[ad_1]

Justin Sullivan

Introduction

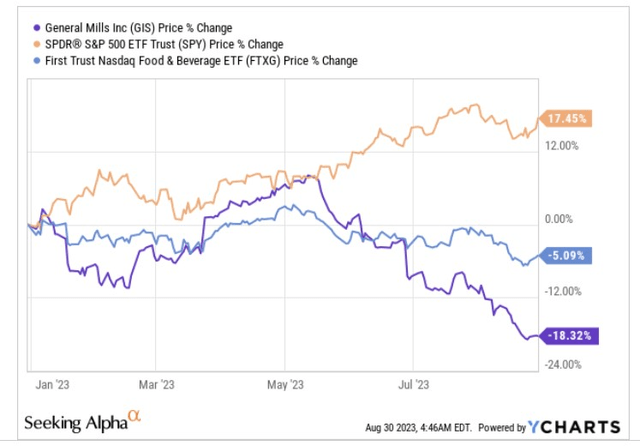

Basic Mills, Inc. (NYSE:GIS), the US-based branded shopper meals firm, has confronted a difficult 2022; admittedly, meals and beverage shares generally, haven’t loved the brightest of years (a preferred meals and drinks ETF-FTXG is down by mid-single-digits on a YTD foundation), however GIS’s underperformance has been much more pronounced. With solely one-third of the 12 months left to go, it might be asking for lots to count on GIS to recoup all its losses, however we’d prefer to suppose the worst is over, and the prospects might nicely change from hereon.

YCharts

Let’s increase on a number of the underlying sub-themes which can be behind our extra optimistic stance.

Monetary Outlook And Valuations

The patron atmosphere within the US might not essentially be essentially the most resilient and even in any other case, the buyer staples sector isn’t essentially the most high-growth avenue round. But regardless of all that, we nonetheless see fairly a number of encouraging cogs inside GIS’s future outlook.

Firstly, notice that the corporate’s long-term “natural” internet gross sales goal is barely 2-3%, but the anticipated progress for FY Could 2024 is a better cadence of 3-4%.

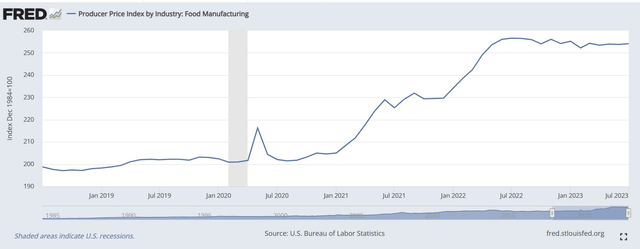

Gross margins final 12 months completed reasonably strongly at 34.2%, a 120bps enchancment over the earlier 12 months, but administration feels that they will proceed to construct on this for the approaching 12 months as nicely. Productiveness ranges within the Pet phase are in a greater place, and a number of the pricing measures taken throughout the general enterprise final 12 months may also be felt this 12 months. Knowledge from FRED exhibits that the PPI for meals producers hasn’t actually come off in an enormous means however continues to stabilize, reflecting the diploma of pricing power.

FRED

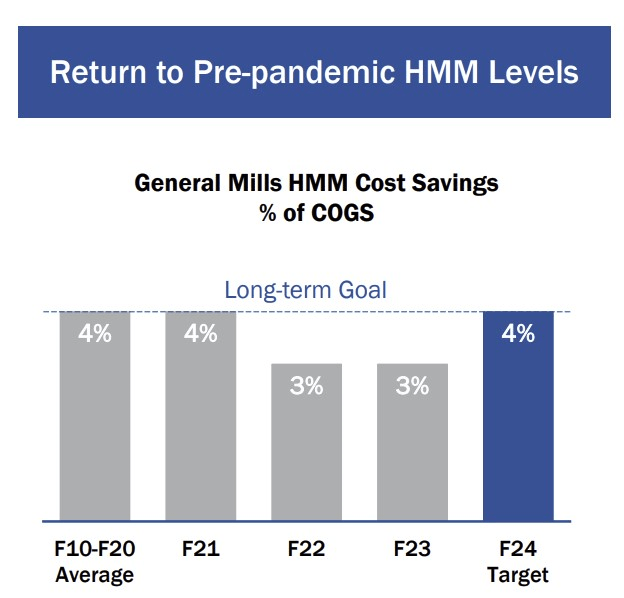

Crucially, provide chain disruptions of the previous are unlikely to go away a cumbersome impact on GIS’s value base. All these components put the corporate in a greater house to get again to delivering 4% HMM (Holistic Margin Administration) value financial savings on the COGS stage.

This autumn Presentation

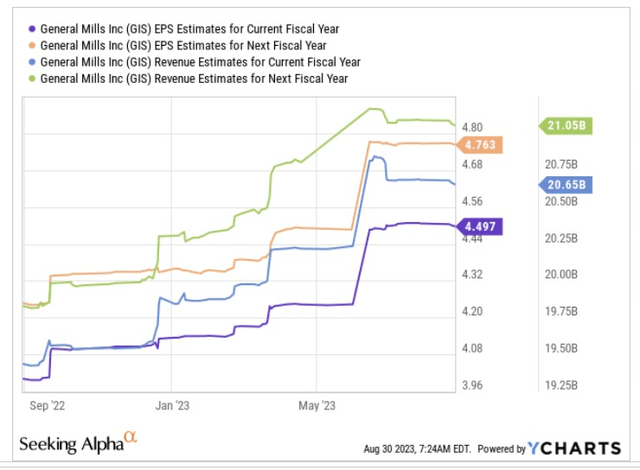

YCharts

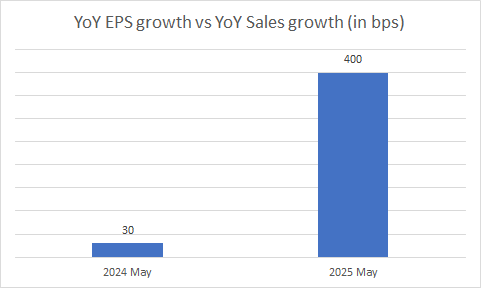

All in all, if one seems at consensus estimates for GIS over the subsequent two years, we really feel reasonably enthused by the bettering working leverage that’s in retailer. For the 12 months ending Could 2024, GIS’s YoY EPS progress (3.1%) is poised to exceed internet gross sales progress (not natural progress) by 30bps, and the next 12 months, the differential between the highest and backside line will widen much more to 400bps, with GIS poised to ship YoY EPS progress of almost 6%!

YCharts

YCharts

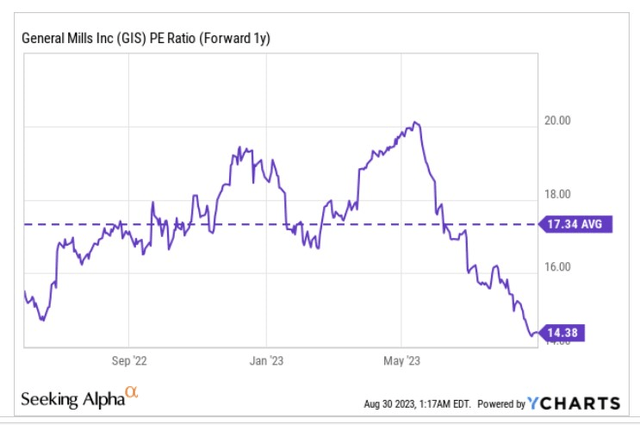

Given the bettering diploma of working leverage that might be seen over the subsequent two years, we really feel it’s a good alternative to select up the inventory on a budget. Primarily based on the Could 2025 EPS estimate, the inventory is priced at solely 14.4x ahead P/E, a 17% low cost to its 5-year common a number of.

Money Technology And Dividend

A doubtlessly higher backside line trajectory additionally places GIS in a greater place to engender superior money technology. The corporate’s long-term objective is to transform 95% of its adjusted post-tax earnings to free money move. Final 12 months, nonetheless, they fell fairly wanting this mark, delivering a conversion price of solely 80%.

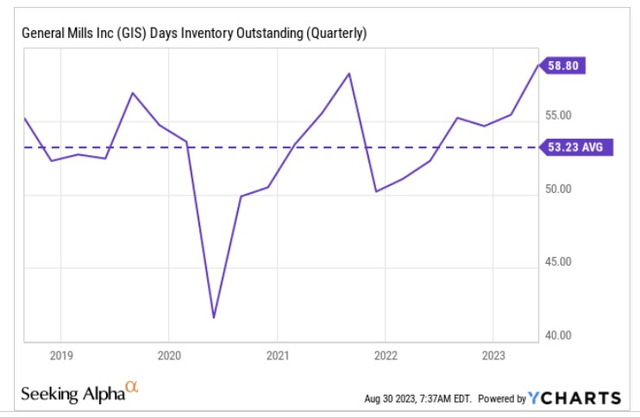

For the approaching 12 months, administration is on report stating that the FCF conversion will probably development again to its long-term objective of 95%, pushed primarily by higher provide chain visibility which in flip facilitates higher stock administration. As you may see from the picture beneath, the times in stock is at present 10% above what they usually keep and it ought to drop down within the quarters forward.

YCharts

Some traders could also be cautious of the retailer stock discount challenges witnessed within the North American area, however on the This autumn name, administration was fast to level out that that is situation just isn’t particular to GIS alone and is unlikely to linger going ahead.

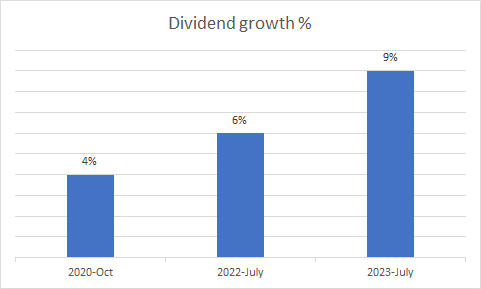

Nonetheless, higher FCF technology additionally will increase the prospect of superior distributions, as GIS’s objective is to return 80-90% of its FCF to shareholders. Only for some perspective, additionally think about that it is a enterprise whose dividend progress has been trending up over time; most not too long ago in July, the corporate hiked its dividend by a formidable 9%, up from 6% beforehand. On account of the superior hike, traders additionally get to pocket a extra engaging yield (3.45%), round 30bps greater than the inventory’s 4-year common yield determine.

Searching for Alpha

Closing Ideas: Danger-Reward And Hedging

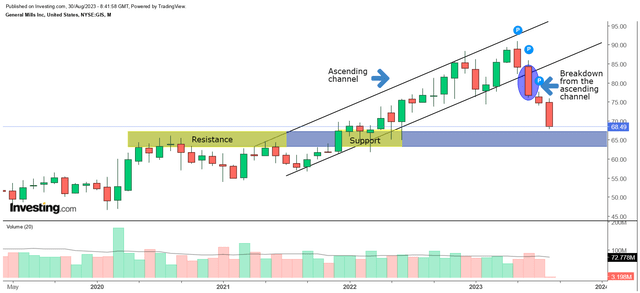

If one seems at GIS’s month-to-month value imprints, we will see that the inventory is at present in a foul means, however there’s potential for this to vary quickly sufficient. Firstly, notice that from November 2021 until Could 2023, the inventory had been trending up within the type of a decent ascending channel.

In June, we noticed a breakdown from this channel, with the onset of a giant red-bodied candle. Since then, the promoting has endured with no indicators but of an finish within the downward development. Until one thing monumental occurs over the subsequent two days it seems all however sure that August would be the fourth successive month the place the month-to-month shut was decrease than the month-to-month open. This offers you a way of how sturdy the promoting momentum has been.

Having stated that we expect the inventory might be near hitting a backside of types, as it isn’t too distant from testing the $63-$67 zone. Why does this zone matter? Nicely, in the event you take a look at the interval from Could 2020-June 2021, one can see that this terrain served as some extent of resistance (space highlighted in yellow); as soon as once more in H1-22, we noticed the identical terrain function a supply of assist, with some lengthy wick candles highlighting the presence of cut price hunters. Principally, the takeaway right here is that the worth usually recoils from that zone, and thus one wouldn’t be shocked to see this function a pivot zone but once more.

Investing

The weak spot for a lot of this 12 months additionally implies that GIS now seems a lot better positioned to mean-revert vs. different choices from the buyer staples universe. The picture beneath highlights how the relative power ratio of GIS as a operate of staple shares is round ~24% off the mid-point of its long-term vary.

Stockcharts

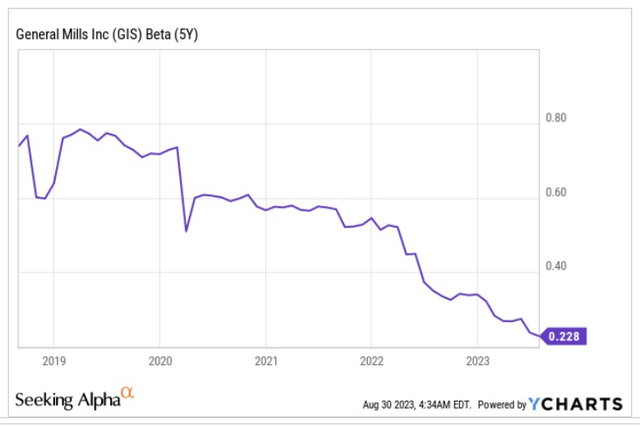

We additionally suppose there’s one thing to be stated about GIS’s rising stature as a potential hedge to the broader markets. The markets have loved a comparatively first rate 2022 to this point (~17% returns), however September has historically confirmed to be the worst month of the 12 months (as per information going again to 1945). Latest macro information additionally means that the financial system might be near peaking with the valuations of the broader markets not fairly reflecting these dangers.

YCharts

Nonetheless, the picture above highlights how the inventory’s sensitivity to the broader markets has been declining over time. Additionally, curiously sufficient, amongst the 48 odd packaged meals shares round, GIS’s sensitivity is without doubt one of the lowest, making it one of many standout defensive hedges.

Searching for Alpha

[ad_2]

Source link