[ad_1]

Nobody in day buying and selling can obtain good outcomes (or turn out to be wealthy) with out understanding the significance of Threat Administration. This is among the most essential issues that merchants and buyers ought to all the time give attention to! It refers to a scenario the place folks cut back their dangers whereas maximizing their returns.

The worldwide monetary atmosphere has achieved huge progress within the final decade. At this time, folks everywhere in the world are in a position to take part within the monetary market which previously was a reserve of the big banks and hedge funds.

The introduction of the excessive frequency buying and selling (HFT) has democratized the monetary market and because of this, many careers have been made (or destroyed). Whereas quite a lot of folks have achieved unparalleled success as merchants, most individuals have misplaced important quantity of their investments.

To realize their success, the previous group has additionally skilled losses. Due to this fact, threat administration is an important facet of buying and selling that no dealer can obtain success with out.

On this article, we are going to clarify how one can handle dangers in buying and selling, the instruments you need to use to attain this, and a few of the prime issues to think about.

What’s threat administration

Threat Administration is the idea of forecasting and evaluating monetary dangers, after which figuring out the important thing mitigation procedures to cut back the impression. Failure to understand this idea will almost definitely lead you to make massive losses.

In regular companies, merchants anticipate the demand of their merchandise and the availability. They then stability the 2 to serve the purchasers higher. In foreign currency trading, a dealer should all the time use threat administration methods to make sure that they don’t put their accounts in danger.

Associated » High Errors You Ought to Keep away from as a Dealer

We need to provide you with a tip typically underestimated: don’t depart your threat administration methods unchanged.

Ranging from a strong baseline is important, however your actions to mitigate/forestall drawbacks should evolve over time. For instance, while you be taught one thing new or when market circumstances change.

If you’re unable to do that, your methods could even backfire!

Threat administration by buying and selling kinds

Broadly, there are three essential kinds of members out there: day merchants, swing merchants, and buyers. Day merchants maintain their trades for a couple of minutes and be sure that they shut them inside the day. Swing merchants, alternatively, maintain their trades for a couple of days whereas buyers maintain them for an extended interval.

For instance, a technique through which day merchants handle their dangers is to maintain taking a look at their screens, utilizing short-term charts, and be fast of their decision-making. And avoiding in a single day trades.

Swing merchants, alternatively, set wider stops, give attention to each technical and basic evaluation, and largely use the trend-following strategy.

Traders use a number of threat administration methods like greenback value averaging, diversify their holdings, and set wider stops.

Completely different methods

Once we discuss threat methods, we frequently are likely to generalize and lump all of them collectively. However these, in addition to by commerce stage, can be divided by typology.

Avoidance: One of the best ways to handle threat is to completely keep away from it. Some merchants make their selections by attempting to exclude volatility and threat fully. This leads them to decide on the most secure property with little or no threat.

Retention: This technique includes accepting the dangers that come up and recognizing that they’re a part of every dealer’s enterprise. On this, growing a great deal of resilience may be very useful.

Switch: Dangers may be transferred from one social gathering to a different. For instance, medical insurance supplies threat switch of protection from the shopper to the insurer, supplied the shopper is present on premiums.

Sharing: This method includes two or extra events taking over an agreed portion of the danger. For instance, reinsurers cowl dangers that insurance coverage firms can not deal with alone.

Loss prevention and discount: Quite than eliminating the potential for threat, this technique means discovering methods to reduce losses by stopping them from spreading to different areas. Diversification is usually a method for buyers to cut back losses.

Benefits of threat administration

There are various benefits of embracing threat administration within the monetary market. A few of the most essential ones are:

Diminished losses

An important benefit of getting the very best threat administration methods is that it ensures diminished losses out there. A very good instance of that is the case of Invoice Ackman, who misplaced over $4 billion when Valeant Prescription drugs collapsed.

One other instance is the collapse of Archegos in 2021. On the time, the house workplace used considerably excessive leverage, which induced him to lose over $20 billion in a couple of days.

Peace of thoughts

The opposite advantage of threat administration is the peace of thoughts it brings. For instance, while you open a commerce and set your take-profit and stop-loss, you will have peace by understanding what you can also make or lose.

These stops ought to all the time be utilized after conducting a superb threat/reward evaluation and never positioned blindly.

Keep away from sudden losses

One other advantage of threat administration is that it helps to cut back sudden loss out there. There are various examples of this. For example, making certain that each one trades are closed in a single day will assist to forestall main occasions that you just don’t have management over.

Key Components of Threat Administration

Threat administration methods may be labeled as primary or superior. Allow us to take a look at the essential administration approaches first.

Threat-Reward Ratio

When coming into or exiting any commerce, a dealer wants to think about the quantity of dangers in it and weigh it in opposition to the reward. If the danger of coming into a commerce may be very excessive, then there isn’t any significance of coming into it within the first place.

Alternatively, if the danger of coming into a commerce is low, then it might make a variety of sense for a conservative dealer to enter it.

The problem is on the right way to stability the 2 as a result of the upper the danger, the upper the reward.

As a dealer, the important thing basis to reaching success is to attempt to decrease the quantity of publicity in any commerce that you just make. The really helpful risk-reward ratio for a day dealer is 1:2 (if you’re to make $50 in a commerce, you need to be snug to lose $100).

This may forestall you from making trades that may expose your whole account to threat.

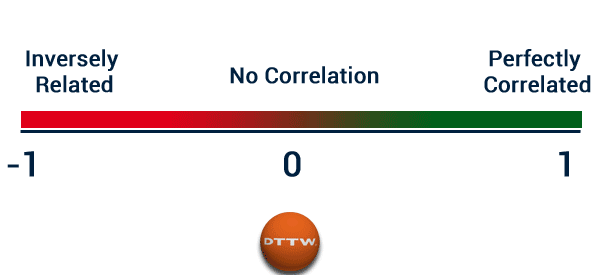

Diversification and correlation

An essential facet of threat administration is named diversification. Investing in a single inventory can result in main losses when it collapses. For instance, within the chart under, we see that Mullen Automotive inventory worth plunged from over $900 to lower than $1. As such, buyers noticed their funds disappear inside a couple of months.

Diversification is so essential, which explains why many individuals choose ETFs somewhat than particular person shares. If you’re an investor, we advocate that you just give attention to having a number of firms and bonds in your portfolio.

On this regard, you must all the time take into consideration the correlation of the property that you just spend money on. For instance, making a portfolio with firms like Chevron, ExxonMobil, Shell, and BP will expose you to a giant threat if oil costs drop.

Due to this fact, you must think about investing in the very best firms throughout all sectors like finance, expertise, healthcare, and utilities.

Diversification and correlation are additionally helpful when day and swing buying and selling. Putting a purchase commerce on firms like Tesla, Nvidia, and Google will typically work when issues are going properly. These shares will typically decline when the market retreats.

In a single day trades

One other essential threat administration technique that’s perfect for day merchants is to make sure that all trades are closed within the in a single day session. The good thing about doing that is that it protects you from sudden occasions that occur while you can not commerce.

For instance, firms launch their earnings after the market closes or earlier than the open. When this occurs, it results in a significant dip or pop within the shares. Additionally, firms are likely to make main information when the market is closed. All these occasions can result in substantial losses.

Measurement your trades

All the time have beneath management the dimensions of the transactions or trades that you just provoke. In all trades, you must all the time be sure that you threat solely a small portion of your account.

In different phrases, you must threat a slight portion of your account in all trades that you just do. The good thing about doing all that is to make sure that you lose solely a small amount of cash if all issues fail.

For instance, if in case you have an account with $10,000, you shouldn’t threat greater than $500 per commerce. In reality, you must all the time threat lower than $200 per commerce.

Doing this may assist you to lose the amount of cash you may lose comfortably. In case you have this account, it implies that shedding simply $200 won’t be very heartbreaking.

Cease loss orders

As a dealer, a cease loss is an important device to handle threat that ought to be utilized in all trades you enter. The essence of a cease loss is to guard your account from large and unsustainable losses.

You need to all the time attempt to make sure that all of your trades are protected. This can be a crucial factor for you as a result of something can occur even while you least anticipated it.

In January 2017, the Swiss Nationwide Financial institution (SNB) eliminated their forex peg from the Euro, days after a senior official assured merchants that this may not occur. Consequently, the volatility out there elevated considerably and lots of merchants made large losses.

For merchants and not using a cease loss, the losses had been large.

In reality, buying and selling firms reminiscent of FXCM went bankrupt. Merchants with cease losses misplaced cash however at a much less scale. The difficult half for brand spanking new merchants is on the place to place a cease loss order to maximise any commerce. Numerous methods have been instructed: the two-day low technique and the parabolic cease and reversal (SAR) technique.

Superior Threat Administration Approaches

State of affairs evaluation

Earlier than coming into any commerce, it is vitally essential to conduct a situation evaluation for the property or devices you need to commerce with. On this, basic and technical evaluation are crucial.

For example, if you’re contemplating a USD dominated commerce, you want to concentrate on the prevailing financial atmosphere. If there may be any financial knowledge being launched, it’s worthwhile to allocate your buying and selling with this in thoughts.

Technical evaluation will assist you to determine a ranging or a trending market thus serving to you to make good enterprise selections.

Two-day low technique

With this technique, a dealer is suggested to place a cease loss roughly 10 pips under the two-day low location. It has been assumed that if the two-day and the ten-year lows are handed, a downward pattern may be skilled.

A very good instance for an extended place is that this: Suppose EUR/USD is now buying and selling at 1.1200, and the earlier candle low was 1.1100, then you must place the cease at 1.1090.

The parabolic cease and reversal (SAR)

That is an indicator (one of many best) many merchants use to determine the cease loss place. The indicator signifies a small dot on the place the place the cease loss ought to be positioned.

A very good instance of that is: enter an extended place and set up the assist and place a cease loss 20 pips under it. Assuming that the cease loss is positioned 60 pips from the entry level, in case you revenue 60 pips, shut the place after which transfer up the entry level. Whereas doing this, use a path cease 60 pips under the transferring market worth.

If the SAR goes up above the entry level, you may transfer the SAR to the cease stage. By doing this, you’ll be experiencing candy returns whereas mitigating the quantity of threat publicity.

Different cease loss methods are: utilizing the transferring common, utilizing the assist and resistance approach, and utilizing the proportion technique.

The key for any dealer is to determine and grasp a superb cease loss approach, again testing, and making use of it in each commerce he enters. With no cease loss, possibilities of shedding all of the invested capital are very excessive.

Associated » The Significance of Cease Loss Orders

Threat administration mindset and psychology

Threat administration is carefully tied to a dealer’s mindset and their emotional wellbeing. Normally, the errors that merchants make are normally tied to their feelings.

The most typical feelings it’s worthwhile to deal with are worry and greed. Worry is manifested in quite a lot of methods when buying and selling. For instance, worry could make you keep away from coming into trades or exit with a smaller revenue than your goal.

Greed, alternatively, can see you overtrade, execute greater trades than regular, maintain them for longer, and embrace worry of lacking out.

You possibly can decrease these approaches utilizing correct threat administration methods. For instance, as talked about, a few of the guidelines of threat administration are limiting the sizes of your commerce and utilizing small leverage.

Different emotional disciplines to recollect are having persistence and being disciplined. In persistence, you must be sure that you’re taking time to be taught to commerce earlier than you progress to a reside account.

Most significantly, you must be aware of the favored biases out there. The most well-liked of those are:

anchoringoptimismherding biasloss aversion bias.

Exterior helpful sources

[ad_2]

Source link