analysts count on the Saudis to unwind the voluntary reduce as soon as the storage draw has materialized, however we digress. We predict the final word objective for the Saudis is worth stability, so if that implicitly implies a decrease general storage stage to attain this, then the Saudis will maintain the voluntary reduce till they see match.

Which means Brent must simply common over $90 for a lot of months earlier than the Saudis ponder a discount. We simply do not see that when the consensus expects a construct in Q1.

That is loopy…

Kpler

Within the years I’ve adopted the Saudis, that is probably the most decided I’ve ever seen them. If we’re proper and the Saudis proceed to increase, then the market will get a impolite awakening. International onshore crude inventories are already beginning to speed up to the draw back and there is extra to return. Maybe, just like the article we printed on Monday, it’s actually simply that simple. Maybe, it’s not. We’ll know with time.

Editor’s Be aware: This text covers a number of microcap shares. Please pay attention to the dangers related to these shares.

[ad_2]

Source link