[ad_1]

Bitcoin value is presently buying and selling at barely above $26,000 per coin, however remains to be reeling after final week’s 10% single day selloff. The state of affairs appears to be like dire for crypto bulls who have been hoping for a extra vital restoration to start after such extended sideways.

Nevertheless, the bullish market construction stays unbroken. Let’s take a more in-depth have a look at what precisely this implies and why the 2023 uptrend remains to be intact.

Recapping Latest BTCUSD Volatility

After a stable begin to 2023 – actually a 12 months that’s been kinder to the king of cryptocurrency than 2022 – BTCUSD has bears celebrating and bulls kicking their wounds. A number of months of sideways value motion and dwindling volatility ended with a bang as anticipated, however the transfer was down and never what bulls had been hoping for.

A pointy, 10% intraday selloff prompted extra lengthy liquidations than the FTX collapse, and despatched the Relative Power Index instantly into essentially the most oversold territory in all of 2023. However even with all of the carnage, Bitcoin stays in a near-term uptrend with a bullish market construction.

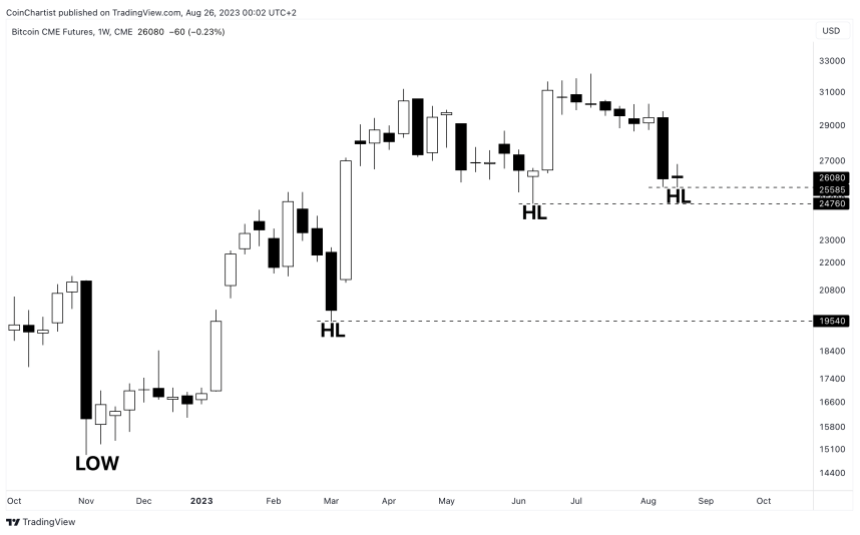

Bitcoin’s uptrend remains to be intact | BTCUSD on TradingView.com

Why Bitcoin Worth Stays In A Structural Uptrend

By pure definition, an uptrend is a collection of upper highs and better lows. Which is exactly what remains to be taking place in BTCUSD value motion all through 2023. At present, the FTX collapse in November 2022 was the native “low” of the downtrend. In distinction, a downtrend is a collection of decrease lows and decrease highs. As soon as a brand new excessive was made in early 2023 after which a better low was put in, the downtrend was thought of over.

The latest 2023 uptrend in Bitcoin hasn’t but made a decrease low after a decrease excessive. Even a potential decrease low past right here remains to be with out a correct decrease excessive. Which means the highest cryptocurrency by market cap might doubtlessly bounce right here, and even decrease, and nonetheless keep an total bullish market construction.

A decrease low would nonetheless be vital, doubtlessly warning that the market construction is popping again bearish. If a decrease low occurs beneath the $25,000 low from June 2023, then will probably be all eyes on if a decrease excessive is to comply with.

The 2023 uptrend in Bitcoin has been muted in comparison with what the cryptocurrency is able to. BTCUSD is up roughly 50% in the course of the first roughly 9 months of the 12 months. The ultimate 9 months of 2020, for instance, had over 900% ROI by comparability. May any such returns quickly be on the way in which? Or will the cryptocurrency market fall again into the clutches of bears?

This chart initially appeared in Challenge #18 of CoinChartist VIP. Subscribe free of charge.

[ad_2]

Source link